- Introduction

- Basic Information about Vietnam

- Economics in Vietnam

- Main Economic Indicators in Vietnam

- Main Industory in Vietnam

- Trends in Exports and Imports

- Trends of Direct Foreign Investments

- International Relationships

- Vietnam as Production Base

- Enlargement of Consumer Market

- Trends of Japanese Companies Entering The Market

- COVID-19’s Effects

- Vietnam’s Economic Outlook for 2023

- The Attractive about Vietnamese Economics

- Summary

Introduction

Vietnam will be a promising overseas destination for foreign companies in the future.

Vietnam has been attracting attention in recent years as a good investment destination in the future due to its stable growth rate, accelerating modern trade, and thriving trade with foreign countries. In the past, Vietnam had been seen as an investment destination for foreign firms to build production plants due to its low labor costs, which would help them reduce production costs.

However, Vietnam is now regarded not only as a manufacturing base, but also as an attractive consumer market. This report provides a comprehensive overview about fundamental information of the Vietnamese economy as an investment destination.

Basic Information about Vietnam

Basic information about Vietnam is as follows

- Capital Hanoi

- Population Approx. 98.51 million (in 2021)

- Land Area 331,690km2

- language Vietnamese

- Religion No religion: 73.6%、 Buddhism: 14.91%

- Ethinicity Kihn(Vietnamese)around 86%, 53 ethnic minorities

- Political System Communist Party

- Average Age 33.3 years old(2022)

- Currency Vietnamese Dong(VND) (1 yen = approximately 174 VND)*As of December 2022

- GDP Growth Rate 2.6% (2021)

- Exports US$ 333,167 million (2021)

- Major imports Electronic products and components, machinery and equipment, and components

- Major Exports Cell phones and components, computers and other electronic products and components, machinery and equipment

- Unemployment Rate 4.3% (2021年, Urban areas)

- Major sectors Agriculture, forestry, fisheries: 12% GDP, Manufacturing and construction: 38% GDP, Services: 41% GDP

Geography and Territory

Vietnam’s land area (331,690㎢) ranks 65th in the world and 4th in Southeast Asia. Its land area (331,690㎢) is equal to that of Japan except for Kyushu area. Vietnam’s population of 98.518 million is the 15th largest in the world and the 3rd largest in Southeast Asia, and is expected to exceed Japan’s population by around 2040. The average life expectancy in Vietnam is 33.3 years, compared to Japan’s average age of 49 years (in 2022). In addition, with a labor force of 50.5 million people aged 15 and over, the country has an abundant young labor force. Besides, it is characterized by inexpensive labor.

Climate

The northern part of the country, where Hanoi is located, has a subtropical climate with four distinct seasons. Temperatures vary widely throughout the year, with cold mornings and evenings from November to April.

January and February are the coldest months, and July and August are the hottest. Precipitation is low from November to December.

The southern part of the country, where Ho Chi Minh City is located, has a tropical monsoon climate with a dry season and a rainy season. The average temperature is 27 degrees Celsius, with high temperatures throughout the year. The rainy season is from May to October, and the dry season is from November to April. The hottest months are April and May, when the rainy season begins.

Administrative Divisions and Area

According to the Vietnamese government’s regional classification, Vietnam is administratively divided into three regions (Northern, Central, and Southern) and six socioeconomic regions (Northern Inland and Mountainous Region, Red River Delta Region, North Central and Central Coastal Region, Central Highlands Region, Southeast Region, and Mekong Delta Region). Furthermore, Vietnam’s administrative divisions can be classified into 5 direct-controlled cities and 58 provinces.

Before spreading COVID-19, GDP continues to grow at an annual rate of about 7%. It is one of the world’s most pro-Japanese countries and shares many strategic interests with Japan.

Economics in Vietnam

Vietnam has developed as a manufacturing base for foreign companies. Until then, China had developed as a manufacturing base for companies from all over the world, but it began to bear various risks, such as higher labor costs and trade friction between the U.S. and China. As a result, the idea of moving manufacturing bases to countries other than China became widespread. Vietnam, with its abundant and inexpensive labor force compared to China, became particularly popular as one of these countries.

In recent years, however, increasing in wealthy and middle class due to rise in average income has drawn attention to Vietnam’s great potential for development as a consumer market. Since average wages in provinces are still low, Vietnam’s economy will have a dual nature as a manufacturing base and a consumer market for some time to come, but it is expected to grow more as a consumer market rather than a manufacturing base in the future.

Main Economic Indicators in Vietnam

Key economic indicators for the Vietnamese economy are as follows

- Total nominal GDP US$ 3,626billion

- Real GDP growth rate 2.6%(y/y)

- GDP per capita $3,725

- Estimated real GDP growth rate 6,0%

- Credit rating (S&P) 2.91% (2022)

- Consumer price inflation rate 1.8%

- Current account balance (balance of payments basis) -US$3,812 million

- Trade balance (balance of payments basis) US$3,324 million

- Financial balance (balance of payments basis) -US$16,624 million

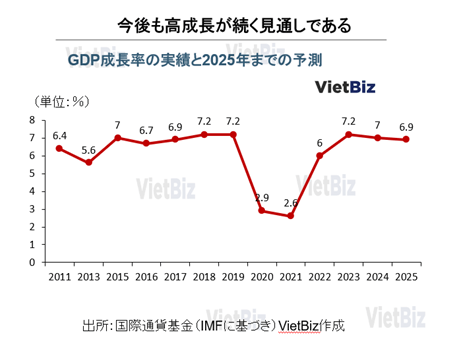

GDP Growth Rate

Economic growth has averaged 5-6% since 2010, and GDP per capita has nearly doubled over the past decade; real GDP growth in 2020 was 2.91%, the lowest growth rate in a decade due to COVID-19, but the highest growth rate in ASEAN while neighboring countries had negative growth. However, it was the highest growth rate in ASEAN, while neighboring countries experienced negative growth. Vietnam was the only country in Southeast Asia with positive growth due to COVID-19.

The Vietnamese government expects GDP growth to reach 6.5% in 2023. The government intends to take appropriate measures to achieve this goal. The International Monetary Fund (IMF) has put Vietnam’s gross domestic product (GDP) at 571.1 billion USD (approximately 77 trillion yen) in 2025, making it the third largest country in the Association of Southeast Asian Nations (ASEAN) after Indonesia and Thailand, with a GDP growth rate of 6.9%. In addition, according to a research report by consulting firm PwC, Vietnam could become the highest-growing country through 2050, growing at an average annual rate of about 5%. Vietnam’s economy is expected to continue to develop significantly.

Demographics

Vietnam has a population of 98.51 million (as of 2021). It is especially known for its large population of young people, and many Japanese companies that are short of labor often bring in human resources from Vietnam. According to the Vietnamese government, the population is expected to surpass 100 million by 2025.

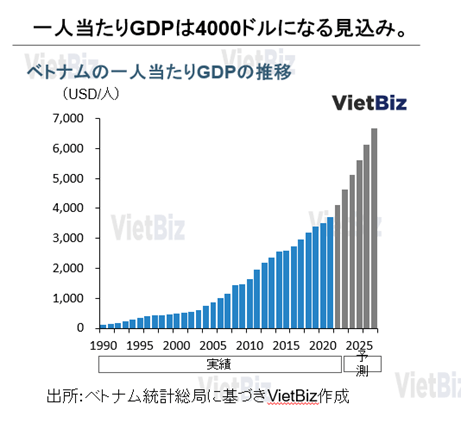

GDP per Capita

The current GDP per capita is US$3,725, and GDP per capita has nearly doubled over the past decade.

The “Five-Year Plan for Economic and Social Development in 2021-2025” published by the Vietnamese government targets an annual GDP per capita of US$4,700-5,000 in 2025 (¥45,000~48,000/month).

Inflation Rate

In 2021, the Consumer Price Index (CPI) rose 1.8%, the lowest rate of increase since 2016. Factors contributing to the full-year CPI increase include higher prices for oil and gas, rice, building materials, and education. On the other hand, temporary reductions in electricity prices to counter the spread of COVID-19 and reductions in tourism-related fees were among the factors that restrained the CPI increase.

Average Income and Wage Level

In the second quarter of 2022, the average monthly income of workers averaged VND6.6 million ($38,280) nationwide, an increase of 8.2% over the same period last year. In the second quarter of 2022, Ho Chi Minh City had the highest average monthly income at VND9.1 million.

As average income increases, consumption expenditures also increase. Vietnam defines “affluent” as those with annual household incomes of US$35,000 or more (¥4,025,000) and “middle class” as those with annual household incomes of US$5,000 or less (¥575,000-¥4,025,000). The middle and affluent classes have continued to expand, tripling in size over the past decade; by 2030, 49% of all households are expected to be in the middle class.

The ultra-high-net-worth population is expected to grow +64% over the five-year period 2019-2024. Vietnam’s growth rate is the third highest in the world after India’s +73% and Egypt’s +66%. The consumer market within Vietnam itself continues to grow due to the expansion of the middle class and affluent class.

Main Industory in Vietnam

Describes the industrial structure of Vietnam and major Vietnamese industries.

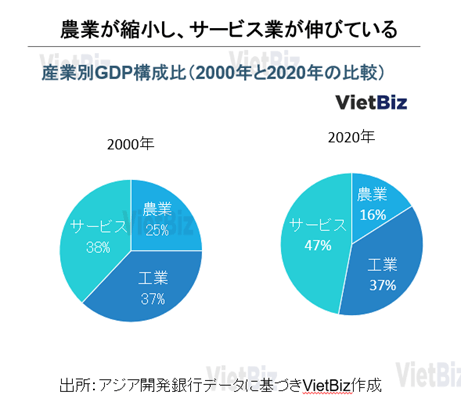

An Industrial Constructure

In 2000, agriculture accounted for 25% of GDP, industry 37%, and services 38%; in 2020, agriculture accounted for 16%, industry 37%, and services 46%; agriculture, which had a large share of GDP in 2000, has been shrinking due to the development of the service industry. Among the service industries, the share of the financial and real estate sectors in particular is growing, while the share of the manufacturing sector, a major industry, has been leveling off in recent years.

Thus, it can be seen that agriculture is shrinking and industrialization (manufacturing) and the service sector are growing.

Agricultural Forestry Industries and Fishers Industris

Vietnam is a major agricultural country. Although the GDP of agriculture, forestry, and fisheries has been increasing year by year, the share of agriculture, forestry, and fisheries in the GDP has been decreasing due to the growth of the industrial sector. Agricultural products with particularly high production include rice, coffee, rubber, cashew nuts, pepper, and fruits. Vietnamese agriculture has three issues; low value-added, low productivity, and high losses during transportation. Future prospects include the spread of smart agriculture (smart forming), cold chain, and enhanced branding.

Regarding forestry, Vietnam ranks first in Southeast Asia, second in Asia, and fifth in the world in terms of wooden furniture exports. Wooden furniture manufacturing occupies an important position in the Vietnamese economy. The main export destinations for Vietnamese wooden furniture are the United States, the European Union, Japan, and China.

In the fisheries industry, the production of fish and shrimp is thriving. In recent years, the technological development of aquaculture has been particularly remarkable, and shrimp and whitefish (pangasius) farming is very common. Even in Japanese supermarkets, one can find Vietnamese black tigers and pangasius fillets on display.

The Manufacturing Industry

Foreign-owned firms continue to grow in the manufacturing sector; the share of manufacturing as a percentage of GDP is on the rise. The most recent trend is the entry of a subsidiary of real estate giant Binh Group into finished vehicle manufacturing in 2017, which will focus on EV production. Labor costs in Vietnam are about 1/3 to 1/2 of those in China, and the country is attracting attention as a manufacturing base for foreign companies. With the rapid expansion of the manufacturing industry, the shortage of workers and rising wages for workers are expected to become even more serious than they are now. With a shortage of domestic suppliers in Vietnam, how to reduce dependence on imports from China will be important for the growth of Vietnam’s manufacturing industry in the future.

The Service Industry

Vietnam’s retail market continues to develop every year, with a market size of US$179 billion in 2021. With the increase in the number of middle-income earners, the market continues to grow at a high rate, and foreign companies are entering the market one after another.

Traditionally, traditional trade was dominated by public markets and private stores, but in recent years, modern trade has developed in supermarkets, convenience stores, and e-commerce, especially in urban areas. In addition, with economic development, demand for cold chain (refrigerated and frozen transport) is rapidly increasing in Vietnam. Currently, preferential factory prices for electricity are not applied, and demand is far exceeding supply due to barriers to entry in investment costs.

Vietnam’s steadily growing population and number of middle-class households suggest that there is great potential in the retail market. Vietnamese, especially those living in urban areas, now prioritize quality, product origin, and a pleasant shopping experience, and they purchase food products in modern supermarkets rather than in traditional traditional markets and independent stores (which offer convenient transportation and lower prices, but do not ensure quality and food safety and hygiene). This is a major change in Vietnamese consumer behavior.

However, a major challenge is the underdevelopment of cold chains in the Vietnamese retail industry. This is due to the lack of high quality standards required in the country and the high cost of using cold chains. On the other hand, some large companies are trying to promote cold chain, and demand is expected to increase in the future. In fact, more than half of Vietnamese companies exporting overseas use cold chain. The development of this cold chain is key for food-related companies and retailers in particular to develop their business in Vietnam.

Trends in Exports and Imports

Since 2010, both the value of exports and imports have been on an increasing trend in Vietnam. In recent years, there has been a gradual shift from exports of agricultural products (coffee, rice, and other agricultural products), minerals, and other raw materials to exports of processed goods and products, such as goods processed from agricultural products, machinery, equipment, telephones, and their components.

Exports

The structure is such that materials and electronic components are imported from China, Korea, and Japan, processed and assembled in Vietnam, and then exported.

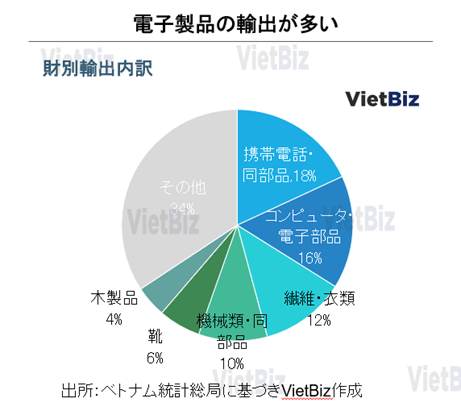

Main Export Items

The most common major export items are cell phones and their components, followed by computers and other electronic products and their components, and then machinery and equipment. Although Vietnam has a large number of machinery and electronic products, clothing and agricultural, forestry, and fishery products are also major export items for Vietnam. Since the late 2000s, exports of electronics products have expanded due to the entry of Korean companies such as Samsung and LG.

Export Partner Countries

According to the Vietnamese Customs General Administration, exports from January to September 2022 by major countries and regions were as follows: the U.S. ranked first with $85,168.21 million (up 23.7% year-on-year), followed by China with $41,222.64 million (up 6.2%) and Korea with $18,681.98 million (up 16.8%). The Netherlands ranked sixth with 7,817.28 million dollars, up 40.1%, and Germany, in seventh place, increased 28.7% to $6,760.7 million dollars, showing a large increase in exports to Europe, especially machinery and equipment and parts thereof.

The Volume of Exports and Amounts of Exports

According to the General Administration of Customs of Vietnam, exports in the first nine months of 2022 totaled $282,346.52 million (up 17.2% y/y).

Imports

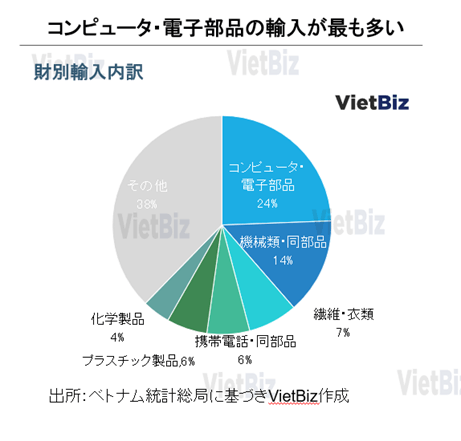

As indicated by the fact that it imports mainly parts, it has a structure in which imported parts are assembled and exported as products.

Main Imports Items

The main import items are computers and other electronic products and parts, followed by machinery and equipment and parts, and cell phones and parts. in 2009, the importing amounts of phone-related products due to the entry of the Samsung Group of South Korea into Vietnam.

Import Partner Countries

According to the General Administration of Customs of Vietnam, in terms of imports from January to September 2022 by major countries and regions, China ranked first with $91,158.28 million (up 12.1% year-on-year), followed by South Korea with $48,118.12 million (up 18.8%) and Taiwan with $17,922.11 million (up 17.2%).

The Volume of Imports and Amounts of Imports

According to the General Administration of Customs of Vietnam, imports in the first nine months of 2022 totaled $275,583.16 million (+12.8%).

Trends of Direct Foreign Investments

Foreign direct investment in Vietnam has increased significantly since Vietnam joined the World Trade Organization (WTO) in 2007. Particularly after Vietnam’s accession to the Free Trade Agreement (FTA), the country’s economy has also been booming. The transition from a traditional socialist-based environment to an open and liberal investment environment, participation in international economic frameworks, and reforms in the domestic regime have made Vietnam an attractive investment proposition for foreign investors. The inflow of foreign direct investment into Vietnam has increased significantly. Japan is one of the countries actively investing in Vietnam, with the second largest cumulative registered investment in the country through December 2021, after South Korea.

International Relationships

Describes Vietnam’s international relations with major countries.

China

China is a very important trading partner for Vietnam, accounting for the highest value of both exports to and imports from Vietnam. However, relations between China and the U.S. have deteriorated in recent years. China and the U.S. account for a large share of Vietnam’s trade value, and Vietnam has inseparable economic ties with both countries which are in deepening confrontation. Therefore, the future relationship between the two countries will have a great bearing on Vietnam’s relationship with them.

(出所)https://jbpress.ismedia.jp/articles/-/72766

United States of America

Vietnam and the U.S. used to be warring enemies, but diplomatic relations were restored in 1995 and transition, and economic and cultural ties between the two countries have become very strong. Two-way trade turnover between Vietnam and the U.S. has increased from 451MilUSD in 1995 to 90.8Bil USD in 2020. The U.S. is also the 11th country in terms of the amount of direct investment in Vietnam, investing 2.6 Bil USD in Vietnam in 2019; cumulatively through October 2021, the U.S. has invested 9.72 Bil USD in direct investment in Vietnam, developing 1,134 projects.

Japan

Japan and Vietnam established diplomatic relations on September 21, 1973. Since then, relations between the two countries have continued to develop in a wide range of political, economic, and cultural fields under the “Broad Strategic Partnership for Peace and Prosperity in Asia.

Currently, Japan is Vietnam’s fourth largest trading partner after China, the U.S., and South Korea, and in 2021, trade between Vietnam and Japan reached the $40 billion mark for the first time, with approximately $42.7 billion. This was an increase of 4.4% over the previous year. Meanwhile, Vietnam’s imports from Japan totaled about $22.65 billion, up 11.3% from the previous year.

According to Vietnam’s Ministry of Investment and Planning, Japan is the second largest investor in FDI in Vietnam; as of November 2021, Japan had developed 4,792 projects in Vietnam with a total investment of 64.2 Bil USD. This represents 16% of Vietnam’s total FDI investment. Japan is also the largest donor of Official Development Assistance (ODA) to Vietnam, with a cumulative amount of 23.76 Bil USD. These funds have contributed significantly to the development of Vietnam’s socio-economic infrastructure and poverty reduction.

(出所)https://poste-vn.com/news/2022-06-20-12439

ASEAN

Japan and the ASEAN countries, of which Vietnam is a member, are important business partners. Trade between Japan and ASEAN countries amounted to more than 24 trillion yen (in 2021), accounting for about 15% of total trade. On the other hand, Japan is the second largest trading partner of ASEAN countries after China, the U.S., and the EU, accounting for about 7% of total trade (in 2021). Japan and ASEAN countries have concluded bilateral Economic Partnership Agreements (EPAs) and ASEAN-Japan Comprehensive Economic Partnership (AJCEP) agreements, and institutional arrangements are underway to further stimulate trade and investment.

Vietnam as Production Base

In the past, Vietnam was seen as an investment destination for foreign companies to build production plants that would help them reduce production costs due to low labor costs. However, many foreign investors now view Vietnam as an attractive consumer market. Vietnam’s consumer goods industry is considered a stable and growing market.

Enlargement of Consumer Market

As mentioned earlier, Vietnam, which has developed as a production center, has begun to attract attention as a consumer market in recent years. With economic development, the incomes of Vietnamese people have increased, and the so-called wealthy and middle classes have expanded. As a result, more expensive goods can now be sold than before, and foreign companies are once again taking notice.

As the middle class population grows along with the process of rapid urbanization, they tend to eat out more. A switch from traditional markets to shopping in modern channels such as supermarkets, markets, and convenience stores is expected to lead to increased consumption of processed products.

Expansion of Modern Trade from Traditional Trade

There are two channels for purchasing goods: modern trade and traditional trade. The former refers to “modern retail formats” and is represented by supermarkets, convenience stores, and department stores. The latter refers to the “traditional retail format” and is represented by mom-and-pop stores (small businesses, mainly family-run).

Although traditional trade accounts for a large proportion of the retail trade in Vietnam, modern trade, such as convenience stores, supermarkets, and shopping centers, has been steadily spreading in the country. In recent years, the growth rate of traditional trade has been limited to a few percent per year, while the growth rate of modern trade has reached more than 10%.

In fact, the number of supermarkets and shopping centers in Vietnam continues to increase. According to the General Department of Statistics of Vietnam, the number of supermarket outlets increased from only 600 as of 2010 to more than 1,000 by 2019. Relatedly, the number of shopping centers has also increased from about 100 stores in 2010 to 240 stores in 2019.

The e-commerce market is also expected to develop: as of 2019, the e-commerce market had sales of US$4.4 billion, and the market is expected to grow to US$8.5 billion by 2024. The number of mail order users is also expected to grow from 39.6 million in 2019 to 66.9 million in 2024, five years later. Although there are still challenges to the development of Vietnam’s e-commerce market in terms of payment systems and logistics infrastructure, the trend toward greater penetration is likely to remain the same.

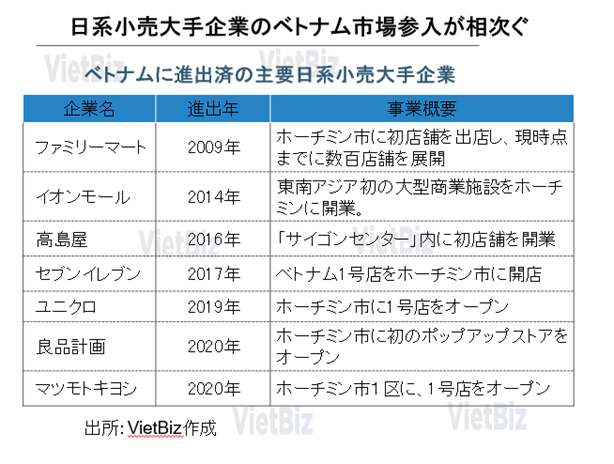

Trends of Japanese Companies Entering The Market

Japanese companies have long been prominent in Vietnam. There are three Japanese chambers of commerce and industry in Vietnam: in Hanoi, Da Nang, and Ho Chi Minh City.

As of January 2022, 789 companies are registered with the Chamber of Commerce in Hanoi, 1,060 in Ho Chi Minh City, and 130 in Da Nang (as of 2019), for a total of 1,939 companies. compared to other ASEAN countries, the number of Japanese companies in Vietnam is among the highest.

The pioneers of Japanese companies entering Vietnam in the 1990s were automobile and motorcycle manufacturers such as TOYOTA, YAMAHA, and HONDA. In particular, because of the large number of motorcycles in Vietnam, YAMAHA and HONDA are names that are often seen around town.

They were followed by major consumer electronics, pharmaceutical, and food manufacturers. Electronics manufacturers such as Sharp, Panasonic, Sony, and Toshiba are widely known in Vietnam.

In the area of pharmaceuticals, Earth Chemicals (insecticide), Rohto (eye drops), and Hisamitsu Pharmaceutical (known for its “Salonpas” compresses) are representative examples. Hisamitsu’s Salonpas, in particular, is so well known that it has become synonymous with the poultice itself.

In the food industry, Ace Co., whose main product is instant ramen, is a pioneer in the Vietnamese market. ace co. entered the market in the early 1990s and thoroughly localized its products. a few years after its entry, it launched “Hao Hao” ramen, which has sold more than 30 billion servings in Vietnam and has become the most sold It became the best-selling instant noodle in Vietnam.

Thus, many of the Japanese firms that entered Vietnam early on are manufacturers and manufacturers.

In addition, Nikkei retailers are entering the Vietnamese market in rapid succession as the Vietnamese consumer base expands.

Major Japanese retail giants already operating in Vietnam include FamilyMart (opened its first store in Ho Chi Minh City in 2009, and has since opened hundreds of stores), UNIQLO (opened its first store in Vietnam in Ho Chi Minh City in 2017, with plans to open 100 stores by 2020), Ryohin Keikaku ( (opened its first pop-up store in Ho Chi Minh City in 2020), and Matsumotokiyoshi (opened its first store in October 2020 at the Binh Com Center in District 1, Ho Chi Minh City).

COVID-19’s Effects

In the years prior to the spread of COVID-19, Vietnam had maintained a GDP growth rate of 7~8% per year, but due to COVID-19, the GDP growth rate in 2021 was 2.58%. This is the lowest growth rate in the last 30 years.

Factories and other manufacturing facilities were unable to operate, and consumption fell because extensive curfew and movement restrictions were in place as ways not spreading COVID-19. In addition, imports and exports were also halted, which resulted in a halt in the procurement of raw materials necessary for manufacturing. Since the outbreak of the new corona epidemic began, Vietnam has experienced four major waves of the spread of infection. The fourth wave was the most serious, with the number of infected people exceeding 300,000 per day by March 2022.

In the early stages, when vaccination against the new coronavirus had not yet begun, the Vietnamese government had taken strict and thorough measures to prevent coronavirus infection.

However, as vaccination rates increased, the Vietnamese government gradually began to ease restrictions on coronas, and as of 2022, economic activity has almost returned to pre-coronas levels. Restrictions on the entry of foreigners have also been largely eliminated.

To date, 79.6 million people, or 81.7% of the population, have received three doses of the new corona vaccine. Given that 61.7% of the population in Japan has received the third dose, this indicates that a very high percentage of the population has been vaccinated.

Vietnam’s Economic Outlook for 2023

In November 2022, the Vietnamese National Assembly adopted a resolution on the “Socio-Economic Development Plan for 2023,” which sets forth 15 major social and economic objectives for 2023. The major social and economic development goals determined in the resolution are as follows. The figures in parentheses are the targets for 2022.

- GDP growth rate 6.5% (approx. 6-6.5%)

- GDP per capita about $4,400 (about $3,900)

- Manufacturing as a percentage of GDP approx. 25.4-25.8% (approx. 25.5-25.8%)

- CPI growth rate is about 4.5% (about 4%)

- Labor productivity growth rate is about 5 to 6 percent (5.5 to 5.5 percent)

- Percentage of agricultural workers 26.2% (27.5%)

- Percentage of trained workers is 68% (67%) Of these, about 27.5% (27-27.5%) are workers with trained qualifications and certificates

- Unemployment rate in urban areas is less than 4% (less than 4%)

The Vietnamese government expects GDP growth to reach 6.5% in 2023. The Vietnamese economy is expected to continue to develop significantly in 2023, as the government intends to take appropriate measures to achieve this goal.

The Attractive about Vietnamese Economics

We have repeatedly mentioned in previous articles that many global companies are increasingly moving their production bases from China to third countries. Among them, many companies are moving their production bases to Vietnam. This article describes the attractiveness of the Vietnamese economy.

Stable Economic Growth Rate Is Expanding Consumer Markets

Japan’s domestic market is already shrinking: as of 2021, the average age in Japan is 48.4 years old, and it is expected to continue to rise. The decline in domestic demand is an inevitable consequence. Vietnam, on the other hand, has a young average age of 33, and its consumer market is expected to expand. Another factor is that the “Japanese brand” is well established due to the success of Japanese companies that have already entered the market.

Pro-Japanese Country

Vietnam is a pro-Japan country. The factors that make Vietnam pro-Japanese are largely influenced by political factors, historical background, contemporary politics, and youth culture.

According to a survey by JETRO of the Japan External Trade Organization (JETRO), the number of Japanese companies operating in Vietnam in 2020 is 1985. With 794 companies operating in Hanoi and Northern Vietnam, 1,044 in Ho Chi Minh City, and 147 in Da Nang, many Japanese companies in Vietnam have indicated that they intend to expand their business in the future.

Many Japanese companies have entered Vietnam, including Aeon, FamilyMart, Panasonic, Honda, Toyota, Ajinomoto, Ace Cook, Rohto Seiyaku, and Uniqlo. Many restaurants have also entered the market, including famous restaurants such as Sukiya, Hanamaru Udon, and Chiyoda Sushi, as well as Japanese restaurants and pubs. In addition, there is a so-called “Japanese street” lined with many Japanese restaurants, Kin Ma Street in Hanoi and Let Thanh Thong in Ho Chi Minh City. This has created a strong affinity among local Vietnamese for Japan, as they have many opportunities to come into contact with Japanese food and the Japanese language. There are many other reasons for the pro-Japanese sentiment in Vietnam, and the country is similar to Japan in many areas.

In addition, 2023 will mark the 50th anniversary of the establishment of diplomatic relations between Japan and Vietnam. Such a pro-Japanese national character is an advantage for Japanese companies to develop in the Vietnamese market.

(出所)https://locobee.com/mag/2021/03/26/vietnam-research/

Summary

This report provides a comprehensive introduction to the fundamentals of the Vietnamese economy as an investment destination.

Vietnam’s economy has developed as a manufacturing base for foreign-invested companies, but its potential as a consumer market has been attracting attention in recent years as national income has increased with economic development and the wealthy and middle class have expanded.

Vietnam’s GDP has continued to grow positively every year and has increased approximately ninefold over the past 20 years. It is expected to continue to grow significantly in the future. In addition, Vietnam’s stable growth rate, accelerated modern trade, and thriving trade with other countries make it a good investment destination for foreign companies.

We hope that foreign companies considering expansion into Vietnam will contact ONE-VALUE, a consulting firm specializing in Vietnamese market entry, for further information.

【関連記事】ベトナム経済については、こちらの記事も合わせてご覧ください。