Introduction

Vietnam’s commodities (daily consumer goods) market is expanding. Vietnam’s population is growing steadily every year, and is expected to reach 97.34 million by 2020, close to 100 million, and by the 2040s, it is estimated to exceed Japan’s population. In addition to population growth, Vietnam is experiencing an increase in income due to economic development, and the percentage of the population that is affluent and middle class is increasing. Under these conditions, it is inevitable that the market for daily necessities will expand in Vietnam.

This report provides a comprehensive overview of daily necessities in Vietnam. It looks at the market structure, major players, as well as consumer characteristics, future trends, and even the impact of the Corona disaster.

Definition of “commodity”

In Vietnam, there is no general concept of “daily necessities” as it is prevalent in Japan. In addition, the law does not specifically define the classification of daily necessities.

This report will specifically address toothpaste, insecticide, powdered detergent, fabric softener, dishwashing detergent, tissue paper, diapers, shampoo, toilet cleaner, and gargle solution among other household products.

Market size

According to market research firm Kantar, the Vietnamese daily necessities market size will reach US$3.1 billion in 2020.

Also, according to the company, consumers tended to spend more cautiously in 2020 due to the new coronavirus, but shopping demand for daily necessities increased by a positive 29%. This is an important phenomenon that represents the potential of the commodities market in Vietnam

Vietnam’s commodities market is dominated by multinational companies with ample capital and branding and marketing know-how. These companies have been in the Vietnamese market since the 1990s, when the Vietnamese government opened the market internationally. As such, they not only have a thorough understanding of Vietnamese consumer psychology and behavior, but also have the advantage of being able to respond quickly to changes in Vietnam’s economic, political, and environmental conditions.

出所:seekingalpha.com

Promising Products

This chapter introduces products that are in particularly increasing demand in Vietnam.

Toothpaste

According to a Coulomb University study (2018), the Vietnamese toothpaste market is dominated by Unilever (UK), the largest foreign-owned daily necessities company, with 60%, Colgate-Palmolive (US) with 30%, and the remaining 10% by small and medium-sized Vietnamese and foreign companies. Unilever has by far the largest share of the Vietnamese toothpaste market.

By the way, in 1995, shortly after the Vietnamese government opened the domestic market to foreign investment, the combined market share of state-owned P/S and Da Lan in the South was over 90%. However, P/S and Da Lan were acquired by Unilever and Colgate Palmoliven, respectively, and the M&A transaction between Unilever and P/S was US$5 million (in 1995), the largest M&A transaction in Vietnam at the time. It was one of the largest M&A transactions in Vietnam at that time.

In recent years, however, new entrants have emerged to capture a share of the Vietnamese daily necessities market. These companies are not pure commodity manufacturers, but are originally major players in different fields. The new entrants are taking major actions, such as investing heavily in TV advertising, which threatens the monopoly that the existing major players maintain.

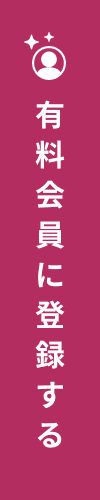

According to a survey by Q&Me (2019), Vietnamese brush their teeth several times a day. The majority of Vietnamese brush their teeth two to three times a day. Apart from the timing in the above graph,many Vietnamese have the habit of brushing their teeth before meetings with clients, before conferences or important events, or other work-related activities.

Insecticide

Because Vietnam is a country with a tropical climate, insecticides are an essential product of life for many Vietnamese, especially in the countryside and near water, where mosquitoes and insects are abundant.

In Vietnam’s pesticide market, foreign brands that entered the market early, starting in the 1990s, when the market was in its infancy, are now recognized by consumers and dominate the market.

The brand that Vietnamese are most familiar with is the “RAID” brand from the US company SC Johnson & Son, which entered Vietnam in the 1990s and focused on TV advertising. The company has been selling its products in Vietnam for about 30 years, and many Vietnamese consumers have learned the packaging and habitually buy the products even if they do not know much about the distributor.

The runner-up to “RAID” is the “JUMPO” brand from Japan’s “Huma-Killer” company. Unlike “RAID,” which has maintained the look and scent of its products over the decades, “JUMPO” frequently markets new scented insecticides. Lavender and lemon scented products are considered to be JUMPO’s best-selling products.

出所:Shopee.vn

Powder detergent

The majority of the laundry detergent market in Vietnam is dominated by brands such as OMO, ARIEL, and other large foreign-owned companies.

According to statistics from the Vietnam University of Finance and Marketing (2019), the market share leaders in the detergent industry are Unilever (54.9%) in the UK and Procter & Gamble (16.0%) in the US

Dai Viet Huong (11.6%) is the largest brand in Vietnam. Other than that, LIX (2.7%), Vico (2.4%), and NETCO (1.5%) hold smaller shares. In addition, the products of domestic detergent brands are mainly purchased in rural and countryside areas, while the products of foreign companies almost completely dominate urban areas.

The key factor that allows foreign firms to dominate Vietnamese domestic firms seems to be “financial power”. These firms are highly competitive because they invest heavily in customer research and advertising, while frequently developing new products and product lines. In contrast, Vietnamese domestic companies lack financial strength (on the contrary, they often operate at a loss or are heavily in debt), are unable to invest in new product development and advertising, and have very low consumer recognition.

According to local Vietnamese newspapers, the size of the laundry detergent industry is increasing by 5-6% per year in 2020, and the top leaders in terms of market share for powdered detergents in four metropolitan areas (Ho Chi Minh City, Hanoi, Da Nang, and Can Tho) are OMO (by Unilever), ARIEL (by Procter & Gamble), and LIX (by LIX, a subsidiary of state-owned Vietnam Chemical Corporation). (Procter & Gamble), and LIX (LIX, a subsidiary of the state-run Vietnam Chemical Corporation). Meanwhile, in rural areas, popular brands include “OMO” and “ALBA” (Dai Viet Huong, a Vietnamese company).

Foreign giants have a dominant share of the Vietnamese detergent market, but something happened in 2021 that threatens that. That is the market entry of MASAN, the largest conglomerate in Vietnam.

Joins Powder Detergent, developed Masan Consumer, a subsidiary of Masan Group’s household products production subsidiary, has recently received a great deal of attention from consumers.

In fact, Masan is an excellent company with strengths in product research and development (R&D) and a good understanding of the needs of the modern consumer. Furthermore, Masan owns a chain of convenience stores called VinMart, which has 3,000 stores nationwide, and should be able to smoothly deliver Joins products to consumers. In addition, unlike domestic detergent manufacturers, Masan is a company with sufficient “financial resources” and decades of experience in selling food products, and thus has the potential to implement brand advertising and sales promotion measures for new products at a high level.

The entry of Masan is considered to be a major factor in changing the structure of the Vietnamese laundry detergent market.

Flexibilizer

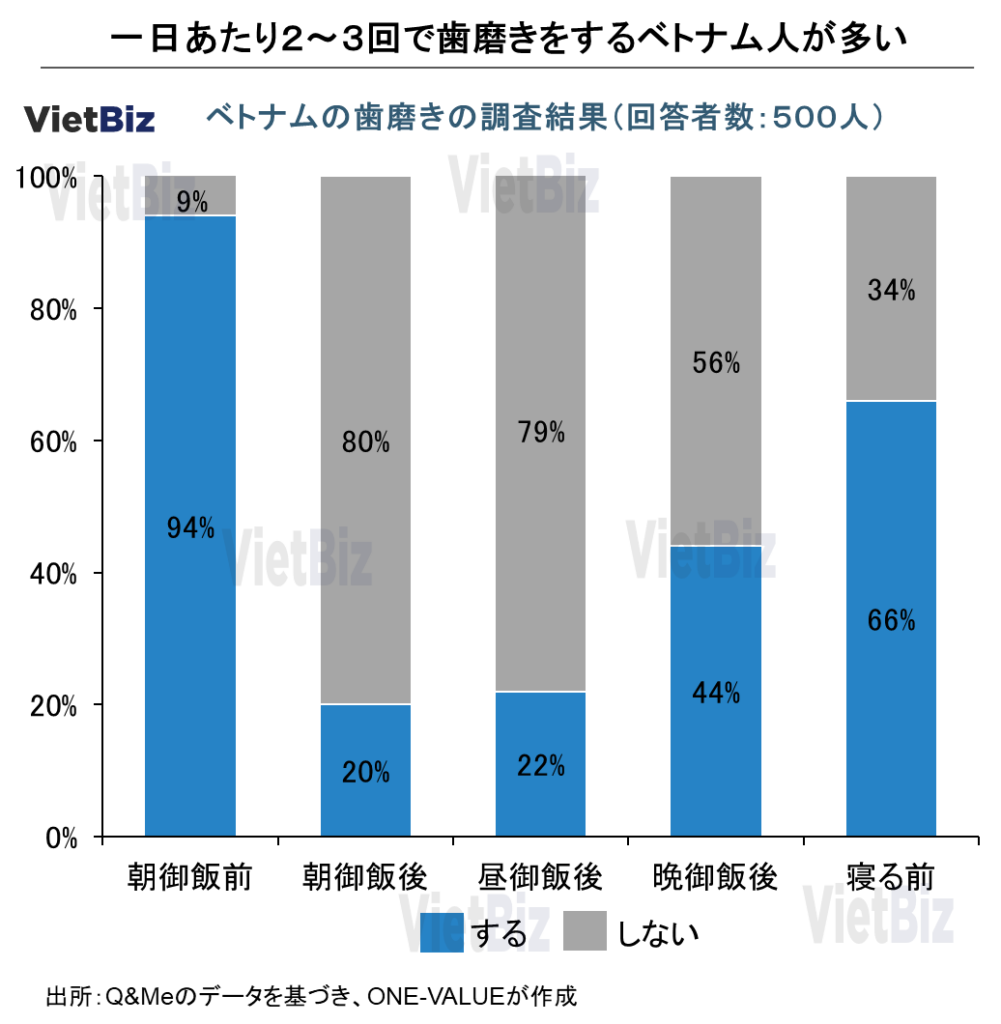

In addition to laundry detergents, many Vietnamese also use fabric softeners. As with laundry detergents, the “Comfort” brand from Unilerver and the “Downy” brand from Procter & Gamble dominate this market.

Threatening the market for fabric softener products are recent laundry detergents that function as both fabric softeners and laundry detergents. VISO (Vietnam) and TIDE (USA) are among the companies that have developed such products. However, since these products are often inferior to fabric softeners in terms of fragrance and duration, Vietnamese people have a habit of purchasing laundry detergent and fabric softener separately.

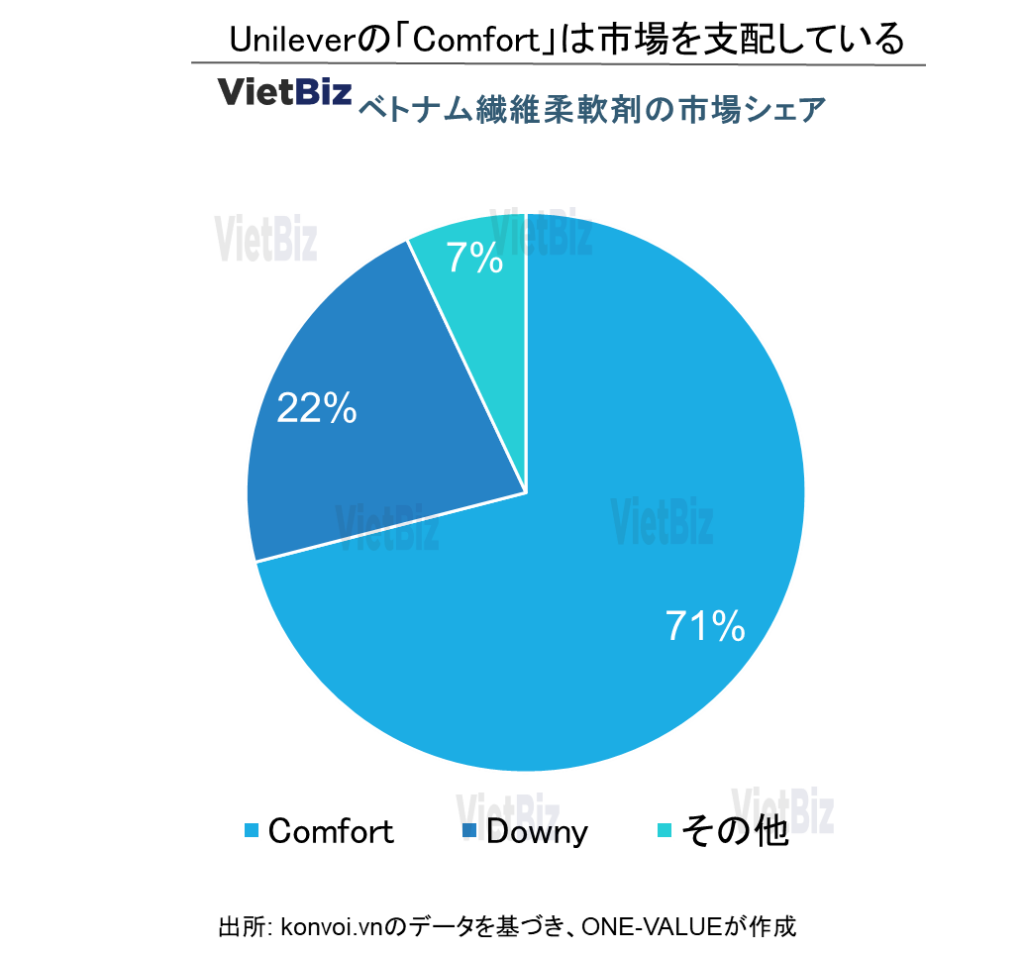

A survey by Konvoi.com found that Vietnamese buy 1 to 1.8 liters of fabric softener products once a month, and that the deciding factor for consumers when purchasing fabric softener is not “brand” but “scent” and “scent duration.

Dishwasher detergent

As with the household products introduced so far, the company that dominates the market for dish detergent is “Unilever”: according to the results of a survey conducted by Vinaresearch with 820 Vietnamese participants, 70% of the participants use Unilever’s “Sunlight” brand dish detergent. Sunlight” brand dishwashing detergent from Unilever. In addition, 95% of participants have used Sunlight products. In fact, it is not uncommon to see the shelves of large urban supermarkets filled in large portions with Sunlight. Other companies’ products, Vinh Hao, Lix, and Surf, are often found in mom-and-pop stores.

Sunlight’s biggest competitor is My Hao, the “king of dishwashing detergents” 20 years ago, which is estimated to have held 80% of the Vietnamese dishwashing detergent market in the 1990s. However, after Unillever entered the market, domestic manufacturers of dishwashing detergents gradually withdrew from the market, and very few companies like Vinh Hao were able to survive.

Today, My Hao’s market share is estimated by local newspapers to be about 30%. The company’s main sales channel is wholesale, targeting restaurants and hotels rather than individual consumers, and My Hao itself has announced that it is “recreating its old glory” and is focusing on developing new products and advertising to compete with Unilever.

Tissue paper

The tissue paper market in Vietnam has great potential for Japanese companies, and there are several examples of successful entry by Japanese companies.

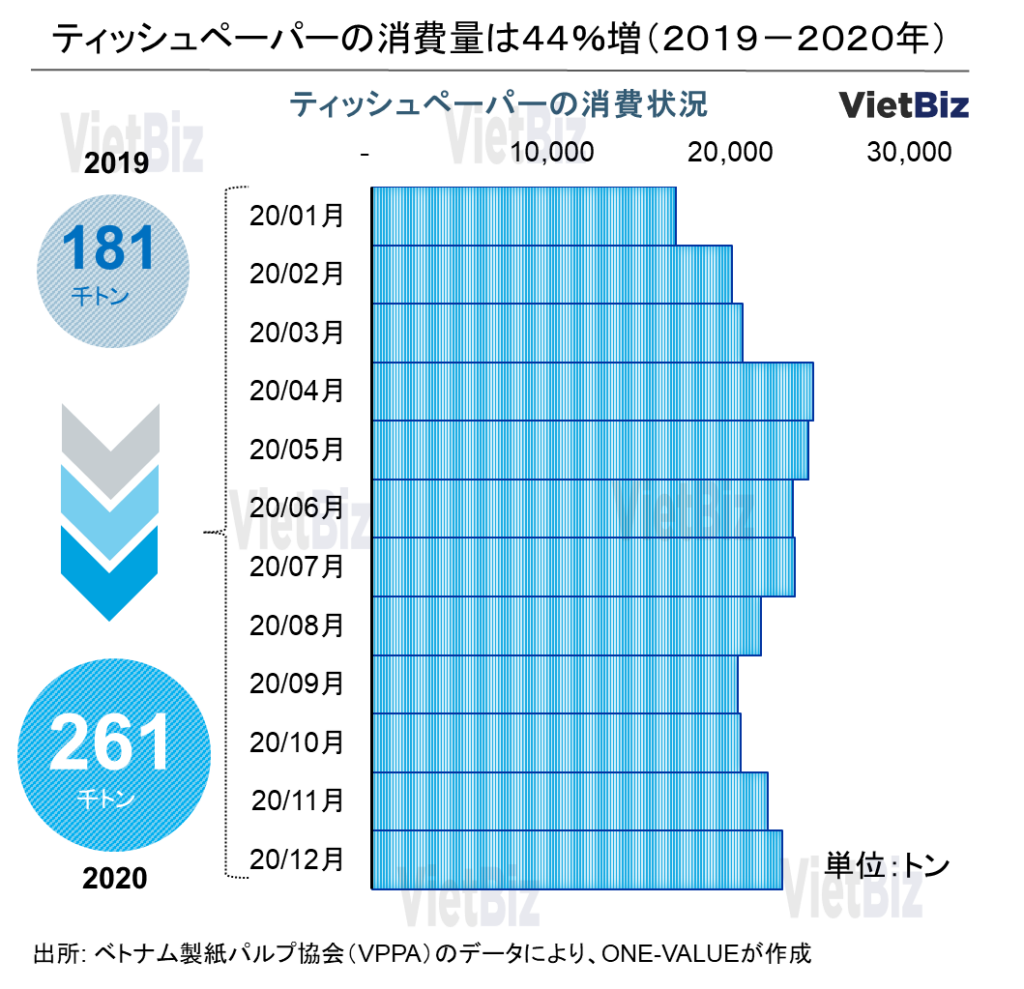

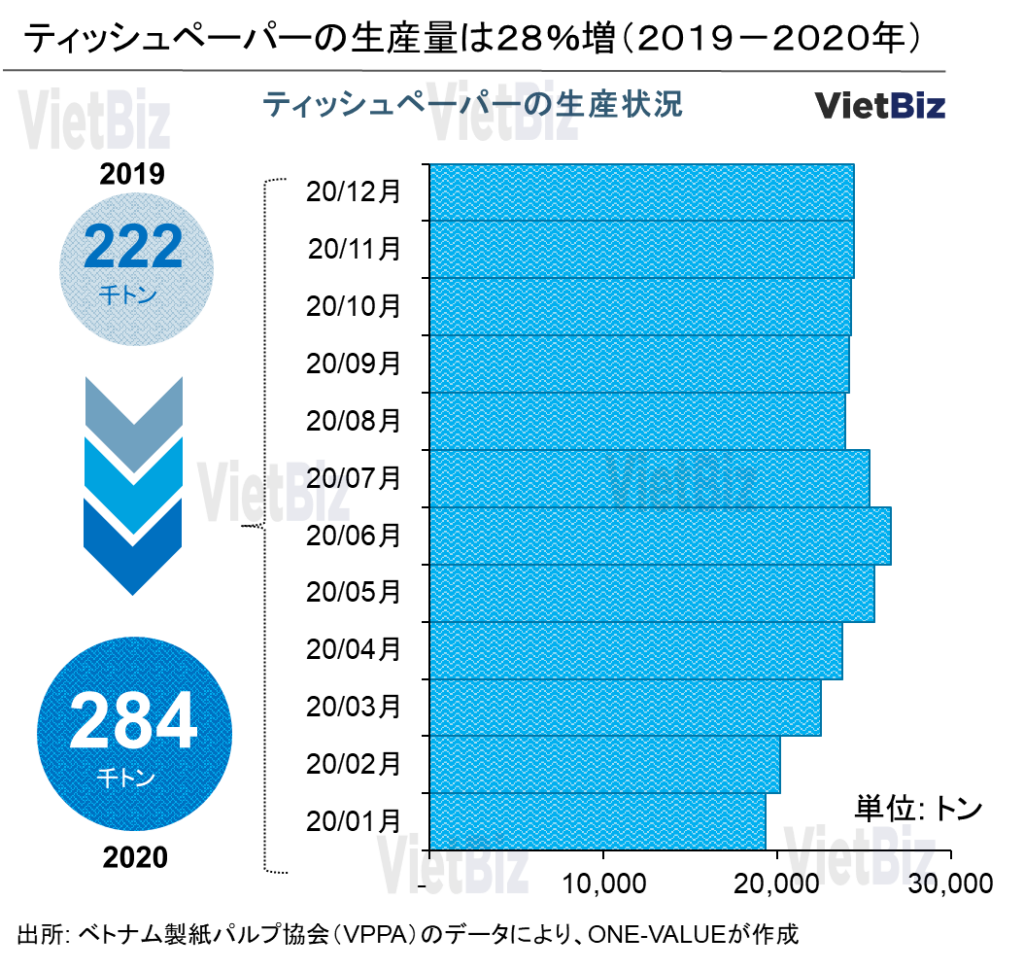

Vietnamese tissue paper consumption has increased by 44% per year, while domestic production has increased by only 28% in comparison. In addition, of the 284,000 tons of tissue paper produced domestically in 2020, more than 20% was exported. Therefore, Vietnam’s domestic tissue paper consumption exceeds its domestic production. 2020, Vietnam imported about 46 thousand tons of tissue paper, mainly from Indonesia, China, and Malaysia.

The major players currently producing and selling tissue paper in Vietnam are NEW TOYO PULPPY (Taiwan), Sai Gon Paper (Japan), and Unicharm Vietnam (Japan). The tissue paper market is also dominated by foreign companies.

While Taiwan’s NEW TOYO PULPPY has built a factory in Vietnam to manufacture and sell tissue paper, Sojitz and Unicharm from Japan have entered the Vietnamese tissue paper market in the form of an “M&A”. Sai Gon Paper was originally one of the largest paper companies in Vietnam. 2018, Sojitz, a major Japanese general trading company, invested in Sai Gon Paper, which was in the red with USD 91 million, and acquired 95% of its outstanding shares. Sai Gon Paper is a familiar brand to Vietnamese people and is the top company in Vietnam in terms of production capacity. Many Vietnamese hope that the company’s business situation will improve under Sojitz’s leadership in the future.

Also in 2011, Unicharm acquired a 95% stake in Diana, a manufacturer of disposable diapers, which at the time had the largest market share in Vietnam. The transaction value was $184 million. After Unicharm acquired Diana, sales of the renamed “Unicharm-Diana” tripled from the pre-acquisition level.

In addition, Do Minh Phu, who led the restructuring of Diana at that time, is now the chairman of DOJI Group, the second largest jewelry market in Vietnam, a major bank Tien Phong Bank, and Tien Phong Securities Company. Phong Bank, holding approximately 10% of the bank’s outstanding shares.

Diapers

The Vietnamese diaper market is largely dominated by foreign-owned giants such as Kimberly Clark’s “Huggies” brand, Procter & Gamble’s “Pamper” brand, Diana Unicharm’s “Bobby” brand, a joint venture between Unicharm of Japan and a Vietnamese corporation, and Kao Corporation’s “Merries” brand. The majority of the brands are foreign-affiliated giants, such as the “Merries” brand of Japan’s Kao Corporation.

According to the Vietnam Paper Association, 45% of the tissue paper and diapers produced in Vietnam are produced by foreign-invested enterprises, while the remaining 55% are produced by Vietnamese enterprises, which used to account for 100%. The association also estimates that in about 10 years from now, tissue paper and diapers produced by foreign-invested enterprises will account for more than 60% of Vietnam’s domestic production.

Producing diapers in Vietnam is not difficult, but requires large investments to dominate the market, and the ability to sell is very important. One thing all Vietnamese diaper manufacturers have in common is that they must import raw materials to produce their products, whether overseas or domestically. Fluff and fluff pulp, the main raw materials for diaper production, are not manufactured in Vietnam. Because of the huge investment required to build a factory capable of producing these raw materials, companies producing diapers in Vietnam have virtually no choice but to import the raw materials.

Although the Vietnamese diaper market is mainly for children, the population is aging and the market for diapers for the elderly has great potential. In addition, Vietnamese people are very protective of their families, especially their parents, so high-quality adult diapers manufactured by Japanese companies are particularly promising.

出所:vnexpress.net

Shampoo

According to Vietnam’s local commerce and industry newspaper (2016), Vietnam’s shampoo market was projected to maintain a steady growth rate of about 6% per year until 2025.

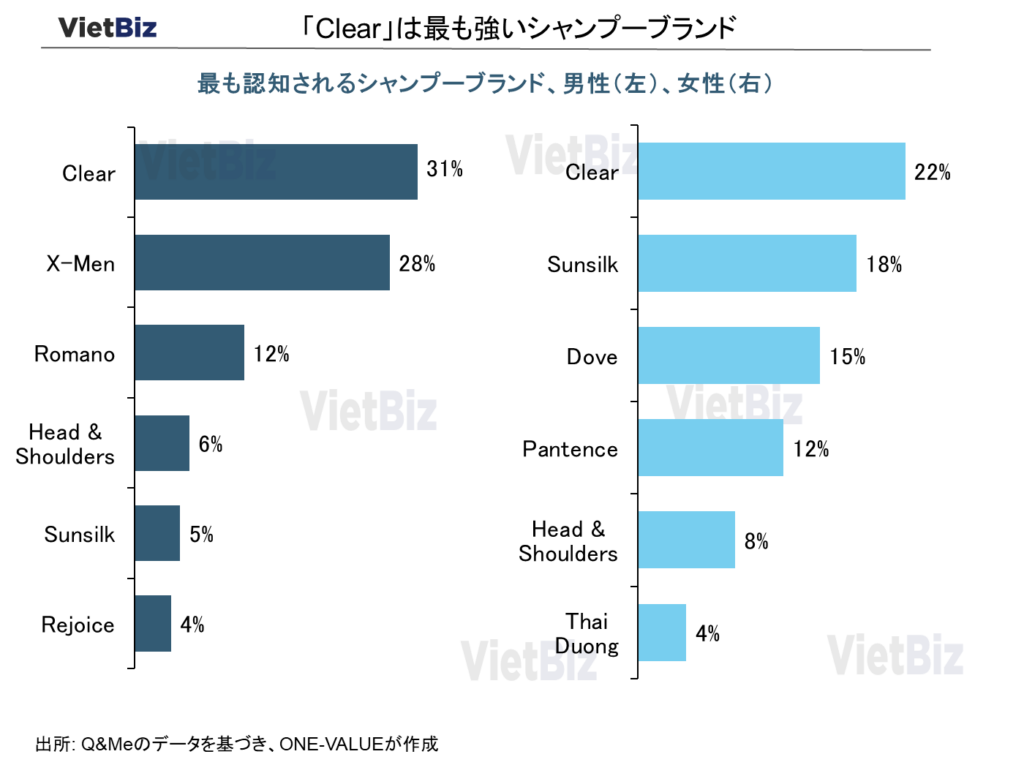

Currently, the Vietnamese shampoo market is mainly dominated by two foreign giants, “Unilever” and “Procter&Gamble”. Unilever’s runner-up, Procter & Gamble, with its “Pantence” and “Head & Shoulders” brands, is the leading shampoo brand for women. Besides the two giants, other foreign-owned brands such as Double Rich, Enchanteur, and Palmolive also participate in the market.

It can be said that Vietnamese domestic companies are almost defeated in this market. The “Thai Duong” brand in Vietnam is the only domestic product that is well known by many people and is trying to compete with the top brands. However, the Thai Duong Company, which owns the Thai Duong brand, has been in the red for many years. Competing with foreign giants requires a great deal of financial resources, and domestic Vietnamese companies with little financial resources continue to face difficulties.

Toilet cleaner

Unilever is also a leader in the toilet detergent market. The company’s “VIM” brand is not only affordable, but has been tested by the Ho Chi Minh City Pasteur Epidemiology Institute to ensure quality and safety. GIFT products are popular in rural areas because of their lack of odor.

The third is the “DUCK” brand from a Thai company. DUCK” contains concentrated chemical detergent concentrates that are 25 times more effective than other products; DUCK markets its products in Vietnam in its own market segment.

Gargle solution

It is common practice for Vietnamese people to brush their teeth every day, but when they are busy, they sometimes use gargle solution instead of brushing.

In the gargle segment, the LISTERINE brand of Johnson & Johnson, a major U.S. company also known in Japan, appears to completely dominate the market. LISTERINE products are sold like common household items through many channels, such as supermarkets, drugstores, and mom-and-pop stores. On the other hand, the Perio Aid Intensive Care products of the Spanish company DENTAID, the runner-up to LISTERINE, are not sold like commodities, but are recommended by dentists and hospitals and are perceived as high-priced “medicines.

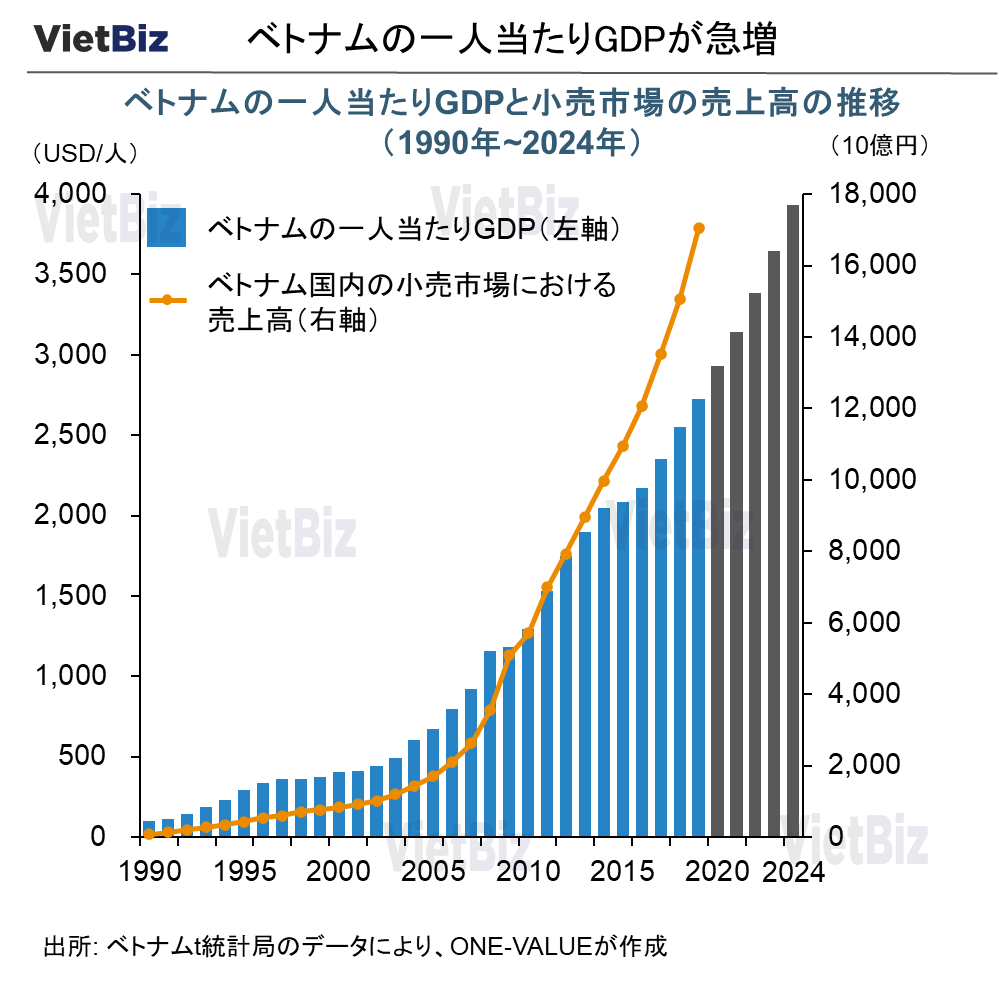

Income level and purchase level of Vietnamese consumers

With Vietnam’s economic development, the GDP per capita of Vietnamese people has also increased rapidly over the past decade. According to data from the General Statistics Office of Vietnam (Ministry of Investment and Planning), the GDP per capita of Vietnamese people has more than doubled from US$1,297 in 2010 to US$2,725 by 2020. It is also projected to reach US$3,931 by 2024.

As per capita GDP increases, retail sales and consumption in Vietnam are also increasing rapidly and the country is regarded as a promising consumer market. It is especially promising for foreign firms, especially Japanese firms with strengths in manufacturing.

Characteristics of Vietnamese consumers

This chapter introduces some characteristics of Vietnamese consumers regarding the consumption of daily necessities.

“Low price” is not a priority

It is important for manufacturers to differentiate the uses of their products from those of their competitors. A product with a differentiated use will build loyalty among consumers who seek that use and will keep coming back to the product over the long term. For example, Unilever’s “Clear” shampoo is advertised as “specifically for dandruff and scalp fungus,” emphasizing that it has a different use than other brands.

In fact, the selling price of daily necessities in Vietnam is not high, and there is not much room to implement price competition. Even if they offer a discount of 10-20% off the set price, it is difficult to create a sense of savings because the original price is low, so Vietnamese producers and sellers of daily necessities often offer “extra” or “increased quantity” campaigns.

From the above two points, simply trying to lower prices is not an effective means in the Vietnamese commodities market

出所:Shopee.vn

Decision makers (purchasing decision makers) are “women”

A study by the Vietnam University of Finance and Marketing (2019) found that 85% of purchasing decision makers for everyday products in Vietnam are “women”.

In Vietnam, especially in rural areas, the idea that housework is the role of women is still the mainstream, and women are also the main purchasers of daily necessities.

Commodity retailers understand this characteristic and therefore often create ads aimed at women. The stories in the ads generally consist of housewives in a neighborhood or among friends talking about the product or showing a happy home while using a good product.

Vietnamese recognize “brand name”, not company name

Even “Unilever” and “Procter&Gamble,” which have appeared frequently in this report and dominate the Vietnamese household products market, are not recognized by many consumers by their company names. Even if they know “Unilever,” not many Vietnamese can immediately think of the products that Unilever sells. On the contrary, it is considered very rare that Vietnamese do not know the representative products of those major companies, such as “OMO Powder Detergent”, “P/S Toothpaste”, and “CLEAR Shampoo”.

In Japan, consumers often recognize companies by their corporate names, such as “Lion” or “Kao”, which is different from Vietnam. Japanese companies considering entering the Vietnamese market need to take this into account.

出所:thanhs.com.vn

The Impact of Corona

The impact of the new Corona is an essential element in introducing the retail sector. This chapter looks at the relationship between the new Corona and commodities in Vietnam.

Health Awareness and Bulk Purchasing

Daily necessities are one industry that has not been affected much by the Corona disaster. However, there has been a change in consumer psychology and behavior.

Consumers are limiting their outings and going shopping more often, and therefore tend to purchase larger quantities at a time. In addition, growing health consciousness is changing the way consumers view products, and an increasing number of Vietnamese consumers are carefully examining product ingredients and product uses. In other words, they are spending more time and considering more conditions before making a purchase decision.

From Papamama Shop to “e-commerce”

Another major change is the growing number of consumers purchasing everyday items through e-commerce (electronic commerce: online shopping).

In the past, consumers have primarily purchased their daily necessities at mom-and-pop stores. This was due to two reasons: supermarkets are often farther away than the papermaker stores located throughout town, and once there, consumers have to leave their bikes completely to do their shopping. On the other hand, Papamama stores are not only located closer to the consumer’s home, but also allow the store owner to bring the goods to the consumer while still on the motorcycle, making shopping easier than in supermarkets.

However, consumers are now shifting their purchasing channels from “mom-and-pop stores” to “e-commerce” because purchasing products through e-commerce has the great advantage of being delivered directly to their homes and reducing infection.

Capturing this shift, commodity giants such as Unilever are responding early: Unilever is promoting digital advertising to drive traffic to its sales pages within e-commerce platforms such as Lazada and Shopee.

出所:vinid.net

Summary

Vietnam’s commodities market is dominated by foreign firms such as Unilever and Procter&Gamble. However, recent moves by domestic giants such as MASAN indicate that Vietnamese companies tend to enter the market and try to gain market share from these multinationals. In other words, we believe that the Vietnamese daily necessities market is about to experience intense competition.

In several cases, Japanese companies have entered and are active in the paper-related segments of the Vietnamese daily necessities market, such as tissue paper and diapers. In the future, the adult diaper market is particularly promising for Japanese companies. When entering the market, Japanese companies should consider three characteristics of Vietnamese consumers: they are not easily attracted by discounts, decision makers are women, and they recognize brand names rather than company names.

The impact of the Corona disaster on the Vietnamese household goods market was not that great compared to other industries. However, it did cause several major changes, such as increased health awareness, large purchases in one shopping trip, and increased use of e-commerce.

▼ベトナム日用品市場の市場調査、M&A、ビジネスマッチングの支援をご要望の方は以下からご連絡ください。

【関連記事】ベトナムの日用品に関連する分野ついては、こちらの記事も合わせてご覧ください。

ベトナム市場調査レポート一覧はこちらからもご覧頂けます。

ベトナム市場の情報収集を支援します

ベトナム市場での情報収集にお困りの方は多くいらっしゃるのではないでしょうか。

VietBizは日本企業の海外事業・ベトナム事業担当者向けに市場調査、現地パートナー探索、ビジネスマッチング、販路開拓、M&A・合弁支援サービスを提供しています。

ベトナム特化の経営コンサルティング会社、ONE-VALUE株式会社はベトナム事業に関するご相談を随時無料でこちらから受け付けております。