Introduction

On December 9, the 13th Vietnam Corporate M&A Forum was held in Ho Chi Minh City, Vietnam. The forum presented a summary and statistical information on Vietnam’s M&A market for the January-October period of 2021, and announced that M&A transaction value will increase by 17.9% compared to 2020, despite the impact of the new Corona.

In this issue, we would like to review the M&A trends and market in Vietnam in 2021 with various data.

Transaction performance of Vietnam M&A market in 2021

Based on the data below, we would like to review M&A transaction performance in Vietnam in 2021.

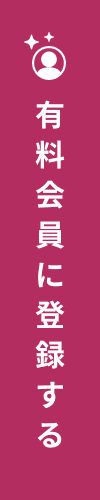

Number of M&A transactions in Vietnam

The number of mergers and acquisitions in Vietnam during the period January-October 2021 was 19. This was the second highest number within ASEAN after Singapore, but fewer than in FY 2019 before Corona.

This is a common feature not only in Vietnam, but also in Singapore, Indonesia, and Thailand countries, indicating that the impact of the new Corona is spreading to the entire ASEAN M&A market.

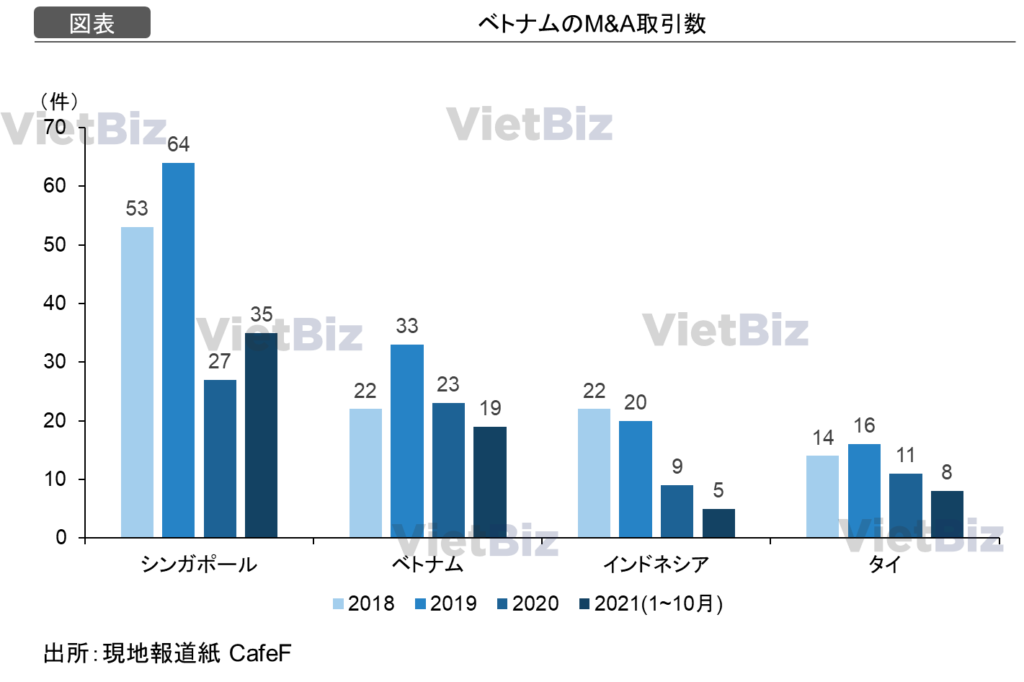

M&A Transaction Value in Vietnam

On the other hand, a look at M&A transaction value shows that despite the impact of the new Corona, transaction value is the largest ever recorded. Vietnam also recorded the second highest transaction value in ASEAN, after Singapore.

This is due to an increase in the number of large M&A transactions in Vietnam. For example, the investment transaction in which Sumitomo Mitsui Consumer Finance, a subsidiary of Sumitomo Mitsui Financial Group (SMBC Group), acquired a 49% stake in Vietnam’s VP Bank was one of the larger M&A deals in Vietnam.

Changes in Vietnam’s M&A Market

続いて、経済発展を続けているベトナムのM&A市場における傾向の変化について見ていきたい。

Increase in M&A transactions by local Vietnamese companies

Since the 2000s, Vietnam has experienced remarkable economic development, and with it, major companies and conglomerates such as Binh Group, Masan Group, Novaland, and Vinamilk have greatly expanded the scale of their operations.

In the past, M&A in Vietnam has mainly involved out-investment by a foreign company in a Vietnamese company (Out-In), but in recent years, there has been an increase in the number of deals involving investment by a Vietnamese company in another Vietnamese company (In-In) or investment by a Vietnamese company in a foreign company (In-Out).

Changes in sectors where M&A takes place

There has also been a significant change in the sectors in which M&A transactions are conducted. In the past, Vietnam’s position as a “production base with inexpensive labor” in the global economy meant that many M&A deals were mainly in the manufacturing sector.

In recent years, however, the consumer market has been developing remarkably with the growth of the middle class, and M&A deals in the retail and consumer goods manufacturing industries, which mainly deal with the B to C domain, and in the financial sector have been increasing.

In addition, as urban development and new industrial parks are being established throughout Vietnam, large real estate companies such as the Binh Group are increasingly acquiring local real estate development companies in various regions.

M&A between Japan and Vietnam

Next, we would like to explain M&A between Japan and Vietnam.

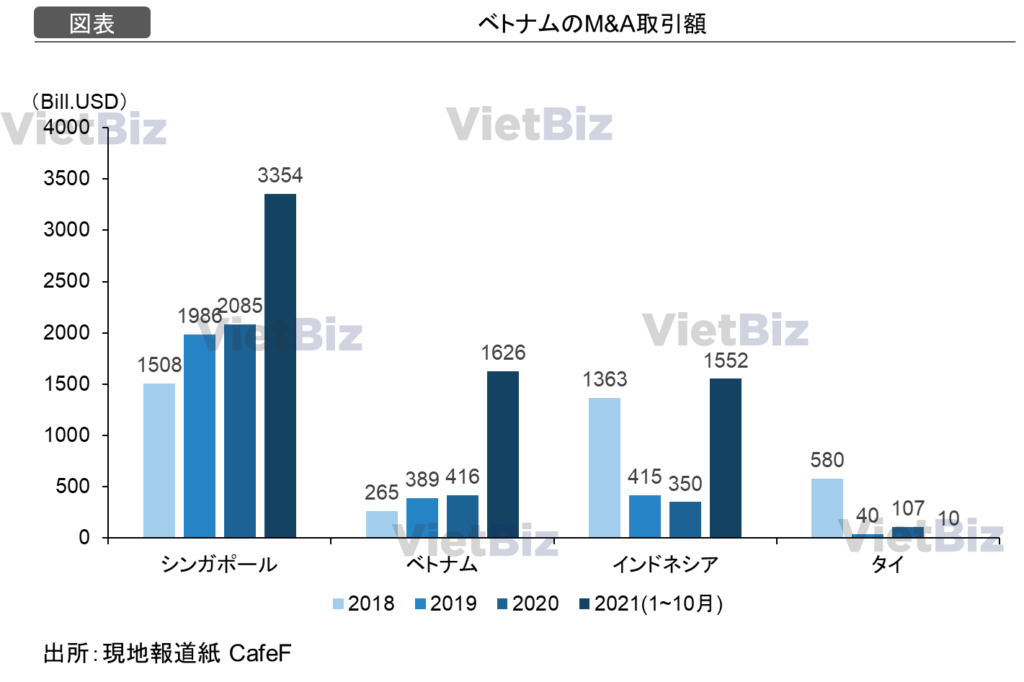

Vietnam’s Position in the Japanese M&A Market

The above graph shows the number of cross-border M&A transactions that Japanese companies conducted within 2021 in the partner country. Vietnam ranks as the sixth country in the world with the highest number of transactions.

There is no significant difference in the number of transactions between India and China and Vietnam, so there is a strong possibility that Vietnam will be ranked higher in the future.

Why Japanese Companies Invest in Vietnam

The following are some of the major reasons for Japanese companies to conduct M&A transactions with Vietnam.

The market in Japan is already mature.

The average age in Japan as of 2021 is 48.4 years old, and it will continue to rise, leading many companies to conclude that the consumer market, especially for younger consumers, is already mature.

On the other hand, Vietnam’s consumer market is expanding year by year due to economic growth, and there are many young people with high purchasing power. Therefore, an increasing number of companies are turning to Vietnam as a new market to sell their products and services.

M&A has become more common for Japanese companies

The second reason is that M&A is no longer as much of a hurdle for Japanese companies as it used to be.

M&A has become more familiar to companies, as evidenced by the emergence of consulting services that support M&A and portal sites that match seller and buyer companies.

Companies, especially those with a lot of excess capital, are aggressively investing abroad to earn capital gains and income gains in order to meet the expectations of their profit-seeking shareholders.

Sectors to watch in Vietnam’s M&A market in the future

In the last part of this report, we would like to explain the sectors that will be the focus of attention in Vietnam’s M&A market in the future. These sectors are not limited to M&A, but will become the future trend of Vietnamese business.

Real Estate and Construction Sector

As mentioned in the previous article, large-scale urban development is currently underway in many parts of Vietnam. In addition, the growing population in large cities such as Ho Chi Minh City, Hanoi, and Da Nang has led to a serious housing shortage, and the construction of apartment complexes and condominiums is underway. As a result, the need for real estate development and construction is expected to continue to grow.

logistics

The new Corona has not only affected the economy, but has also caused major changes in people’s lives and purchasing behavior. In particular, the use of online shopping services such as Tiki and Sendo has increased due to the restrictions imposed by Corona. More people are buying not only clothes and sundries, but also groceries online.

However, since perishable foods and other products need to be transported in refrigerated or frozen conditions, a cold chain is necessary as a logistics infrastructure. Since the cold chain is not yet fully developed in Vietnam, investment in the cold chain in the country is expected to increase in the future.

renewable energy

The 8th Draft National Electricity Master Plan (PDP8) published by the Ministry of Industry and Trade of Vietnam in September 2021 sets limits on plans to develop new coal-fired power plants and to reduce the share of coal-fired power in the country’s power supply mix, with plans to meet electricity demand through renewable energy generation capacity, mainly wind and solar power.

Therefore, investments in renewable energy power generation are expected to increase in the future. In addition, since there is still a lack of engineers in Vietnam who are familiar with renewable energy, the Vietnamese government and companies are likely to receive technical cooperation from overseas firms as they pursue development.

Conclusion

In this report, we have reviewed the Vietnam M&A market in 2021 and also explained the future outlook. In particular, the increasing number of large-scale M&A deals in Vietnam and the increasing transaction value per deal, as well as the expansion of M&A sectors beyond manufacturing to include retail, finance, and real estate, are points to watch closely for the future of business in Vietnam.

【関連記事】ベトナムのM&A動向については、こちらの記事も合わせてご覧ください。

ベトナム市場調査レポート一覧はこちらからもご覧頂けます。

ベトナム市場の情報収集を支援します

ベトナム市場での情報収集にお困りの方は多くいらっしゃるのではないでしょうか。

VietBizは日本企業の海外事業・ベトナム事業担当者向けに市場調査、現地パートナー探索、ビジネスマッチング、販路開拓、M&A・合弁支援サービスを提供しています。

ベトナム特化の経営コンサルティング会社、ONE-VALUE株式会社はベトナム事業に関するご相談を随時無料でこちらから受け付けております。