Introduction

The Vietnamese drugstore market is currently in a transitional phase, with large drugstore chains gaining market share from privately owned stores. Major players in the Vietnamese drugstore market include Long Chau, Pharmacity, and Medicare. Of these, Long Chau has been highly profitable and is gaining a reputation for having a superior product lineup to its competitors.

This report will analyze the management strategies of Long Chau and other companies and discuss where Long Chau excels.

Long Chau Analysis

This chapter analyzes Long Chau’s recent business conditions and store opening strategy.

Long Chau’s Management Situation

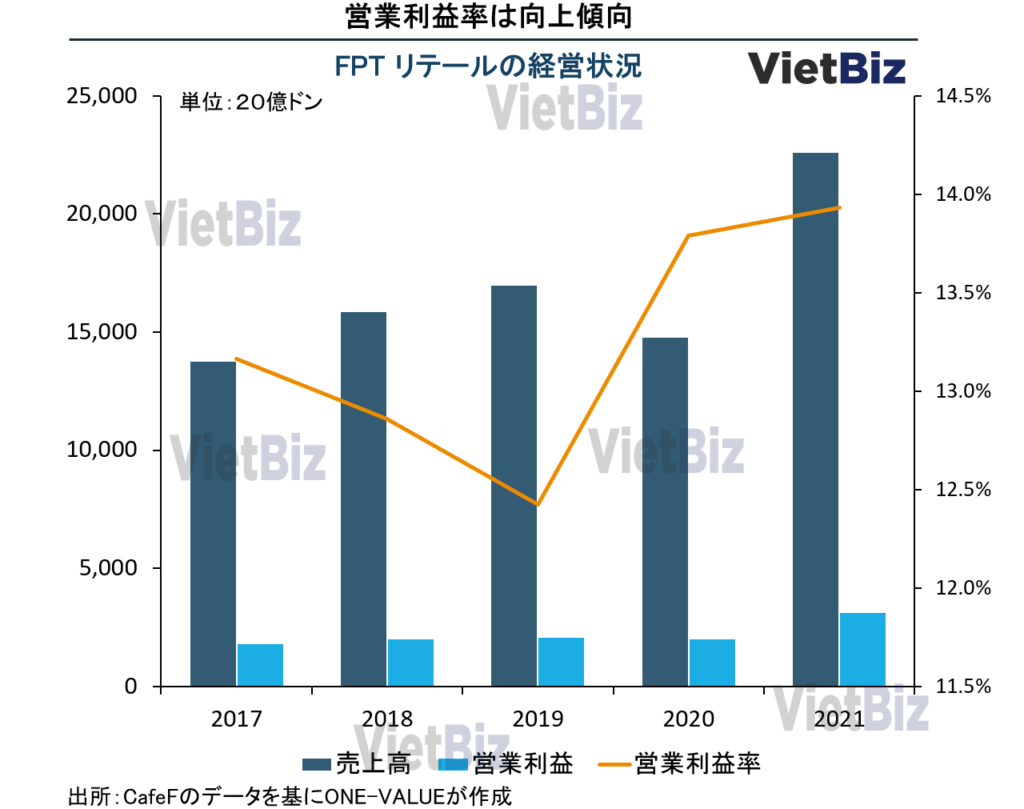

In 2018, FPT Retail acquired the Long Chau drugstore chain, which had fewer than 20 stores at the time. according to FPT Retail’s annual report, as of the beginning of 2021, Long Chau had expanded to more than 400 stores across 53 regions in Vietnam. in four years, the number of stores has increased by about 20 times the number of stores.

FPT Retail’s own research also estimates that Long Chau has a 45% share of the Vietnamese drugstore market.

As of May 2022, Long Chau had 580 stores, with plans to reach 800 stores by the end of 2022.

According to Nguyen Bac Dip, chairman of FPT Retail, there is plenty of room for growth in Vietnam’s drugstore market. There are about 57,000 mom-and-pop drugstores (small, independently owned stores) in Vietnam, but the total number of stores is only about 3,000, according to the three major drugstore chains, Pharmacity, Long Chau, Medicare, and An Khang. (modern drugstores) Long Chau is poised to lead this market in the future.

On the other hand, the key to survival for privately owned drugstores is how to incorporate the elderly, who do not change their behavioral habits much.

Long Chau Success Factors

This paragraph analyzes the factors that contribute to Longchau’s success.

Store Opening Strategy

Unlike other companies that use the chain method, Lon Chau does not place the highest priority on speed of expansion, but rather on store management efficiency, and according to FPT Retail’s research, Lon Chau’s profit margin per store is the highest in the Vietnamese drugstore market.

In other words, Long Chau does not have a policy of expanding the chain anyway, but rather has a strict policy of immediately discontinuing store expansion if the profitability of the stores it operates declines.

Thus, despite the rapid expansion of the number of stores in recent years, Long Chau reached the break-even point without going out of business and began to make a profit last year.

The sales required to achieve the break-even point for each of Long Chau’s stores varies, of course, depending on factors such as store floor space and rent. Some stores have a break-even point of VND500 million per month (approximately ¥2.5 million), while others require VND2 billion per month in sales to break even. However, in Long Chau, it is not unusual for a store to generate sales of 10 billion dong (approximately 50 million yen) per month, so even if 2 billion dong is the break-even point, the task of making a profit is not that difficult.

Specifically, in 2021, the average sales per store in Long Chau was VND1.1 billion per month. However, in the first quarter of 2022 (January-March), this increased to VND1.5 billion per month, a 36% increase over the previous year.

Optimal Products and Prices

Long Chau does not offer a uniform assortment of products throughout Vietnam, but rather a flexible assortment of products for sale according to the income and needs of the residents of each region.

When Long Chau first entered the market outside of Hanoi and Ho Chi Minh City, there was concern that profit margins would be low. However, Long Chau has turned that prospect on its head.

Each province in Vietnam has one provincial capital under the direct jurisdiction of the province (similar to a prefectural capital in Japan). (Basically, the residents of the provincial capital of each province have relatively high incomes, comparable to those around Ho Chi Minh City and Hanoi. Therefore, Long Chau offers the best product groups for various clientele.

For example, in urban areas, the company will focus on imported pharmaceuticals from France, Australia, India, Taiwan, etc., while in rural and farming areas, it will focus on domestic Vietnamese pharmaceuticals. Long Chau ensures that profit margins are equal for both imported and domestic products.

At the aforementioned Longchau shareholders’ meeting, it was announced that 80% of Longchau’s products are less expensive than the average market price, with some products being several tens of percent cheaper.

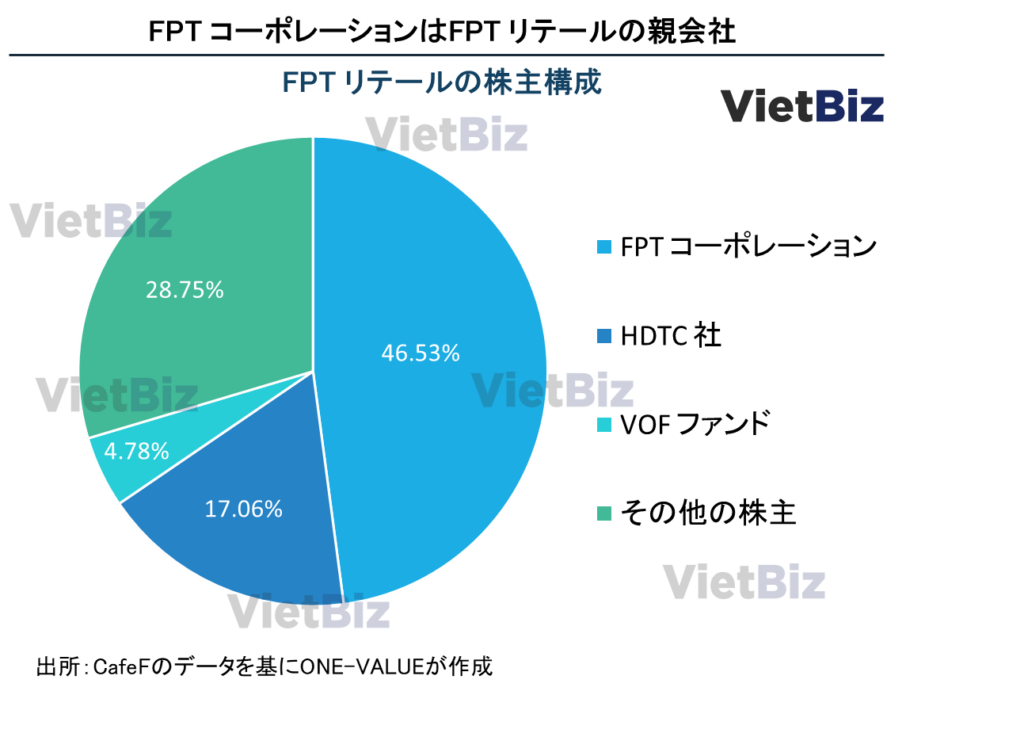

Support of Corporation

Long Chau has received tremendous financial and technical support from FPT Corporation. FPT Retail, which owns Long Chau, is a subsidiary of FPT Corporation, the largest IT company in Vietnam.

FPT and Long Chau are collaborating on a project to use AI to improve the supply chain and better serve customers.

There is. Therefore, Longchau also focuses on software applied to sales management.

For example, medicines containing the active ingredient paracetamol are often used to treat colds and flu. There are about a dozen companies in the Vietnamese market that manufacture drugs containing paracetamol, and there are dozens of drugs that contain the ingredient itself. Each has different benefits, and different doctors prescribe different products to their patients.

Longchau’s AI analyzes customer purchasing behavior and informs Longchau that stores in this area need to sell A cold medicine instead of B, especially when purchasing prescriptions.

Pharmacity Analysis

In this chapter, we will analyze the management situation of Pharmacity and the challenges it faces.

Pharmacy’s Management Situation

Established in 2011, Pharma City has more than 700 stores by the end of 2021. According to local reports, as of May 2022, Pharma City’s store count had increased to approximately 1,100 stores nationwide in Vietnam.

However, the management of Pharma City has been difficult.

In 2019, Pharma City recorded a net loss of VND265 billion (about $1.4 billion); at the end of 2020, Pharma City’s net loss was found to be VND421 billion (about $2.2 billion), increasing its cumulative loss by more than VND100 billion (about $5.5 billion) by the end of 2020. Although Pharma City’s opening speed is considerably faster than that of Long Chau, there is a tendency for Pharma City to incur larger losses the more openings it has.

Comparing Pharmacy Issues and Long Chau

In this paragraph, we will compare the issues of farmacities with those of Longchau, while taking a deeper look into the challenges of farmacities.

Shortage of Products Sold (logistics)

In recent years, one of Pharmacy’s most significant challenges has been the inadequate supply of products for sale to its stores, and many customers have complained to Pharmacy about this. The main reason is that the pace at which Pharmacy is opening new stores is too fast. Its product transport and inventory management systems have not been able to keep up with the increase in the number of stores, resulting in a poor selection of products in the stores.

To solve logistics challenges, Pharmacity has announced plans to build a logistics center in 2020 in cooperation with DH Logistic Property Vietnam (a subsidiary of Daiwa House of Japan) in Loc Anh district, Dong Nai province. The logistics center will cover an area of approximately 10,635m2 with an investment of approximately USD 3 million.

However, Pharmacy City’s challenges are not limited to its store assortment.

Sales Format Issues

Unlike Lon Chau’s focus on selling pharmaceuticals, Pharma City stores have more shelves for selling not only pharmaceuticals but also home medical equipment, beauty care, health care, and other household items. Therefore, Pharmacy’s store area is considerably larger than that of Lon Chau’s stores.

Pharmacy’s sales approach is a self-service system in which customers are free to browse the store, with no active customer service from in-store staff.

Long Chau, on the other hand, uses a full-service approach, with a pharmacist at the entrance of the store who first listens to the customer’s needs and symptoms, selects the product, and then sells it to the customer. Full-service selling is the traditional Vietnamese private pharmacy sales method.

Pharmacy’s sales per store are also lower than Longchau’s. The reason for this is that about half of Pharmacy’s store space is used to sell consumer goods and health care supplies, rather than pharmaceuticals, which are in high demand.

Many experts have characterized self-service sales in drugstores such as Pharmacy as “not a sales method that should be adopted today, but something a little more in the future.

Vietnamese people do not yet have the custom of making their own selections and purchasing medicines in the same way they purchase consumer goods and daily necessities. On the other hand, Long Chau should consider developing stores that operate on a self-service basis, such as Pharmacy City stores in the future.

Chris Blank, CEO of Pharmacity, also admitted that Vietnamese are not yet accustomed to buying medicines at self-service drugstores. Therefore, he said, Pharmacity is focusing on promotions to encourage customers to purchase daily necessities, health care products, and other items.

Chris Blank, on the other hand, is convinced that the era of self-service is approaching due to the changing attitudes of the Vietnamese people. Pharmacity does not intend to change the company’s previous long-term management policy.

Fast Opening Speed

Pharmacity’s strategy for opening stores is to expand while incurring losses through aggressive upfront investment, as is typical of startup companies. In other words, Pharmacity’s store development policy is to first open as many stores as possible.

On the other hand, Long Chau was developing based on FPT Retail and FPT Corporation’s traditional growth strategy of “sure and fast. This means that the company would wait to see how well the stores it opened were doing before deciding whether to open new stores or cancel them.

In accordance with Pharmacity’s mid-term business plan through 2025, the company aims to reach 5,000 pharmacies nationwide in Vietnam by 2025. The company seeks to achieve 50% of the Vietnamese population having access to a pharmacy within 10 minutes, and if all of the above goals are achieved, Pharmacity could achieve sales in excess of US$3 billion.

Medicare(Medicare)

Medicare is a Vietnamese company from Ho Chi Minh City, Vietnam, and a pioneer in the modern drugstore industry. The company operates approximately 90 stores, mainly in Ho Chi Minh City. Targeting a relatively young demographic, the company focuses on beauty products in addition to pharmaceuticals.

Medicare’s first store opened in 2001 in District 1, Ho Chi Minh City, making this the first modern drugstore in Vietnamese history.

Medicare mainly opens tenant stores in shopping malls rather than street-front stores, and this is the most significant difference between the two aforementioned companies.

Other Notable Pharmacies

In this chapter, we will introduce Vietnamese drugstores that should be watched closely in the future, other than the three major Vietnamese drugstore chains mentioned above.

An Khang

Ancan’s parent company is Mobile World, a major Vietnamese retailer. Mobile World had previously owned 49% of Ancan, but acquired 100% of its shares in November 2021.

As of May 2022, the company has approximately 300 stores in Vietnam.

Mobile World has announced that it will make a major investment in An Khang in the near future, with the aim of making inroads into Vietnam’s three major drugstore operators, which as of May 2022 have not yet made a major investment, but already hold a large share of Vietnam’s retail sector, including cell phones, consumer electronics, and food. Mobile World’s entry into the drugstore market has attracted attention both at home and abroad.

EC Sales

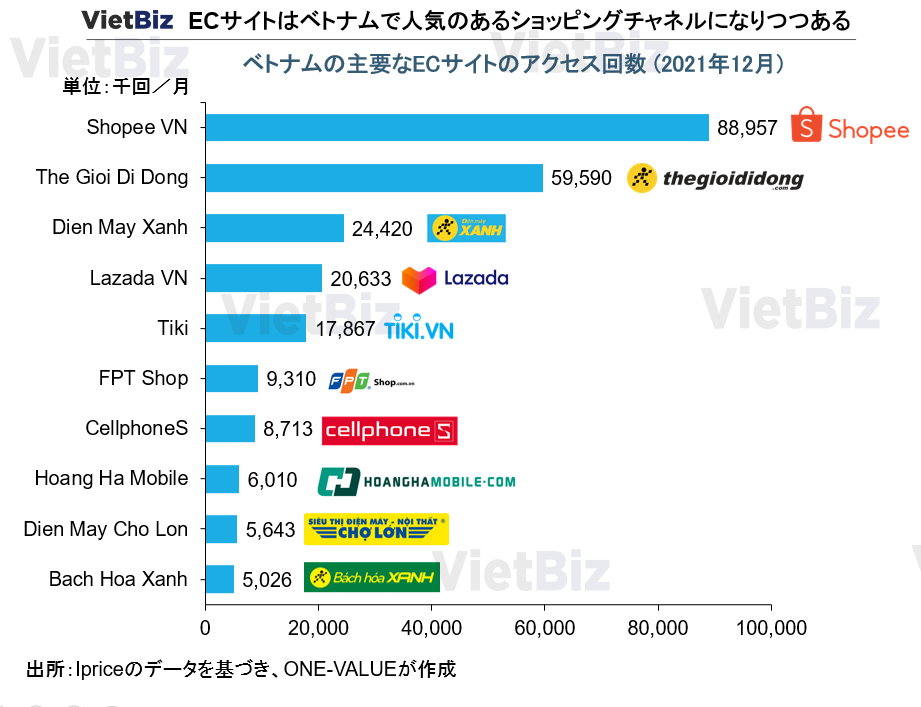

Ancan’s parent company, Mobile World, is distinguished largely by its expertise in e-commerce sales. Mobile World operates three retail chains, The Gioi Di Dong, Dien May Xanh, and Bach Hoa Xanh, all of which are involved in EC sales as well as store operations. Thee Zoi Dong focuses on cell phones, Dien May Xanh on consumer electronics, and Bach Hoa Xanh on food products.

As shown in the graph above, the three brands operated by Mobile World are the second, third, and tenth most visited e-commerce sites in Vietnam, respectively.

Thus, Mobile World is expected to focus on e-commerce sales in the drugstore market as well.

Matsumotokiyoshi

Japanese drugstore Matsumotokiyoshi opened its first store in Vietnam in Ho Chi Minh City in October 2020.

The company plans to increase the number of stores in the future, particularly in Ho Chi Minh City.

It takes time for foreign companies to gain the trust of Vietnamese consumers, but Japanese companies have an advantage in this regard. In Vietnam, trust in Japanese products has already been built up through the entry of Japanese companies into the country in the areas of motorcycles, daily necessities, and food products.

Matsumotokiyoshi’s expansion into Vietnam is the third country for the company, following Thailand and Taiwan, but the company is also focusing on increasing its presence in the Asian market by expanding into Hong Kong, its fourth country, in May 2022.

Trends in the Vietnamese Pharmaceutical Market

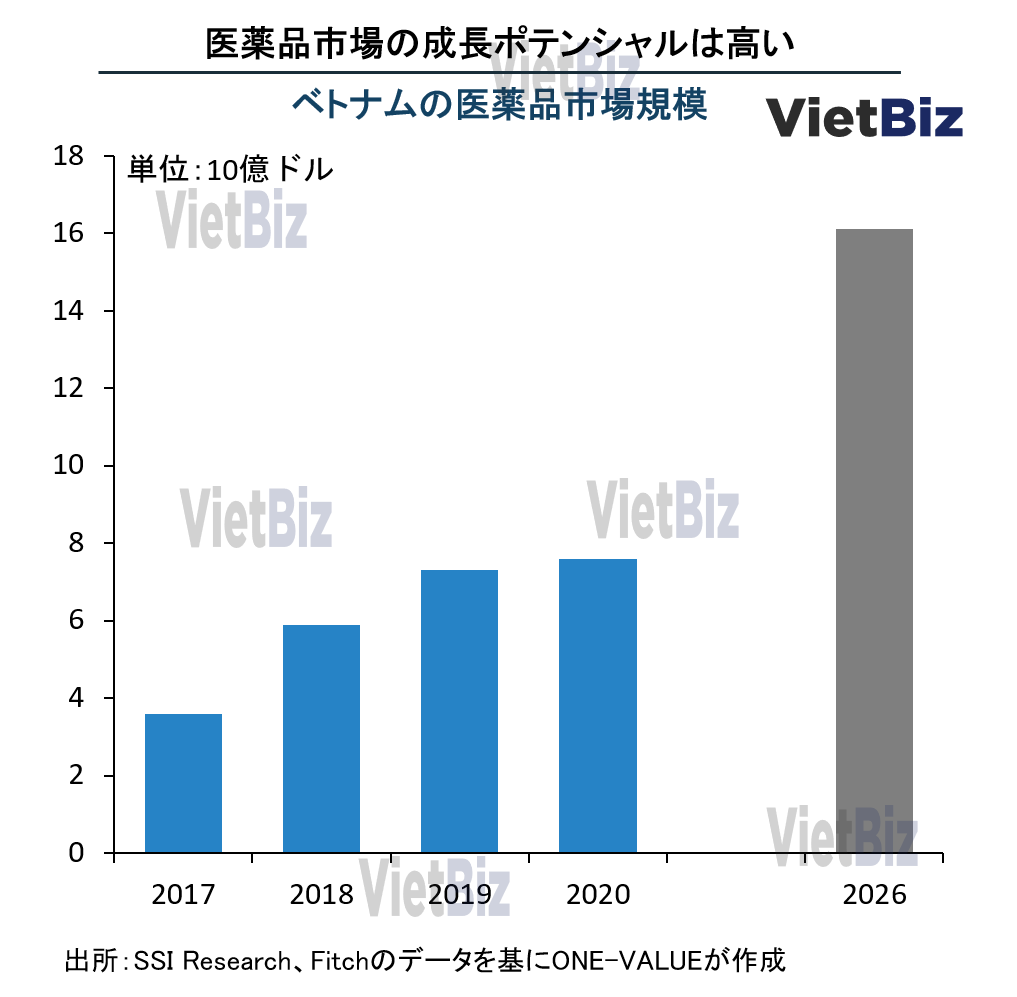

Vietnam’s pharmaceutical market is expected to grow from US$7.7 billion in 2021 to US$16.1 billion in 2026.

In addition, the Vietnamese pharmaceutical market is expected to grow at a CAGR of +11.05% from 2016 to 2023, with ethical drugs expected to drive the market. As for over-the-counter (OTC) drugs, the market was worth about US$1.5 billion in 2018 and is projected to continue growing to US$2.3 billion by 2023.

Per capita spending on pharmaceuticals in Vietnam, demand by disease, demand for generic drugs, etc. are discussed in other Vietbiz reports.

Summary

Modern drugstores are expanding rapidly in Vietnam, but there are a great many more small, privately owned drugstores. Nevertheless, the share of modern drugstores is growing.

As of May 2022, Long Chau is ahead of Pharmacity in most of the management efficiency indicators other than the number of stores it operates. On the other hand, if Vietnamese consumers change their mindset and become more self-service oriented in the future, Pharmacity’s performance may recover.

These two companies and Medicare, the first modern drugstore in Vietnam, are three particularly well-known drugstore chains in the country.

Among new entrants into the Vietnamese drugstore market, Ancan, invested by Mobile World, which has strength in e-commerce sales, and Matsumotokiyoshi of Japan should be noted. Demand for pharmaceuticals in Vietnam is increasing due to a variety of factors, including population growth, rising incomes, the prevalence of lifestyle diseases, and increased health consciousness. In line with this, the Vietnamese drugstore market is expected to continue to grow.

▼ベトナム小売市場の市場調査、M&A、ビジネスマッチングの支援をご要望の方は以下からご連絡ください。

【関連記事】ベトナムのドラッグストアついては、こちらの記事も合わせてご覧ください。

ベトナム市場調査レポート一覧はこちらからもご覧頂けます。

ベトナム市場の情報収集を支援します

ベトナム市場での情報収集にお困りの方は多くいらっしゃるのではないでしょうか。

VietBizは日本企業の海外事業・ベトナム事業担当者向けに市場調査、現地パートナー探索、ビジネスマッチング、販路開拓、M&A・合弁支援サービスを提供しています。

ベトナム特化の経営コンサルティング会社、ONE-VALUE株式会社はベトナム事業に関するご相談を随時無料でこちらから受け付けております。