Introduction

Vietnam’s pharmaceutical retail market is expected to develop as a promising market in Asia, with a projected CAGR of 9.5% in sales from 2021 to 2025 (forecast by EIU).

This report provides information to assess the potential of the pharmaceutical retail market in Vietnam and to forecast the country’s future development prospects.

Leading Pharmaceutical Retailers in Vietnam

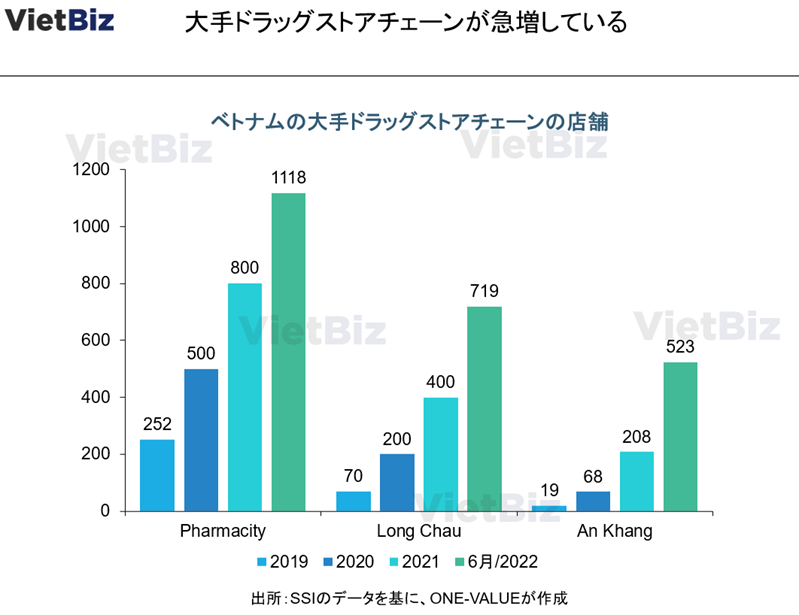

Pharmaceutical sales in Vietnam have been growing recently; EIU reports that during the period 2017-2021, pharmaceutical sales grew at a CAGR of 7.5%, with sales reaching $5.9 billion in 2021. The growth in sales in the pharmaceutical retail industry has been driven by the increasing size of drugstore chains in Vietnam, with Pharmacity, Long Chau, and An Khang drugstore chains currently dominating the market. In June 2022, Pharmacity led the market with 1,118 stores, followed by Long Chau with 719 stores and An Khang with 523 stores.

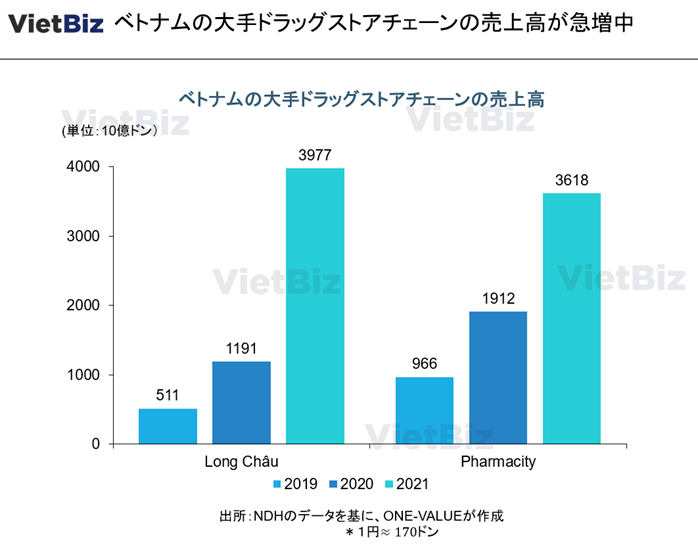

Sales of Major Companies in the Pharmaceutical Retail Industry in Vietnam

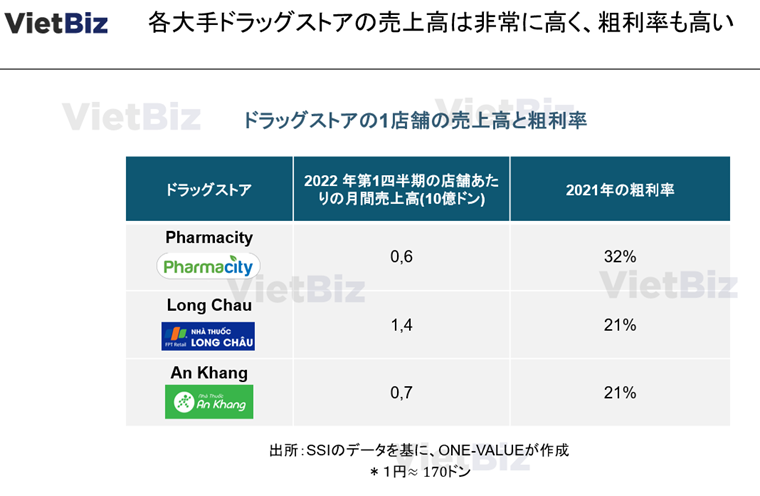

The three largest drugstore chains in Vietnam have very high average monthly sales of more than 500 million VND/store with gross margins exceeding 21% in 2021. Long Chau had the highest average monthly sales at VND1.4 billion/store, followed by An Khang at VND700 million/store and Pharmacity at VND600 million/store.

Vietnam’s leading drugstore chains are increasing their sales year after year. Long Chau’s sales increased from VND511 billion in 2019 to VND3,977 billion in 2021 (equivalent to a CAGR of 98% from 2019 to 2021). Pharmacity’s sales increased from VND966 billion in 2019 to VND3,618 billion in 2021 (equivalent to a CAGR of 55% from 2019 ∼ 2021).

Pharmaceutical Retailing Channels in Vietnam

This chapter describes the Vietnamese pharmaceutical retail market in a segmented manner.

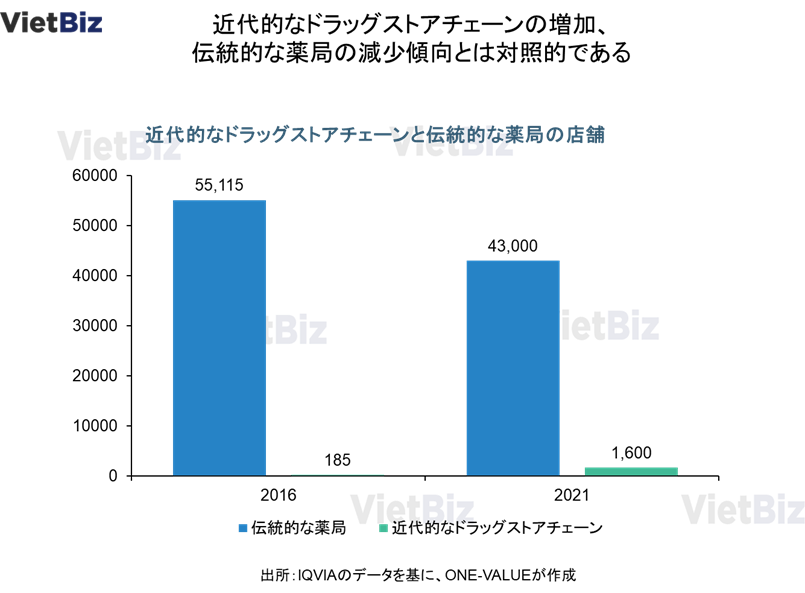

Traditional Pharmacies and Modern Drugstore Chains

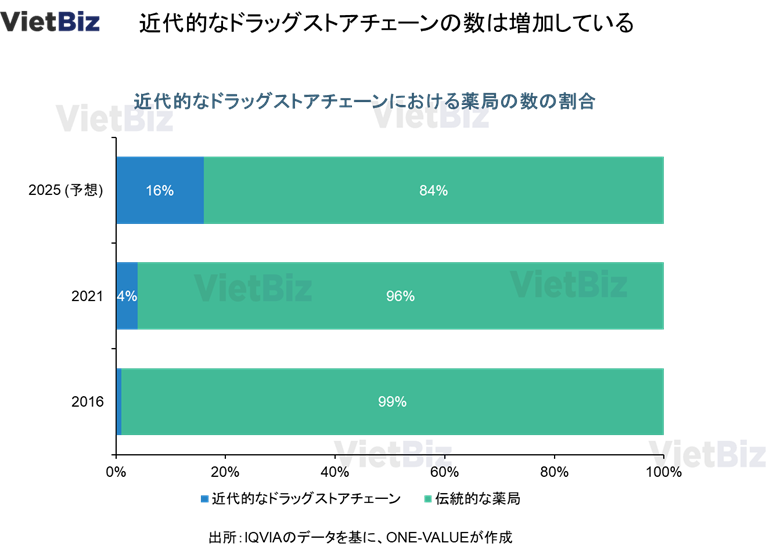

In order to achieve this, they are gradually accelerating the opening of new stores: according to IQVIA, in 2016 there were 55,300 drugstores in Vietnam, of which 185 were modern drugstore chains and 55,115 were traditional pharmacies. However, by 2021 the total number of drugstores had decreased to 44,600 while the number of modern drugstore chains had increased to 1,600 and the number of traditional pharmacies had decreased to 43,000.

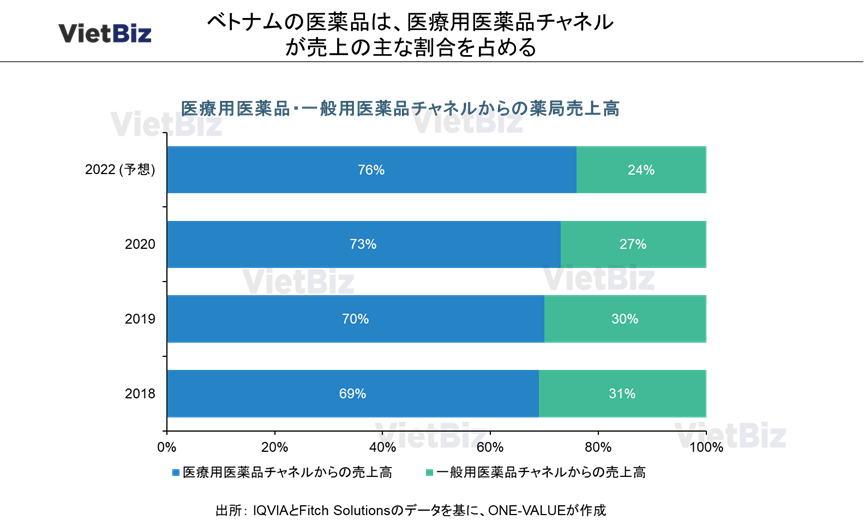

Ethical Drug Channel and OTC Drug Channel

In Vietnam, there are two channels for selling pharmaceuticals: the ethical drug channel and the over-the-counter drug channel. The ethical drug channel includes drugs sold by prescription, and is also a channel specialized for hospital prescriptions. The OTC channel, on the other hand, includes drugs that do not require a prescription and are used under the direction of a physician at the point of sale.

The prescription drug channel’s share of Vietnam’s pharmaceutical sales grew from 69% in 2018 to 76% in 2022, while the OTC channel’s share decreased from 31% in 2018 to 24% in 2022.

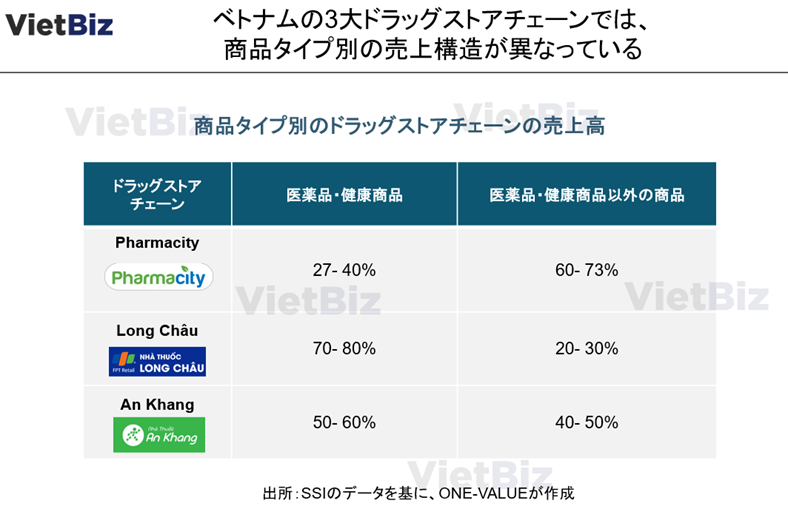

Product type

The three major drugstore chains in Vietnam differ in the percentage of sales by product type: pharmaceuticals and health products account for a large percentage of sales (over 50%) at Long Chau and An Khang, while at Pharmacity, pharmaceuticals and health products account for only 27-40% of sales. Pharmacity’s sales of pharmaceuticals and health products are only 27-40%.

Prospects for Pharmaceutical Retailing in Vietnam

This chapter examines the future of pharmaceutical retailing in Vietnam.

Continuous Sales Growth

For the period 2017-2021, pharmaceutical retail sales had a compound annual growth rate of 7.4%. Over the next five years, pharmaceutical retail sales were projected to grow at a CAGR of 9.5% (according to EIU data). The growth factors in the pharmaceutical retail market are due to the following reasons:

Expanding middle class: According to World Data Lab data, Vietnam has a growing middle class, and by 2030 there will be an additional 23.2 million people in the middle class (third in Southeast Asia), increasing the need for healthcare spending. Consumption in the high-end pharmaceutical sector is also projected to increase.

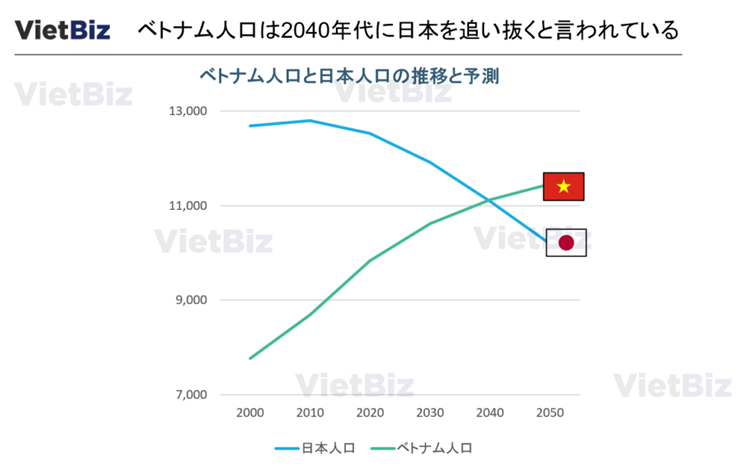

Population Growth: Vietnam’s population continues to grow. Vietnam’s population is projected to reach 98.2 million in 2021 and grow to 109.6 million by 2050. With population growth, the pharmaceutical retail market is expected to continue to expand.

- Novel Coronavirus Pandemic: The novel coronavirus pandemic has accelerated the growth of the pharmaceutical industry as a whole, especially modern models such as drugstore chains. The impact of the new coronavirus has increased people’s awareness of health issues and spending on healthcare and pharmaceuticals.

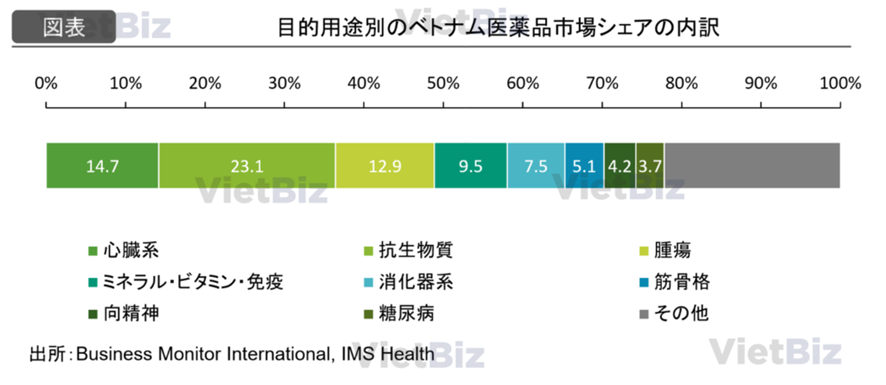

- Population aging: Vietnam entered the age of population aging in 2017; according to WorldBank, the process of population aging in Vietnam will take place in a very short period of time and is expected to be completed before 2040; the population over 65 years old will exceed 15% of Vietnam’s total population in 2039 The aging of Vietnam’s population is expected to be completed before 2040. The aging of the population is expected to increase demand for healthcare products and pharmaceuticals. Per capita spending on pharmaceuticals in Vietnam is expected to reach $50 in 2020. By purpose, the pharmaceutical market is dominated by cardiac (14.7%), antibiotics (23.1%), oncology (12.9%), minerals/vitamins/immunology (9.5%), and digestive system (7.5%). By disease, demand for drugs related to cardiovascular diseases, liver cancer, and diabetes is expected to increase in the future.

Growth Trends in Modern Drugstore Chains

Modern drugstore chains are rapidly growing in Vietnam and are expected to gradually replace traditional pharmacies in the future: in 2016, modern drugstore chains accounted for only 1% of total pharmacies in Vietnam, but this is expected to increase to 4% by 2021 and to 16% by 2025 This is projected to increase to 16% by 2025.

Vietnam’s modern drugstore chain market is also active, and many new entrants to Vietnam’s pharmaceutical retail market are expected in the near future, including Wincommerce (which owns Winmart and operates about 3,000 small supermarkets) and Viettel (which owns a telecom retail network of about 370 stores).

出所: https://viettimes.vn/pharmacity-long-chau-an-khang-da-banh-truong-hau-covid-19-nhu-the-post160040.html

Japanese Pharmaceuticals Are Growing in Popularity.

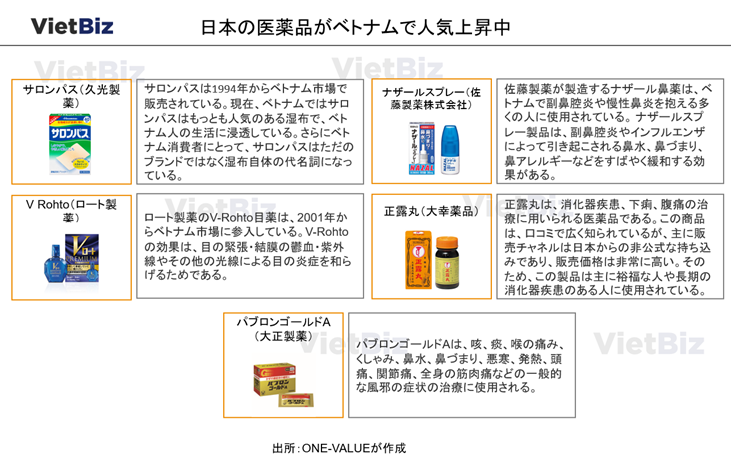

Japanese pharmaceuticals and health products are popular in Vietnam because of their high quality and high efficacy. Demand for Japanese pharmaceuticals and health products in Vietnam is expected to increase in the future. Popular Japanese pharmaceuticals in Vietnam include Salonpas (Hisamitsu Pharmaceutical), V Rohto (Rohto Pharmaceutical), Nazar Spray (Sato Pharmaceutical Co., Ltd.), Seirogan (Daiko Pharmaceutical), and Pabron Gold A (Taisho Pharmaceutical).

Summary

With a market size of $5.9 billion in 2021 and a projected CAGR of 9.5% from 2021-2025, Vietnam is an attractive market for the pharmaceutical retail industry. Future growth factors for the pharmaceutical retail market in Vietnam include rapid income growth, an aging population, and growing interest in health needs following the new coronavirus pandemic.

Conclusion

This report provides an overview of the pharmaceutical retail market in Vietnam.

ONE-VALUE is a management consulting firm specializing in the Vietnamese market. We provide support services to promote Japanese health products and pharmaceuticals to the Vietnamese market, including market research and procedures for pharmaceutical distribution to retail channels.

If you are interested and would like more information, please click the button below to contact ONE-VALUE Corporation, which operates this Vietbiz.

【関連記事】ベトナムのM&A案件については、こちらの記事も合わせてご覧ください。

ベトナム市場調査レポート一覧はこちらからもご覧頂けます。

ベトナム市場の情報収集を支援します

ベトナム市場での情報収集にお困りの方は多くいらっしゃるのではないでしょうか。

VietBizは日本企業の海外事業・ベトナム事業担当者向けに市場調査、現地パートナー探索、ビジネスマッチング、販路開拓、M&A・合弁支援サービスを提供しています。

ベトナム特化の経営コンサルティング会社、ONE-VALUE株式会社はベトナム事業に関するご相談を随時無料でこちらから受け付けております。

ベトナム市場調査レポート一覧はこちらからもご覧頂けます。