Introduction

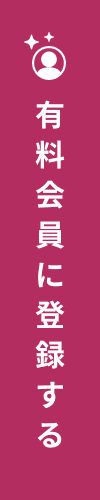

Vietnam’s recent economic development is largely due to the fact that Vietnam has become a manufacturing base for many developed country companies. More recently, however, the country has experienced remarkable growth as a consumer market due to stable population growth, rising incomes, and modernization of lifestyles.

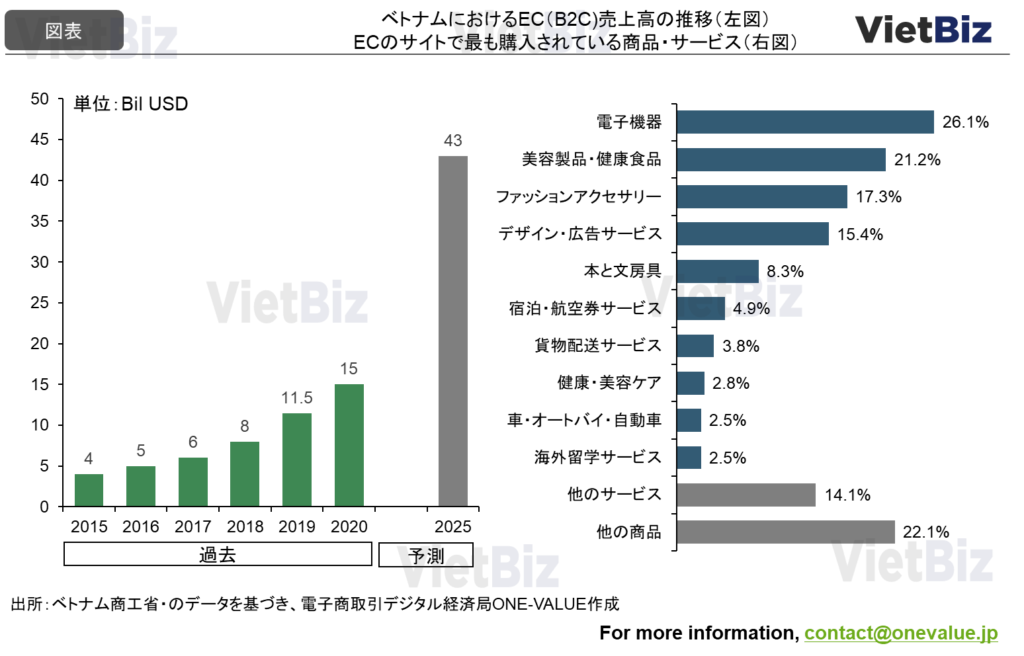

Because of the large number of mom-and-pop stores (independent stores) and traditional markets that have become tourist attractions, the image of Vietnam as a country with traditional trade is probably deeply rooted in the minds of many.

However, contrary to this image, modern trade (supermarkets and online shopping) is expanding rapidly in Vietnam.

In this report, we will discuss online shopping, or so-called e-commerce (EC), in Vietnam from various perspectives.

About Vietnam’s EC Market

Overview of the EC market

Before the corona outbreak, Vietnam’s GDP was stable at a high 6-7% annual rate. Even during the corona disasterVietnamThe domestic consumer market as a whole did not decline much, and the country’s GDP remained at a high level of 6-7% annually. Overall, the domestic consumer market has not declined much, and GDP is expected to settle at positive growth in 2021. As a result of this economic growth, the number of middle class and affluent people in Vietnam is increasing rapidly, and the domestic consumer market in Vietnam is seen as promising by many companies. Specifically, health food, cosmetics, food retail, healthcare, apparel, sporting goods, and educational services are particularly promising sectors.

Internet Penetration Rate

Vietnam’s Internet penetration is very high. According to the Department of Communications (affiliated with the Ministry of Information and Communication of Vietnam), Vietnam is one of the top 20 countries in the world with the highest rate of Internet use among its citizens, with statistics from the General Statistics Office in 2019 showing that the ratio of Internet users to the population was 68.7%, higher than the world average of 51.4%. This percentage is lower than in developed countries (86.7%), but considerably higher than in developing countries (44.4%) and Asia-Pacific countries (44.5%).

More than 61.37 million people in Vietnam own a smartphone. This is equivalent to 64% of the population and is among the top 10 countries with the highest smartphone penetration in the world.

Most Vietnamese smartphone and Internet users use EC. The number of consumers who made at least one online purchase within 2020 is estimated to be about 49.3 million (more than 50% of the population), with an average spend per person of about $240.

88% of those who used the Internet in Vietnam in 2020 also shopped online, up significantly from 77% in 2019.

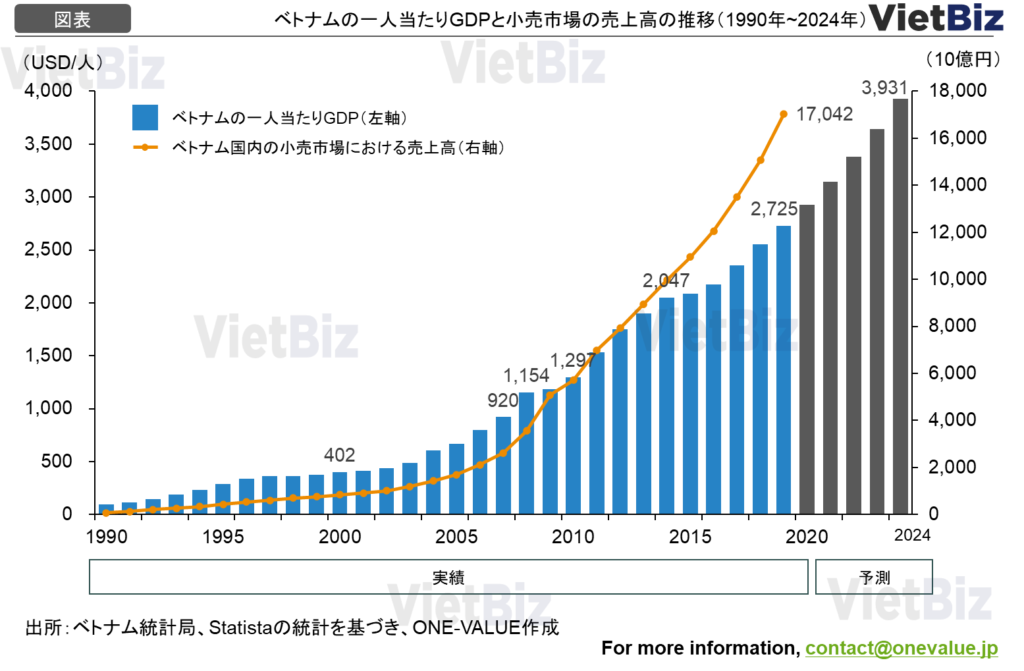

Market size of the EC market

According to data from the Vietnam EC Index Report 2021 published by the Vietnam EC Association (VECOM), the average growth rate of Vietnam’s EC from 2016 to 2020 is about 30 percent.The market size of retail and services (B2C) market size increased from US$4 billion in 2015 to about US$11.5 billion in 2019 and US$15 billion in 2020. The market size is projected to reach US$52 billion by 2025, with an average growth rate of 29% for the period 2020-2025.

Popular categories in EC

While most electronics are purchased through EC in Vietnam, daily necessities such as food and clothing are still purchased through traditional offline channels. This is a trait that also applies to the Japanese, but Vietnamese prefer to “try on and see for themselves” products such as clothing and food. On the other hand, large items that need to be transported to the home, such as the aforementioned electronics, are often purchased by consumers online.

The impact of the new Corona

The new coronavirus epidemic is believed to have spurred growth in Vietnam’s e-commerce market.

According to statistics from the Hanoi Department of Industry and Trade, consumption by mail order in Hanoi has increased by 30-50% compared to pre-Corona levels. Also, during the lockdown period in southern Vietnam, e-commerce giant Lazada more than doubled its daily traffic, buyers, and orders. The same was true for Lazada’s live commerce, which more than doubled last year’s viewings.

According to Foodmap.Asia, a mail-order company specializing in food, consumers have a strong tendency to hoard food amid the Corona disaster. However, as consumer incomes have declined, orders for luxury items have fallen. Nonetheless, during the lockdown period, orders increased to four to five times the normal level.

Movement restrictions were issued in areas where a lockdown was in place due to the spread of the disease, which meant that residents could only go to the supermarket twice a week and a surge in Vietnamese people using online shopping for fresh food On the other hand, the number of Vietnamese who shop for fresh produce online increased rapidly. Meanwhile, the lack of logistics systems for transportation and delivery of fresh produce, especially the supply of cold chain, has become a major challenge for Vietnam.

Major Players in the Vietnamese EC Market

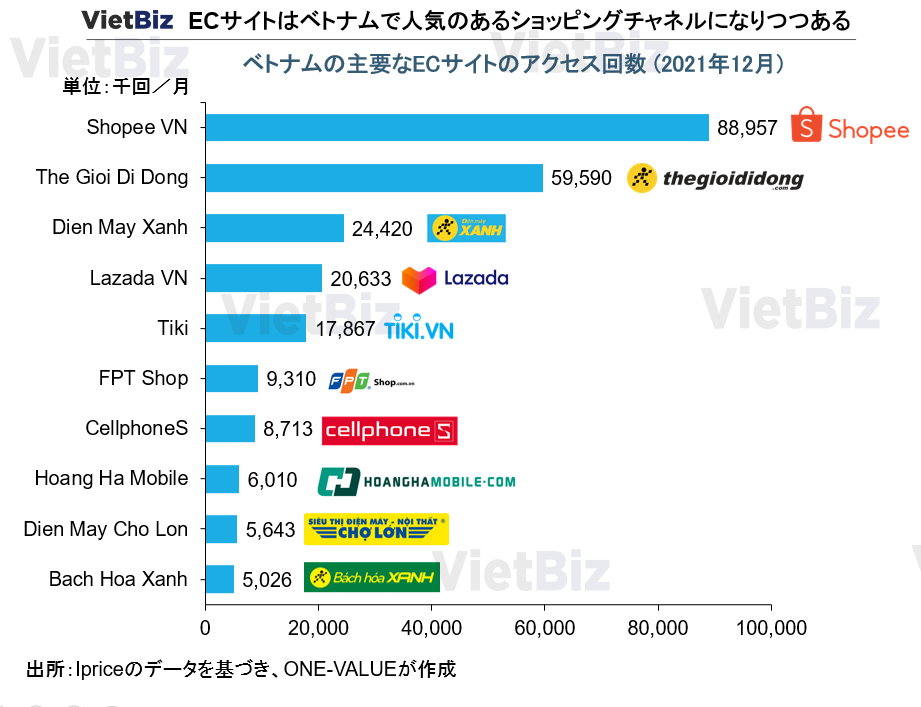

Shopee leads the Vietnamese e-commerce market, ranking first in terms of average monthly visits; the second- and third-ranked sites combined are too far behind to reach Shopee.

Shopee(ショッピー)

| 会社名 | Shopee Pte Ltd |

| 設立 | 2015年 |

| 本店 | ハノイ |

| HP | https://Shopee.vn/ |

| アクセス数 | 88,956,700 回/月(2021年12月) |

| 売上 | 9,95Bil USD |

| 特長 | ベトナムで最多のアクセス数、商品数と出品者も最大級 |

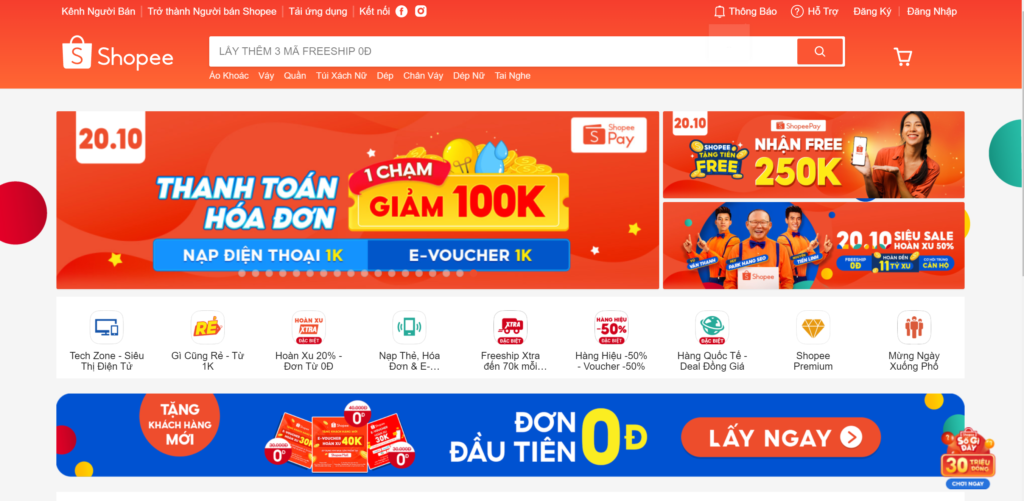

Shopee Vietnam was founded in 2015 and is a subsidiary of SEA Holdings, headquartered in Singapore. It currently operates EC businesses in Malaysia, Thailand, Taiwan, Indonesia, Vietnam, the Philippines, and Brazil.

Shopee Vietnam’s original business model was a C2C marketplace (like Mercari, providing a place for consumers to buy and sell to each other). However, Shopee Vietnam is now primarily a B2C business model. Sellers’ sales commissions and advertising fees are Shopee’s main sources of revenue.

Features

Analyze Shopee’s strengths and weaknesses from a seller’s perspective.

Shoppe’s Strength

- Most accesses (traffic) in the EC industry.

- Easy to open a store: You can register and sell products with just an email address and phone number.

- Many things can be done at no cost: There is no commission for opening a store. There is also zero commission for selling products.

- The interface is eye-catching, easy to read, and well received.

- The company has its own shipping company (Shoppee Express) and also works with 10 major outside shipping companies, allowing it to build a flexible and extensive nationwide shipping network in Vietnam.

- Available various payment methods including ShopeePay, an e-wallet operated by Shopee

Shoppe’s weakness

- Competition in Shoppe is extremely fierce: with no cost of entry, many sellers, from individuals to large corporations, are crowded into Shopee. Consumers have many options to choose from, even for one type of product.

- Strict conditions for free delivery: free delivery is offered for orders over 200,000 VND (about ³,000), which puts sellers of low-priced products at a disadvantage.

- Long censorship time to allow product sales: In addition, even products that have once been approved for sale are often subject to re-censorship.

- Product quality and fakes are not adequately controlled.

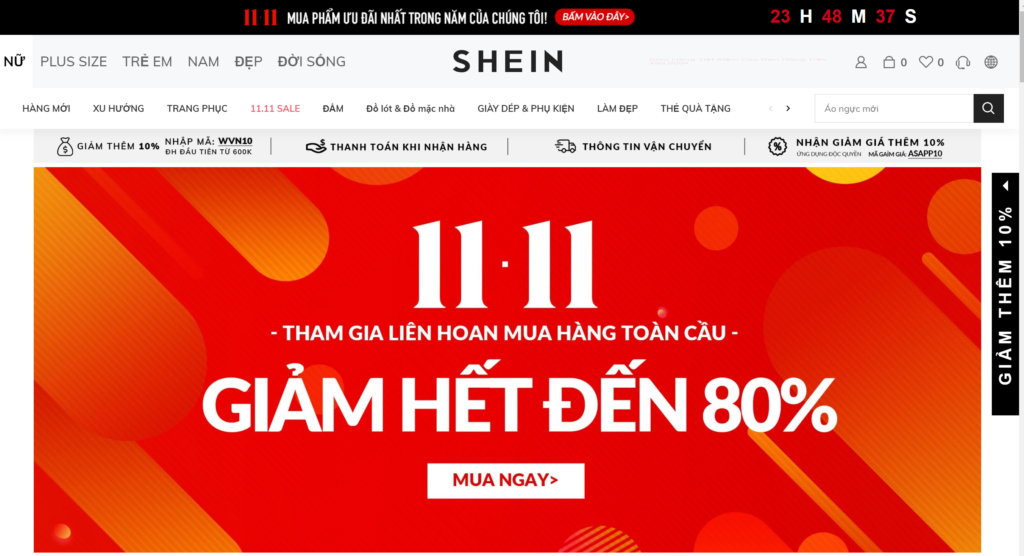

※11.11(ダブルイレブン)とは、中国の「独身の日」から派生した、アジア版のブラックフライデー。

経済効果では既にブラックフライデーを上回っている。

In addition to its main e-commerce site, Shopee has a food delivery app, Shopee Food (a service originally developed by Foody Vietnam and acquired by Shopee in 2017). Shopee Food is currently one of the most popular food delivery apps in Vietnam, along with GrabFood, Baemin, and Gojek.

Lazada(ラザダ)

| 会社名 | LAZADA Group |

| 設立 | 2012 |

| 本店 | ホーチミン |

| HP | https://www.lazada.vn/ |

| アクセス数 | 20,633,300 回/月(2021年12月) |

| 売上 | 21Bil USD |

| 特長 | 最先端の技術・マーケティング手法に積極的に投資中 |

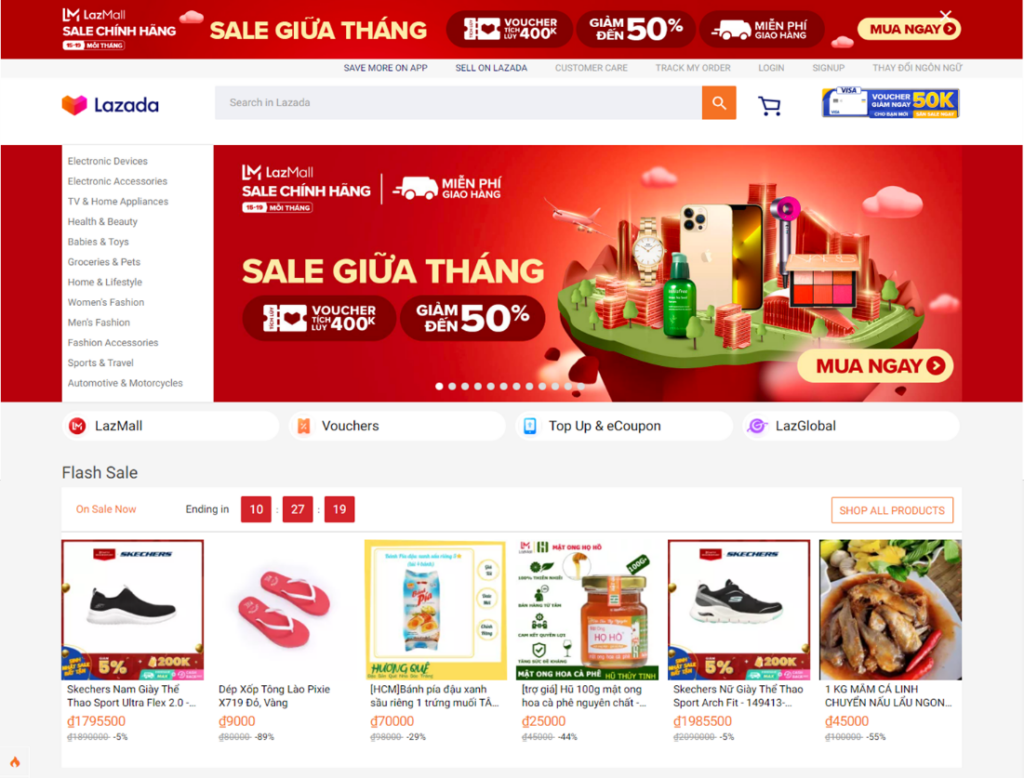

Lazada Vietnam is an e-commerce platform offering different categories of products such as furniture, cell phones, tablets, fashion products, healthcare products, beauty products, toys, sporting goods, etc.

Lazada Vietnam is a subsidiary of multinational e-commerce giant Lazada Group, which currently has operations in Indonesia, the Philippines, Singapore, Thailand, and Malaysia. In 2015, Chinese e-commerce giant Alibaba officially made Lazada Vietnam its subsidiary through a share acquisition.

Features

Lazada’s strengths and weaknesses are discussed.

The strength of LAZADA

- No fixed fees for registration and tenant maintenance (as of October 2021)

- Low commission rates (especially for electronic products): 5% for electronic products, 10% for fashion products, average 8% for other products.

- he company focuses on implementing campaigns and advertising through actors, singers, and other celebrities (influencers).

- Substantial investment in logistics systems in 2021, using AI to reduce time from order acceptance to delivery

LAZADA Weaknesses

- The interface is not eye-catching and is rated as less attractive than competitors.

- Logistics (receiving and transporting goods) costs are high.

- The hurdles in the process of opening a store are somewhat high: first of all, the company does not accept individuals to open a store, and only corporations are allowed to do so. There are also companies that provide support services for opening a Lazada store.

Lazada is also a pioneer of “shopper entertainment” in Vietnam. Shoppertainment” is a term coined by combining the words “Shopper” and “Entertainment” and is attracting attention as a new marketing trend.

Shoppertainment refers to the addition of entertainment elements to the EC customer experience. Specifically, this can include watching live feeds, playing games, and working with influencers.

Lazada invests heavily in conducting online concerts, live-streaming and other marketing events featuring celebrities. In this way, they are increasing Lazada’s exposure while improving the customer experience.

Mobile World Group(モバイルワールドグループ)

The gioi di dong, Dien may xanh, and Bach Hoa Xanh, which ranked 2nd, 3rd, and 10th in the aforementioned access rankings, are subsidiaries of Vietnam’s retail giant Mobile World Investment Corporation.

Unlike EC trading platforms like Shopee, Lazada and TIKI, “The gioi di dong”, “Dien may xanh” and “Bach Hoa Xanh” are e-commerce sites that sell products such as smartphones, computers, TVs, refrigerators and food sold by their parent companies. EC sites. These e-commerce sites are characterized by a strategy that combines physical stores and e-commerce.

the gioi di dong.com(テ・ゾイ・ディ・ドン)

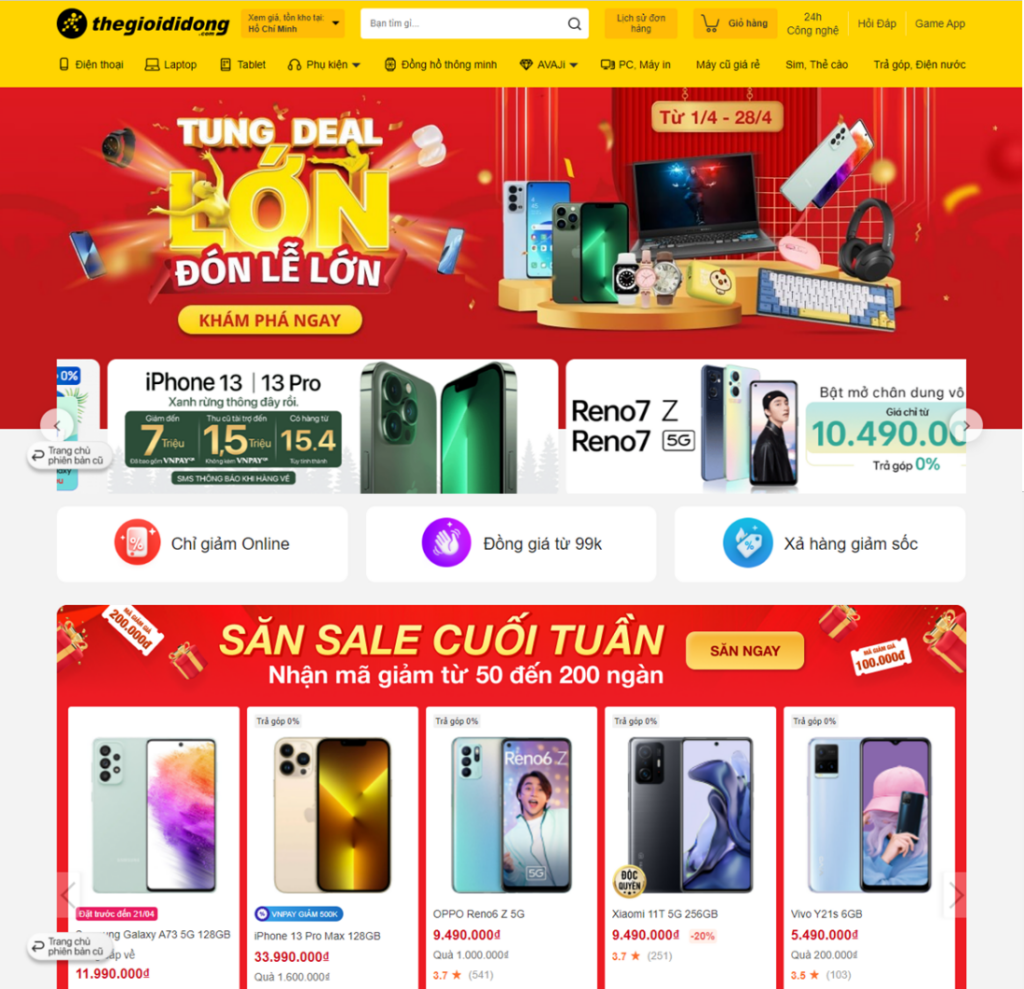

thegioididong.com is an electronics-focused retail chain founded in 2004 by Mobile World, currently the largest retailer in Vietnam. At its inception, thegioididong.com’s website only provided product information for customers to shop at physical stores, but today it is the second most visited e-commerce site in Vietnam after Shopee.

Thegioididong.com e-commerce site specializes in offering its own chain of electronic devices such as computers, smartphones, tablets, smartwatches, related accessories, SIM/cards, and utility services such as electricity and water payment. Featuring high quality products, customer service, and short delivery times, the company has a large market share in Vietnam for online sales of electronic devices such as those listed above.

Dien May Xanh(ディエン・マイ・サン)

DienMayXanh.com, like thegioididong.com, is a retail chain operated by Mobile World, focusing on consumer electronics. The company has about 120 physical stores throughout Vietnam.

The products they handle are very diverse, ranging from large home appliances such as TVs, refrigerators, washing machines, and air conditioners to medium and small appliances such as rice cookers, gas stoves, fans, and hair dryers.

Dien May Xanh’s e-commerce site is basically operated in the same way as thegioididong.com and has almost the same features.

The sales of these two e-commerce sites, Dien May Xanh and thegioididong.com mentioned above, reached VND4.37 billion in 2021 (up 53% from the previous year), accounting for 12% of Mobile World’s sales.

Bach Hoa Xanh (バック・ホア・サン)

BachHoaXanh, like the gioi di dong and Dien May Xanh mentioned above, is a small supermarket chain operated by Mobile World. In the six years since its establishment, the number of stores has reached approximately 2,000 nationwide, with more than 20 distribution warehouses. This number of locations is also a major strength in e-commerce sales: BachHoaXanh.com is its e-commerce site. BachHoaXanh.com operates primarily targeting young customers, especially in the southern, eastern, and central and southern provinces.

At the peak of the Corona disaster, Vietnam was on lockdown, making it difficult to get groceries. At that time, demand for delivery services and e-commerce surged, which was a tailwind for this Bach Hoa Xanh.

With a wide variety of products, clear origin labeling, and advanced delivery services, BachHoaXanh.com holds a large share of e-commerce sales of fresh and frozen foods, etc.

Tiki(ティキ)

| 会社名 | Ti Ki Company Limited |

| 設立 | 2010 |

| 本店 | ホーチミン |

| HP | https://tiki.vn/ |

| アクセス数 | 17,866,700 回/月(2021年12月) |

| 売上 | – |

| 特長 | 最初のベトナム発ECサイト、配達の速さがトップクラス |

Tiki is a Vietnamese-born e-commerce service established in March 2010. Tiki, like other e-commerce sites in Vietnam, is active in B2C.

One of the key features of Tiki is that it is the only platform that requires all sellers to obtain a business license from the Vietnamese government. Tiki guarantees that no counterfeit goods are circulated within their service. This strict regulation has allowed Tiki to be regarded by consumers as a reliable e-commerce site. In addition, Tiki focuses on large Vietnamese cities such as Hanoi and Ho Chi Minh City. It has logistics warehouses in such large cities and offers a service called “TikiNow,” which delivers products to targeted areas within two hours of ordering.

Features

First, we will discuss Tiki’s strengths and weaknesses in terms of its features.

Strengths of Tiki

- Strict standards for sellers and products: Shops are thoroughly vetted for product quality and origin, and can only sell products that are included in the list of products allowed for distribution established by the Vietnamese government. Thus, Tiki is far more trusted than other e-commerce platforms.

- The return rate is less than 1% (according to Tiki)

- Products are stored in Tiki’s warehouse at all times. Even if a consumer orders a variety of items, they can be packaged and delivered as one.

Weakness of Tiki

- High hurdles to opening a stall: Exhibitors are limited to corporations or organizations, and individuals cannot open a stall. A business license must be submitted when registering to open a stall.

- In line with the high hurdle for opening a stall, the variety of products is still small. However, this is a tailwind for Japanese companies looking to enter the market.

- Normally, delivery time is relatively long (4-10 business days after receiving an order)

- In addition to the sales commission (8% on average), there is a membership fee to maintain the store; among the three major Vietnamese e-commerce sites, Shoppe, Lazada, and Tiki, the cost of sales is the highest.

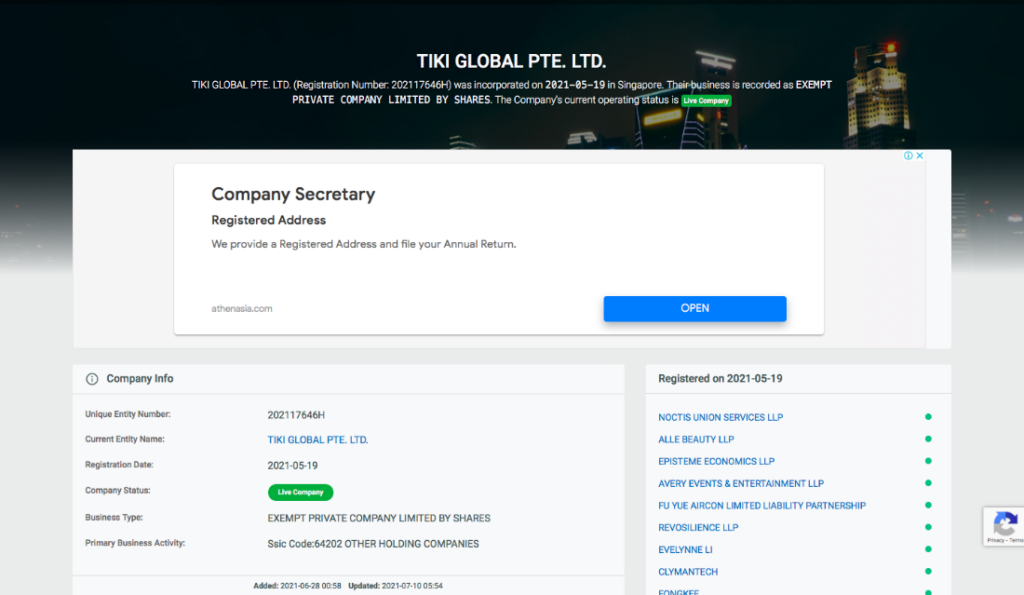

Also, Tiki has been working to raise more capital for an IPO overseas in order to compete head-to-head with foreign EC’s with large capital.

And in July 2021, Tiki announced that it had completed the transfer of 90.54% of its shares to “TikiGlobal,” a newly formed corporation in Singapore, and was preparing to execute an IPO in Singapore.

Sendo(センドー)

| 会社名 | FPT Online JSC |

| 設立 | 2007 |

| 本店 | ハノイ |

| HP | https://www.sendo.vn/ |

| アクセス数 | 4,946,700 回/月(2021年12月) |

| 売上 | 27Mil USD |

| 特長 | 地方に注力、ベトナム国産品に注力 |

Sendo was founded in Vietnam in September 2012 and is one of the oldest players in the Vietnamese e-commerce industry. Sendo is operated by FPT Corporation, the largest technology company in Vietnam. There are more than 500,000 sellers registered with Sendo.

Sendo’s most unique feature is that it trades mainly in domestically produced Vietnamese products. Although Sendo competes with Tiki in terms of originating from Vietnam, the two companies complement each other’s services to some extent, as Tiki focuses on large cities while Sendo focuses on other regional cities. Sendo also focuses on selling Vietnamese products.

Features

Discusses the strengths and weaknesses of Sendo from a seller’s perspective.

Sendo Strengths

- Low commissions (especially for electronic products): 3% for electronic products, 8% for fashion products, and an average of 5% for other products, but up to 10% for interior and household goods.

- The registration process for opening a store is simple: you only need an email address and phone number to register and sell your products.

- Because the company is affiliated with FPT Corporation, the largest IT company in Vietnam, consumers have a high level of trust in the company.

Sendo’s Weaknesses

- A few cases of system failures on major holidays and events that are expected to increase access, such as International Women’s Day and Black Friday, have pointed to system vulnerabilities.

- Shallow coordination with carriers: only three delivery companies can be designated: VNPost, Giao hang nhanh, and Viettel Post. This is relatively few in Vietnam.

- There are many provisional orders, and sellers often have to call customers to confirm orders.

Voso(ヴォーソー)

| 会社名 | Viettel Post JSC |

| 設立 | 1997 |

| 本店 | ハノイ |

| HP | https://voso.vn/ |

| アクセス数 | 120,400 回/月(2021年12月) |

| 売上 | 937Mil USD |

| 特長 | 本業は郵便業、農産物に注力 |

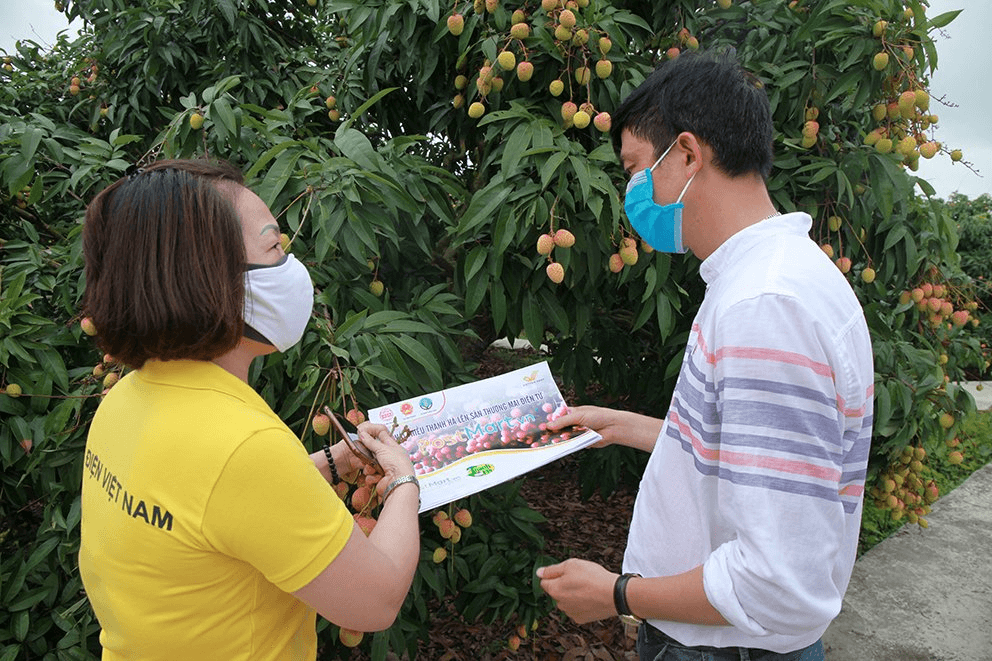

In July 2019, ViettelPost, a member company of Viettel, Vietnam’s largest telecommunications company, established an e-commerce site called Voso.vn (meaning shell). It focuses on food and agricultural products.

In the two years since its inception, Voso.vn has reached 18 million consumers and partnered with 2.5 million farm households.

Features

Voso.vn is focused on providing agricultural products directly to end-users without going through wholesalers, and this is its most important feature.

In addition, since our core business is postal services, we have 1,300 post offices and 6,000 transaction points from the beginning. The availability of this skilled logistics system covering the whole country of Vietnam from the very beginning is one of Voso.vn’s strengths. The excellent delivery system is especially compatible with agricultural products, where freshness is critical.

In addition, Voso.vn continues to strengthen its support for farmers through its e-commerce site to promote its products.

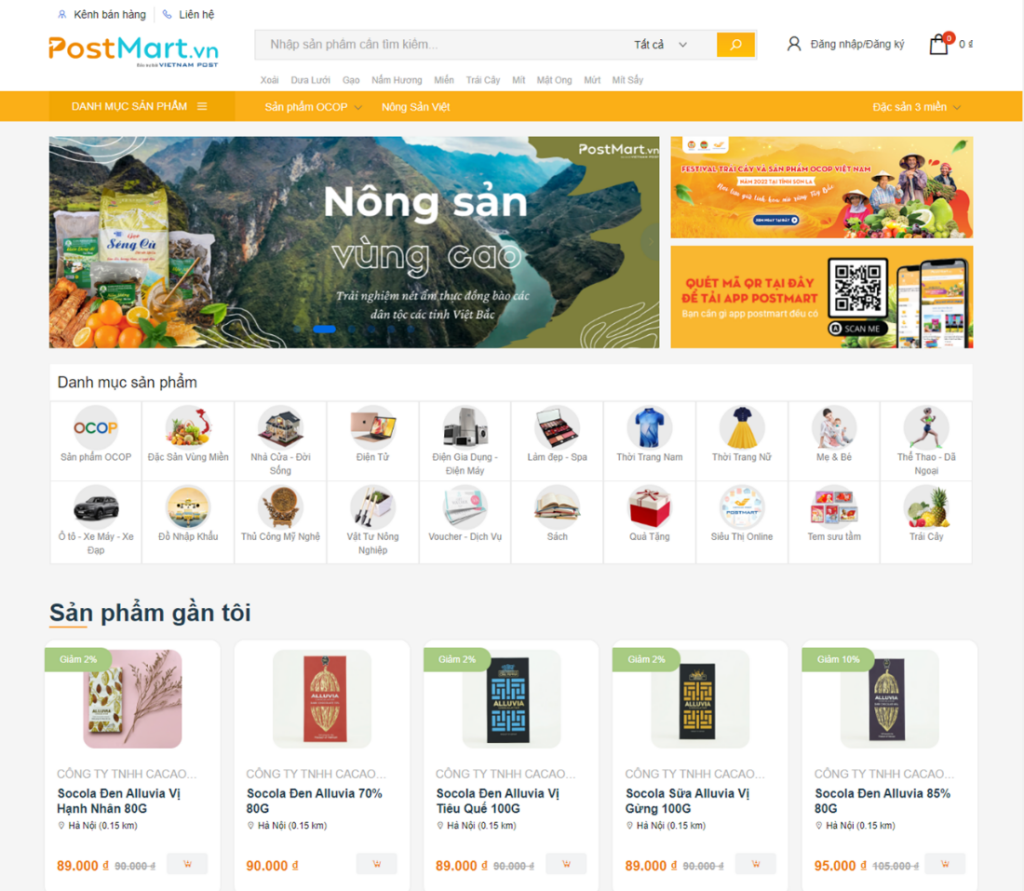

POSTMART(ポストマート)

| 会社名 | Vietnam Post Logistics (VN Post) |

| 設立 | 2007 |

| 本店 | ハノイ |

| HP | https://postmart.vn/ |

| アクセス数 | 50.000 回/月(2021年12月) |

| 売上 | 1.1Bil USD |

| 特長 | 本業は郵便業、出店者へのサポートが手厚い |

POSTMART is an e-commerce site established by Vietnam Post Corporation (Vietnam Post) at the end of 2018, offering products in a variety of categories. Among them, it focuses on agricultural products and local specialties. Similar in concept to ViettelPost’s Voso.vn mentioned above, POSTMART, along with ViettelPOST, is the main e-commerce site for trading agricultural and specialty products in Vietnam.

Features

Statistics show that the average number of visits to the POSTMART site is about 9,400 per day and the average number of orders is about 1,500 per week. In 2021 alone, VietnamPost helped 2.7 million farm households set up store on POSTMART. In terms of registering with POSTMART, farmers receive the following support:

- Create a store on the e-commerce site for free

- Comprehensive support for marketing, customer communication, packaging, delivery, and payment

- Use of VNPOST’s distribution network of over 13,000 locations

- Traceability Provision of IT solutions to ensure

FPT SHOP(FPT ショップ)

| 会社名 | FPT Retail |

| 設立 | 2012 |

| 本店 | ハノイ |

| HP | https://fptshop.com.vn/ |

| アクセス数 | 9,310,000 回/月(2021年12月) |

| 売上 | 982Mil USD |

| 特長 | ベトナム最大手IT企業の傘下 |

Features

FPTshop.com was established in 2012 by FPTRetail, a group company of FPT Corporation, one of the largest IT companies in Vietnam, along with its physical stores.

FPTShop.com specializes in providing electronic devices such as phones, computers, related devices, and SIM cards. The company’s sales approach is characterized by a combination of physical stores and e-commerce.

Amazon

Amazon has raised expectations for its entry into the Vietnamese e-commerce market with the establishment of its subsidiary Amazon Global Selling Vietnam (Amazon Global Selling Vietnam) in Vietnam in 2019.

In reality, however, Amazon Global Selling Vietnam is a company whose purpose is to help Vietnamese companies open stores on Amazon. According to the CEO of Amazon Global Selling Vietnam, Amazon has no plans to establish warehouses or develop sales in Vietnam, even in the next five to seven years, and has no plans to enter the Vietnamese e-commerce market.

Trends of Vietnamese EC users

Vietnam’s EC is spreading, especially among young people in urban areas. In this chapter, we would like to explain the general situation of EC users.

Gender, marital status, and occupation of EC users

According to local Vietnamese press reports, there are approximately 35.4 million EC users in Vietnam, and this number is expected to increase by over 6.6 million to over 40 million by 2021.

According to market measurement firm Nielsen Vietnam, some 60% of online shoppers in Vietnam are female and the remaining 40% are male when divided by gender. The younger demographic has a higher usage rate, with consumers in their late 20s accounting for 55% of the total. More than half of online shoppers are in their late 20s.

Many online shoppers are also reported to be single, with 55% of all shoppers being office workers.

Areas with many EC users

Most of Vietnam’s EC users are mainly concentrated in urban areas: as of 2019, the combined population of Hanoi and Ho Chi Minh City is about 18% of the country’s total population, but the total number of EC users in these two cities, EC users in these two cities together account for more than 70% of the total number of EC users in all of Vietnam.

Devices for EC use

About 35% of online shoppers do so via desktop and 59% via smartphones and other mobile devices.

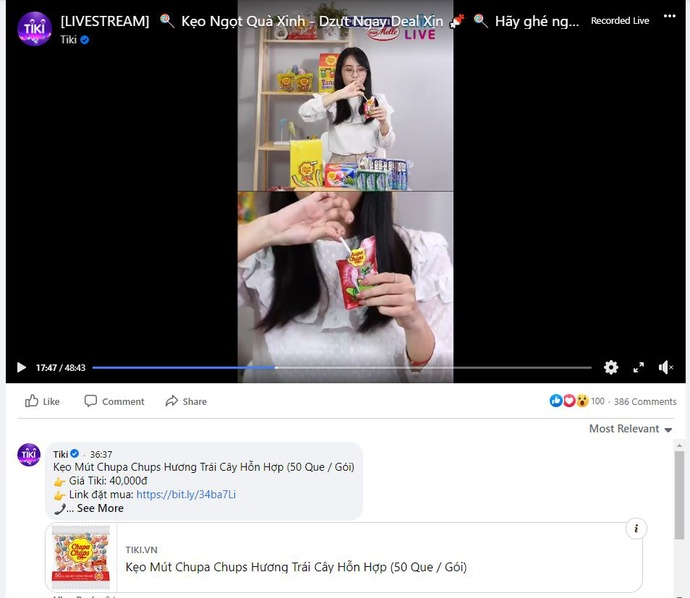

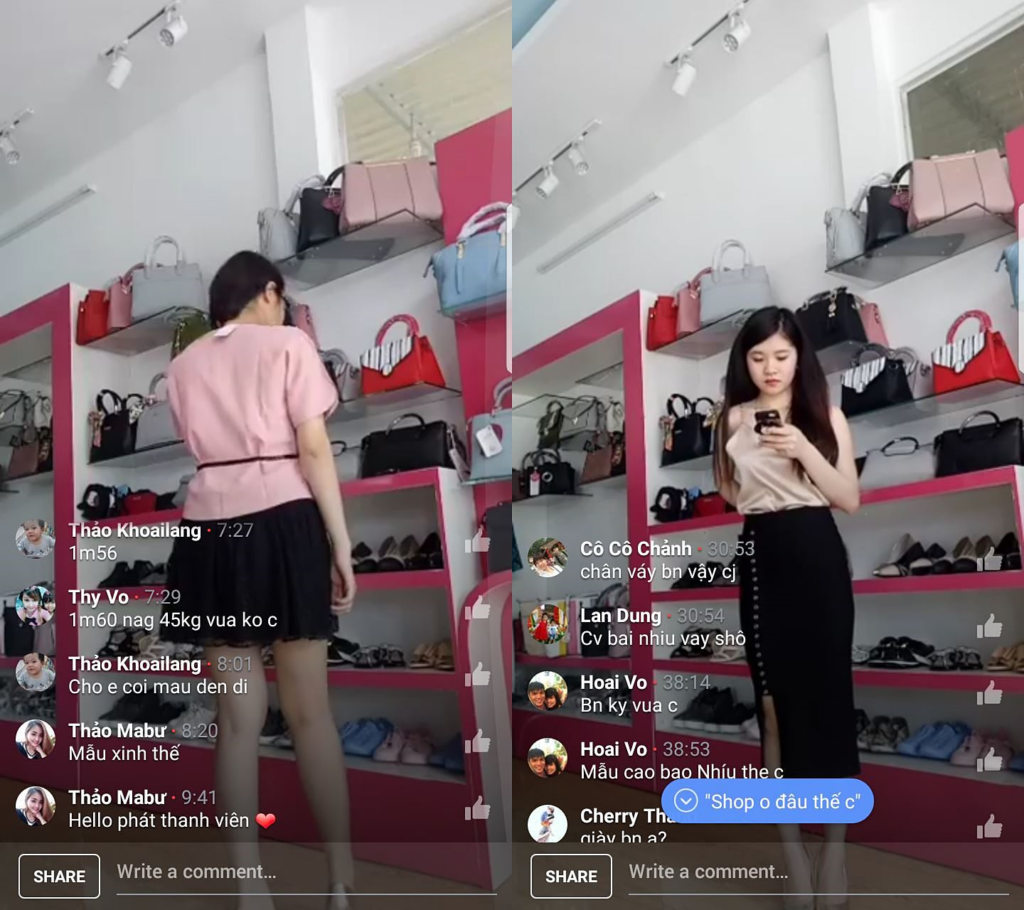

Facebook and the Live Commerce Craze

In recent years, more and more companies in Vietnam are marketingthrough social networking sites. According to analysis data from We Are Social, a UK-based digital marketing in 2019, Vietnam’s population is about 97 million, of which 64 million use the Internet and SNS. On average, Vietnamese spend 2 hours and 23 minutes per day on social networking sites, with Facebook, Tiktok, and Zalo, a Vietnamese-originated social networking site, being particularly popular. company,Vietnamese share information about their study, work, and life on these three social networking sites relatively often.

This practice of using it to promote marketing and sales of products has become a major trend in Vietnam. Vietnam’s major e-commerce platforms Shopee, Tiki, Lazada, and others are also active in live streaming on Facebookde. In general, the practice of selling products through live product introductions is called live commerce.

The live commerce scene in Vietnam can be divided into two main categories.

For platforms:Platform operators often use their own contracted models or celebrities (influencers). The influencer introduces the product and places the platform’s order link in the comments section, enticing consumers to order from the platform.

For individuals and small private stores:The store owner or employee personally introduces the products and advertises and sells the products. In the comments section of the live webcast, the store’s phone number and contact information, such as Facebook, Zalo, or other social networking sites, are provided so that interested customers can contact the store directly and place an order.

出典:マーケティングコンサル企業 Doopage

Popularity of digital payments

Digital payments are gradually increasing their presence on e-commerce platforms. According to local reports, 90% of e-commerce payments in Vietnam are cash on delivery as of 2018.However, according to Shopee statistics for 2020, the total number of orders settled electronically has increased fourfold compared to the end of 2019. In addition, the consumer segment with the highest increase in digital payments has been found to be consumers over 50 years old. In addition, there is a trend of increasing cashless payments not only in e-commerce, but also when shopping in physical stores.

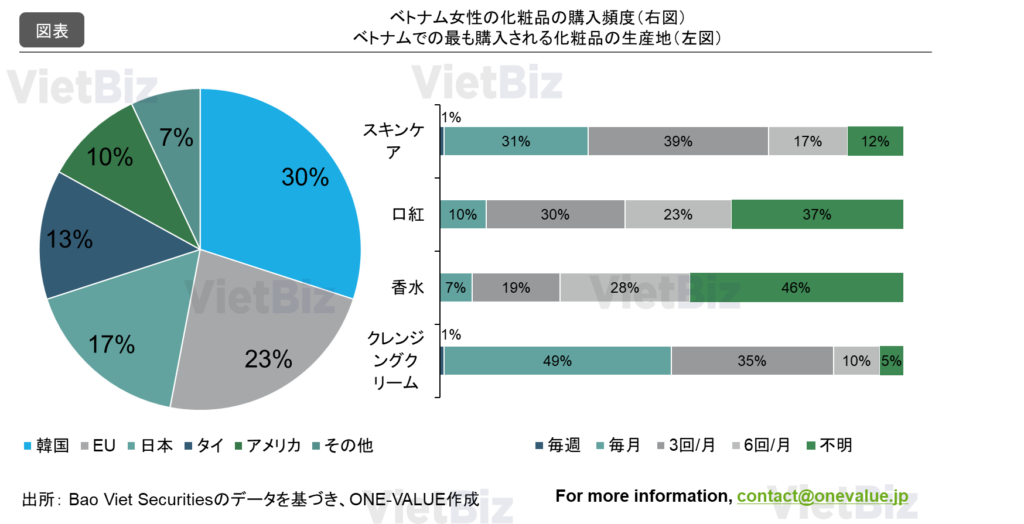

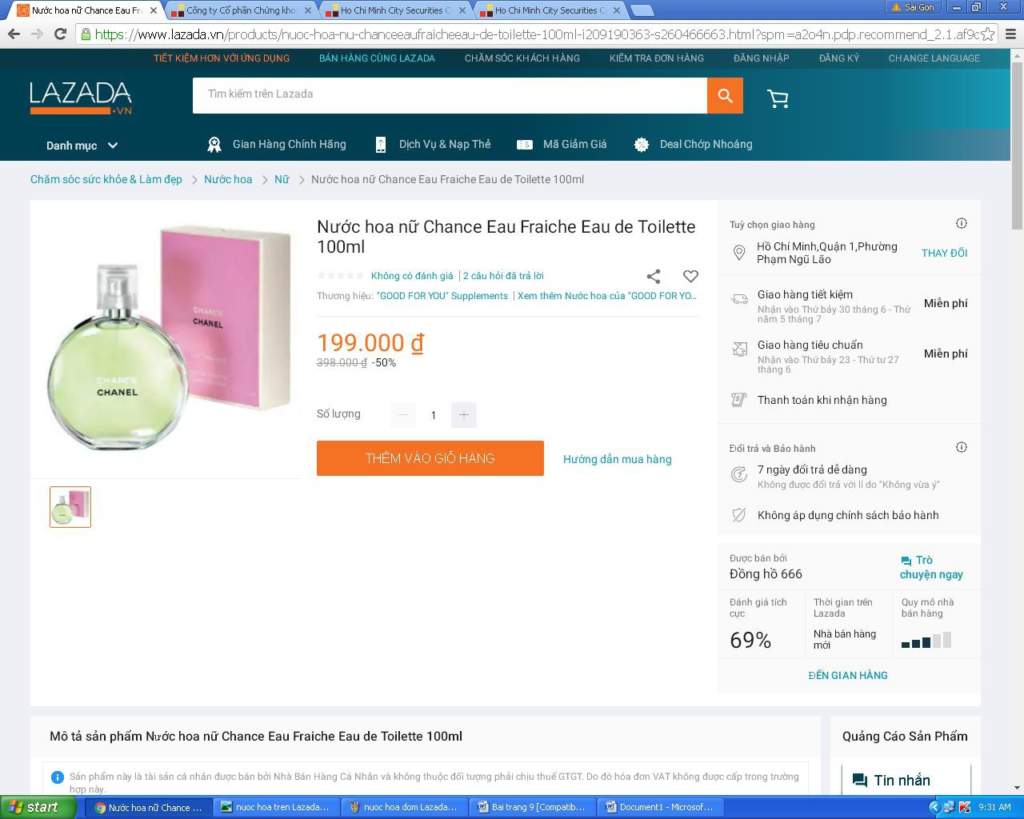

Middle-aged female users increase, cosmetics sales through e-commerce channel

According to the latest report from the Vietnam Online Business Forum (VOBF 2021),there has been a marked change in the percentage of EC users in 2020. Specifically, the percentage of female users aged 35-45 increased by 6%, accounting for the highest percentage (29%) of the consumer structure. In addition, young single women were the largest segment of EC users in 2019, but by 2020 the proportion of married women had increased sharply, accounting for 67% of EC users. The most commonly purchased products by this consumer segment are primarily cosmetics (the second most traded product in all of Vietnam’s EC).The increase in middle-aged women’s use of EC can be attributed to trends such as rising incomes and increased awareness of beauty and health.

As for specific spending, Vietnamese women spend about 7.1 million dong per year on cosmetics. German women, on the other hand, spend an average of about 4.3 million VND per year on cosmetics, while Austrian women spend about 5.7 million VND per year. It can be said that the cosmetics needs of Vietnamese women are quite large.

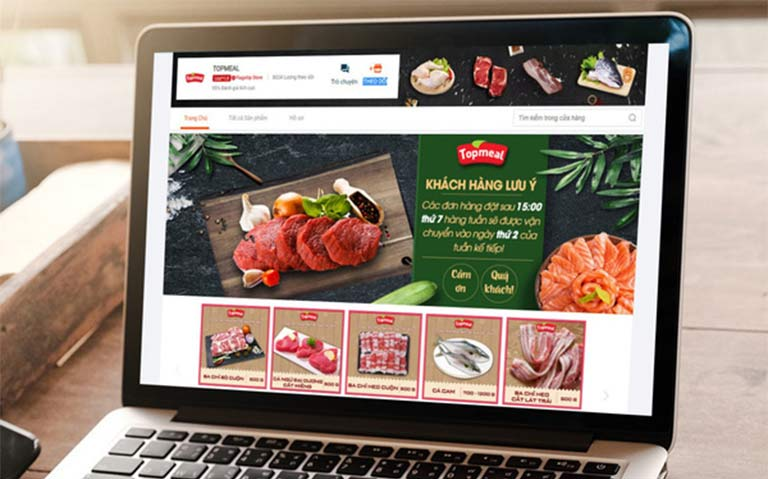

Popularity of online retailing of fresh produce

Online purchasing of fresh produce has the potential to grow significantly in the future.

In Vietnam’s EC, the fresh food sector is an untapped market, but there are many potential needs, and the potential for significant growth in the near future is not low. However, there are many challenges in the fresh food EC market. For example, there is a need to optimize transportation time and cold chain facilities to maintain quality.

Vietnam’s lockdown due to the spread of the new corona outbreak provided an opportunity for consumers to buy food in EC and gradually change their traditional trade habits of going to the market. Even if Vietnam enters the after-corona phase in the future, some Vietnamese will continue to purchase fresh food through EC as usual.

What is cross-border EC

One of the keywords we hear most often these days in the Japanese retail industry is the term “cross-border EC. In a nutshell, cross-border EC refers to online shopping across borders. First of all, we will explain the basics of cross-border EC, its merits and specific flow.

Advantages of cross-border EC

There are two main advantages of cross-border EC.

This is the point where we can acquire new customers in Vietnam. In particular, Vietnam is geographically and culturally close to Japan and has a rapidly developing consumer market. Of course, China is a larger market, but Vietnam’s EC market is now in a transitional stage. It is a less competitive and more promising market than China’s, as the market size continues to expand while facing multiple issues and room for improvement.

Secondly, it is relatively easier to establish a business in Vietnam than in a physical store. It depends on the products and legal conditions of the destination country, but for example, if you have stock in Japan, you can keep the cost down. In addition, many businesses are starting cross-border EC as a trial run with a view to opening physical stores in the future.

Specific schemes for cross-border EC

While we speak of cross-border EC in one word, the specific flow can be divided into several categories. There are many schemes depending on the destination country and the merchandise, but we will introduce three basic ones.

①Establish a local subsidiary in Vietnam

This method involves setting up a local subsidiary in the destination country and building an EC mall there. It is costly and time-consuming, but if the cross-border EC becomes large-scale and full-fledged, it can provide significant benefits in terms of logistics, for example. This is a high-risk, high-return method.

②Open a store in a local e-commerce mall

Opening a store in a local e-commerce mall is the easiest method of cross-border EC. Since the platform is already in place, the biggest advantage is the ability to enter the market while keeping costs to a minimum, making it easy for even small businesses to enter the market.

③ Use your own e-commerce site

This is a method of entering the Vietnamese market by preparing your own Vietnamese-language e-commerce site. This method can be completed at a relatively low cost. However, it is more difficult to attract customers than opening a store in a local e-commerce mall, so a more careful marketing strategy is required.

Taxation system for entering the Vietnamese market

When expanding into Vietnam, including cross-border e-commerce, it is necessary to have a deep understanding of the relevant laws and regulations, especially the taxation system. There may be tax benefits depending on the type and details of the business, so it will be highly beneficial to learn about them.

Value Added Tax (VAT)

VAT is a tax imposed on the importation of foreign goods in Vietnam for the sale or supply of products and services. The basic rate of this VAT is 10%.

Special consumption tax (ET)

The special consumption tax (ET) is a tax on so-called luxury items. The respective rates are set for cigarettes, alcoholic beverages, passenger cars with 24 or fewer seats, airplanes, gasoline, air conditioning equipment, imported playing cards, pachinko and other gambling machines, goods related to golf (tools and golf courses), lottery tickets, and so on.

Foreign Contractor Tax (FCT)

Foreign Contractor Tax (FCT) is a tax imposed on income or value added in Vietnam when a foreign individual or organization sells goods or provides services under a contract concluded with a Vietnamese individual or organization.

Vietnam EC Success Stories

In this chapter, we will present success stories in the Vietnamese EC market. Both examples of Vietnamese companies and examples of foreign-invested companies will be given.

Success stories of Vietnamese companies

Two examples of successful EC by Vietnamese companies are listed.

Shopee, the top e-commerce platform in terms of traffic

Shopee was only born in 2015, making it a late market entrant compared to major competitors such as Lazada and Tiki. Nonetheless, Shopee has already become a popular e-commerce platform with more than 70 million monthly PVs, the top in Vietnam.

The biggest factor in Shopee’s victory in the Vietnamese market was the company’s focus on developing applications for smartphones. While its competitors have focused on designing pages for PC browsing, Shopee has correctly recognized the rapid increase in smartphone usage among Vietnamese and has developed an app that is easy for Vietnamese to use. Currently, 90% of product transactions on Shopee are conducted through the mobile app.

Mobile World Investment Corporation, the largest retailer in Vietnam

“Mobile World Investment Corporation” operates large retail chains in Vietnam, including “The gioi di dong” (smartphones, computers, etc.), “Dien may xanh” (televisions, air conditioners, washing machines, etc.) and “Bach Hoa Xanh” (food, beverages, daily necessities, etc.). (food, beverages, daily necessities, etc.).

This “Mobile World Investment Corporation” also owns the e-commerce sites of the three brands mentioned above, and each site is among the top most visited e-commerce sites in Vietnam. In particular, during the lockdown in southern Vietnam, the fresh food e-commerce page for “Bach Hoa Xanh” was constantly crowded, and many products were out of stock. That is how high the demand is and how popular the products are.

In June 2021, “Mobile World Investment Corporation” is formally collaborating with major e-commerce platforms such as Shopee, Lazada and Tiki to enhance its reach to consumers through e-commerce.

According to the company’s latest announcement, EC sales for the January-September period of 2021 increased by 2.5 times over the same period last year.

Success stories of foreign companies

Case studies of Chinese companies and Japanese companies are given.

SHEIN, a Chinese apparel e-commerce platform

SHEIN is a China-based EC seller of fast fashion clothing in a B2C format. The company primarily manufactures and sells women’s clothing, but also offers a wide range of men’s and children’s clothing, accessories, shoes, bags, and other fashion items. SHEIN mainly targets the European, American, Australian, Middle Eastern, and Vietnamese markets. Recently, the company has begun to gain popularity in Japan.

SHEIN is not only active in the manufacture and sale of low-cost products, but is also very focused on social network marketing, including Facebook, Instagram, and Pinterest. Another key strength of SHEIN is its use of AI and data systems that automatically process orders with little or no human intervention.

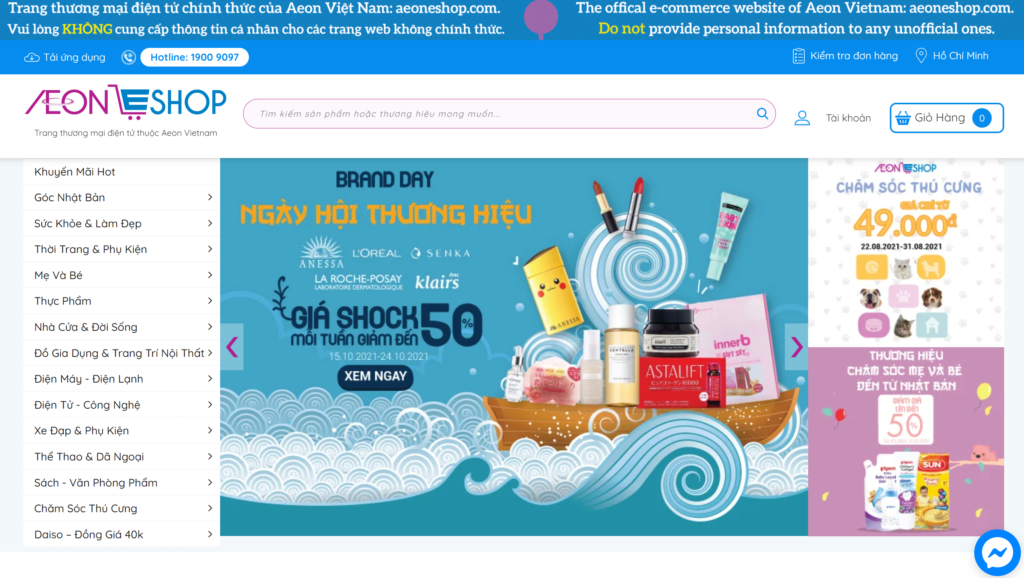

Success stories of Japanese companies

Amid the Corona disaster in Vietnam in 2021, Japan’s Aeon is making great strides in online sales through its own e-commerce site and app.

During the lockdown in southern Vietnam, particularly in Ho Chi Minh City, the number of orders for Aeon food and beverages increased significantly. Additionally, the number of orders placed through shopping agents and Aeon’s mobile app also increased significantly.

Challenges of the Vietnamese EC market

This chapter examines challenges in the Vietnamese EC market.

Settlement issues

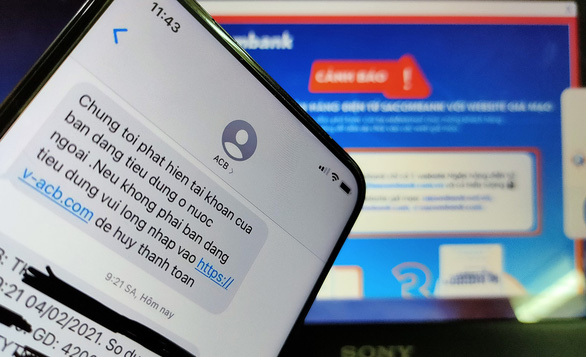

As mentioned above, 90% of payment methods for EC use in Vietnam are cash on delivery. Recently, payment methods such as credit cards and bank transfers have gradually become popular, but information management problems and fraud have become problems.

Specifically, it is not uncommon for consumers to be tricked by fake transaction confirmation messages, emails, fake bank websites, and e-commerce pages, and their bank passwords and credit card numbers It is not uncommon for them to be taken. This seems to be a major barrier to the spread of cashless payment in Vietnamese EC.

Transportation and delivery

The development of Vietnam’s transportation infrastructure has not kept pace with the growing transportation needs.Especially in large cities such as Hanoi and Ho Chi Minh City, the transportation infrastructure has not been able to keep up to a large extent, and traffic congestion is frequent, resulting in long transport times for goods.

Also, unlike Japan, Vietnam’s railroads are not developed. Most Vietnamese railroads were built during the French colonial period, so the rolling stock and tracks are quite old. Goods are mainly transported by road.

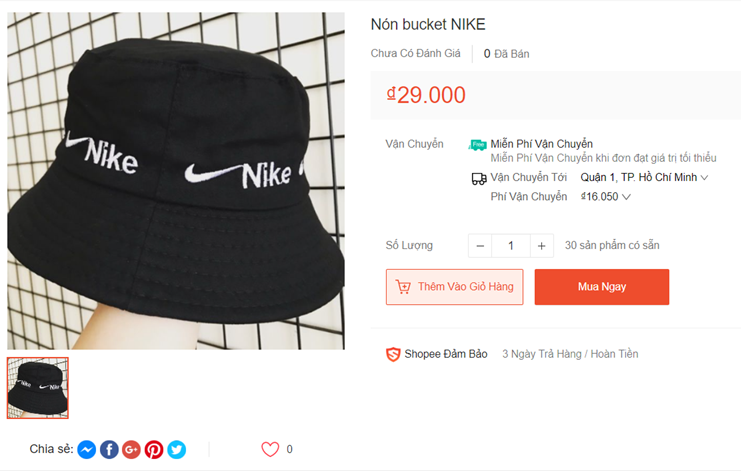

Many fakes

While e-commerce is very convenient, it naturally has its disadvantages. The most obvious example of this is the inability to check products directly before purchase. Therefore, consumers are at risk of being sold counterfeit or obviously low-quality inferior goods.

The problem of fake products in Vietnam is much more malicious than in Japan. For example, in Vietnam, there are not only fake fashion brands, etc., but also many fake cosmetics, health foods, and other products that are used directly on the body.

The most common fake products in EC are fashion items and cosmetics, and many consumers are deceived into buying fake products because they look very similar to the real ones but are sold at prices several times lower.

Refrigerated transport

As mentioned above, EC of perishable products such as meat, fish and fruits is considered to be one of the key trends in Vietnam EC in the future.

However, the biggest problem hindering the development of this trend is the lack of cold chain facilities. Vietnam has a growing shortage of refrigerated trucks and cold storage facilities, which has a significant impact on the deliverable area, transit time, and quality of refrigerated goods and food products. Specifically, only 8.2% of Vietnam’s domestic food distributors use cold chain.

Future Outlook

Vietnam’s e-commerce market has the basic elements necessary for significant development. A young population, high Internet and smartphone usage, and rising incomes are factors driving the growth of the e-commerce market.

However, management systems and legislation for e-commerce transactions and payment behavior have not kept pace with the rapid development of the market, leading to problems such as fakes, false advertising, and other Internet-based fraud.

Also, the biggest barrier to EC development in Vietnam is the transportation and logistics infrastructure, especially the cold chain.

Vietnam’s e-commerce user base is gradually increasing, not only among digitally savvy young people, but also among middle-aged people. This is mainly due to the increasing optimization of UI/UX and functions on Vietnamese e-commerce platforms, making them more accessible to a larger number of people. This trend is expected to continue.

In the future, almost every Vietnamese household, from rural to urban, will have access to EC.

Summary

This report provides a comprehensive overview of the EC market in Vietnam. Specifically, it introduced what cross-border EC is, the general situation and challenges of the market, major players, and future trends.

In a nutshell, cross-border e-commerce is online shopping across borders. While the details of this strategy vary from country to country, it is important to understand the basic scheme.

Vietnam’s e-commerce market continues to grow in the wake of the Corona disaster lockdown. This growth is supported by the high penetration of the Internet and smartphones. The size of the Vietnamese Ec market reached US$15 billion in 2020. Large electrical appliances are a particularly popular category. On the other hand, demand for fresh food e-commerce is also growing.

Major players in the Vietnamese e-commerce market include services such as Shopee, Lazada, Mobile World Group, Tiki, Sendo, etc. As for digital marketing related to e-commerce, live commerce using Facebook is very popular Facebook is the most popular e-commerce platform in Vietnam, with about 65% of the population using Facebook. This is because about 65% of the Vietnamese population uses Facebook.

Market trends include the spread of electronic payments and the increasing demand for fresh food. On the other hand, as for challenges, he mentioned that there are many frauds and fakes, and that the transportation infrastructure is underdeveloped.

One of the prospects for the future is the expansion of the areas in Vietnam where EC is available. Bringing new opportunities to Vietnam’s rural areas through EC will create more diverse options for both sellers and buyers.

【関連記事】ベトナムのEC市場についてはこちらの記事も合わせてご覧ください。

ベトナム市場調査レポート一覧はこちらからもご覧頂けます。

ベトナム市場の情報収集を支援します

ベトナム市場での情報収集にお困りの方は多くいらっしゃるのではないでしょうか。

VietBizは日本企業の海外事業・ベトナム事業担当者向けに市場調査、現地パートナー探索、ビジネスマッチング、販路開拓、M&A・合弁支援サービスを提供しています。

ベトナム特化の経営コンサルティング会社、ONE-VALUE株式会社はベトナム事業に関するご相談を随時無料でこちらから受け付けております。