- Introduction:Expansion into Vietnam

- Why Is Expansion into Vietnam Attracting Attention?

- Trends of Japanese Companies Expanding into Vietnam

- Advantages of Expanding into Vietnam

- Challenges and Risks of Expanding into Vietnam

- Growth Potential and Future of The Vietnamese Economy

- Key Points for Successful Expansion into Vietnam

- Careful Information Gathering (market research in Vietnam)

- Necessity of Market Research in Vietnam (1): The Vietnamese market is a rapidly changing environment.

- Necessity of Market Research in Vietnam (2): Vietnamese consumers’ preferences differ from those in Japan.

- Need for market research in Vietnam (3): For internal approval procedures

- The need for market research in Vietnam (4): to gain a better understanding of the local market

- Searching for Promising Local Partners in Vietnam.

- Identification of Vietnam Sales Strategy Issues

- Understanding of Local Vietnamese Business Practices and Communication Methods.

- Careful Information Gathering (market research in Vietnam)

- Use of Consultants for Entry into Vietnam

- ベトナム市場の情報収集を支援します

Introduction:Expansion into Vietnam

The number of Japanese companies expanding into Vietnam has been increasing every year. The expansion of Japanese companies into Vietnam seems to correlate to some extent with the economic situation in Japan.

The timeline for Japanese companies entering Vietnam can be broadly categorized as follows.

- From 1986 to 1992, before and after Vietnam introduced the “Doi Moi Policy

→Japan was in a period of high economic growth = not many Japanese companies entered the Vietnamese market. - From 1994 to 1997, just after the burst of the bubble economy

→Japanese domestic economy shrank = more and more companies, including large companies, entered the Vietnamese market. - After 2001

→ Long-term contraction of the Japanese economy = Acceleration of continuous expansion into Vietnam, mainly by Japanese manufacturers.

The introduction of foreign companies, including Japanese companies, into Vietnam was triggered by the “Doi Moi Policy” introduced in 1988. However, in the five years that followed, only 29 direct investments from Japan were approved, mostly in the construction, engineering, and consulting industries. This may have been due in part to the booming economy during Japan’s period of rapid economic growth at the time. Japanese companies during this period did not need to expand into Vietnam.

In the 1990s, just as Japan’s strong domestic economy began to contract, the period from August 1994, when then Prime Minister Tomiichi Murayama visited Vietnam, to the first half of 1997 is recognized as the “first boom in Vietnamese expansion. At that time, however, Vietnam was not positioned as a manufacturing base, but rather as a consumer market with 80 million people, which was opened to foreign capital at the time.

Therefore, the main Japanese companies that entered the market during this period were manufacturers for domestic demand, such as Ajinomoto and Ace Cook (food products), Kao (daily necessities), Wacoal (clothing), and Hisamitsu Pharmaceutical (pharmaceuticals) in the consumer goods sector, many of which still have a strong presence in the Vietnamese domestic market today. In the durable goods sector, vehicle manufacturers such as Toyota Motor Corporation (automobiles), Mitsubishi Motors Corporation (automobiles), Honda Motor Company (motorcycles), Matsushita Electric Industrial Co. ), Sony (televisions), and other audio/visual equipment manufacturers, which were based mainly in the southern part of the country near Ho Chi Minh City, Vietnam’s largest economic center.

After the Asian economic crisis in 2000, Vietnamese companies began to move into the country again, but from this period, expansion into the north began to grow. At the time of the opening of Vietnam to foreign investment, the dominant motivation for expansion into the country was the desire to develop the domestic market, and while many companies expanded into the south, centered on Ho Chi Minh City, interest in the north was not as high as in the south. The decision of Japanese automobile and motorcycle manufacturers to expand into the north rather than the south at the time of their entry into the country was reportedly due to government guidance rather than their own judgment.

However, by the beginning of 2000, after the “first boom in Vietnam,” when most of the expansion was into the southern part of the country,

- Infrastructure development underway in northern Vietnam, progress of manufacturing cluster

- Physical distance from Guangdong Province, China, which is a material procurement base for the manufacturing industry

The changes in the business environment, such as the “second boom” in Vietnam, were perceived as favorable conditions, and durable goods manufacturers expanded their operations in the northern part of the country. This “second boom in Vietnam” is generally considered to have started after 2000.

Retail expansion since 2010, after a round of large expansion projects, has again focused on the southern part of the country.

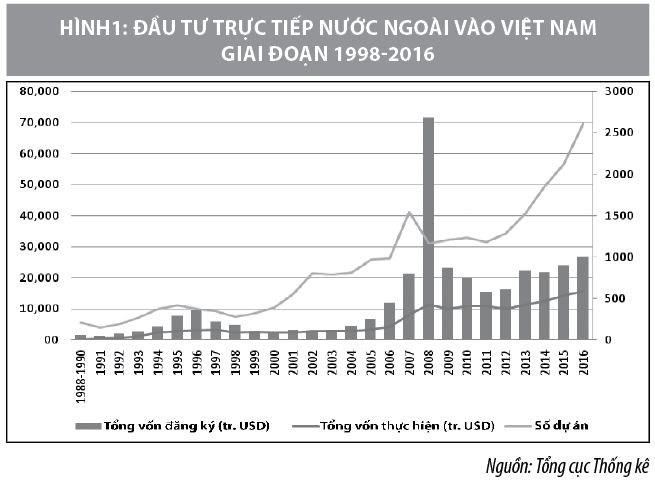

As of 2022, the number of foreign direct investment (FDI) into Vietnam will be approximately 80 countries, with South Korea as the largest investor, followed by Japan, Singapore, Taiwan, and other Asian countries. By investment sector, secondary industry accounts for about 70%, tertiary industry for about 30%, and primary industry for the remaining several percent.

This report provides a comprehensive overview of the advantages, challenges, and other aspects of expanding into Vietnam.

Why Is Expansion into Vietnam Attracting Attention?

The biggest reason for Vietnam as a promising destination is “future growth potential of the local market,” followed by “inexpensive labor” in second place and “excellent human resources” in third place (according to a survey conducted by the Japan Bank for International Cooperation for Japanese manufacturing companies in 2012).

Stable and High Economic Growth Rate of The Vietnamese Economy

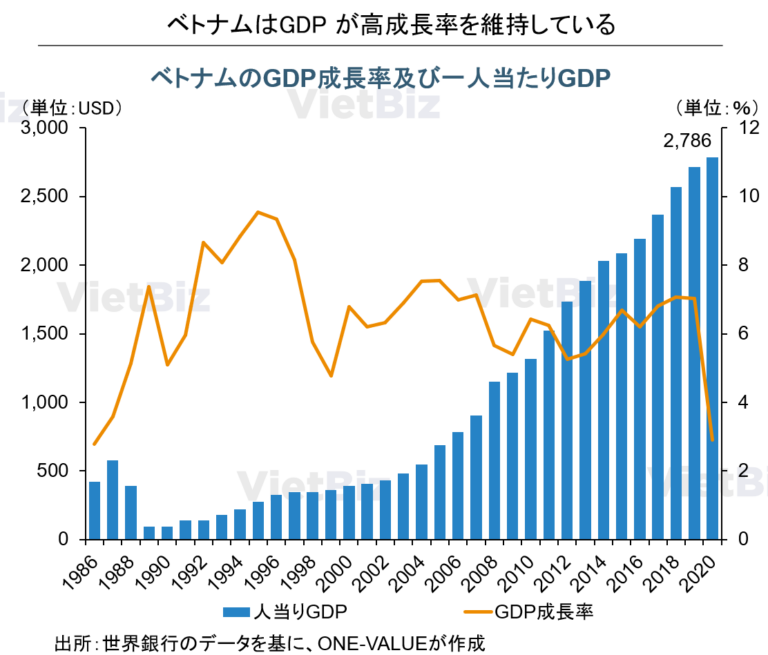

Vietnam’s transformation from a socialist to a capitalist market under the “Doi Moi Policy” proposed in 1986 led to gradual economic growth. As a result, the country maintained a high growth rate during the 1990s and GDP per capita gradually increased; in 2014, GDP per capita exceeded USD 2,000, about 20 times higher than in 1990.

- Membership in ASEAN

Vietnam joined the Association of Southeast Asian Nations (ASEAN) on July 28, 1995. Since its accession, Vietnam has actively promoted its membership in ASEAN to Laos, Cambodia, and Myanmar, which in turn has enabled Vietnam to establish deep ties with the international economy and to participate in a number of “ASEAN+ regional” cooperation mechanisms and ASEAN-centered regional free trade agreements (FTAs). The country has been able to participate in a number of “ASEAN+ regional” cooperation mechanisms and ASEAN-centered regional free trade agreements (FTAs).

- Accession to WTO

Vietnam applied for accession to the World Trade Organization (WTO) on January 4, 1995; bilateral and multilateral consultations with member countries were required for WTO accession, and it took 12 years before Vietnam became a full member of the WTO as of January 11, 2007.

The two main principles of the WTO are “most-favored-nation” and “national treatment,” meaning that all WTO members must be treated equally in terms of imports and exports, and domestic and imported goods must be treated equally. This allows Vietnam to participate in the global free trade network.

Young and Abundant 100 Million-strong Vietnamese Population

Vietnam has a population of 98.51 million (as of 2021). It is especially known for its large population of young people, and many Japanese companies that are short of labor often bring in human resources from Vietnam. According to the Vietnamese government, the population is expected to surpass 100 million by 2025.

Local labor costs in Vietnam are gradually increasing, partly due to government wage hikes. However, compared to other Asian countries, labor costs are still inexpensive. In particular, labor costs are lower in the suburbs than in urban areas.

Rising Income Levels and A Growing Middle Class

The income middle class and affluent class is expanding in Vietnam; by 2030, the middle class is projected to expand rapidly in Vietnam, with 49% of all households in the country being in the middle class. Vietnam’s ultra-high-net-worth population is expected to grow 31% over the five-year period from 2019 to 2023, the highest growth rate in the world.

Vietnam’s GDP per capita will soon exceed 3,000 USD. It is generally believed that once the per capita GDP exceeds 3,000USD, consumers will rapidly increase their purchases of home appliances, etc., and the purchasing power of consumers in Vietnam is expected to expand rapidly in the future.

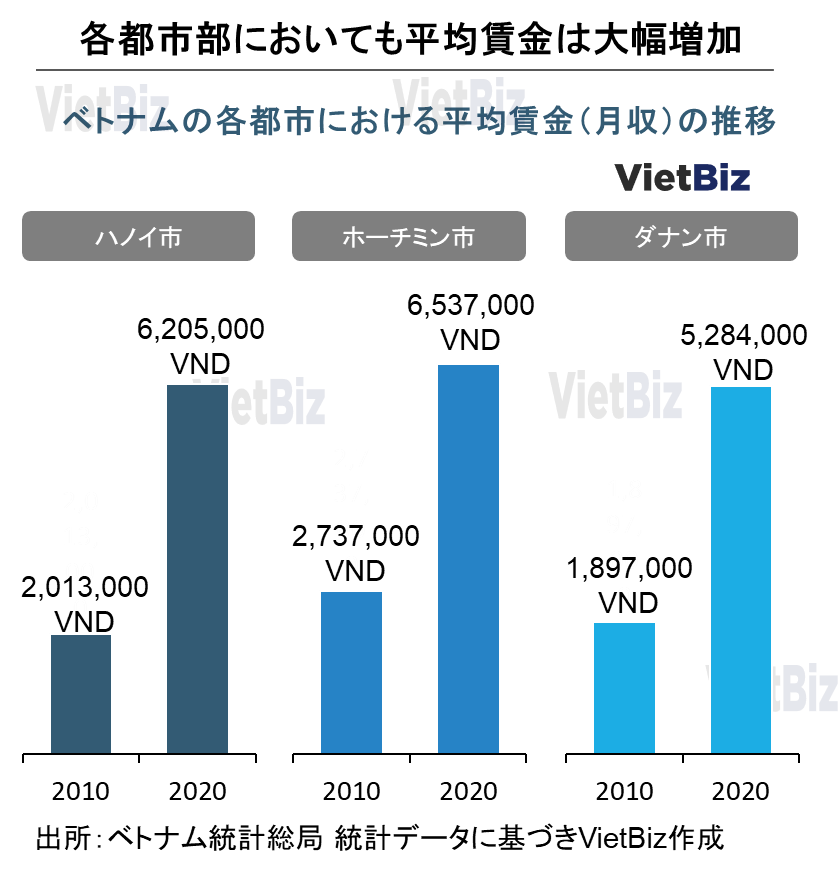

Average wages also increased significantly in Hanoi, Ho Chi Minh City, Da Nang, and other cities. The average wage in Hanoi increased to VND6,205,000 (approximately 36,000 yen at the August 2022 rate), in Ho Chi Minh City to VND6,537,000 (approximately 38,000 yen), and in Danang City to VND5,284,000 (approximately 30,000 yen).

Wage growth in these cities has been driven by an increase in the percentage of people working in white-collar jobs such as IT engineers, finance, and clerical work, as opposed to jobs in agriculture, fishing, and factory workers.

On the other hand, in some places where agriculture and fishing remain the main industries, the rate of wage growth has only doubled. The wage gap between urban and rural areas is widening, and young people, especially those living in rural areas, are increasingly leaving the country to work abroad in search of higher income.

Pro-Japanese and Highly Trusting of Japanese Companies and Products

Reasons why the Vietnamese are particularly pro-Japanese among Southeast Asian countries include the following

- Japan is a technologically advanced country that was the first in Asia to achieve economic development and has made economic inroads into other countries around the world.

- Both are culturally similar, influenced by Confucianism, and the Japanese are polite and cooperative.

- Japan’s ODA is the largest in Vietnam, and many Japanese companies have established operations in Vietnam. These news are often introduced on TV and in newspapers.

- The quality of products produced and manufactured by Japanese companies in Vietnam is high, and there is a high level of trust in the safety of these products. Some products are deeply familiar to Vietnamese people’s daily lives. For example, Honda motorcycles are so prevalent that many Vietnamese refer to the motorcycles themselves as “Honda. Ace Cook’s Hao Hao Ramen is the best-selling instant noodle in Vietnam.

- Japanese anime such as Doraemon, Dragon Ball, and Conan are also popular in Vietnam.

- Confronted by China, which claims territorial rights over the entire South China Sea, the Vietnamese people are beginning to develop vague expectations of Japan, which is also troubled by encroachments from China, and feelings of a security ally.

Vietnam is culturally similar to Japan among Southeast Asian countries, many Japanese companies have established operations in Vietnam, and the relationship between the two countries, which often share similar economic and security interests, has been described as a “loose alliance” or “natural alliance.

Trends of Japanese Companies Expanding into Vietnam

According to the “Survey on the Number of Japanese Companies Operating Overseas” by the Ministry of Foreign Affairs, the number of Japanese companies operating in Vietnam as of 2022 is approximately 2,120, while JETRO’s survey based on the number of companies belonging to local associations of commerce and industry shows approximately 1,973. The number of companies that have entered the market is generally considered to be 2,000, although the actual number varies. This number is comparable to that of Indonesia, followed by Thailand with approximately 6,000 companies in Southeast Asian countries.

Expansion Trends by Industry

In terms of the breakdown by industry sector, the manufacturing sector accounts for about half of the companies that have set up operations (about 50%). The next two largest sectors are commerce (approximately 10%) and services (approximately 7%). This is not limited to Vietnam, but can be seen in many other countries in the process of economic development. In the case of Thailand, the manufacturing sector accounts for 40% and the commercial sector for 25%. In the case of Indonesia, manufacturing accounts for 50% and commerce 15%. Although the composition ratio differs depending on the maturity of the domestic economy, it seems to be common for Japanese companies to enter a country at the stage of expansion where the manufacturing sector is followed by commerce.

The overwhelming majority of Japanese companies establish a local subsidiary as a wholly-owned subsidiary, with approximately 70% of the companies being wholly-owned and 10% being a joint venture with a local company. There are also many cases where a Japanese company establishes a joint venture and then transitions to sole ownership by purchasing shares.

Expansion Trends in Vietnam by Region

There are Japanese chambers of commerce and industry in the northern city of Hanoi, the central city of Da Nang, and the southern city of Ho Chi Minh City; as of December 2020, approximately 800 companies are members of the Japanese Chamber of Commerce of Vietnam (Hanoi), 150 companies are members of the Da Nang-Vietnam Japanese Chamber of Commerce (Da Nang), and 1,050 companies The number of members is about 1,050 companies in Ho Chi Minh City.

In the mid-1990s, general trading companies such as Sumitomo Corporation and Nissho Iwai (now Sojitz Corporation) began to develop industrial parks, and companies with strong brands that are still familiar to Vietnamese people, such as Ajinomoto (established in 1991), Ace Cook (started business in 1995), and Hisamitsu Pharmaceuticals (started business in 1995), entered the southern area. (started business in 1995), and Hisamitsu Pharmaceutical (started business in 1995). In the north, motorcycle manufacturers such as Honda Motor (started operations in 1997) and Yamaha Motor (started operations in 1998) entered the market in the late 1990s, and clusters of related parts suppliers began to emerge.

This manufacturing clustering in the North subsequently became more pronounced in the printer manufacturing industry in the 2000s, with major manufacturers such as Canon (Hanoi and Bac Ninh Province, established in 2001), Brother Industries (Hai Duong Province, started operations in 2007), Kyocera Document Solutions, and Fuji Xerox ( (both in Hai Phong City, started operations in 2012), and other major manufacturers have established operations near National Highway Route 5, which runs from Hanoi to Hai Phong City, attracting companies and business categories such as electronic component manufacturers and EMS (electronic equipment manufacturing service) manufacturers, which are suppliers to these companies. This type of manufacturing clustering is a move not often seen in the South, and is an industrial structure unique to the North.

On the other hand, in the south, where Ho Chi Minh City accounts for about 20% of GDP, it is easy to see consumer goods manufacturers targeting domestic demand, such as Yakult Honsha, Nissin Foods, Nippon Ham, and other food and beverage manufacturers, clothing manufacturers, Rohto Pharmaceuticals, and other pharmaceutical manufacturers.

Concerning the commercial sector, which accounts for the second largest share after the manufacturing sector, the southern part of the country is actively expanding its business, with FamilyMart (Japan), GS25 (Korea), and Circle K (Vietnam) opening 24-hour convenience stores in the south, while there is almost no movement in the north.

Such regional differences are not uncommon in Vietnam, and in industries that require store development, nationwide expansion to include Hanoi in the north and Ho Chi Minh City in the south is not necessarily the norm, but there are many domestic and foreign companies that do business only in either the north or south and not in the other. There are many domestic and foreign companies that operate only in either the north or the south and not in the other. In the domestic cab industry, the leader, Mai Linh (headquartered in Ho Chi Minh City), operates in both the north and south, while the second largest, Vinasun (headquartered in Ho Chi Minh City), operates only in the south.

Yody (headquartered in Hai Duong Province), a domestic branded apparel chain targeting young people, has expanded its business from opening its first store in 2014 to 185 stores in the country as of November 2021, but has opened the majority of its stores in the north, with only 5 stores in southern Ho Chi Minh City. Similarly, in the Vietnamese consumer electronics retailing industry, the number of stores in the upper ranks has been increasing. Similarly, Dien May Cho Lon (headquartered in Ho Chi Minh City), one of the top three electronics retailers in Vietnam, had opened 94 stores as of July 2022, but no stores in the central and northern regions.

Thus, it can be said that in Vietnam, business expansion does not necessarily mean nationwide expansion.

Trends in SME Expansion

Approximately 52% of the companies operating in Vietnam are small and medium-sized enterprises (JETRO’s 2019 survey results). Although there are differences in the population numbers according to various surveys, more than half of the Japanese companies expanding into Vietnam consist of small and medium-sized enterprises (SMEs). This is due to the fact that the “first boom in Vietnam” and the “second boom in Vietnam” in the early 2000s have already seen a round of large-scale projects by automobile and motorcycle manufacturers and home appliance makers. In terms of the environment for companies entering the Vietnamese market, the increase in the number of Japanese-affiliated rental factories, which do not require large investments to set up factories, and the increase in the number of service companies entering the market are also helping to reduce the burden on small and medium-sized enterprises (SMEs), and are increasing the percentage of SMEs entering the market.

Some SMEs also take advantage of the Export Processing Enterprises (EPE) program, which is defined as “an enterprise established and operating in an export processing zone (or in an industrial park or economic zone) that exports all of its products”. This is a preferential treatment for enterprises that export all of their products without supplying them to the Vietnamese domestic market. Under this system, import duties and VAT (value-added tax) on parts and materials and export duties on manufactured goods are exempted, and this system is used by small and medium-sized enterprises (SMEs) in the metalworking industry that wish to reduce processing costs by producing in Vietnam.

Japanese Firms in The Consumer Market

Among the business categories that have entered the Vietnamese market to capture the Vietnamese consumer market, many food manufacturers, pharmaceutical manufacturers, daily necessities manufacturers, retailers, and restaurants have entered the market.

Ace Cook, an instant noodle manufacturer, entered the market in 1993, much earlier than other Japanese companies, and entered the market in 1995, and has grown to become the largest company with approximately 50% market share in the domestic market size, which is estimated to be 7 billion servings per year as of 2021, with production at 11 factories in 7 domestic bases.

Pharmaceutical manufacturer Hisamitsu Pharmaceutical established a local subsidiary in 1994 and began production the following year at a factory in Dong Nai Province, adjacent to Ho Chi Minh City. Its main product, Salonpas, is highly recognized in Vietnam, and many Vietnamese recognize the compress itself as Salonpas. Since 2006, Hisamitsu Pharmaceutical’s base in Vietnam has also been positioned as an important export base for Southeast Asian countries.

As a joint venture, Sapporo Beer built a factory in the southern province of Long An, adjacent to Ho Chi Minh City, in 2011 and has been conducting sales activities mainly in the south since 2012. As a result, its recognition in Ho Chi Minh City in in-house surveys has reached 98%, and while the company is positioned as a leading Japanese brewer, it took time to improve its performance, but in 2018 it posted its first profit.

In the retail industry, Aeon established a representative office in Vietnam in 2008, and six years later, in 2014, opened its first Aeon Mall in Vietnam, the Celadon Tan Phu store in Ho Chi Minh City. As of 2022, the company operates a total of six stores, two each in Ho Chi Minh City and Hanoi, and one each in Binh Duong Province and Hai Phong City, with sales of approximately 14.3 trillion VND (approximately 80 billion yen) in FY2020.

Thus, companies that entered Vietnam in the early 1990s, at the dawn of their expansion into the country, seem to have a strong tendency to establish themselves as already stable brands in the consumer market.

Advantages of Expanding into Vietnam

In this chapter, we list the advantages of expanding into Vietnam.

High Potential for Future Growth in The Vietnamese Market

Vietnam’s consumer market is expected to grow through the long term to 2050. As mentioned earlier, Vietnam is a country with a large and growing national income. In addition, some observers believe that although Vietnamese people have a large number of side jobs, the income earned from these side jobs is not well reported and does not show up in statistics, pointing to the idea that Vietnamese income is higher than statistics suggest.

There has also been a change in Vietnamese consumer values. Consumers are increasingly emphasizing quality, safety, and hygiene as well as affordability, and more expensive products are becoming easier to sell than in the past.

With a growing middle class and affluent population, Vietnam has a large potential for growth in the consumer market, and foreign participation in the retail sector is becoming more common.

Abundance of Talented people, Excellent Young Workers

Vietnam is often cited as a promising destination for expansion because of its young, inexpensive, and abundant labor force, and according to a JETRO survey, in recent years Vietnam has been rated as one of the following.

In the Southeast Asia Primary Education Achievement Index (SEA-PLM) 2019 released by the Southeast Asia Education Ministers Organization (SEAMEO) and the United Nations Children’s Fund (UNICEF, UNICEF), Vietnam ranked first in reading, writing and mathematics. (6 participating countries: Vietnam, Laos, Myanmar, Malaysia, Cambodia, and the Philippines)

In the International Mathematical Olympiad 2020 (for high school students, 105 participating countries), Vietnam ranked 17th out of 105 countries in terms of medals won. Japan was in 18th place.

In the ABU Asia-Pacific Robot Contest (ABU Robocon), organized by the Asia-Pacific Broadcasting Union (ABU) and held between universities in the Asia-Pacific region, Vietnam is ranked first, ahead of China, in the number of times it has won the first 18 (2002-2019) grand prizes.

Although a market economy has been introduced, the national system is socialist, so the government is focused on the equal dissemination of education. In addition, in JETRO’s survey of “management problems” for companies entering the nine ASEAN countries (Vietnam, Thailand, Laos, Cambodia, Myanmar, Indonesia, Malaysia, Singapore, and the Philippines), the percentage of companies that answered “quality of employees” was the second lowest in Vietnam, after Singapore. Vietnam was second only to Singapore in the percentage of companies that answered “quality of employees” in the survey.

Modern Trade Develops

Modern retail formats, or “modern trade,” as represented by convenience stores and supermarkets, are developing in Vietnam.

The retail sector can be broadly classified into “traditional trade” and “modern trade” based on the final distribution stage that touches the end consumer. In Vietnam, traditional trade mainly refers to the traditional “public markets” and “mom-and-pop stores” (small stores selling daily necessities and foodstuffs) established in each region of the country, while modern trade refers to modern commercial facilities such as supermarkets, convenience stores, and shopping malls as the final point of purchase for consumers. The term “modern trade” refers to a form of distribution that classifies modern commercial facilities such as supermarkets, convenience stores, and shopping malls as the final place of purchase.

In the case of Vietnam, the Ministry of Industry and Trade has announced that the ratio of traditional trade to modern trade will be 74% and 26% by 2020. Due to factors such as changes in the living environment and the entry of new companies into the retail industry, this ratio has begun to shift toward the modern trade, but overall, the traditional trade remains the core of the retail industry.

Considering on a city-by-city basis, Hanoi and Ho Chi Minh City, the two largest cities in Vietnam, are assumed to have a higher modern trade ratio than other provincial cities because they have more modern commercial facilities with stores than other cities, but even between these two cities, for example, Ho Chi Minh City has by far the largest number of convenience store outlets and brands, It can be inferred that the modern trade ratio in Ho Chi Minh City is the highest in Vietnam. Nevertheless, traditional trade is still the mainstream in Vietnam as a whole, with modern trade at 15%-25% and traditional trade at 75%-85%.

Security Is Good and The Government Is Stable.

Vietnam is a safe and stable country with a stable government. Vietnam’s political system is based on the collective leadership of the General Secretary of the Communist Party, the President of the State, and the Prime Minister. Policies are set every five years by the Communist Party Congress and adjusted at the biannual plenary sessions of the Central Committee.

Vietnam is promoting an international emphasis policy that opens the Vietnamese economy to the world, with trade and investment at its core.

The main policies are as follows.

- 1995Signed the Economic and Trade Cooperation Agreement with Europe and became a member of ASEAN

- 1996: Joined CEPT/AFTA Agreement

- 1998: Joined APEC

- Joined WTO in 2007

- 2015Participation in the Trans-Pacific Strategic Economic Partnership Agreement (TPP); elimination of intra-regional tariffs as the ASEAN Economic Community (AEC) enters into force

Through international partnerships such as the following, we are deepening our trade and investment relationships with countries around the world and consistently working to improve the business environment.

According to the “3 Security and Traffic Situation” section of the “Security Situation in Vietnam” published by the Japanese Ambassador to Vietnam in February 2019, the security situation in Vietnam is assessed as follows

General Crimes in Vietnam

There are no national crime statistics, so it is difficult to gauge the security situation in Vietnam numerically. In my experience, the security situation in Vietnam is generally good, though not as bad as in Japan. However, traffic conditions are very bad.

There is no awareness that publicizing the number of crimes and other information will contribute to effective crime prevention and public awareness.

There is no centralized system for crime statistics, and public security does not have a grasp of the actual figures. The published statistics are also unreliable.

In the first place, even if a damage report is filed, the crime is not reported to Public Safety because the likelihood of arresting the perpetrator or recovering the damage is low. (e.g., public security agencies do not accept damage reports and tend to treat them as lost cases.)

Terrorism in Vietnam

There are no Islamic extremist terrorist organizations and no incidents have occurred.

Differences between the Vietnamese Communist Party and the Chinese Communist Party

Vietnam’s political system, like China’s, is one-party rule by the Communist Party, but in “6 Differences between Vietnam and China,” the following points are evaluated as major differences with the Communist Party system in China.

- Collective leadership system, North-South balance (China: dictatorship)

- Moderate patriotism (China: Chinese dream, nationalism arousal, AIIB, One Belt One Road, Declaration of a Strong Country)

- Moderate regulation and censorship of freedom of speech and press (China: strict regulation and censorship of freedom of speech and press)

- Moderate restrictions on human rights and religious freedom (China: arrest of human rights lawyers, suppression of religion)

- Respect for minority cultures (China: assimilation policy, suppression of Xinjiang Uyghur, Tibet)

- Privatization of state-owned enterprises (China: strengthening state capitalism)

- Administrative and personnel reforms (China: strengthening Party power)

- Expropriation of land through persuasion (China: expropriation of land with or without consent)

These are reputations.

Challenges and Risks of Expanding into Vietnam

The challenges and risks associated with entering the Vietnamese market include “soaring labor costs,” “lack of a legal system,” and “difficulty in procuring raw materials and parts locally.

In JETRO’s “Survey of Japanese Companies in Asia and Oceania (2016~2018),” “Soaring labor costs,” “Undeveloped/opaque legal system,” “Cumbersome tax and tax procedures,” “Cumbersome administrative procedures,” and “Underdeveloped infrastructure” were the main investment risks in Vietnam cited by local The soaring cost of labor, in particular, was cited by Japanese companies in the region. In particular, soaring labor costs ranked first in the above survey for the third consecutive year.

Lack of Data and Statistics Necessary for Expansion into Vietnam

Statistical data are generally scarce in Vietnam, and even when they are available, they are often inaccurate.

In Vietnam, the General Statistics Office (GSO) is the government statistical agency that handles official domestic statistical data, while the Ministry of Planning and Investment is in charge of data related to foreign direct investment. On the other hand, the lack of industry associations and stagnation in their activities have made it difficult to obtain trends and statistics for each industry sector, and in recent years the government has begun to develop such associations.

According to the 2021 Economic Statistics conducted by the General Department of Statistics of Vietnam, the number of enterprises with business activities as of the end of December 2020 is about 700,000. Of these, about 1% are in the primary industry, 65% in the secondary industry, and 35% in the tertiary industry. Since about 25,000 of these firms are foreign-owned, about 660,000, or 95%, are domestically-owned firms.

According to the SME identification criteria published by the government in August 2021, according to the number of employees with social insurance, annual sales and capital, they are classified as micro enterprises (Doanh nghiệp siêu nhỏ), small enterprises (Doanh nghiệp nhỏ) and medium enterprises (Doanh nghiệp vừa) About 75% (about 530,000 companies) are micro enterprises with annual sales of 3 billion VND or less, 25% (about 170,000 companies) are medium and small enterprises with annual sales of 200 billion VND, and 1% (about 10,000 companies) are large enterprises. The majority of these enterprises are operated with small capital, and cooperation among companies in the same industry is relatively weak.

In December 2021, Vietnam Report, a domestic research firm, released its “2021 Ranking of Vietnam’s Largest Companies” based on sales, net income, assets, and number of employees. According to the report, the top 10 companies are as follows.

| 1位 | Samsung Vietnam(electron/Korea) |

| 2位 | EVN Group(electric power) |

| 3位 | Petro Vietnam(oil and gas) |

| 4位 | Viettel Group(telecommunication) |

| 5位 | Vingroup(real estate, commercial, manufacturing, etc.) |

| 6位 | Agri Bank(financing) |

| 7位 | Petlimex Group(oil) |

| 8位 | BIDV Group(financing) |

| 9位 | The Gioi Di Dong(trade) |

| 10位 | Vinacomin Group(coal) |

Samsung Electronics (Vietnam), ranked No. 1, has been a prominent player in the ranking of large companies, maintaining the No. 1 position for five consecutive years, with sales of 74.2 billion USD in 2021, generating approximately 20% of the country’s GDP of 360 billion USD in 2021. On the other hand, many other companies have a strong public interest in the country, including Vingroup, the 5th largest conglomerate in the country, with group sales of approximately 6 billion USD in 2021, and The Gioi Di Dong, the 9th largest retailer of digital devices and consumer electronics in the country, with group sales of approximately 2.2 billion USD in 2021. In 2021, The Gioi Di Dong, the ninth largest retailer of digital equipment and home appliances in Japan, will have group sales of about 2.2 billion USD. Because of the large number of such small-capitalized firms, membership in industry-specific trade associations, management, and public relations activities are not very active, making it difficult to see the actual situation in each industry. The government also recognizes that this weakness in inter-enterprise cooperation is directly related to the weakness of the industrial base, particularly in the manufacturing sector, and the government is in the process of developing industry associations, such as the establishment of the Vietnam Association of Support Industries (VASI) in 2017 under the management of the Ministry of Commerce and Industry.

The Vietnam Plastics Industry Association, a trade association for the plastics industry said to have more than 2,000 companies in the country, also includes Sumitomo Heavy Industries Plastic Machinery Division and Toyobo, but the information has not been updated since 2018.

Underdeveloped Materials and Supporting Industries

One problem that tends to become apparent after a company expands into Vietnam is the local procurement of materials and raw materials. This was also revealed in the aforementioned “Survey of Japanese Companies in Asia and Oceania” conducted by JETRO.

There have been cases where companies have entered Vietnam for the purpose of manufacturing and processing, but even if they try to procure parts and materials domestically, they are forced to import them from Japan or other countries because they cannot procure parts and materials that meet their quality requirements locally, making it difficult to maintain the profitability that they had planned before entering the country.

This is a major difference between China and Vietnam in terms of industrial development in the manufacturing industry. In the late 1990s, when China was the “world’s factory” and was responsible for subcontract processing for Japanese and Western manufacturers, Chinese domestic manufacturers became more selective and accumulated more technology in order to respond to requests from companies placing orders. Based on their experience and technological capabilities, Japanese companies in China are now able to procure about 70% of their parts and materials in China, as their productivity and technological capabilities have bottomed out to the point where they can supply their own brand products, moving away from a subcontracting position with low added value.

On the other hand, many foreign companies have entered Vietnam as an alternative manufacturing base to China, but the domestic procurement rate for parts and materials has remained below 40% due to the lack of progress in technology development for Vietnamese domestic companies. Since this includes the percentage of materials procured from overseas manufacturers operating in Vietnam, the actual local procurement rate is said to be around 20%, forcing companies entering the Vietnamese market to procure parts and materials from overseas and domestic manufacturers. As a result, Vietnamese domestic manufacturers are unable to improve their technology and productivity, and are stuck in a situation of low value-added production. This component procurement rate is not an issue unique to Japanese firms, but is also a major challenge for firms from other countries, such as Korean firms.

Legislation Is Vague and Unclear in Some Areas.

Vietnam’s opaque laws and regulations are also a common problem for companies expanding into the country. In some cases, laws and regulations are hastily enacted with no specific handling stipulated, only to be suspended a few months later, and companies expanding into Vietnam are often forced to deal with unclear and changing laws and regulations.

Another challenge faced by Japanese companies entering the Vietnamese market is dealing with the complexity of applications and procedures with administrative agencies such as the Department of Planning and Investment, which handles the procedures for entering the market, and the General Administration of Customs, which manages imports and exports. Even if the law is applicable to all provinces and cities in Vietnam, there are differences in practice and operation between provinces and cities, and even within the same provincial or city administrative organization, there are frequent cases where the decision and operation differs depending on the person in charge.

In addition, there are many documents to be submitted to the government, which require a considerable amount of time and effort to prepare and obtain approval from the authorities. Many Japanese companies feel that such complicated administrative procedures are an issue that needs to be improved.

In response, in July 2021, the government promulgated the National Basic Plan for Administrative Reform for the Period 2021-2030. The current Vietnamese government has 18 central ministries, 4 specialized agencies, and 8 organizations directly under the government, and including local administrative organizations, the number of employees is approximately 250,000. Under the National Basic Plan for Administrative Reform, the government has begun moving toward streamlining government organizations and ministries, including even local administrative organizations, by 2030.

Infrastructure Development Is Lagging Behind.

Vietnam’s infrastructure remains underdeveloped.

Road

Road administration in Vietnam consists of national roads managed by the government, provincial roads managed by the provinces, district roads, village roads, and town roads, depending on the administrative unit in charge. The average speed of national roads is 50 km/h. Overall road width is narrow, and according to World Bank statistics, the pavement ratio of all roads in Vietnam was approximately 50% in 2007, which is inadequately maintained.

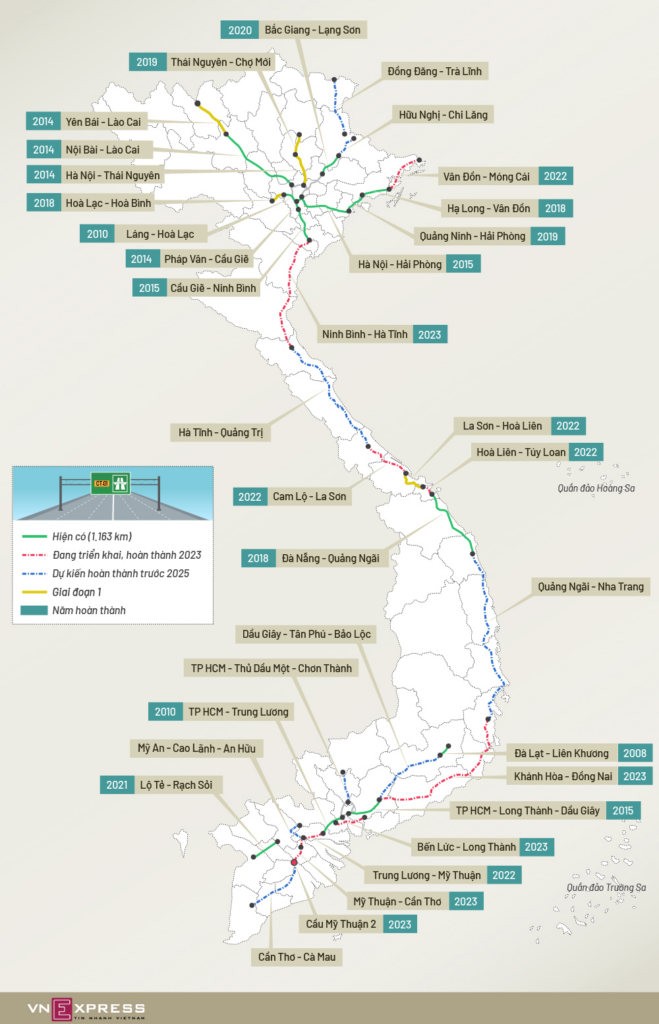

According to the Ministry of Transport, 1,163 km of expressways have been completed as of June 2021, and another 916 km will be invested by 2023, with the goal of reaching 5,000 km of expressways by 2030.

In addition, there is a network of highways extending radially from Hanoi, Da Nang City-Quang Ngai, which is a key point for north-south transportation, and several starting from Ho Chi Minh City, but the full opening of the north-south highway from Hanoi to Ho Chi Minh City is expected to be in 2025.

In terms of logistics, the percentages of domestic transportation by mode in 2019 based on transport volume are approximately 80% for road, 15% for water transportation, 4% for marine transportation, 1% for rail, and 0% for air transportation, and with the current trend of increasing transport cargo volume, highway opening remains essential in improving domestic transportation.

Railroad

As of 2020, the state-owned Vietnam Railways Corporation was the sole operator of railroads in the country, but in 2021, 10 years after construction began, one line, Hanoi Urban Railway Line 2A, opened for passenger use in Hanoi, bringing the number of domestic railroads to two. As of 2022, Hanoi is constructing Line 3, which is planned to be partially opened by the end of 2022 and fully opened the following year, 2023.

Meanwhile, Ho Chi Minh City is also planning to build eight high-speed urban rail lines, one tram line, and two monorail lines, and although construction of Line 1 began in 2012, the line has not yet opened as of 2022, and its opening is expected to be delayed until 2023.

In terms of logistics, the use of railroads is mainly for international transport, with a slight increase in transport volume of approximately 500,000 tons in 2020.

Harbors

According to the statistics of 79 ports in the country published by the Vietnam Ports Association, the volume of cargo handled in 2020 will be 400 million tons, with the South accounting for about 60% of the total, the North for about 30%, and the Central for about 10%. The volume of containers handled is approximately 17 million TEUs (twenty-foot container equivalent), with the South accounting for more than 70% of the total, the North approximately 20%, and the Central less than 10%. By port, the New Port of Saigon in Ho Chi Minh City accounts for 24% of the cargo volume handled and 37% of the container handling volume.

In response to the yearly increase in the volume of cargo handled, the city is rushing to develop its major ports, Haiphong and Catrai, with the highest priority given to their development.

Growth Potential and Future of The Vietnamese Economy

Regarding the forecast of Vietnam’s economic growth in 2022, many international organizations and financial institutions are forecasting significant positive growth. This is explained below.

World Bank

The World Bank forecasts that Vietnam’s GDP will grow +6.5~7.0% in 2022. According to the World Bank, Vietnam’s lockdown, social quarantine, and other measures have been successful, and the economy is expected to recover in 2022 as the new coronary infection settles down toward the end of 2021. Exports from Vietnam to the United States, the European Union, and China are also expected to recover and expand, and furthermore, by the mid-2022s, 70% of the population will be vaccinated and coronas will be under control.

Asian Development Bank

In its Asian Development Outlook 2021, released in September 2021, the Asian Development Bank forecasts that the Vietnamese economy’s GDP will grow +6.5% in 2022. This projection is due to the fact that the outlook for economic growth in 2021 is lower than expected in early 2021, while the economy will recover in 2022.

出所:chothuevinhome.com

Key Points for Successful Expansion into Vietnam

This chapter examines the key points for successful expansion into Vietnam.

Careful Information Gathering (market research in Vietnam)

The reason why a Vietnam market survey is necessary is to avoid risks specific to the Vietnamese market in advance and to clarify the roadmap/action plan for doing business in Vietnam.

Horizontal development of successful cases in Japan does not necessarily guarantee success in the Vietnamese market. Naturally, the environment of the Vietnamese market is completely different from that of the Japanese market. Below we have listed the necessity of conducting market research in Vietnam.

Necessity of Market Research in Vietnam (1): The Vietnamese market is a rapidly changing environment.

In Vietnam, where rapid economic development continues, the market environment is changing rapidly. In a mature country like Japan, industrial and industry structures are well established and laws are well developed, so there are limits to social change. The relationship between vested interests is also fixed.

The market environment changes very quickly in emerging Asian countries, including Vietnam. Legal regulations and systems remain immature in Vietnam, and the Vietnamese government frequently amends legal regulations. The industry structure in Vietnam is also changing markedly, and corporate players are emerging rapidly.

Currently, there is little information on the Vietnamese market that can be accessed from within Japan. It is necessary to determine whether the information that can be obtained from Internet searches is new and reliable.

Through market research, it is necessary to accurately grasp the latest trends in the Vietnamese market.

Necessity of Market Research in Vietnam (2): Vietnamese consumers’ preferences differ from those in Japan.

The tastes of Vietnamese consumers are quite different from those of Japanese consumers.

In Vietnam, income levels are increasing rapidly along with rapid economic development. As the number of middle class and affluent consumers increases, consumer preferences and consumption behavior are also likely to change. Vietnamese consumers’ perceptions also differ from those of Japanese.

For example, a Japanese food manufacturer once showed its products to Vietnamese consumers in order to sell them to the affluent class in Vietnam, and many of them mistook them for “bags of candy” because the packaging was of a type not common in the Vietnamese market.

Vietnam is long from north to south, and each region has different characteristics and features. In addition, the difference in development between urban and rural areas is greater than one might imagine. In urban areas, many consumers prefer to buy in supermarkets and shopping centers (modern retail format: modern trade), while in rural areas, traditional markets and mom-and-pop stores (traditional retail format: traditional trade) tend to be preferred.

Through the Vietnam market research, we can get a clear idea of Vietnamese consumers’ preferences and consumption behavior in advance.

Need for market research in Vietnam (3): For internal approval procedures

Failure to conduct market research in Vietnam may result in a situation where decisions cannot be made later on in important aspects of the Vietnam business.

In fact, many Japanese companies do not conduct market research in Vietnam. Of course, it depends on the policy of each company and is not absolutely necessary. There are many companies that would rather search for local partners in Vietnam and sell their products immediately than conduct market research. In addition, there are many cases in which Vietnamese companies wish to immediately consider a deal without conducting market research in the event of M&A.

There is a concern that it is difficult to make decisions on business development, investment, and corporate acquisitions in Vietnam without conducting market research. This is because the person in charge must understand and explain the market environment and risks himself in order to obtain approval at the upper levels of the company.

The need for market research in Vietnam (4): to gain a better understanding of the local market

The author strongly believes that the most important factor for successful business in Vietnam is to “attack the local situation in Vietnam.

It is important to understand the local situation, which cannot be seen from information on the Internet or from meetings with companies. Statistics and data published by the Vietnamese government should not be easily taken for granted. Sometimes you have to sweat and gather information on the ground.

For example, in the past, our researchers have conducted on-site surveys of waste disposal facilities in the local area, one by one, for companies considering business development in the Vietnamese waste market.

For companies considering the development of commercial facilities, we have also conducted interview surveys on the income levels and consumption behavior of consumers residing in the trade area. This is because statistics are not available in Vietnam in many cases.

Businesses in rural areas of Vietnam need to be especially careful. In some cases, even if you contact the local government (People’s Committee) in Vietnam or request statistics, you may not be presented with accurate information. In the past, when we inquired about statistics on businesses from a Vietnamese provincial government, we were provided with several years’ worth of data that had not been updated at all. In many cases, statistics are not properly maintained as in Japan.

We imagine that readers who are considering conducting market research in Vietnam are at an early stage of their expansion and business development in the country.

Searching for Promising Local Partners in Vietnam.

There are many ways to enter the Vietnamese market, but in any case, it is very important to work with a promising local partner. There are many factors that must be considered to ensure a good fit, including the nature of the business, the direction of future development, the corporate culture, and the mindset of the decision makers and staff.

Identification of Vietnam Sales Strategy Issues

The first step is to identify the issues involved in developing sales through existing distributors. In many cases, many Japanese companies leave marketing activities to their local partners in Vietnam. Specifically, they often face the following issues.

- Local partners are entrusted with promotion and marketing activities, but are not achieving sufficient results.

- Local regulations and application permission are left to the local distributor.

- You are not sure if your company’s (Japanese company’s) products really match the tastes of Vietnamese consumers.

- Existing distributor has limited sales channels and is considering exploring another distributor

- The first thing to check is whether the company has an exclusivity agreement with the existing local distributor. If not, there is room to find a new local partner.

Can You Design New Products for The Vietnamese Market?

It is necessary to confirm whether the company’s (Japanese company’s) products are manufactured for the Vietnamese market or whether the company is exporting products sold for the Japanese market to Vietnam. Or, if they are currently exporting products to Vietnam that are intended for the Japanese market, it is important to determine whether they will be able to design new products for the Vietnamese market in the future. Strictly speaking, this is something that varies from item to item, but in a great many cases, the thinking of the Japanese and the tastes of the Vietnamese are different.

In many cases, even packaging methods, ingredients, and appealing messages that are common in the Japanese market were not at all attractive to Vietnamese consumers.

Reconfirmation of Your Company’s (Japanese company’s) Policy Regarding Market Development in Vietnam

We need to stop and think again about what kind of policy we are planning for development in the Vietnamese market. If you are looking at the Vietnamese market in the short term, there is little need to design new products for the Vietnamese market. On the other hand, if your policy is to expand sales in the Vietnamese market over the long term, designing new products for the Vietnamese market is an effective option.

Understanding The Needs of Vietnamese Consumers Is Paramount.

If you are considering long-term expansion in the Vietnamese market, the first thing you should do is market research for Vietnamese consumers. It is strongly recommended to conduct quantitative interview surveys with Vietnamese consumers and interview surveys (depth interviews) with Vietnamese consumers, experts, and industry participants.

It Is Sometimes Necessary to Review The Vietnam Sales Strategy.

While there are advantages to developing sales through local distributors when entering the Vietnamese market, there are also disadvantages. If the company’s (Japanese company’s) policy is to focus on the Vietnamese market, it is essentially important for the company (Japanese company) to fully understand the Vietnamese market and consumers, rather than leaving it up to the local distributor. The ideal way to review local agencies would be to start by gathering information on the Vietnamese market and consumers.

Understanding of Local Vietnamese Business Practices and Communication Methods.

Vietnam has business practices and communication manners that are unique to Vietnam. For example

- Strong top-down

Vietnamese companies, regardless of size, tend to have a strong top-down approach. Therefore, when trying to move or persuade a Vietnamese company, it is advisable to speak directly with the decision makers, such as the company’s top management, such as the president or chairman, or the head of the business if it is a large company.

- Decision-making is fast.

One of the advantages of a strong top-down approach is that decision-making is fast. In Japanese companies, decision-making often begins with laying the groundwork, and approval is finally obtained through multiple meetings. Therefore, when collaborating with Vietnamese companies, it is desirable to make efforts to match the speed of decision-making with that of Vietnamese companies as much as possible.

- Lax in compliance

Double bookkeeping is not uncommon, especially among small and medium enterprises in Vietnam. The modus operandi varies, but from a Japanese perspective, very bold tax evasion can be seen. In particular, when acquiring or investing in a Vietnamese company, it is necessary to conduct a thorough audit and discuss how to resolve the problem and where to drop the matter.

- Communicating in Vietnamese is important

Due to the growing demand for education in Vietnam, the number of English-speaking personnel is increasing, especially among the younger generation. Therefore, many foreign companies communicate in English with general personnel of Vietnamese companies. On the other hand, there are not that many English speakers among middle-aged and older workers in important positions. Since it is a big risk to have miscommunication with decision makers, it is very important to establish a system that enables communication in Vietnamese.

Use of Consultants for Entry into Vietnam

There are many market research and consulting firms that offer Vietnam market research as a service. Consulting with and using the services of such companies is a major method. The selection situation (i.e., where to obtain quotes) may vary from research firms with which one has a regular business relationship to firms that have been introduced to one another.

Fundamentally, the selection should take into account experience and know-how in Vietnamese market research, past performance, familiarity with local conditions, and local networks. In particular, the following three points should be checked.

・Availability of Local Network in Vietnam

Make sure they have enough networks in the Vietnamese private sector and government agencies. The key is not the brand of the research firm, but the local network and the depth of information that can be obtained.

Companies that have many past research cases or provide M&A services often have a pipeline to the management level of Vietnamese private companies. As mentioned earlier, local networks are the most important element in Vietnam’s top-down business practices.

・Are You Familiar with The Vietnamese Market?

Naturally, understanding and knowledge of the Vietnamese market will greatly determine the quality of market research. Attending several Vietnam-related seminars will help you make a decision.

Even if a company is well branded, well known, and has a strong past performance, the quality of the survey results will depend on the abilities of the individual members of the team who conduct the survey work. Before placing an order, please carefully check the backgrounds of the managers, consultants, researchers, and analysts in charge of market research work, their past performance, and their understanding of Vietnam, as well as their support structure. Checking the website, online MTG, and of course, visiting the office are also effective.

・Details of Implementation System

It is also important to check the size of the actual research team, not the candidate company itself. Even in large companies with many employees, it is not unusual to find only two or three people actually involved in market research and support. The number and background of the people actually involved in the research should be checked, not the size of the company itself.

【関連記事】ベトナムへの進出、マクロ経済については、こちらの記事も合わせてご覧ください。

ベトナム市場調査レポート一覧はこちらからもご覧頂けます。

ベトナム市場の情報収集を支援します

ベトナム市場での情報収集にお困りの方は多くいらっしゃるのではないでしょうか。

VietBizは日本企業の海外事業・ベトナム事業担当者向けに市場調査、現地パートナー探索、ビジネスマッチング、販路開拓、M&A・合弁支援サービスを提供しています。

ベトナム特化の経営コンサルティング会社、ONE-VALUE株式会社はベトナム事業に関するご相談を随時無料でこちらから受け付けております。