Introduction

Carbon Pricing in Vietnam has been attracting attention. Carbon Pricing is a global warming countermeasure policy that places a price on carbon dioxide (carbon/CO2) emissions, thereby changing the behavior of CO2 emitters and reducing emissions.

There are two main reasons why carbon pricing in Vietnam has attracted so much attention.

The first is because Vietnam has publicly stated its goal of achieving zero greenhouse gas emissions by 2050 (carbon neutrality). Carbon pricing in Vietnam is underdeveloped, but that is why it is expected to be the key to achieving this goal in the future.

Second, the Vietnamese government has declared that it will launch an “emissions trading market” by 2025. As will be discussed in more detail below, “emissions trading” can be simply described as “a mechanism to link CO2 emission reductions more directly to profits. In Vietnam, where economic development and the accompanying urbanization and industrialization are remarkable, the emergence of such a new market is an important element in the management strategy of companies, and is therefore attracting a lot of attention.

What Is Carbon Pricing?

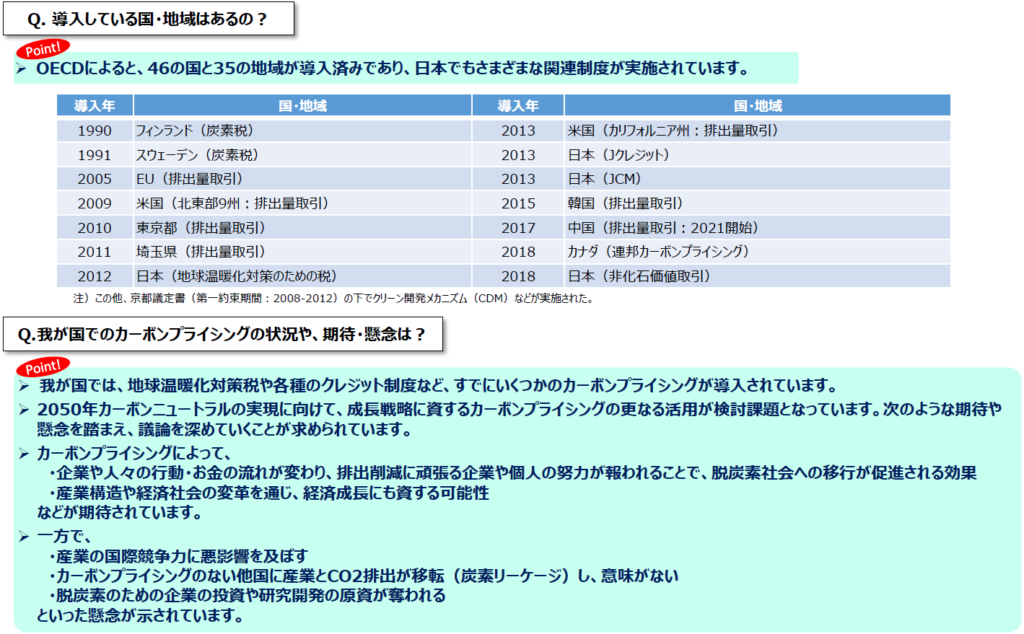

The most advanced carbon pricing in the world is in the European region, and is being introduced in Japan as well. The number of countries and regions that have adopted carbon pricing has more than tripled in the last decade, covering more than 20% of global greenhouse gas emissions. It is expected to penetrate emerging and even developing countries in the future.

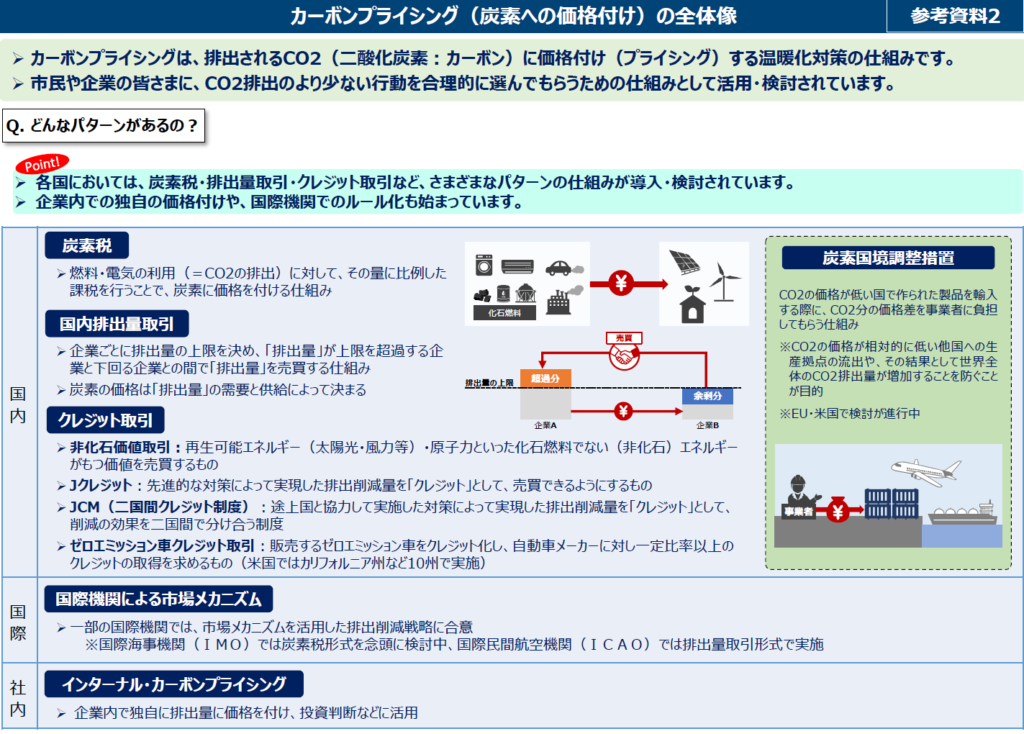

Specific methods and mechanisms for carbon pricing in Japan can be divided into four types, as defined by the Ministry of the Environment.

- Carbon Tax

- Emissions trading

- Credit Trading

- Carbon Border Adjustment Measures

In addition to these four types of carbon pricing, there are two other types of carbon pricing: “market mechanisms by international organizations” as international carbon pricing and “internal carbon pricing” as intra-company carbon pricing.

This chapter will briefly introduce the four types in Japan.

Carbon Tax

A carbon tax is a mechanism for governments to put a price on carbon by imposing a tax on CO2 emissions, and has been introduced by European countries such as Finland and Sweden since the early 1990s.

Since the price of a carbon tax is set by the government, the price is stable but the actual reductions are difficult to predict. Another advantage is that a carbon tax can divert existing tax collection systems. Therefore, a carbon tax is relatively easy to introduce with low administrative costs. In fact, slightly more countries and regions have introduced carbon taxes than emissions trading, which will be introduced next.

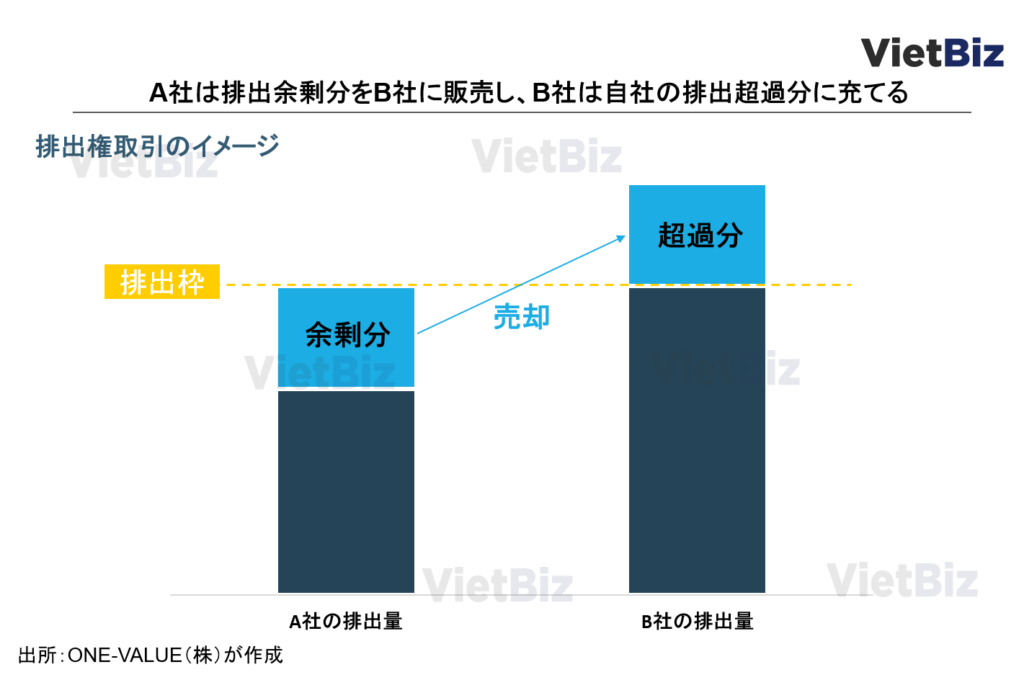

Emissions Trading

In emissions trading, the government first sets a national CO2 emissions cap, which is then allocated to individual companies. Companies that are able to meet their emission caps can then sell their excess emission allowances and receive a price for their carbon. Since companies can earn a profit from the sale of excess allowances, it is expected that emissions will be reduced through proactive efforts by companies.

Unlike a carbon tax, the government determines the amount of emissions, so the actual reductions are more predictable, but there is concern that the price may be unstable. The disadvantage of this system is that there are many points that need to be carefully designed, such as setting emission caps for each company and implementing trading, and the administrative costs are high.

In Vietnam, as mentioned above, the program was declared to start in 2025 by Protocol No. 06/2022 / ND-CP, issued on January 7, 2022.

In Japan, the Tokyo Metropolitan Government has been implementing the program since 2010, and Saitama Prefecture since 2011. No other implementation has been made.

Emissions trading is also sometimes referred to as “emissions trading” or “emissions quota trading.

Credit Trading

Credit trading is the trading of certificates for the value of CO2 reductions. The Japanese government operates the Non-Fossil Value Trading, J-Credit System, and JCM (Japan-Country Crediting Mechanism).

For example, the JCM (Japan-China Credit Mechanism) is a system under which Japan implements projects that contribute to CO2 reduction in partner countries, and the reductions are shared between the two countries as “credits. These credits are then used to meet national CO2 reduction targets.

Several JCM credit issuances between Japan and Vietnam have been implemented and are expected to be further strengthened and promoted in the future.

Carbon Border Adjustment Measures

A carbon border adjustment measure is a mechanism whereby businesses bear the difference in CO2 prices between the two countries when importing products manufactured in countries with lower CO2 prices.

If this system were not in place, there is a fear that many manufacturing sites would be transferred to countries with lower CO2 prices in the future, resulting in increased CO2 emissions. Currently, this is being considered in Europe and the United States.

Vietnamese Government’s Decarbonization Policy

This chapter presents the Vietnamese government’s policy on decarbonization.

Declaration of the Government of Vietnam at COP26

On November 1, 2020, Vietnamese Prime Minister Pham Minh Chinh announced at the 26th Conference of the Parties (COP26) to the United Nations Framework Convention on Climate Change (UNFCCC) in the United Kingdom that the country is aiming for virtually zero greenhouse gas emissions (carbon neutral) by 2050.

After COP26, the Vietnamese government instructed the Ministry of Natural Resources and Environment to establish an “Executive Guiding Committee” to realize the goals announced at COP26. The Guiding Committee was established at the end of 2021 with the role of developing a carbon reduction strategy to achieve “carbon neutrality” by 2050, including a “National Strategy on Climate Change by 2050,” an “Action Plan on Methane Emissions Reduction by 2030,” and a “National Strategy on Green Growth. The National Strategy for Green Growth was established at the end of 2021 with the role of developing a carbon reduction strategy.

The Ministry of Natural Resources and Environment has also expressed its intention to work with the Ministry of National Defense and related ministries and their branches and local governments to conduct marine surveys, review the national marine development master plan, and promote offshore wind power development. In addition, the Ministry of Natural Resources and Environment, the Ministry of Finance, and the Ministry of Commerce and Industry have been instructed to jointly design and propose to Prime Minister Chin a carbon pricing plan, including a carbon tax and emissions trading, within 2022.

Development of renewable energy

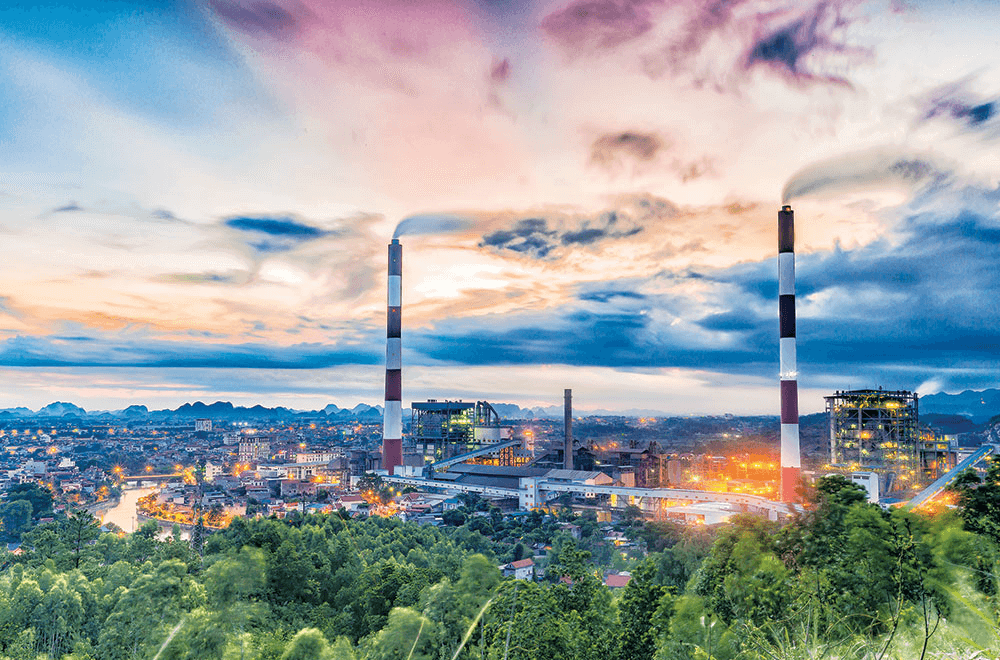

Vietnam will focus on reducing the share of coal-fired power generation and increasing the share of renewable energy in the development of its power supply mix. after announcing at COP26 that it will achieve carbon neutrality, the Vietnamese government announced on November 10, 2021 that the draft 8th National Electricity Master Plan (PDP8) announced that it would revisit the draft.

Although the details of the revised plan have not yet been clearly disclosed, it is clear that the Vietnamese government intends to restrict the construction and expansion of new coal-fired power plants, which account for about 40% of the country’s power supply mix, and to reduce the share of coal-fired power generation. Furthermore, the Vietnamese government intends to develop renewable energy sources, particularly wind and solar power.

However, today in Vietnam there is an overabundance of photovoltaic development, 20 times the development target by 2021. It is predicted that the government will limit solar power development in the future. Instead, wind power, especially offshore wind power, taking advantage of Vietnam’s excellent wind conditions, is likely to be the power source that the Vietnamese government will focus on most in the future.

New Legal Provisions for Waste Management

The Environmental Protection Law has been amended by the Vietnamese government and is officially effective as of January 1, 2022. The most important change in the new Environmental Protection Law is that it places responsibility for waste disposal on manufacturers.

Under the previous law, manufacturers were responsible up to the sales stage. Under the new law, manufacturers are also responsible for collecting and recycling their products after consumers have used them. The new law expands the scope of responsibility for waste disposal to producers. Specifically, product producers must either collect and dispose of the waste themselves or donate it to an environmental protection fund. Producers are legally penalized if they refuse to comply with both of these obligations.

Vietnam ranks seventh in the world in terms of the amount of plastic waste discharged into the ocean, and many countries around the world have been critical of the country in this regard. The new law shows that the Vietnamese government is serious about reducing waste, especially plastic waste.

In addition, the aforementioned Protocol No. 06/2022 / ND-CP issued by the Vietnamese government on January 7, 2022, made decisions other than emissions trading. It obliges producers that meet the criteria set by the government to record their greenhouse gas emissions.

Specifically targeted are companies, organizations, and institutions that emit 3,000 tons of CO2 or more per year. In addition, entities that meet one of the following criteria are also eligible.

- Industrial production facilities, companies or thermal power plants with total annual energy consumption of 1,000 TOE* or more

- Freight transportation companies with total annual fuel consumption of 1,000 TOE or more

- Commercial buildings with total annual energy consumption of 1,000 TOE or more

- Waste treatment facilities with an annual operating capacity of 65,000 TOE or more

TOE (Tonne of Oil Equivalent) refers to the amount of energy generated in terms of tons of oil in order to facilitate comparison of various energy sources.

Prior to January 7, 2022, there were no specific legal instruments in Vietnam that obligated businesses to measure, report, and reduce greenhouse gas and CO2 emissions.

Carbon Tax System and Emissions Trading in Vietnam

Since 2010, the Ministry of Finance of Vietnam had introduced a taxation system under the name of “Environmental Protection Tax” in accordance with Notice No. 152/2011/TT-BTC, targeting raw materials and fuels that adversely affect the environment, such as gasoline, oil, coal, and pesticides.

This “environmental protection tax” sets the amount of taxation based on fossil fuel use, not on greenhouse gas emissions.

For example, the environmental protection tax on gasoline use in 2020 is set at VND1,000-4,000 per liter (5-20 yen) or VND10,000-30,000 per ton (50-150 yen). The environmental protection tax is paid by the buyer when purchasing fuel.

The Vietnamese government has been conscious of environmental protection and introduced a tax system for fossil fuel consumption at an early stage, but it is likely to convert to a new environmental protection tax that also takes into account the amount of carbon dioxide emitted, or to introduce a new “carbon tax” in conjunction with the existing environmental protection tax.

Regarding emissions trading in Vietnam, on January 28, immediately after the aforementioned January 7, 2022 decision, Deputy Prime Minister Le Van Thanh approved the draft of the “General Carbon Pricing and Emissions Trading Market Structure” proposed by the Ministry of Finance, while adding his comments. This is the first time that the Vietnamese government has approved a carbon pricing proposal. This is an indication of the seriousness of the Vietnamese government’s commitment to carbon pricing.

Movement of Companies in Vietnam

Until 2021, Vietnam had no clear legal provisions expressing the obligation to reduce greenhouse gas and CO2 emissions for domestic private enterprises, so there have not yet been many decarbonization measures taken by Vietnamese companies. However, foreign companies operating in Vietnam have initiated and implemented programs for decarbonization from an early stage.

Unilever Vietnam

Unilever Vietnam is the largest manufacturer of daily consumer goods in Vietnam. As a manufacturer, the company is a pioneer in plastic waste collection and recycling in Vietnam.

Unilever Vietnam is working with URENCO and VIETCYCLE in Hanoi to establish a plastic waste collection system at public facilities and roads in Hanoi to help consumers separate waste correctly. In addition, waste collectors in the city have been educated and trained to safely and correctly separate waste at collection points.

In the recycling phase, recyclable plastics are separated and recycled as raw materials for Unilever’s packaging production. Non-recyclable plastics, on the other hand, are converted into fuel oil.

Starbucks Vietnam

Starbucks Vietnam has partnered with Veritas Vietnam to recycle coffee grounds (dregs after coffee is brewed). Veritas Vietnam employees travel to Starbucks stores twice a week to collect coffee grounds. The company uses these waste materials to make shoes, cups, and masks, which it sells to automakers, hotels, and other customers.

Nestle Vietnam

In December 2021, Nestlé Vietnam signed a “Cooperation Agreement” with the Ministry of Natural Resources and Environment of Vietnam. The agreement aims to raise awareness of environmental protection among Vietnamese consumers through Nestlé Vietnam’s activities.

At the same time, Nestlé Vietnam also announced its goal of using recyclable plastic packaging by 2025. The company is also supporting its partners with plastic waste sorting machines to improve their non-recyclable plastic waste collection and sorting methods.

Nestlé Vietnam is also the first company in Vietnam to replace plastic straws used in its stores with FSC-certified paper straws.

Conclusion

Vietnam is expected to move quickly and aggressively to develop carbon pricing in order to meet its international commitments regarding environmental protection and carbon emissions.

The main reason is that Vietnam’s economy is very open to foreign countries. Compared to the GDP of $276.2 billion in 2021, Vietnam’s total export receipts are 2.4 times the GDP, making the Vietnamese economy one of the most open in Southeast and East Asia, after Singapore and Hong Kong.

In other words, Vietnam’s economy tends to be somewhat dependent on foreign markets, and the Vietnamese government has a policy of avoiding international pressure, opposition, and trade restrictions as much as possible. Therefore, it is believed that Vietnam will try to achieve the carbon neutrality targets announced in the “Paris Agreement” and “COP26” and so on.

Carbon pricing in Vietnam, especially the introduction of an “emissions trading market,” is a promising entry opportunity for Japanese companies with advanced carbon reduction technologies and know-how.

Another of the most important points of environmental protection that Vietnam is pursuing is the change in its power supply structure. The reduction of coal-fired power generation under PDP 8, which is awaiting formal entry into force, is almost certain to be followed by a focus on the development of renewable energy, especially offshore wind power. For Japanese companies, this is another good opportunity to enter Vietnam’s renewable energy industry.

▼ベトナム再生可能エネルギー市場の市場調査、M&A、ビジネスマッチングの支援をご要望の方は以下からご連絡ください。

【関連記事】VietBizでは環境・再生可能エネルギー分野に関するレポートを他にも取り揃えています。本記事と併せてぜひご覧ください

ベトナム市場調査レポート一覧はこちらからもご覧頂けます。

ベトナム市場の情報収集を支援します

ベトナム市場での情報収集にお困りの方は多くいらっしゃるのではないでしょうか。

VietBizは日本企業の海外事業・ベトナム事業担当者向けに市場調査、現地パートナー探索、ビジネスマッチング、販路開拓、M&A・合弁支援サービスを提供しています。

ベトナム特化の経営コンサルティング会社、ONE-VALUE株式会社はベトナム事業に関するご相談を随時無料でこちらから受け付けております。