- Introduction

- Trends in the Digital Economy in Vietnam

- Status of Formulation of Digital Economy Strategy and Legal Provisions of the Vietnamese Government

- Status of Digital Economy Development in Representative Sectors

- DX Consulting Company Driving the Digital Economy

- Start-ups Driving the Digital Economy

- Opportunities for Japanese Companies to Enter the Market

- The Future of Vietnam’s Digital Economy and Society

- Three Challenges in DX

- Conclusion

- ベトナム市場の情報収集を支援します

Introduction

The size of Vietnam’s digital economy is growing rapidly.

The size of Vietnam’s digital economy in 2021 will reach 21 billion USD (about 2.37 trillion yen), ranking third among the six major Southeast Asian countries after Indonesia and Thailand.

In particular, the e-commerce (e-commerce, EC) market in Vietnam is worth 13 billion USD (about 1.47 trillion yen) and is expected to grow to 39 billion USD (about 4.4 trillion yen) by 2025, drawing attention to its growth potential. This statistic was published in the research report “e-Conomy SEA 2021,” jointly conducted by Google, Temasek, and Bain & Company.

The “digital economy” and “digital transformation” (hereinafter referred to as “DX”) in the Vietnamese market are expected to grow significantly in the future.

The “digital economy” or “DX” has been one of the most mentioned keywords by the Vietnamese government over the past five years. In particular, the fact that new Prime Minister Pham Minh Chinh serves as chairman of the Vietnam National DX Committee suggests the Vietnamese government’s temperature on DX.

This article presents the unfolding landscape of Vietnam’s digital transformation and digital economy, as well as predicts future trends.

Trends in the Digital Economy in Vietnam

According to the Vietnamese Ministry of Science and Technology, DX is the “innovation and creation activity” of government agencies, private organizations, or enterprises. It also says that government agencies, private organizations, and enterprises use information technology to digitize information, restructure business processes and organizational structures, and transform from traditional to digital environments.

First, I would like to summarize the definition of the digital economy and the difference between IT and DX.

Difference between “digital economy,” “IT-ization,” and “DX.”

The Japanese Cabinet Office defines the digital economy as “an economy in which digitized goods, services, information, and money are distributed among individuals and businesses via the Internet. While there are various definitions of the digital economy, the digital economy addressed in this report is in line with the above definition.

IT is the application of digital technology to improve the efficiency of work methods. It is expected to improve productivity because it can reduce work hours. In other words, it is expected to reduce human labor and contribute to solving social problems such as long overtime work and overwork.

DX (Digital Transformation) is an initiative to improve people’s lifestyles or develop new business models through the use of digital technology.

IT is the introduction of information technology with the objective of improving corporate productivity, while DX is the use of digital technology with the objective of creating new business models or transforming existing business models.

For example, “automation of production lines” or “more efficient wage calculation” can be called IT. However, “new payment methods used by consumers,” “development of new products based on customer data analysis,” and other changes in the existing structure can be called DX.

The State of Development of the Digital Economy in Vietnam

According to the “e-Conomy SEA 2021” jointly conducted and published by Google, Bain & Company of the United States and Temasek of Singapore, Vietnam’s digital economy in 2021 will reach US$21 billion, a 31% increase over the previous year. Vietnam ranks third in Southeast Asia after Indonesia and Thailand.

According to the study, the size of Vietnam’s digital economy is expected to reach USD 57 billion in 2025, an increase of 30% from 2021.

According to the study, the size of Vietnam’s digital economy is expected to reach USD 57 billion in 2025, a 30% increase over 2021.

The Vietnamese government intends to set a target for the digital economy to account for at least 20% of total GDP by 2025 and 30% by 2030, but the latest proposal from the Ministry of Investment and Planning in September 2021 proposed consideration of raising the ratio to 50% by 2030.

Currently, the development of Vietnam’s digital economy can be described as a leap-frog type. Leapfrogging is a phenomenon in which the latest technology penetrates at once, leaping over intermediate stages in emerging and developing countries that lack existing infrastructure. For example, in Japan, the telephone culture spread through public telephones in towns and fixed-line telephones in homes, but in Vietnam, the telephone culture spread suddenly through cell phones and smart phones.

With the spread of the Internet, smartphones, and 4G/5G in Vietnam, the digital economy is expected to develop at a leapfrog pace in the future.

Digitalization and DX in Vietnam

Vietnam’s DX is somewhat behind compared to the rest of the world. It can be said that Vietnam recognizes the importance of digitalization, but the speed of implementation has not accompanied it.

There are two main reasons why DX in Vietnam is said to be slow.

The first is that the population and land databases have not yet been completed. Traditionally, Vietnam has used paper “family registers,” which require a great deal of labor and cost for land management and processing of population and resident data. In addition, it is very difficult to update population and land information accurately and in real time.

However, progress has been made in this regard, with the suspension of the issuance of new paper family registers in July 2021, and the digitization of national information on population and land.

The second is the lack of awareness of DX among enterprises and people. According to a Cisco Vietnam survey, more than 70% of Vietnamese SMEs are passive toward DX and do not have a clear DX policy. A “shift in mindset” is the first step in DX, but Vietnam is not doing well even at this rudimentary stage.

DX Development Goals of the Vietnamese Government

According to the “National DX Program until 2025” (Decision No. 749/QD-Ttg) approved by the Prime Minister of Vietnam, the country has set DX development targets in three areas, including e-government, digital economy, and digital society.

e-government

The Vietnamese government’s development goal by 2025:

- 80% of citizens to be able to register and pay for public services online (100% by 2030)

- 90% of provinces, cities and regions to digitize administrative documents (100% by 2030)

- 50% of central government agencies digitized (70% by 2030)

デジタル経済

The Vietnamese government’s development goal by 2025:

- Digital economy to account for 20% of Vietnam’s GDP (30% by 2030).

- Digital economy to account for at least 10% of GDP by sector (agriculture, services, industry, construction, etc.) (at least 20% by 2030)

- Productivity growth of at least 7% per year (at least 8% by 2030)

- Rank in the top 50 in the ICT Development Index (IDI) (top 30 by 2030)

- Global Competitiveness Index (GCI) ranking in the top 50 (top 30 by 2030)

- Global Innovation Index (GII) ranks within 35 (top 30 by 2030)

Digital Society

The Vietnamese government’s development goal by 2025:

- 100% fiber coverage in each region (at least 80% coverage to each household, 100% by 2030)

- Broadband deployment covers 4G/5G nationwide (5G coverage nationwide by 2030)

- Electronic payment account ownership is at least 50% of the population (80% by 2030)

- Global Cybersecurity Index (GCI) ranking in the top 40 (top 30 by 2030)

Status of Formulation of Digital Economy Strategy and Legal Provisions of the Vietnamese Government

The Vietnamese government is oriented toward the digital transformation of government functions, society, and the economy as a whole, and has been working to materialize the DX strategy annually through administrative documents such as “Policy on Actively Participating in the Fourth Industrial Revolution” (Decision No. 52-NQ / TW) (2019), “Implementation of the Government Action Plan and the 13th National Congress of the Communist Party” (Decision No. 50 / NQ-CP) (April 2020), ” National DX Plan until 2025 and for 2030″ (Decision No. 749 / QD-TTg) (June 2020), and through other administrative documents, the DX strategy is materialized annually.

In the 2019 Policy on Actively Participating in the Fourth Industrial Revolution (Protocol No. 52-NQ / TW), the government clearly stated Vietnam’s countrywide DX lag and established a radical and comprehensive DX policy.

The “Government Action Plan and Implementation of the 13th National Congress of the Communist Party” (Protocol No. 50 / NQ-CP) (April 2020) expressed a more specific national DX direction than the previous “Protocol No. 52-NQ / TW”. The government nominated sectors and institutions to do DX and gave clear guidance on the roles of government, ministries, and local governments in DX, according to the government.

The latest DX document, the “National DX Plan to 2025 and 2030” (Decision No. 749 / QD-TTg) (June 2020), establishes a “National DX Strategy” and announces that all efforts will be made to achieve the DX targets set by each agency for 2025 and 2030. The DX strategy is established and the government announced that it will make every effort to achieve the DX targets set by each agency by 2025 and 2030.

Status of Digital Economy Development in Representative Sectors

Cashless and Electronic Payments

According to the Ministry of Finance of Vietnam, 85% of the Vietnamese population will use e-wallets and e-payments as of 2021. In particular, 71% of them will make electronic payments at least once a week.

Vietnam’s popular e-payment apps such as Viettel Pay, MoMo, and AirPay offer comprehensive payment services for purchasing and paying insurance, utility bills, phone bills, internet, electricity, and water bills, school fees, and plane tickets. Those apps also work with major e-commerce sites such as Shopee, Lazada, and Tiki.

The development of Vietnam’s electronic payment market has great potential for Japanese companies: on December 10, 2021, Mizuho Bank, a Japanese megabank, invested 15 billion yen in “MoMo,” which holds a 53% share of Vietnam’s electronic payment market, acquiring 7.5% of the company’s shares. With this investment, “MoMo” became the third unicorn in Vietnam. Another example was in 019, when SoftBank’s investment fund “SoftBank Vision Fund” acquired a 20% stake in “VNPAY,” a cashless payment startup in Vietnam.

Agriculture(Smart Agriclture)

In the agricultural sector, the government is oriented toward fundamental reform, aiming for sustainable development by shifting production from “quantity” to “quality” through the application of technology to increase the added value of agricultural products.

This transformation is still in its early stages and has been implemented in several regions of Vietnam, but has not spread nationwide. In the future, the Ministry of Agriculture and Rural Development intends to continue implementing smart agriculture in specific regions and to model successful practices to establish a methodology to be used nationwide.

Environment and Energy

In the energy and environment sector, the Vietnamese government aims to digitize its electricity usage management system while investing in renewable energy (especially wind power) in the future.

In fact, EVN (Electricity of Vietnam Corporation) is actively operating an electronic billing network called “e-billing” to check and pay electricity bills. Currently, the company is actively conducting advertising activities to promote the service to the public.

Currently, however, solar PV development has exceeded the planned capacity by 2030, resulting in oversupply in some areas. In addition, overloading of transmission lines and slow application of system-wide power management technologies are issues that will need to be resolved.

Developments in DX have not been well introduced in the environmental sector. The most significant reason is that the high cost is not balanced by the expected productivity gains.

Talent Management

Vietnam has developed a plan to develop its workforce, but overall the approach is traditional and not very DX oriented. There are also no DX-related documents in the human resources sector published by the government.

In practice, however, online job search platforms are being actively developed to meet labor market needs, and human resource management DXs are also being actively implemented by companies to reduce administrative costs. For example, in the cleaning industry in Vietnam, an application that can manage the attendance of cleaners at each job site is becoming widespread.

Since Japanese companies that excel in human resource development are powerful partners for Vietnamese companies, the need for collaboration in the area of human resources is expected to increase in the future.

Education

Education is one of the most DXed areas in Corona Disaster Vietnam. The traditional structure of education has changed dramatically in just one year, 2020, as all students, from elementary school to university, are now learning online.

In addition to online conferencing platforms such as Zoom and Google Meeting, Vietnamese technology companies also provided online platforms to support students and teachers. educational materials through platforms developed by domestic Vietnamese companies such as Topica, Hocmai downloading, homework submission, and participation in online exams have become common in Vietnam.

These companies already participated in the market before the Corona Disaster and have a very good understanding of the market, so competition in this area remains very intense.

Medical and Health

Vietnam’s medical and health sectors were greatly advanced in DX by the Corona disaster. Prior to the corona disaster, patients were concentrated in large hospitals in big cities and overcapacity occurred. In Vietnam, small hospitals in rural areas are less reliable, and this is due to the fact that many patients from outside the cities flood into these hospitals.

However, in the wake of the corona disaster, large hospitals implemented and promoted online diagnosis and joint diagnosis with regional hospitals, which reduced the burden on large hospitals and the risk of corona transmission.

DX Consulting Company Driving the Digital Economy

FSI

| Company name | FSI Technology Development and Trading Investment Joint Stock Company |

| year of establishment | 2007 |

| location | Cau Giay District, Hanoi city |

| HP | https://fsivietnam.com.vn/ |

FSI is one of the leading companies in the DX consulting field in Vietnam, having started out as a software design and development company and transformed into a company whose main business is DX consulting for large Vietnamese companies. Currently, FSI has over 600 clients including private companies and government agencies such as MB Bank (Vietnam Military Bank), Viettel (Vietnam Military Telecom), Prudential, and LG Group in Vietnam.

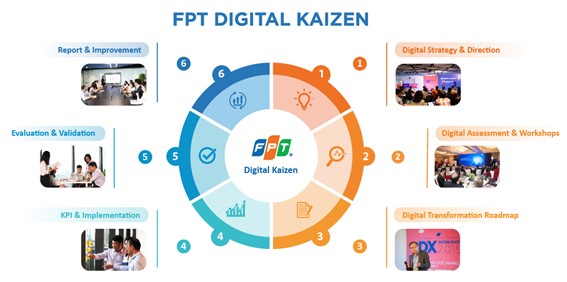

FPT Digital

| company name | FPT Digital Co., Ltd (FPT Group) |

| year of establishment | 2020 |

| location | Cau Giay District, Hanoi city |

| HP | https://digital.fpt.com.vn/ |

FPT Digital is a subsidiary of FPT Corporation, one of the largest IT companies in Vietnam. The company provides consulting services for holistic DX solutions from planning to implementation of digital transformation for enterprises.

FPT Digital’s proprietary DX solution, FPT Digital Kaizen, is also available in Japan. what differentiates FPT Digital from other DX consulting firms is the experience of its personnel. many of FPT Digital’s managers and engineers are Many of FPT Digital’s managers and engineers are from FPT Corporation and have been providing DX consulting services to Japanese companies and government agencies since the early 2000s. This enables the company to provide high-quality DX support to its clients.

MISA

| company name | FPT Digital Co., Ltd (FPT Group) |

| year of establishment | 2020 |

| location | Cau Giay District, Hanoi city |

| HP | https://digital.fpt.c |

MISA is not a large company, but it is well known in Vietnam. It provides financial and accounting management software for businesses. The company offers DX solutions in business management areas such as HR and SG&A, with a particular focus on small and medium-sized enterprises. Its accounting system for government agencies, MISA FinGov, was selected as one of the three best DX solutions of the year by the Vietnamese government in 2021.

出所:baotintuc.vn

Start-ups Driving the Digital Economy

MCGREEN SOCIAL SERVICES

| company name | MCGREEN SOCIAL SERVICES |

| year of establishment | 2018 |

| location | Hanoi |

| HP | https://mgreen.vn/ |

mGreen is a waste collection company that utilizes digital technology. It focuses on supporting the separation of waste at the source. In Vietnam, awareness of waste separation is not as high as in Japan, and few citizens have the knowledge to separate waste.

Users sort their household waste according to the guidance provided by mGreen’s smartphone application, and then mGreen collects the waste. Once users register an account with the mGreen app, they will receive a free waste bin to sort their waste and the app will explain how to sort their waste. This is intended to educate users about waste separation. Once the waste has been sorted, the user, via the app, requests an mGreen employee to collect recyclable waste from their home. Users can accumulate in-app points for each kilogram of recyclable waste, which can be redeemed for points that can be used for shopping.

Currently, mGreen provides its services mainly in Hanoi. In addition, mGreen’s operations are supported by major companies such as Nestle and Vin Group, and the Communist Youth Association of Hanoi also supports the company’s home waste collection.

MIMOSA TECHNOLOGY

| company name | MIMOSA TECHNOLOGY |

| year of establishment | 2014 |

| location | Ho Chi Minh |

| HP | https://mimosatek.com/ |

MIMOSA TECHNOLOGY (MimosaTEK) is a company that develops in the field of smart agriculture.

From soil moisture sensors, automatic operation, irrigation management, nutrient management, and fertilizer to a mobile app that is easy for farmers to understand, MIMOSA TEK designs its own products.

Data collected and analyzed by the system is sent to the farmer’s smartphone, which provides advice on what the farmer should do next.

MimosaTEK is also partnering with Eurofins Agro (Netherlands) to build an IoT system that will collect and analyze soil nutrient data and weather station data in real time through agriculture.

EDOCTOR

| company name | EDOCTOR |

| year of establishment | 2014 |

| location | Ho Chi Minh |

| HP | https://edoctor.io/ |

eDoctor was founded in late 2014 to provide medical consultation and diagnostic services over the phone and develop a mobile app. Currently, the eDoctor app uses artificial intelligence (AI) to analyze patient questions and recognize keywords in patient requests before matching them with the appropriate specialist. Doctors access their own specialty page and respond to patient requests and demands.

eDoctor is developing a chat, phone, and video phone service between patients and physicians. eDoctor’s full-time physician team consists of approximately 30-50 physicians from hospitals nationwide.

eDoctor is known as one of the hottest startups in Vietnam, having received over US$1 million in investment in March 2020 from four large funds: CyberAgent Capital and Genesia Ventures from Japan, Bon Angels and Nextrans from Korea.

Opportunities for Japanese Companies to Enter the Market

The Vietnamese government welcomes the entry of Japanese companies in the digital economy and DX sector.

In November 2021, Vietnamese Prime Minister Pham Minh Chinh paid an official visit to Japan. During that visit, he met with representatives of Japanese companies and mentioned cooperation in digital economy and DX development. Major companies that participated in the dialogue included SBI, Sony, Daiwa Securities, SCSK, Dai Nippon Printing, and KDDI.

During the meeting, Prime Minister Chin indicated five areas in which he would like to cooperate with Japanese companies, including digital infrastructure, IoT, AI, blockchain, and especially digital human resource development, and each company expressed interest in the areas they are focusing on.

Since Prime Minister Chinh is the Chairman of the National DX Committee of Vietnam, the holding of this meeting could mean that the Vietnamese government welcomes the entry of Japanese companies into the DX sector.

The Future of Vietnam’s Digital Economy and Society

Expansion of EC Users

The size and number of users of Vietnam’s e-commerce market will continue to grow steadily, thanks to the widespread use of the Internet and smartphones.

According to statistics from Vietnam’s Ministry of Information and Communication (2020), more than 61.37 million people in Vietnam own a smartphone. This equates to 64% of the population and places Vietnam among the top 10 countries in the world with the highest smartphone penetration rate. In addition, Vietnam has 4G penetration in most regions and cities across the country. These two factors are seen as the soil for EC development in Vietnam.

According to iPrice data, which provides statistics on the number of visits to websites, the number of visits to the three largest Vietnamese e-commerce platform sites in 2021 has increased significantly over the previous year: in just the three months of June and September 2021, Shopee recorded 77.8 million visits (an increase of 16 million visits compared to the same period last year), TIKI had 22.5 million visits (an increase of 5.5 million visits over the previous year), and LAZADA, which is restructuring its business strategy, had 21.4 million visits (an increase of 1.4 million visits).

The Corona Disaster has also led to an increase in food purchases through e-commerce channels. For example, the average number of visits to the e-commerce site of Bach Hoa Xanh, a company specializing in food retailing, increased 2.3 times in one year.

The size of the Vietnamese EC market in 2021 was USD13 billion (approximately 1.47 trillion yen), up 53% from the previous year, and is expected to grow to USD39 billion (approximately 4.4 trillion yen) in 2025, up 32% from 2021.

Increased Expectations for DX and IT

According to the results of the “State of Digital Transformation in 2020” survey of over 400 companies conducted by the Vietnam Chamber of Commerce and Industry (VCCI), the cloud was the most adopted technology in internal management, with 60.6% of surveyed companies using it. This is an increase of 19.5% compared to 2019. Online conferencing was the next most widely deployed technology. About 30% of companies were found to have had online conferencing tools in place prior to 2019, but after the Corona disaster of 2020, an additional 19% of companies began implementing online conferencing.

98% of the surveyed companies expect a lot from DX and IT, including cost savings, increased efficiency of paperwork, and improved quality of products and services.

Three Challenges in DX

Vietnamese society in general, and Vietnamese SMEs in particular (98% of domestic Vietnamese enterprises are SMEs), face three major and biggest challenges in DX.

The first is the lack of a DX foundation. Vietnam is relatively behind the rest of the world in terms of technological capabilities and is dependent on foreign goods and technologies because its core technologies, which could serve as a foundation for DX, are immature. Currently, Vietnamese SMEs are aware of the need for DX, but the degree of adoption of business digitalization is low to begin with, and the conditions for implementing DX are difficult, i.e., there is no base for DX implementation.

Second is funds for investment in DX, which requires a large investment to change the entire enterprise in terms of awareness, strategy, human resources, infrastructure, and technological solutions, etc. Even if there are Vietnamese SMEs with DX awareness, there are cases where they want to implement drastic DX but cannot because of limited funds available for investment. There are cases where SMEs in Vietnam are aware of DX, but have limited funds available for investment.

Third is the awareness of companies and people: DX must start with a change in the mindset of leaders, as it requires a shift from a traditional mindset to a cutting-edge one using digital technology. In light of this, DX awareness is still insufficient in Vietnam. The Vietnamese government needs to focus more on spreading DX awareness throughout society.

Conclusion

This report provides a comprehensive overview of trends in Vietnam’s digital economy.

First, regarding the relationship between “digital economy,” “ITization,” and “DX,” the report defined the digital economy as “an economy in which digitized goods and services, information, and money are distributed among individuals and companies via the Internet,” and introduced ITization as “the application of digital technology to make work methods more efficient, DX is an effort to improve people’s lifestyles or develop new business models through the use of digital technology.

Regarding the size of Vietnam’s digital economy, it reached US$21 billion in 2021, a 31% increase over the previous year. Vietnam ranks third in Southeast Asia after Indonesia and Thailand.

In 2025, the size of Vietnam’s digital economy is expected to reach USD 57 billion, a 30% increase from 2021.

On the other hand, Vietnam’s DX is still not very advanced, and two reasons were cited: first, information on the people and land has not been digitized, and second, the Vietnamese national authority and Vietnamese companies have not paid that much attention to DX. However, regarding the first, digitization has been underway since July 2021.

In addition, the DX areas that are attracting attention in Vietnam are agriculture (smart agriculture), environment and energy, human resources, education, and healthcare.

Vietnam is home to many companies, from major players to start-ups, that are contributing to the development of the digital economy, including DX and IT, and the Vietnamese government also welcomes the participation of Japanese companies.

The entry of Japanese firms is expected to solve the three DX-related problems that Vietnam faces: (1) lack of infrastructure, (2) lack of investment funds, and (3) lack of awareness and interest. With much room for improvement, Vietnam’s digital economy-related market is a promising market for Japanese companies.

【関連記事】VietBizではデジタル分野に関するレポートを他にも取り揃えています。本記事と併せてぜひご覧ください

ベトナム市場調査レポート一覧はこちらからもご覧頂けます。

ベトナム市場の情報収集を支援します

ベトナム市場での情報収集にお困りの方は多くいらっしゃるのではないでしょうか。

VietBizは日本企業の海外事業・ベトナム事業担当者向けに市場調査、現地パートナー探索、ビジネスマッチング、販路開拓、M&A・合弁支援サービスを提供しています。

ベトナム特化の経営コンサルティング会社、ONE-VALUE株式会社はベトナム事業に関するご相談を随時無料でこちらから受け付けております。