- Introduction.

- Definition of Cold Chain

- Current status of the cold chain (refrigerated and frozen transport) in Vietnam

- Major companies in the Vietnamese cold chain (refrigerated refrigerated transport)

- Challenges and Breakthroughs in the Vietnamese Cold Chain

- Examples of successful projects

- Industries benefiting from the development of cold chain

- 結論:投資コストが課題だが需要は今後も拡大

- ベトナム市場の情報収集を支援します

Introduction.

In recent years, demand for cold chain (refrigerated/frozen transport) logistics services with temperature control has increased in Vietnam due to population growth, dietary diversification with rising income levels, and expansion of the EC market. In recent years, demand for cold chain logistics services involving temperature control has been increasing in Vietnam.

On the other hand, low quality services with inadequate temperature control in exchange for lower costs are found in many cases, causing health hazards and food waste during transportation. Furthermore, the lack of trust from shippers and consumers in the quality of the cold chain has led to a vicious cycle that makes it difficult for a healthy cold chain logistics market to take root.

Vietnam has a higher demand for cold chain than other Asian countries, but in addition to the trust issue mentioned above, the business environment, including infrastructure and legal regulations, which are preconditions for cold chain, is lagging. This has delayed the entry of Japanese companies into the market. As a result, Japanese companies have been slow to enter the market.

In this report, we would like to analyze in detail the current situation, challenges, and breakthroughs in cold storage logistics in the Vietnamese market.

Definition of Cold Chain

Cold means low temperature. The term “cold chain” refers to a system that links distribution processes such as production, transportation, and warehousing like a chain, while maintaining predetermined temperatures and conditions such as refrigeration and freezing. In Japan, it is often referred to as a “cold logistics system” or “cold logistics.

The term “cold chain” as used in this report refers to “constant temperature”, “refrigerated” and “frozen” below 20°C.

According to the General Association of Refrigerated Warehouses, the items by storage temperature zone are as follows.

- Ultra low temperature (-40°C or lower): tuna, etc.

- Frozen (-18°C or lower): seafood, meat, frozen foods, and Ice cream, bread dough, etc.

- Refrigerated (-18°C to +10°C or below): Dairy products, paste products, vegetables, meat, fresh fish and seafood, etc.

- Standard temperature (+5°C to +18°C or below): Mayonnaise, chocolate confectionery, rice grains, etc.

Current status of the cold chain (refrigerated and frozen transport) in Vietnam

Vietnam’s cold chain (refrigerated frozen transport) has developed remarkably in recent years, benefiting from technological development. The first commercial refrigerated warehouses were built in Vietnam around the mid-1990s. In terms of industry history, the industry is only about 20 years old.

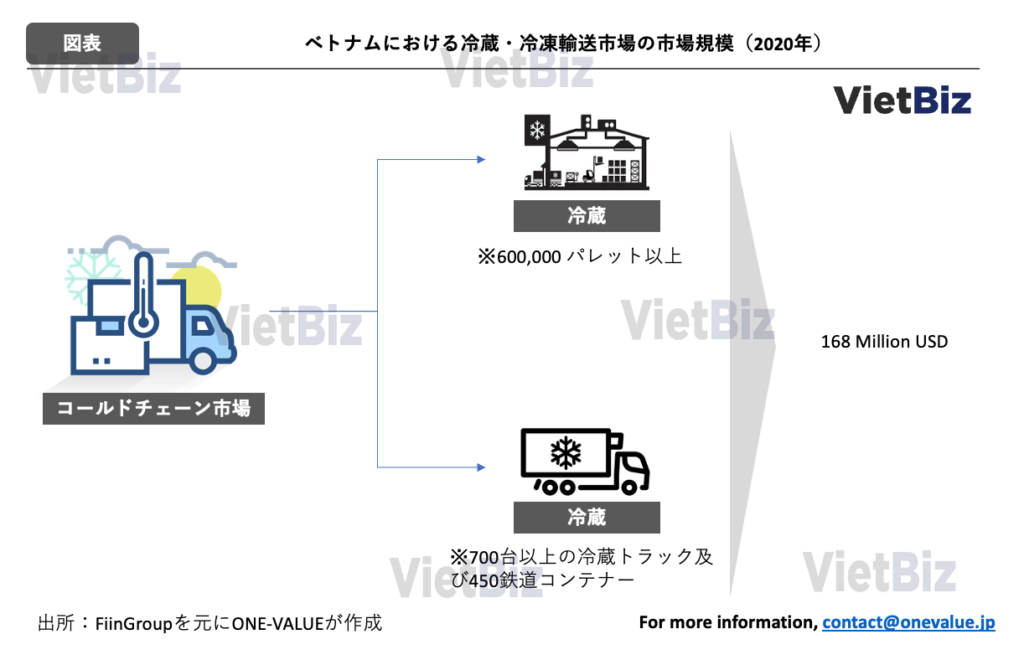

The market size of Vietnam’s cold logistics market in 2019 is estimated to be US$169 million, according to a study by Vietnam research firm Fiin Group. In addition, according to a report by global market research firm Ken Research, the market size of Vietnam’s cold chain market is expected to reach US$1.8 billion in 2021, expanding more than tenfold compared to 2019.

According to local Vietnamese press reports, only 8.2% of companies that primarily target the domestic market apply cold chain (refrigerated frozen transport). This figure is far below the 66.7% of exporters. Due to the lack of clear and high standards for goods in the Vietnamese market, traders tend to store food at room temperature and not use cold chain (refrigerated and frozen transport) to avoid incurring additional costs. In the Vietnamese fresh food market, losses are tolerated to a certain extent to begin with, and the food is transported from farm to retail outlets in a short period of time.

According to a local Vietnamese business newspaper, many Vietnamese companies currently regard cold chain (refrigerated frozen transport) as a mere cost, not an investment.

In order to promote low-temperature logistics in Vietnam, there is a need to change the perception of low-temperature logistics as an investment, not a cost.

Promising Cold Chain Market in Vietnam

This paragraph discusses the potential of Vietnam’s cold chain market from two perspectives: the size of the market and the need for frozen and refrigerated food products.

Size of Vietnam’s cold chain market

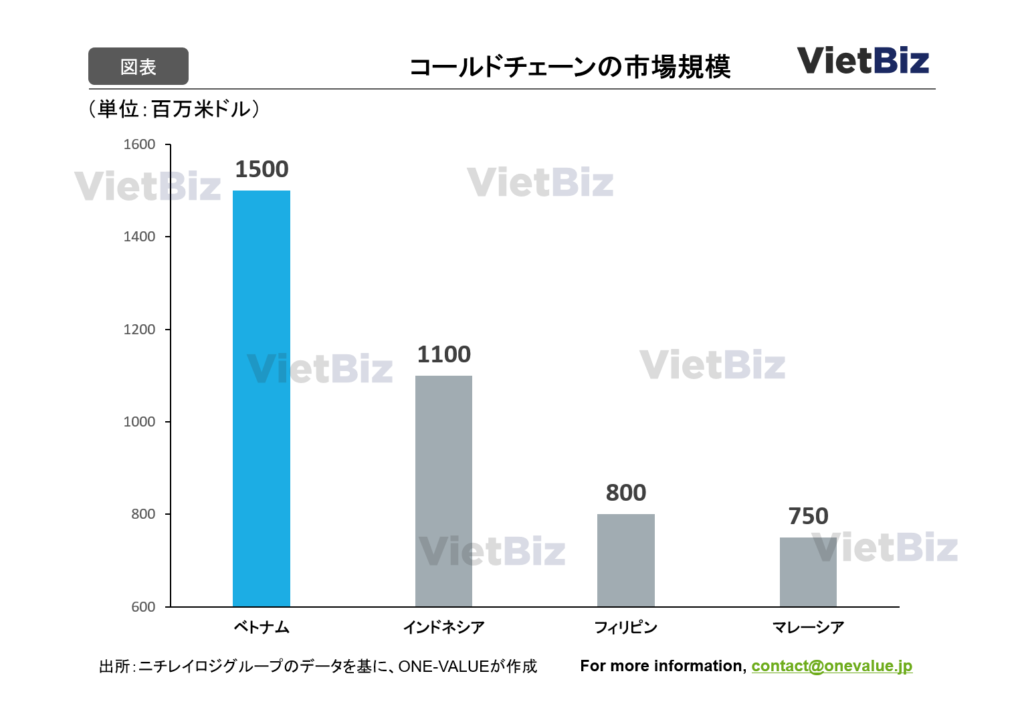

Vietnam’s cold chain (refrigerated and frozen transport) market has great potential. According to the Nichirei Logistics Group, the largest low-temperature logistics company in Japan, Vietnam’s cold chain market is the largest in ASEAN.

Vietnam is rated more promising than Indonesia, which has a population nearly twice that of Vietnam. It is also about twice the size of the markets of the Philippines and Malaysia.

Vietnam’s cold chain market is one of the most promising in ASEAN.

Frozen and Refrigerated Food Needs in Tnum

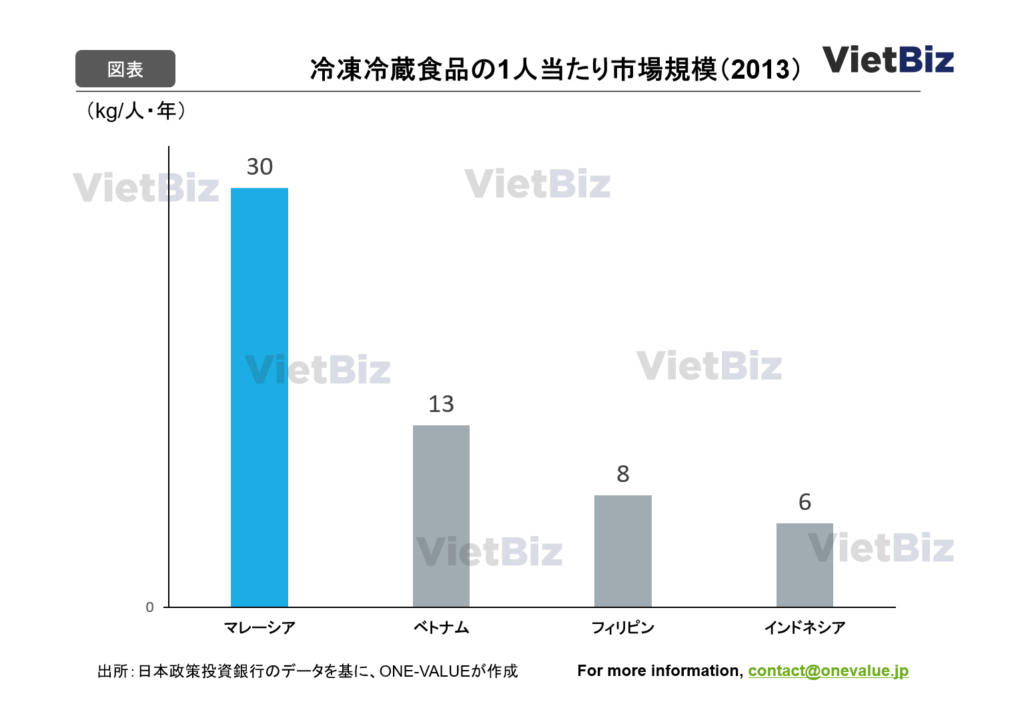

The above graph shows the per capita market size of frozen and refrigerated food in the four ASEAN countries. It refers to the consumption of 30 kilograms of frozen and refrigerated food per capita per year in Malaysia. In Vietnam, the figure is 13 kilograms; in the Philippines, 8 kilograms; and in Indonesia, 6 kilograms.

Malaysia consumes more than twice as much as Vietnam, the second largest consumer, but this information is from 2013, so consumption in each country is likely to fluctuate.

In terms of the size of the aforementioned cold chain market, Vietnam was twice as large as Malaysia. In light of this, the consumption of frozen and refrigerated foods in Vietnam today is expected to increase further.

The “increasing need for frozen and refrigerated foods” also suggests the high potential of Vietnam’s cold chain market.

The latest trends in the Vietnamese economy are detailed in the following articles.

Major companies in the Vietnamese cold chain (refrigerated refrigerated transport)

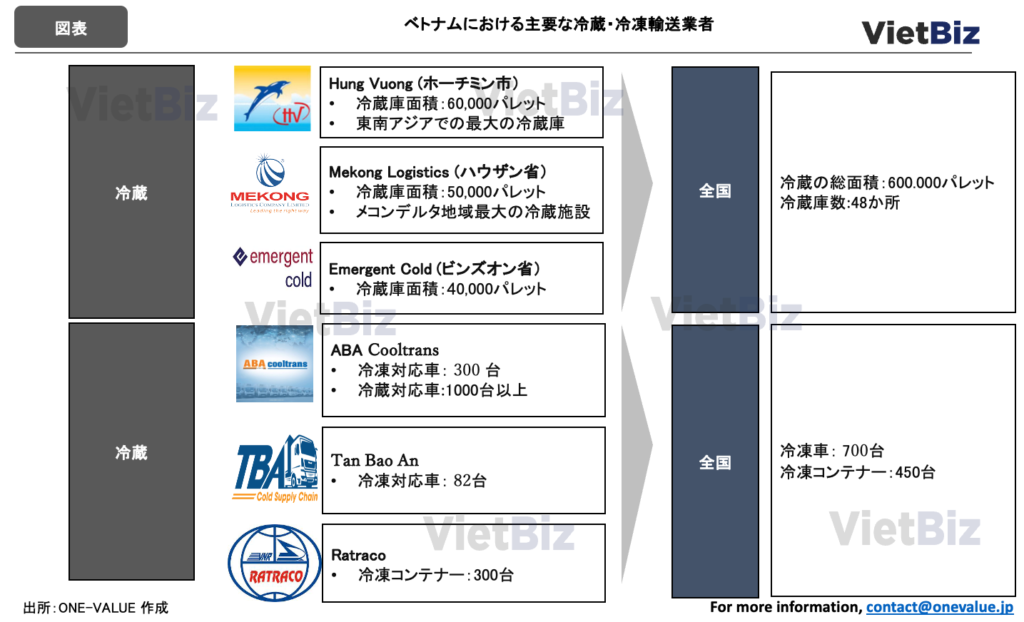

Companies that provide cold chain (refrigerated refrigerated transport) services are concentrated in the southern region, where demand is high. The average temperature in southern Vietnam is 27 degrees Celsius, which is hot throughout the year, and the climate is very different from that of the north, so the need for cold chain (refrigerated refrigerated transport) is high. Of the total number of companies, 76% are Vietnamese and the remaining 24% are foreign-owned.

Major firms include leading companies in the logistics industry such as Transimex, Gemadept, and Saigon Newport. Other companies developing large-scale cryogenic logistics systems in Vietnam include major companies in the fisheries industry.

Mekong Logistics (a joint venture between Gemadept and Minh Phu Seafood Company) owns the largest refrigerated warehouse in the Mekong Delta region. Hung Vuong Panga owns a 60,000-pallet refrigerated warehouse, the largest refrigerated warehouse in Southeast Asia.

A representative foreign company is SCS Vietnam, which operates a temperature-controlled network of warehouse systems spread across Vietnam, using a variety of technologies, advanced integrated warehousing and shipping techniques to manage a total frozen warehouse area of approximately 275,000 pallets. The company uses a variety of technologies, advanced integrated warehousing and shipping techniques to manage a total area of approximately 275,000 pallets of frozen warehouse space.

It is said that only about 30-35% of the total Vietnamese market demand for low-temperature-zone-capable warehouses is being met. Currently, there are many warehouses for imports and few refrigerators/freezers for the domestic market.

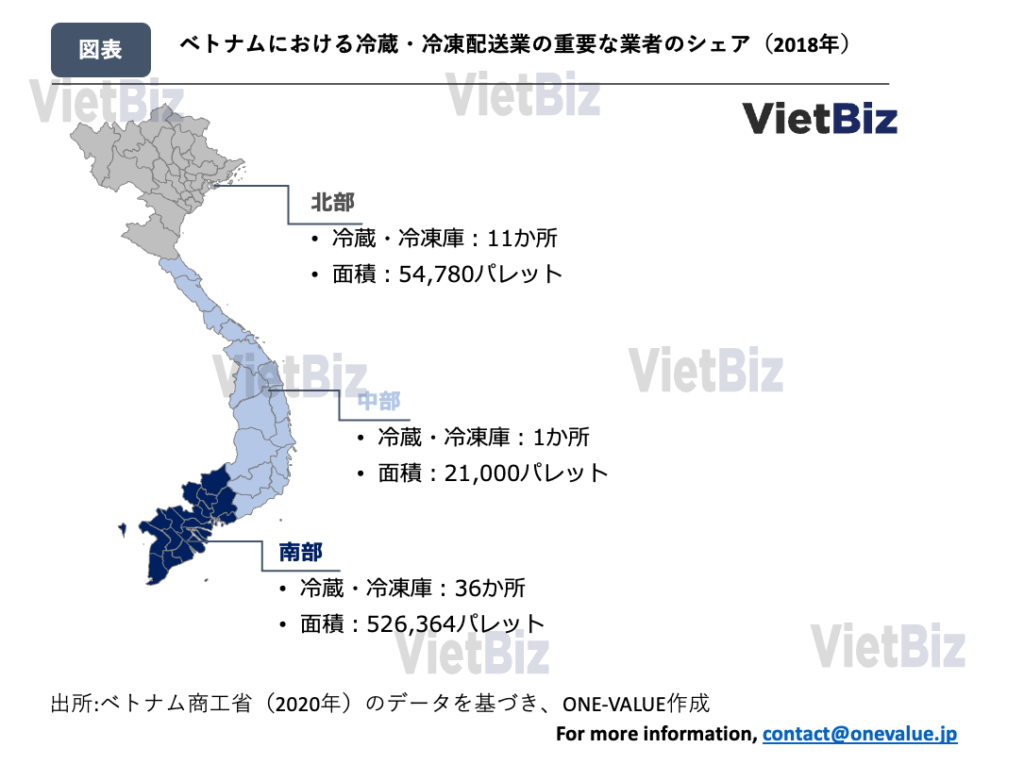

There are 48 large low-temperature-zone-capable warehouses throughout Vietnam with a total capacity of approximately 700,000 pallets. A breakdown shows that 36 low-temperature-zone warehouses with a capacity of 526,364 pallets are located in the southern part of the country. On the other hand, there is only one warehouse (21,000 pallets) in the central region. In the north, there are 11 refrigerated and frozen warehouses with a total capacity of 54,780 pallets

Currently, the supply of frozen warehouses is still inadequate compared to demand, and storage fees are high. In some warehouses, goods must be booked up to a year in advance before they can be stored.

Representative cold chain companies (1) ABA Cooltrans

- Company Name:ABA Business Solutions Corporation (ABA Cooltrans)

- Established:2008

- Headquarters:Hochiminh city

- Homepage:https://aba.com.vn/

- Company Profile:

ABA Cooltrans (ABA) is a leading Vietnamese company in the field of logistics and cold storage services. According to a survey by CEL Vietnam, ABA is rated as the third largest player in the field of refrigerated warehousing with a 12% market share in the refrigerated transportation sector.

ABA Cooltrans (ABA) owns 17 warehouses throughout Vietnam, including 15,000 pallet freezers and 2,500m2 of refrigerated warehouses. In the field of cold transport, ABA operates more than 300 trucks dedicated to the transport of frozen goods (0 to -22 degrees Celsius) and more than 1,000 refrigerated vehicles (including those of affiliated companies).

Cold chain representative company (2) TAN BAO AN (Transportation)

- Company Name:Tan Bao An Logistics Joint Stock Company (TBA)

- Established:2010

- Headquarters:Hochiminh city

- Homepage:http://www.xelanhtba.com/

- Company Profile:

Tan Bao An is a company specializing in frozen and refrigerated transportation in southern Vietnam. All of the company’s transport fleet consists of 82 trucks of all types, ranging from 1.4 to 18 tons, with refrigeration systems completely imported from Korea, Japan, and the United States.

To ensure the safety and temperature of goods in transit, the vehicles are equipped with state-of-the-art shock absorbers, GPS tracking, and smart temperature measuring devices. Currently, Tambaoan is looking to build a refrigerated warehouse to complete the company’s refrigerated supply chain and is searching for a strong partner from abroad.

Cold chain representative company (3) FM Logistic (warehouse)

- Company name:FM SUPPLY CHAIN VIETNAM COMPANY LIMITED (FM Logistic)

- Established:2017

- Headquarters:Hochiminh city

- Homepage:https://www.fmgloballogistics.com/

- Company profile:

FM Supply Chain Vietnam (FM) is a subsidiary of the FM Logistic group from France. FM Vietnam entered the Vietnamese cold chain market in 2017 and began operating its first cold storage warehouse with an area of 6,500 m2 in Binh Duong province in 2019.

As of 2021, the company’s warehouse capacity in Vietnam is approximately 10,000 pallets. Additionally, the company appreciates the potential of the Vietnamese market and has decided to build a refrigeration center in Bac Ninh Province in April 2019 for a total cost of US$30 million.

Construction of the Bac Ninh warehouse is expected to be completed by 2022, and the startup of this warehouse is projected to increase FM Vietnam’s total capacity of freezers and refrigerators by approximately 52,000 m2 or 70,000 pallets.

FM Vietnam also announced that it intends to focus its services on daily consumer goods (FMCG) companies in Vietnam in the future.

Challenges and Breakthroughs in the Vietnamese Cold Chain

Issue

In Vietnam, the construction cost of a refrigerated warehouse is two to three times higher than that of a room temperature warehouse. Similarly, companies need to spend a lot of initial capital when investing in the cold chain (refrigerated refrigerated transport). The cost issue is a major barrier for carriers to enter the cold chain business.

In addition, the income of the Vietnamese people is increasing along with economic growth, and demand for food products is also increasing. As a result, the distribution volume of frozen food storage and transportation is also expected to continuously increase. In contrast, there is currently a significant shortage of refrigerated warehouses because the construction period for frozen warehouses is longer than for regular warehouses.

Rail cold transport is difficult. Rail transport, especially rail cold transport, is very inexpensive and can transport much larger volumes than trucks. However, rail transport in Vietnam is underdeveloped. Vietnam’s current railroads are mainly tracks built during the French colonial period, and the Vietnamese government has not focused on railroad development to date.

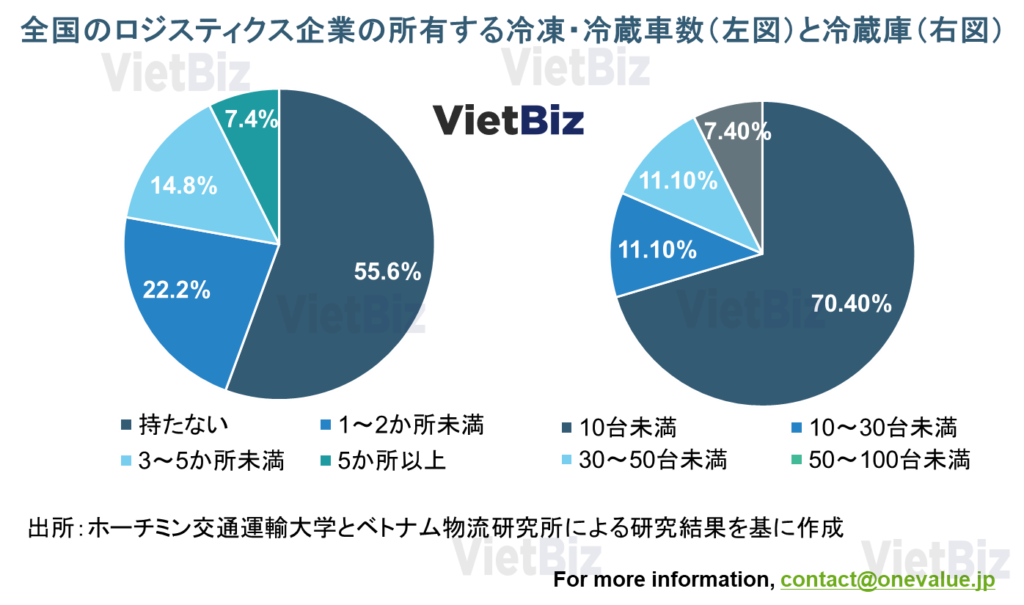

The cold chain market is fragmented, with many small and medium-sized local vendors in the region. In some cases, small and medium-sized companies that own approximately two to five refrigerated trucks in each region dominate their local and surrounding markets. However, it is not uncommon for these companies to experience problems with quality of service, such as ensuring transportation temperatures, and the vendors who use these companies take on a lot of risk.

Even ABA Cooltrans, the largest refrigerated transport company in Vietnam, accounts for only 12% of the refrigerated transport market. Therefore, large companies wishing to acquire a share of the Vietnamese cold chain market must compete with local SMEs, and therefore must conduct careful research and develop a strategy before entering the market.

breakthrough solution

Processors of seafood and food retailers often develop their own warehouses, fleets of vehicles, or consolidate small and medium-sized transportation companies in their respective regions. For example, The Gioi Di Dong, a major Vietnamese company that operates 2,000 food retail outlets (under the Bach Hoa Xanh brand), is developing its own company-led cold storage logistics system with 200 freezers and refrigerators and 50 refrigerated vehicles to transport products that need to be kept warm, including vegetables, fruits, dairy products, ice cream, and processed foods. The Gioi Di Dong will develop its own low-temperature logistics system led by the company with 200 freezers/refrigerators and 50 refrigerated vehicles to transport products that need to be kept warm, such as vegetables, fruits, dairy products, ice cream and processed foods.

Large seafood processing companies such as Hung Vuong and Minh Phu are also working with major logistics companies such as Gemadept and Sai Gon New Port to build their own large frozen and refrigerated warehouses.

More players are expected to enter the cold chain, purchase refrigerated vehicles, and invest in the construction of large refrigerated warehouses. 2020 will see a number of large refrigerated warehouses under construction, including the Hung Vuong Warehouse (about 60,000 pallets), AJ Total Long Hau (32,000 pallets), AJ Total Hung Yen (25,000 pallets), and many other large frozen warehouses under construction. In addition, manufacturers are developing their own refrigerated warehouses to store goods for domestic consumption.

Representatives of ABA Cooltrans, a leading refrigerated transport company, have stated that they will increase the number of refrigerated transport vehicles fivefold over the next five years. Along with the increase in demand, competitive relationships are expected to intensify.

In addition, it is not only Vietnamese domestic companies that are recognizing the potential of Vietnam’s cold chain market, but also foreign companies are beginning to move in. In addition to the aforementioned French company FM Logistics, logistics companies from Taiwan in particular have expressed their intention to enter Vietnam through the Taiwan Cold Supply Chain Association.

(出所)vietnamnet.vn

Examples of successful projects

This chapter presents a case study of a successful cold chain project in Vietnam.

Hung Vuong Fisheries Co.

A major seafood processing company, Hung Vuong, is investing VND1.3 trillion (about $6.11 billion) to build a new 60,000 pallet refrigerated warehouse in Ho Chi Minh City. This cold storage warehouse is built on approximately 4 hectares of land, with 60,000 pallets, capable of storing 60,000-70,000 tons of goods.

So far, this is the largest refrigerated warehouse in Vietnam and Southeast Asia and the second largest capacity facility in the world. (The world’s largest is a 65,800-pallet refrigerated warehouse in Spain.)

According to HVG, if the average rent for a refrigerated warehouse in Vietnam is approximately 20,000 VND/ton/day, the company should be able to recoup its investment in this warehouse in just four years.

Minh Phu Co.

In 2016, Vietnam’s leading seafood processing company Minh Phu began operating a 50,000-pallet cold storage warehouse in SongHau Industrial Park in Hau Giang Province. The 50,000-pallet cold storage warehouse was co-invested by Minh Phu and Gemadept Group (a leading Vietnamese logistics company) with a total project investment of VND300 billion ($150 million).

With an area of approximately 50,000 m², the warehouse is the second largest capacity refrigerated warehouse in Vietnam after Hung Vuong’s 60,000 pallet refrigerated warehouse. The warehouse meets international standards for frozen storage of seafood and is designed with optimal solutions such as energy conservation and renewable energy.

(出所)tst-vn.com

Bach Hoa Xanh (The Gioi Di Dong Group)

Bach Hoa Xanh is a food retail chain building its own cold chain development strategy; as of 2021, Bach Hoa Xanh had self-developed a cold logistics system that included over 300 refrigerated and freezer units. In addition to the central refrigerated warehouse in Ho Chi Minh City, Bach Hoa Xanh also opened a number of refrigerated warehouses in various regions to run online sales of fresh food products.

What is special about Bach Hoa Xanh can be seen in that it has implemented a strategy of merging and acquiring small and medium-sized refrigerated transport operators in the areas where it operates stores.

Industries benefiting from the development of cold chain

foodstuff

According to statistics from Vietnam’s Ministry of Industry and Trade, logistics costs from production to consumer for vegetables and fruits are 29.5%, while for rice they account for 30%. To reduce logistics costs, most major food retailers have developed their own cold chains.

However, the development of refrigerated transport systems is likely to allow small and medium-sized food enterprises to significantly reduce their selling costs, thereby helping to lower food prices in Vietnam.

There is also the fact that wholesalers (trading companies), especially food products, are not well developed in Vietnam and most food product manufacturers have to deliver and transport their products themselves. Wholesale companies with the ability to develop commercial networks and logistics would greatly help the development of the cold chain in Vietnam.

(出所)kho-lanh-satra.business

agricultural and marine products

While major agricultural and fisheries players such as Minh Phu, Vinh Hoan, and Sao Ta have ample capacity to develop their own cold chains, most small and medium-sized companies without financial resources have no choice but to turn to logistics firms.

Statistics from Vietnam’s Ministry of Industry and Trade show that logistics costs account for about 20-25% of the cost of agricultural products sold in Vietnam, which is considerably higher than the average of 10-15% in other Southeast Asian countries.

Under these circumstances, in 2019 Vietnam’s Ministry of Agriculture and Rural Development proposed to the central government to create a policy to encourage cold chain development to lower the logistic costs of agricultural and marine products.

A 2019 Vietnam logistics survey conducted by a private company announced that logistic costs for agricultural and marine products from Ho Chi Minh City to Hanoi are higher than logistic costs from Ho Chi Minh City to the United States. This was published in the Vietnamese media with the word “shock”.

Medical supplies

90% of the raw materials for pharmaceuticals in Vietnam are imported from China, India, and other foreign countries, while 90% of pharmaceuticals are consumed domestically. Therefore, the domestic cold chain is considered to have a very important role for the pharmaceutical industry.

Unlike food companies, pharmaceutical companies in Vietnam often outsource the transportation of their products to outside transportation companies due to the low volume of shipments. Because of the high quality standards required for the transportation of pharmaceuticals, many pharmaceutical companies choose to work with large transportation companies that provide excellent service.

However, these large carriers are equipped with tracking, smart temperature measurement, etc., and there is a large equipment gap with other common Vietnamese refrigerated carriers that do not offer these services. As a result, service costs are often very high.

Therefore, it can be predicted that raising the general standards of quality and transportation capacity of cryogenic logistics services in Vietnam will lower transportation costs. This would be very beneficial not only for the pharmaceutical industry but for Vietnamese enterprises as a whole.

(出所)Cekind

You can read more about Vietnam’s pharmaceutical market in the following article.

結論:投資コストが課題だが需要は今後も拡大

Currently, the Vietnamese government is focusing on creating incentive policies for cold chain development in Vietnam. In addition, economic development has increased the demand for domestic consumption in Vietnam and the speed at which goods are distributed.

Therefore, we predict that Vietnam’s cold chain will grow rapidly in the future as more and more foreign and major domestic logistics companies participate in Vietnam. This will benefit agricultural products, fresh produce, food and beverage, pharmaceuticals, and all Vietnamese consumers.

In addition, the technology, know-how, and quality standards possessed by Japanese companies are what the Vietnamese cold chain market is looking for, so their entry is expected. Of course, further development of the cold chain is also a great opportunity for Japanese food and pharmaceutical companies.

In addition, it is often said that the way Vietnam’s economy is growing is similar to Japan’s period of rapid economic growth. Similarly for cold chain, Vietnam is expected to develop similarly to Japan.

In Japan in the 1970s, truck transportation increased and the number of supermarkets handling fresh and frozen foods grew. Vietnam is currently in this stage. The market for modern trade, such as supermarkets and convenience stores, is expanding, and transportation by truck is increasing.

Since the 1990s, Japan has seen a shift to small-lot refrigerated and frozen transport. In parallel, mail order and small-lot services for corporate customers increased. This is precisely the state that Vietnam is currently striving to achieve. In the future, we can expect to see firm demand for frozen foods, expansion of demand for home-meal service, and expansion of fixed-temperature zone products for convenience stores and chain stores.

In Japan, refrigerated warehouses, which are closely related to low-temperature logistics, expanded mainly in fishing ports where marine products are landed, and later, with the modernization of distribution (development of modern trade), livestock and agricultural products were also added to the storage targets. Vietnam’s refrigerated warehouses are expected to grow in scale in the future.

Although the number of EC (online shopping) users in Vietnam has increased rapidly in the wake of the Corona disaster, such small-lot needs have not yet been met. Thus, the cold chain (refrigerated/frozen transport) market in Vietnam is expected to develop in the same way as in Japan. Therefore, it is very promising for Japanese food and logistics companies with technology and experience to enter the Vietnamese market.

▼ベトナム冷蔵・冷凍輸送市場の市場調査、M&A、ビジネスマッチングの支援をご要望の方は以下からご連絡ください。

【関連記事】コールドチェーンに関係するベトナムの分野については、こちらの記事も合わせてご覧ください。

ベトナム市場調査レポート一覧はこちらからもご覧頂けます。

ベトナム市場調査レポート一覧はこちらからもご覧頂けます。

ベトナム市場の情報収集を支援します

ベトナム市場での情報収集にお困りの方は多くいらっしゃるのではないでしょうか。

VietBizは日本企業の海外事業・ベトナム事業担当者向けに市場調査、現地パートナー探索、ビジネスマッチング、販路開拓、M&A・合弁支援サービスを提供しています。

ベトナム特化の経営コンサルティング会社、ONE-VALUE株式会社はベトナム事業に関するご相談を随時無料でこちらから受け付けております。