- Introduction

- M&A and Acquisition of Vietnamese Companies

- M&A Case Studies①:Sabeco (ThaiBev)

- M&A Case Studies②:Vinhomes (GIC)

- M&A事例③:Vinhomes (KKR)

- M&A Case Studies④:Big C (Central Group)

- M&A Case Studies⑤:JOINT STOCK COMMERCIAL BANK FOR INVESTMENT AND DEVELOPMENT OF VIETNAM(KEB Hana Bank)

- M&A Case studies⑥:The CrownX(Alibaba)

- M&A Case Studies⑦:Vingroup(SK Group)

- M&A Case Studies⑧:Vincommerce(SK Group)

- M&A Case Studies⑨:Vietcombank – Cardif Insurance(FWD Group)

- M&A Case Studies⑩:Nguyen Kim(Central Group)

- Summary

- ベトナム市場の情報収集を支援します

Introduction

Vietnam has the largest number of M&A deals and transaction value in Southeast Asia, second only to Singapore. In the past, most M&A transactions in Vietnam have been conducted as FDI (Foreign Direct Investment), with the seller being a Vietnamese domestic company and the buyer being mainly a foreign company (Thailand, Singapore, Japan, Taiwan, Korea, etc.).

This report presents examples of M&A transactions conducted by foreign firms in Vietnam in which the industry structure has changed significantly as a result of the transaction, rather than simply because of the size of the transaction.

M&A and Acquisition of Vietnamese Companies

M&A Case Studies①:Sabeco (ThaiBev)

| publication date | December. 2017 |

| industry | food and beverage industry |

| case type | majority-owned |

| buyer | Thai Beverage Public Company Limited(Thailand) |

| seller | Ministry of Industry and Trade (Government of Vietnam) |

| target company | Saigon Beer Alcohol Beverage Corporation(Sabeco) |

| Target Company Business | Production and sales of beer and alcoholic beverages |

| Percentage of acquisition | 53.59% |

| Amount of transaction | 4.8 billion USD |

This M&A deal is unique in two respects. First, it is the largest transaction in Vietnam’s history, and second, the foreign company was able to circumvent the Vietnamese government’s “foreign investment restrictions” and successfully acquire a Vietnamese state-owned company.

In this deal, ThaiBev acquired Sabeco through its Vietnamese-capital affiliate called “Vietnam Beverage Corporation,” thus avoiding foreign investment restrictions set by the Vietnamese government (foreign investors cannot hold a majority of Sabeco’s outstanding shares).

Since ThaiBev owns only 49% of the shares of “Vietnam Beverage Corporation” itself, and 51% is held by Vietnamese investors, “Vietnam Beverage Corporation” is legally recognized as a Vietnamese company. Therefore, this M&A transaction was legally considered a transaction between private Vietnamese companies.

Although the Vietnamese Ministry of Industry and Trade has sold its 53.59% stake in Sabeco, it still owns 36% of Sabeco’s shares through the State Capital Management Fund (SCIC), making it Sabeco’s second largest shareholder.

Sabeco will offer beer brands such as “Sai Gon” and “333,” which are especially popular among Vietnamese.

M&A Case Studies②:Vinhomes (GIC)

| publication date | May. 2018 |

| Industry | real estate |

| case type | minority-owned |

| buyer | GIC Private Limited (Singapore government-affiliated very large investment fund) |

| seller | Vingroup(Vietnam) |

| target company | Vinhomes JOINT STOCK COMPANY |

| target company business | Development of residential neighborhoods, condominiums, and industrial parks |

| percentage of acquisition | 5.74% |

| amount of transaction | 1.3 billion USD |

In May 2018, the Singapore government-affiliated GIC Private Limited investment fund officially announced that it had purchased 153.85 million shares of Vinhomes, representing 5.74% of the outstanding shares, making it the company’s majority shareholder, although the amount invested by the GIC fund was USD 1.3 billion, The GIC fund invested USD1.3 billion in the company, but did not acquire the 5.74% stake for the full amount, but instead partially borrowed against Vinhomes.

GIC has executed the largest cumulative amount of transactions in Vietnam. Currently, some of the largest Vietnamese companies in which GIC has invested include Masan Group (approximately 5% stake), Vietjet Air (approximately 5%), Vinamilk (0.7%), FPT (3.5%), PAN Group, and Vinasun.

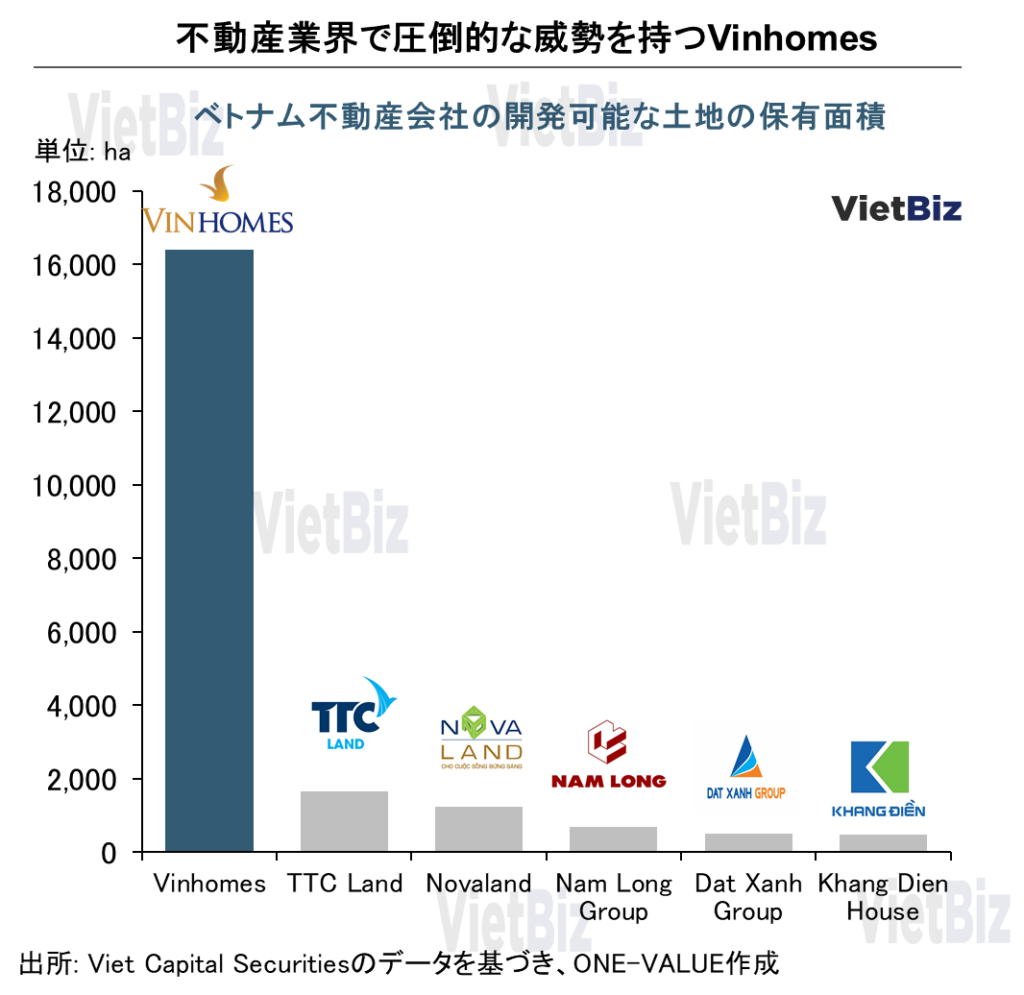

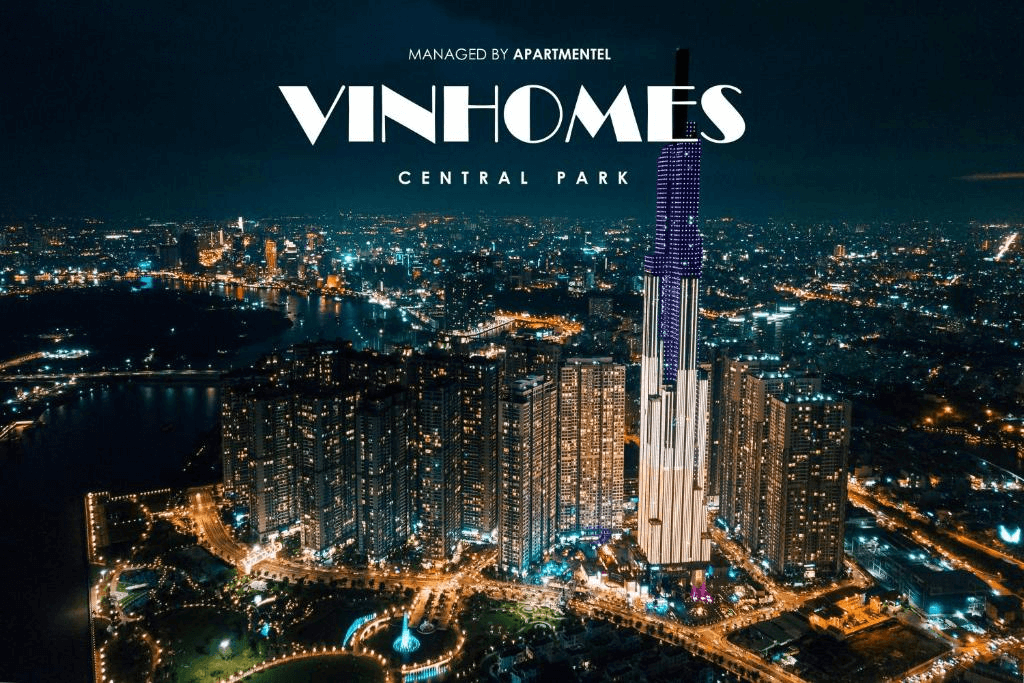

Vinhomes is the largest real estate developer in Vietnam. With many large real estate projects in 40 provinces and cities across the country, Vinhomes is a spin-off from the real estate operations of Vingroup, the largest company in Vietnam. With strong support from its parent company, Vinhomes has completed many land development projects in Vietnam to date.

The company has the largest amount of land resources in Vietnam that can be developed in the future, about 10 times the amount of the second largest, TTC Land.

M&A事例③:Vinhomes (KKR)

| publication date | June. 2020 |

| industry | real estate |

| case type | minority-owned |

| buyer | KKR&Co. L.P.(USA)、Temasek(Singapore Government Affiliated) |

| seller | Vingroup(Vietnam) |

| target company | Vinhomes JOINT STOCK COMPANY |

| target company business | Development of residential neighborhoods, condominiums, and industrial parks |

| percentage of acquisition | 5.5% |

| amount of transaction | 650 million USD |

In June 2020, the Kohlberg Kravis Roberts Investment Fund (KKR) of the United States announced that a group of investors represented by KKR (including Temasek, a very large Singaporean government-owned fund) had signed an investment agreement with Vinhomes Joint Stock Company (Vinhomes).

A group of investors led by KKR invested approximately US$650 million to acquire 5.55% of Vinhomes’ outstanding shares. After this transaction, Vingroup still owns 66% of Vinhomes and remains the number one major shareholder. The Singapore government-affiliated GIC Fund was the second largest shareholder, and the investor group led by KKR became the third largest shareholder.

KKR sees strong growth potential in the Vietnamese real estate industry. Among them, Vinhomes has the largest developable land holdings and was rated the top in Vietnam in terms of residential and industrial real estate development capacity.

There is great potential for the Vietnamese real estate industry and Vinhomes in the future.

M&A Case Studies④:Big C (Central Group)

| publication date | April. 2016 |

| industry | retail |

| case type | Capital increase, acquisition of control |

| buyer | Central Group(Thailand) |

| seller | Casino Group(France) |

| target company | Big C shopping mall chain |

| target company business | Shopping malls, sports stores, and e-retail operations |

| percentage of acquisition | 58,6% |

| amount of transaction | 1.05 billion USD |

Central Group, Thailand’s largest retailer, acquired a chain of shopping malls in Vietnam called Big C from Casino Group (Casino Group: France) for €920 million (equivalent to USD 1.05 billion) in April 2016.

The transaction gave Central Group a controlling interest in Vietnam’s largest shopping mall chain.

Central Group is one of the largest companies in Thailand, and in addition to retail, it also operates real estate, hotels, restaurants, and other businesses. Meanwhile, BigC operated four large shopping malls, 27 sports stores, 30 apparel stores, one hotel, 21 electronics retailers, one e-commerce channel, and 13 food supermarkets across Vietnam at the time of acquisition.

Central Group continued to use the “Big C” trademark after completing its acquisition of Big C. Beginning in 2020, all Big C stores and shopping malls will be renamed “GO!

M&A Case Studies⑤:JOINT STOCK COMMERCIAL BANK FOR INVESTMENT AND DEVELOPMENT OF VIETNAM(KEB Hana Bank)

| publication date | October. 2019 |

| industry | bank |

| case type | minority-owned |

| buyer | KEB Hana bank(Korea) |

| seller | JOINT STOCK COMMERCIAL BANK FOR INVESTMENT AND DEVELOPMENT OF VIETNAM(Vietnam) |

| target company | OINT STOCK COMMERCIAL BANK FOR INVESTMENT AND DEVELOPMENT OF VIETNAM(Vietnam) |

| target company business | One of the state-owned banks, loans, credit |

| percentage of acquisition | 15% |

| amount of transaction | 882 million USD |

In 2019, the Bank for Investment and Development of Vietnam (BIDV) issued more than 603.3 million new shares to KEB Hana Bank (Korea) and received USD 882 million in loans from KEB Hana Bank. This was the largest merger and acquisition (M&A) transaction in the history of the Vietnamese banking industry. In addition, there was a special condition that KEB Hana Bank would own 15% of BIDV’s shares for a minimum of five years.

KEB Hana Bank has been found not simply to make financial investments in BIDV, but also to support BIDV in improving its risk management system, diversifying its assets, developing digital banking, retail banking, etc., and training human resources. after issuing new shares to KEB Hana Bank, BIDV’s equity capital increased from VND34.187 trillion to VND40.22 trillion, the highest among Vietnamese banks.

BIDV is one of the four largest state-owned banks in Vietnam (BIDV, Vietcombank, VietinBank, and Agribank). After the M&A transaction was completed, three of the four state-owned banks in Vietnam have foreign strategic partners (major shareholders), and in addition to BIDV, which has a partner from Korea, the other two partners of Vietcombank and VietinBank are Japanese megabanks, Mitsubishi UFJ Bank and Mizuho Bank.

M&A Case studies⑥:The CrownX(Alibaba)

| publication date | June. 2021 |

| industry | retail |

| case type | minority-owned |

| buyer | Alibaba, Alibaba’s relationship BPEA Fund(China) |

| seller | Masan Group(Vietnam) |

| target company | The CrownX(Vietnam) |

| target company business | Operation of retail business of parent company MASAN Group |

| percentage of acquisition | 5.5% |

| amount of transaction | 400 million USD |

In mid-June, Masan Group raised a total of USD400 million from Chinese giant Alibaba Group and Baring Private Equity Asia (BPEA), an investment fund involving Alibaba. Rather than investing in Masan Group, Alibaba and BPEA will acquire 5.5% of the outstanding shares of “The CrownX” company (unlisted), a subsidiary of Masan Group.

The CrownX is the company that manages and operates Masan Consumer (daily consumer goods) and VinCommerce (operator of Winmart convenience stores), two of the Masan Group’s key areas of development. Through this transaction, the value of The CrownX, which is unlisted, was valued at USD 6.9 billion.

Under the terms of the deal, VinCommerce also established a business partnership with Lazada, Alibaba’s e-commerce platform operating in Southeast Asia; VinCommerce exchanged information with Lazada and Masan became a supply Masan became a partner.

M&A Case Studies⑦:Vingroup(SK Group)

| publication date | May. 2019 |

| industry | conglomarate |

| case type | Capital increase, minority investment |

| buyer | SK Group(Korea) |

| seller | Vincommerce(Subsidiary of Vingroup)、Vingroup(Vietnam) |

| target company | Vingroup(Vietnam) |

| target company business | Parent companies such as Vinhomes(real estate)、Vinfast(automobile) |

| percentage of acquisition | 6% |

| amount of transaction | 1 billion USD |

In May 2019, Vingroup issued 154 million shares to South Korea’s SK Group, while Vincommerce, a subsidiary of Vingroup, also transferred 51.4 million Vingroup (Ho Chi Minh City exchange, code: VIC) shares to SK Group.

SK Group became Vingroup’s third largest shareholder with its investment of approximately USD 1 billion in the transaction, which together with the newly issued shares and the shares transferred, gave it a 6% stake in Vingroup’s outstanding shares.

Vingroup is a very large conglomerate in Vietnam, and its subsidiaries, Vinhomes (real estate), Vinpearl (tourism and hotels), and Vinfast (automobiles), are all leading companies in their respective industries in Vietnam.

Former Prime Minister of Vietnam Nguyen Xuan Phuc (current President of Vietnam) and Chey Tae-won, Chairman of SK Group of Korea, meet at the Prime Minister’s Office (2019)

出所:koreatimes.co.kr

M&A Case Studies⑧:Vincommerce(SK Group)

| publication date | December. 2021 |

| industry | retail |

| case type | minority-owned |

| buyer | SK Group(Korea) |

| seller | Masan Group(Vietnam) |

| target company | Vincommerce(Vietnam) |

| target company business | Convenience store operations |

| percentage of acquisition | 16.26% |

| amount of transaction | 410 million USD |

To begin with, it should be kept in mind that in 2022 the parent company of “Vincommerce” company is not Vingroup, but “Masan Group”.

In January 2020, Masan Group acquired from Vingroup the company “Vincommerce”, which operates the “Vinmart” (convenience store chain). Subsequently, in 2021 Masan changed the trademark of the convenience store chain from “Vinmart” to “Winmart”.

Vincommerce was originally a wholly owned subsidiary of Vingroup; from Vincommerce’s inception in 2014 through 2020, it had opened 5,000 stores, but had been in significant losses for six consecutive years. at the time of its acquisition by Masan Group, Vincommerce had accumulated $100 million dollar losses and was completely dependent on its parent company, Vingroup, to fund its operations.

When SK Group invested in Vincommerce, it was shortly after the Masan acquisition, and as of 2022, Vincommerce’s shareholders consisted of the Masan Group with 83.74% and SK Group with 16.26%. With SK Group’s investment, Vincommerce’s enterprise value is estimated at US$2.5 billion.

Unlike convenience stores in Japan, Winmart sells fresh vegetables, fresh meat, etc., and is similar to a small supermarket.

出所:tuoitre.vn

M&A Case Studies⑨:Vietcombank – Cardif Insurance(FWD Group)

| publication date | November. 2019 |

| industry | Finance and Insurance Industry |

| case type | full acquisition |

| buyer | FWD Group(Hong Kong) |

| seller | Vietcombank bank(Vietnam) |

| target company | Vietcombank – Cardif Insurance(VCLI) |

| target company business | bancassurance(over the counter sales (often of financial packages)) |

| percentage of acquisition | 100% |

| amount of transaction | private(Bloomberg forecast: $1 billion) |

In November 2019, Vietcombank, Vietnam’s largest bank, and FWD Group signed a 15-year exclusive partnership to sell insurance (bancassurance) at Vietcombank bank counters, while Vietcombank also sold its VCLI insurance joint venture to FWD FWD. Under the agreement, FWD can exclusively sell life insurance products through Vietcombank’s network (customer information, contact points, etc.) for 15 years.

The “Vietcombank – Cardif Life Insurance” (VCLI) joint venture was 45% owned by Vietcombank and 55% by French giant BNP Paribas.

Established in 2008, VCLI is capitalized at VND600 billion, and in 2018, VCLI’s revenue reached VND485 billion (up 49.2% from the previous year). Of this revenue, 87% came from insurance brokerage commissions.

Meanwhile, FWD, an insurance company under the Pacific Century Group (PCG) investment group, had entered the life insurance markets of nine Asian countries, including Vietnam.

出所:tuoitre.vn

M&A Case Studies⑩:Nguyen Kim(Central Group)

| publication date | June. 2019 |

| industry | retail |

| case type | Capital increase, acquisition of control |

| buyer | Central Group(Thailand) |

| seller | Nguyen Kim Group(Vietnam) |

| target company | NKT Corporation(Vietnam) |

| target company business | Retail of electrical products |

| percentage of acquisition | 51% |

| amount of transaction | 120 million USD |

The “Nguyen Kim” electronics retail chain was operated by the “Nguyen Kim Trading JSC” company. However, 100% of the shares of Nguyen Kim Trading JSC are owned by “NKT Corporation” (NKT), the company that is the subject of this transaction. This complex relationship must be kept in mind.

The “Nguyen Kim” electrical retail chain operates mainly in the southern part of Vietnam and is one of the largest retail sellers of electrical products.

Beginning in 2014, Thai giant Central Group held a 49% stake in NKT for five years before acquiring the remaining 51% from Nguyen Kim Group in 2019, completing its acquisition of this entire chain of Vietnam’s oldest electrical products.

However, Central Group did not directly invest in NKT; the M&A was carried out by Central Retail, a subsidiary of Central Group, and other companies under the group. As a result, Central Retail’s ownership is only 81.5%.

According to Central Group, the transaction amounted to approximately USD120 million, of which USD102 million was paid in cash and the remaining amount was accounted for as a forgiveness of Central group’s debt to NTK.

Summary

This report presents 10 of the most notable M&A transactions in Vietnam. However, this report only includes transactions carried out by foreign firms. In fact, in recent years, major Vietnamese companies such as Masan Group, Vingroup, Hoa Phat Group, and Vinamilk have also conducted large-scale M&A transactions.

With the development of the Vietnamese economy, many foreign companies have discovered the potential of various industries in Vietnam, and fast-moving companies have already merged, acquired, or acquired Vietnamese domestic companies.

On the other hand, the Vietnamese government has established legal provisions such as “prohibited investment areas,” “conditional investment areas,” and “foreign investment limit ratios” to prevent the takeover of some major industry companies, to prevent market monopolization, and for national defense. This is the first point that Japanese companies considering entry into the Vietnamese market should pay attention to.

The Vietnamese government plans to gradually sell shares in major state-owned companies and privatize them. These companies not only have a long history, but also often have a high market share.

In addition, the corporate value of these state-owned enterprises is very high due to their holdings of land, real estate, and other assets. The sale of these companies will continue to generate large-scale M&A transactions in the future.

Even today, Vietnam’s largest insurance company Bao Viet Group (BVH), leading insurance company Bao Minh Group (BMI), leading plastics producer Nhua Tien Phong (NTP), Vietnam Pharmaceutical Corporation (DVN), and Vietnam State Textile Enterprise Group (VGT) are already on the Vietnamese government’s stock sale list.

▼ベトナムの市場調査、M&A、ビジネスマッチングの支援をご要望の方は以下からご連絡ください。

【関連記事】ベトナムのM&Aついては、こちらの記事も合わせてご覧ください。

ベトナム市場調査レポート一覧はこちらからもご覧頂けます。

ベトナム市場の情報収集を支援します

ベトナム市場での情報収集にお困りの方は多くいらっしゃるのではないでしょうか。

VietBizは日本企業の海外事業・ベトナム事業担当者向けに市場調査、現地パートナー探索、ビジネスマッチング、販路開拓、M&A・合弁支援サービスを提供しています。

ベトナム特化の経営コンサルティング会社、ONE-VALUE株式会社はベトナム事業に関するご相談を随時無料でこちらから受け付けております。