This report describes Vietnam’s population growth trends, the resulting aging of the population, changes in the industrial structure, and the demand potential for nursing care companies and other services.

Growing trend of Vietnamese Population

According to the Ministry of Foreign Affairs, Vietnam’s announced population in 2020 was 97.62 million. Vietnam’s population ranks 14th in the world.

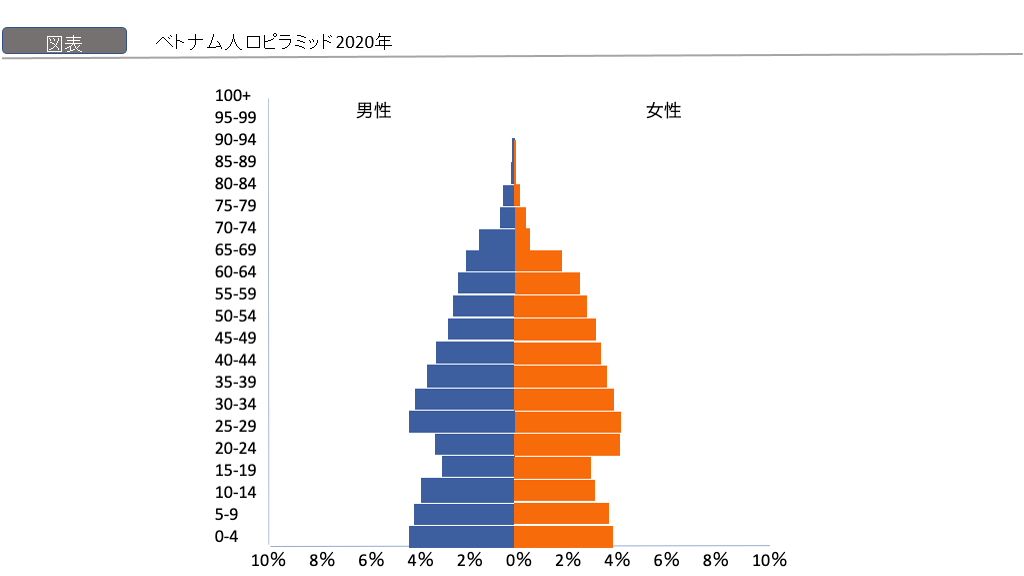

In 1960, during the Vietnam War, Vietnam had the highest percentage of 0-4 year olds, and the population was unstable due to high fertility and high death rates. After the end of the Vietnam War, the birth rate continued to grow and the number of children continued to increase further. In 1988, 13 years after the war, the Vietnamese government attempted to control the population by implementing the “two-child policy. The fertility rate gradually stabilized, and by 2000, two children per woman was the norm.

Aging in Vietnam

In 2017, Vietnam was projected by the United Nations to be an aging society (7% of the elderly population) and an older society (14% of the elderly population) by 2034. In fact, in 2017, the General Statistics Office (GSO) reported an aging rate of 11.9%, indicating that the population is aging at a faster rate than expected.

Children born in the 1960s, when the birth rate was at its highest, will be in their 60s in 2020, so we are certainly moving toward an aging society. (Vietnam defines an elderly citizen as one who is 60 years old or older.)

The period when the working-age population (population aged 15-64) continues to increase as a percentage of the total population and economic development is promoted is generally referred to as the demographic dividend period. Failure to achieve economic growth during the demographic dividend period leads to an increase in unemployment and a deterioration in public safety as well as the economy.

During the demographic bonus period, Vietnam attracted a large number of foreign companies and increased employment, which prevented the unemployment rate from rising and allowed the country to achieve further economic growth.

Concerns about social security issues associated with an aging population

One of the problems that Vietnam faces as it prepares to become an aging society is that the environment for caring for the elderly is not yet in place.

It is predicted that an aging society under the disability system will not be able to continue to secure pensions by 2030.

The main reasons are the very small number of participants in the pension fund and the fact that the pension is a levy system. The retirement age is as young as 60 for men and 55 for women, so there is a disproportionate balance between the amount paid and the amount of salary.

Increased care needs due to aging population

Currently in Vietnam, many elderly people take care of themselves at home or hire housekeepers to take care of them. However, as the population ages, the need for residential care facilities is expected to increase. In particular, Japan, which has the world’s most aged population, has advanced technology for residential care, and demand is expected to be high. Vietnam has passed the peak of its demographic bonus period and now has a large population of relatively young workers with low wages, which is favorable for companies entering the country.

Already in 2017, a Japanese care company opened a residential nursing home in Binh Duong Province, where local caregivers provide Japanese-style care.

Industries with growing needs

As for what needs will grow in the future, sectors such as pharmaceutical and health food sales, medical services, and medical equipment sales as well as the nursing care business are expected to develop.

Care

Care recipients in Vietnam are supported in a variety of ways. The main ones are family relationships, private companies, public facilities, community organizations (charitable institutions), and hospitals.

Because Vietnamese people value family relationships, they often care for their children at home. In some quarters, it is considered wrong for children not to take care of their parents. Therefore, even today, there are frequent cases of sons who go from the countryside to work in urban areas to send money to their families and take care of their parents.

At the same time that the number of elderly people will increase, the number of middle-income and affluent people in Vietnam will further increase. This will also drive an increase in demand for private, fee-based long-term care services.

Medical products and health foods

Products are also in high demand, sold through mail order sites and Facebook. Currently, modern drugstores such as Pharmacity and Guardian are increasing the number of outlets in Vietnam and are gaining traction with the Vietnamese population; although often sold through EC, there are also many fakes on the market, so gaining consumer trust is a challenge.

Medical Services

Medical services are expected to increase further as the population ages.

Vietnam has introduced a referral system for medical care. The referral system is a system in which medical institutions refer patients to each other according to their symptoms. By following this rule, it is possible to receive medical care at a relatively low cost. Vietnam has adopted a “universal health insurance” system similar to that of Japan.

However, an increasing number of people, especially the wealthy, are ignoring the referral system and seeing patients at advanced medical institutions, creating an issue of patient concentration.

Another concern is the low number of physicians in the medical field in Vietnam; in 2016, according to the General Department of Statistics of Vietnam, there were 77,539 physicians in the country. A total of six years of university education, consisting of four years of basic education and two years of specialized education, is required for Vietnamese to become physicians.

In order to correct the shortage of medical personnel, a system was constructed to allow people to obtain certification simply by undergoing education and training, but this system has yet to solve the problem.

In order for a foreigner to become a doctor, he/she must take a Vietnamese language exam. Or they must have an interpreter on staff who can provide medical interpretation. However, a medical accident in 2012 in which a foreign doctor caused the death of a patient has led to a strong trend toward stricter regulations.

Medical Device Industry

Vietnam’s medical device industry has seen the entry not only of local companies but also of foreign manufacturers: in August 2020, VINGROUP of Vietnam and MEDTRONIC of the U.S. formed a partnership to export medical devices manufactured by VINGROUP to the U.S. and Ireland, and a new business The project has been started.

The export of used medical equipment to Vietnam is strictly prohibited. Only new equipment can be exported to Vietnam, and used medical equipment is totally prohibited.

Medical devices may be imported only by legal entities that have business registration certificates or investment certificates for the sale and importation of medical devices.

In addition, vendors providing technical support for medical equipment must employ personnel with degrees in medical fields and medical-related training. In addition, they must have a place to store medical equipment, secure it, and label the equipment.

Summary

In Vietnam, where the population is on the rise, the aging of the population will surely increase the need for not only nursing care but also related services and products. The government is gradually developing social infrastructure and laws to support the elderly, and companies doing business in Vietnam, or considering doing so, need to keep a close eye on these changes in social security.

【関連記事】ベトナムのマクロ経済や介護関連産業については、こちらの記事も合わせてご覧ください。

ベトナム市場調査レポート一覧はこちらからもご覧頂けます。

ベトナム市場の情報収集を支援します

ベトナム市場での情報収集にお困りの方は多くいらっしゃるのではないでしょうか。

VietBizは日本企業の海外事業・ベトナム事業担当者向けに市場調査、現地パートナー探索、ビジネスマッチング、販路開拓、M&A・合弁支援サービスを提供しています。

ベトナム特化の経営コンサルティング会社、ONE-VALUE株式会社はベトナム事業に関するご相談を随時無料でこちらから受け付けております。