- Introduction

- Vietnamese Legal Regulations on the Construction Industry

- Overview and Trends of the Construction Industry in Vietnam

- List of general contractors in Vietnam

- Leading Vietnamese Construction Companies

- Challenges Facing the Vietnamese Construction Industry

- Summary

- ベトナム市場の情報収集を支援します

Introduction

The construction industry is one of the industries projected to have the highest growth rate in Vietnam over the next few years. In addition, Japanese general contractors and construction companies are already participating in large-scale projects in Vietnam, contributing significantly to the Vietnamese construction industry. This report will focus on trends in Vietnam’s construction industry and the major players in the industry.

Vietnamese Legal Regulations on the Construction Industry

Vietnam is a socialist country, and its laws pertaining to land, real estate, and construction differ from those of Japan in many respects. This chapter introduces Vietnam’s legal provisions related to the construction industry.

Legal Provisions Regarding the Entry of Foreign Capital

According to the Law on Investment in Vietnam of 2020, the construction industry is defined as a “conditional management investment sector”. The construction industry can be subdivided into many specialized businesses. The Law on Investment in Vietnam designates some of these specialized businesses in the construction industry as conditional management investment areas. Specifically, they are as follows.

Construction business activities included in the conditional management investment sector:

Large-Scale Construction Execution Service Business

Large-Scale Construction Investment Project Management Enhancement Service Business

Detailed Survey Service

Construction Design, Construction Design Evaluation Service

Large-Scale Construction Execution Supervisory Consultant Service

Large-Scale Construction Execution Service

Construction activities by foreign investors

Construction investment expenditure management service

Construction quality conformity testing and approval service

Common infrastructure system operation management service business

Construction planning and design service business

Urban planning service for foreign organizations and individuals

Apartment management and operation services (new)

etc.(Citation: Ministry of Land Infrastructure, Transport and Tourism, Japan 建設業に関する外資規制)

Legal Regulations on Licensing and Quality

In Japan, most construction work requires a construction license, but this is different in Vietnam. This paragraph introduces the licensing system in the construction industry in Vietnam.

Legal Regulations Related to Construction Permits

Vietnam does not have a comprehensive construction license system like Japan’s Construction Industry Law.

The government takes into account the size, area, and other characteristics of each construction project, and then classifies the project and issues a construction permit. Depending on the project, the local government (province or city) or the central government (Ministry of Construction) may examine the project directly.

Construction Safety Management Standards

The safety management standards for construction are governed by the Vietnam Building Code.

Reference:【英語版】ベトナム建築基準(Vietnam Building Code)(建設省)

Building Standards

Building code standards are applied as mandatory standards through the designation of relevant “Vietnamese Standards” (Vietnamese Standards) in the Vietnamese Building Code.

reference:【ベトナム語】ベトナム基準(科学・技術省)

ホーチミン市地下鉄1号線のBen Thanh駅の様子(2021年3月撮影) 出所:24hニュース

Overview and Trends of the Construction Industry in Vietnam

Subsequent parts of this report will provide an overview of the Vietnamese construction industry, its trends, and key players and projects.

Market Size of the Vietnamese Construction Market

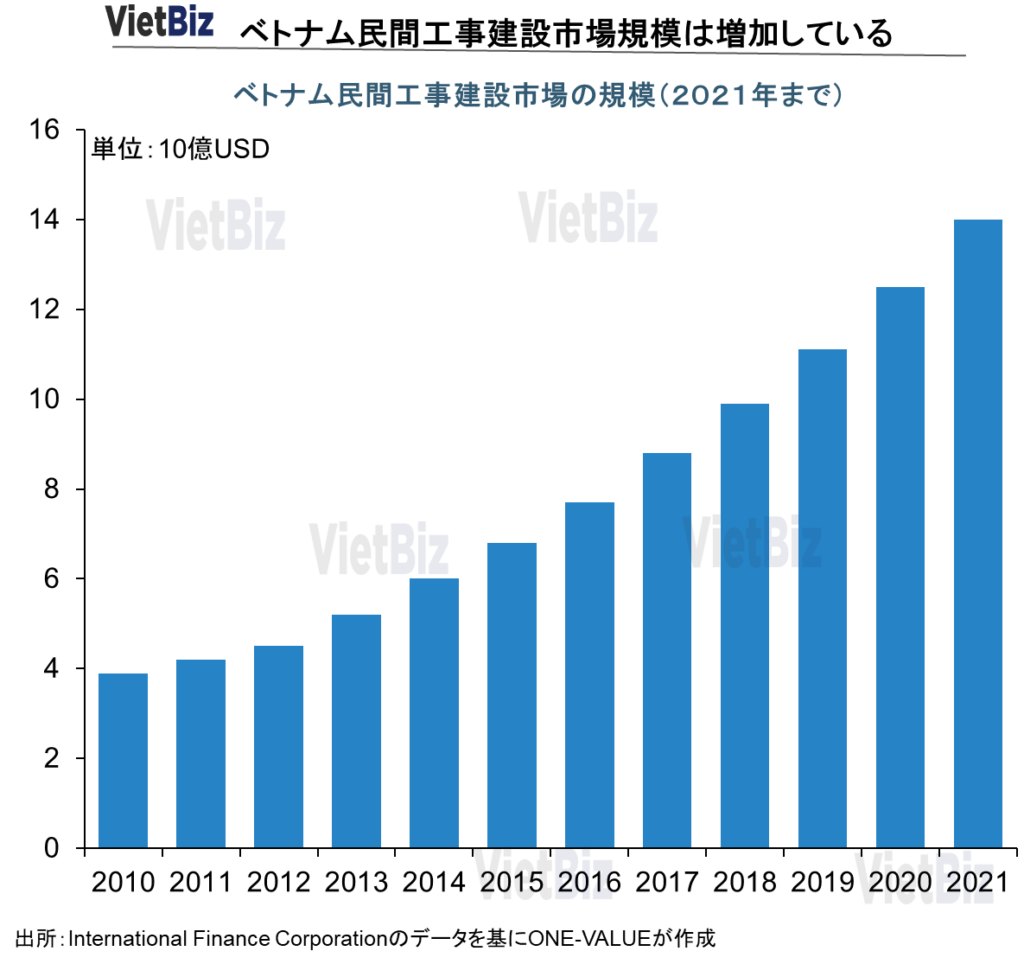

In Vietnam, the growth rate of private construction work has averaged 12% per year over the past decade. In addition, as of 2021, the market size of private construction works is estimated to be USD 14 billion. (Survey by the International Finance Corporation)

In addition, the market size of private construction work in Vietnam in 2015 was approximately US$6.8 billion, so by 2021 the market will have more than doubled in size.

According to a World Bank study, Vietnam has had the largest increase in the middle class in the world over the past decade. It also predicts that by 2030, more than 23 million Vietnamese will be in the middle class.

Vietnam is experiencing not only this income growth, but also population growth and an increase in the urban population ratio. Vietnam’s urban population ratio continued to increase even during the Corona disaster, suggesting an increase in demand for housing in urban areas.

The World Bank also estimates that by 2030, more than half of the world’s construction projects will take place in Asia, particularly in Southeast Asia.

According to a report by Mordor Intelligence, Vietnam’s construction works market (including infrastructure, flood control, and private works) was worth US$57.5 billion in 2020 and is expected to reach US$94.9 billion by 2026. In this case, the average growth rate during the period 2021-2026 will be 8.7%/year.

The construction industry has contributed significantly to Vietnam’s development, growing at an average annual rate of 8% each year over the past decade.

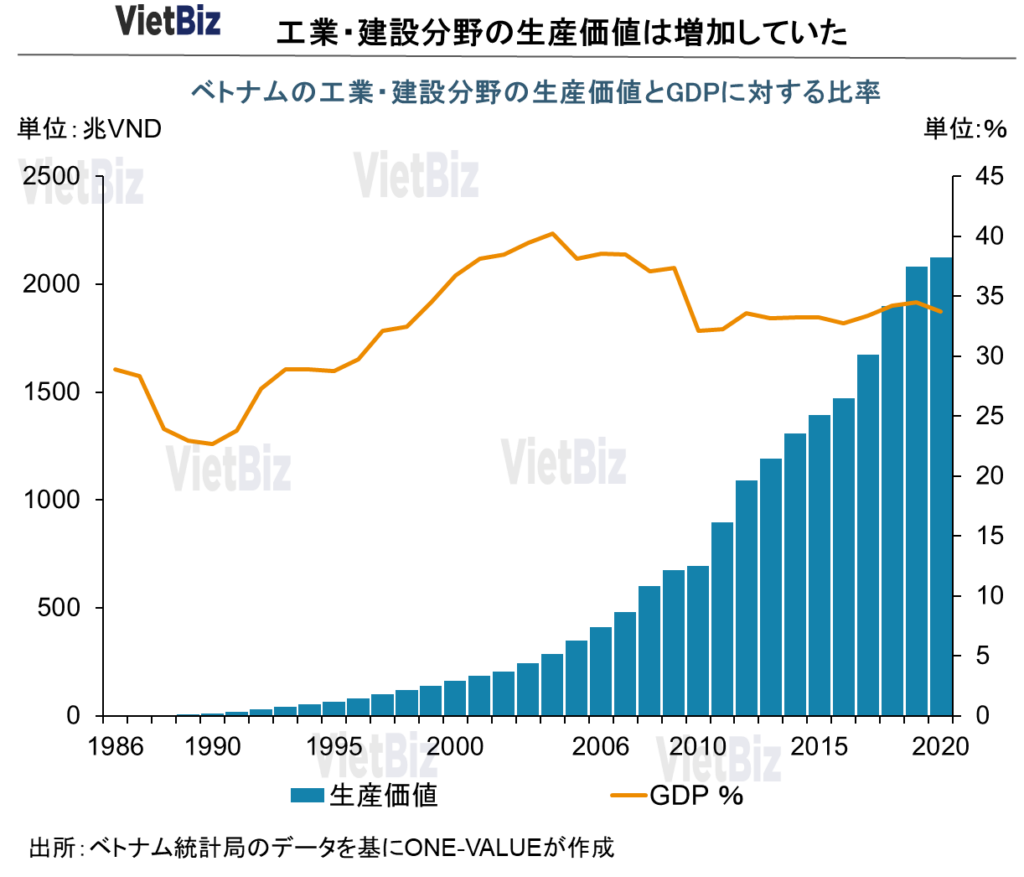

Value Added in the Construction and Industrial Sectors

Since there are no value-added statistics only for the construction sector in the data of the Vietnamese Statistics Office, we will discuss this based on the data for the “construction and industrial sector”.

The construction and industrial sector accounts for about 35% of Vietnam’s gross domestic product (GDP).

According to data from the Vietnam Statistics Office, despite the spread of the new coronavirus in 2021, the output value of the construction sector is estimated at over VND1,938.9 trillion, an increase of 5.1% over the previous year (2020).

Public investment is a key area of focus in a situation where consumption has not fully recovered due to the impact of the corona. The government has made it clear that it intends to focus on infrastructure projects to facilitate economic recovery.

Bidding Structure

Construction tenders in Vietnam are divided into packages such as survey consulting, purchase of goods, construction execution, etc., and the ordering agency conducts separate tenders for each package.

Bidding methods include public bidding and limited bidding.

From the standpoint of the ordering agency, assuming a typical bidding process for the implementation of construction work, the flow would be as follows

Preparation for selection of construction contractor ➞ Selection of construction contractor ➞ Review and evaluation of bids ➞ Negotiation of contract ➞ Submission, review, approval and release of bid results ➞ Contract execution

Cost of construction

Plus PM Consultant SD,n Bhd. presents the results of a survey of construction costs in and around Ho Chi Minh City. As Ho Chi Minh City is the largest economic city in Vietnam, construction costs in the Ho Chi Minh City area are relatively higher than in other areas. The following are some of the specifics.

reference:Plus PM Consultant SD,n Bhd.社

Housing complex form

For intermediate high-rise residential buildings:20,300,000 VND ~ 25,600,000 VND/m2

For high-end, high-rise residences:24,300,000 VND ~ 28,800,000 VND/m2

Form of office/commercial property

For intermediate high-rise buildings:23,400,000VND ~ 27,900,000 VND/m2

For high-end high-rise buildings:26,100,000VND ~ 35,100,000 VND/m2

Hotel Form

For 3-star hotels:35,2000,000VND ~ 45,200,000VND/m2

For 5-star hotels:50,400,000VND ~ 60,300,000VND/m2

Forms of factories, production facilities, warehouse logistics facilities

For light industry:11,500,000VND ~ 23,000,000VND /m2

For heavy industry:23,000,000VND ~ 41,400,000VND/m2

For building only:7,100,000VND ~ 8,900,000VND/m2

List of general contractors in Vietnam

This chapter introduces domestic companies and major Japanese general contractors and subcontractors in Vietnam.

reference:Plus PM Consultant SD,n Bhd.社

Major construction company in Vietnam

• Vietnam construction import-export joint stock (VINACONEX)

• Bach Dang Construction (BACH DANG)

• Song Da Construction (SONG DA)

• Vietnam infrastructure development and construction (LICOGI)

• Construction Corporation NO.1

• HANOI CONSTRUCTION JOINT STOCK COMPANY NO.1

Japanese general contractor and subcontractor company

Dai Ando, Andohachi, Obayashi Corporation, Kajima Corporation, IHI Infrastructure Systems, Kumagai Corporation, Konoike Corporation, Penta-Ocean Construction, Shimizu Corporation, The Zenitaka Corporation, Taikisha Corporation, Taisei Corporation, Takasago Thermal Engineering Corporation, TSUCHIYA, Tekken Corporation, Toa Construction Industry, Tokyu Corporation, Toyo Construction Corporation, Tokura Corporation, Mineta Construction, Nishimatsu Construction, NIPPO, Sanwa Corporation, Hitachi Zosen Corporation, JFE Engineering Corporation, Maeda Corporation, Sumitomo Mitsui Construction Corporation, Yokogawa Corporation

Others

• Bouygues(Frence)

• Vinci(Frence)

• Modern Construction(Korea)

•Lotte Construction(Korea)

Leading Vietnamese Construction Companies

This chapter introduces some of the most influential companies in Vietnam’s construction industry.

In Vietnam, construction works are classified into civil works, industrial works, transportation works, agricultural and rural development works, technical infrastructure, and national defense and security works.

In this chapter, we will introduce representative companies along with trends in each field by dividing them into genres such as general construction, highways, bridges, and airports, ports, and petroleum-related projects. Japanese construction companies that have entered the Vietnamese market are also introduced.

Super general contractor, general construction

Huge general contractors that build houses, condominiums, commercial buildings, infrastructure and factories are responsible for the construction of huge projects in Vietnam. Coteccons Group and Hoa Binh Group, both listed below, are renowned as Vietnam’s super general contractors. Vietnam, with its rapidly developing construction industry, has a large number of major construction companies. However, only two companies, Coteccons Group and Hoa Binh Group, can be called super general contractors in Vietnam.

representative company:Coteccons Group

| company name | Coteccons Group |

| year of establishment | 2004年 |

| head office | Ho Chi Minh |

| HP | https://www.coteccons.vn/ |

Coteccons Group is the largest general contractor in Vietnam. Coteccons Group is also the only “debt-free” company in the Vietnamese construction industry. (Often referred to as “Coteccons Construction” in Japanese.)

Founded in 2004, Coteccons Group is one of the leading construction companies in Vietnam today, working as a general contractor on large-scale projects throughout the country.

Specific examples include Landmark 81 (Binh Tan District, Ho Chi Minh City), the tallest building not only in Vietnam but also in Southeast Asia; the Vinfast automobile production complex (Haiphong City); and the Hoa Phat Group’s Dung Quat ironworks (Quang Ngai Province), which has become representative of Vietnam’s industrial and real estate industry.

On the other hand, in recent years, a factional war among major shareholders occurred within the Conteccons Group: with the retirement of Mr. Nguyen Ba Duong, the founder of the Conteccons Group, in 2021, members of Mr. Duong’s faction left Conteccons, and moved to “Newteccons” and In 2021, with the retirement of Nguyen Ba Duong, founder of the Conteccons Group, members of Mr. Duong’s faction left Conteccons for new construction companies that Mr. Duong had founded, including Newteccons and Ricons.

The actual current owner of Conteccons Group is believed to be the Eastern European “Kusto Fund”. Due to the internal factional strife, since 2018, Conteccons Group’s sales, profits and projects awarded have also declined significantly from previous years, and its current performance is below that of Hoa Binh Group, which originally ranked second in the industry.

representative company:Hoa Binh Group

| company name | Hoa Binh Group |

| year of establishment | 1987 |

| head office | Ho Chi Minh |

| HP | http://www.hoabinhcorporation.com.vn |

Hoa Binh Group (Hoa Binh Construction Group) was established in 1987 and is the second largest general contractor in Vietnam.

Hoa Binh is not only a major contributor to Vietnam’s development, but also the first Vietnamese construction company to enter foreign markets such as Malaysia (Le Yuan Residence project and Desa Two project) and Myanmar (GEMS project). Hoa Binh’s medium-term business strategy for the future includes expanding beyond the Southeast Asian region into overseas markets such as the Middle East, Australia, and Canada.

Currently, projects built by Hoa Binh have been completed in 40 of Vietnam’s 63 provinces and cities, in addition to foreign projects in Malaysia, Myanmar, Kuwait, and other countries. Those built by Hoa Binh include many types of housing, cultural, medical, and educational facilities, aviation, and hotel-resort projects. Among them, representative projects for the region include the passenger terminal at Can Tho International Airport (Can Tho City), the passenger terminal at Tan Son Nhat International Airport (Ho Chi Minh City), the An Giang Provincial Central General Hospital (An Giang Province), and the Phu My Hung residential area (Ho Chi Minh City).

However, in contrast to Cotecconss Group, which has a strict policy of debt-free management, Hoa Binh Group has been chasing a large amount of debt for many years. The company is seen as having a sense of crisis in its capital structure.

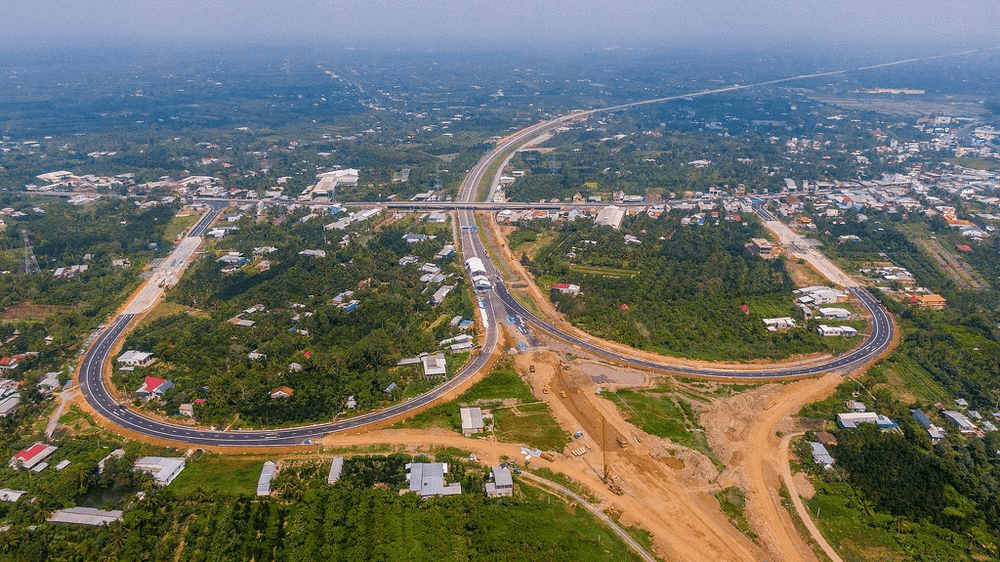

Highways, bridges, and airports

The Vietnamese government is promoting the development of transportation infrastructure, especially highways and airports.

To monitor and promote public investment, the Vietnamese government established the Public Investment Supervisory Board at the end of 2021, with Deputy Prime Minister Pham Binh Minh serving as its chairman. In addition, the official social networking sites of the Vietnamese government frequently post photos and news of Prime Minister Pham Minh Chinh and Deputy Prime Minister Le Van Thanh visiting transportation infrastructure works across the country to promote the implementation of infrastructure projects.

There are two major projects that the Vietnamese government is particularly focused on.

The first is the North-South Expressway. The North-South Expressway is a 1,811-km expressway that runs from the Huu Nghi entry/exit point (in Lang Son Province), which borders China, to Ca Mau, the southernmost city in Vietnam.

The second is Long Thanh International Airport. Long Thanh International Airport will be the largest airport in Vietnam and is expected to become a hub airport in Southeast Asia. The total area of Long Thanh Airport is 5,000 hectares, with a planned operating capacity of 100 million passengers per year, and the airport is scheduled to open in 2025.

出所:ベトナム軍隊ニュース

The road network development plan for 2021-2030 determines that the total length of Vietnam’s highways will be extended from the current approximately 1,100 km to 5,000 km by 2030.

The government budget for investment in road transportation infrastructure construction is planned at about USD 22.2 billion in 2025 and more than USD 39.2 billion in 2030.

representative company:VINACONEX

| company name | VINACONEX Corporation |

| year of establishment | 1987 |

| head office | Hanoi |

| HP | https://vinaconex.com.vn/ |

VINACONEX (“VCG”) is a leading real estate and infrastructure construction company in Vietnam. vinaconex was originally a state-owned company under the Vietnamese Ministry of Construction. However, the Vietnamese government privatized the company in 2004, and Pacific Holdings now owns more than a majority (approximately 63%) of VCG’s outstanding shares and controls the company. Incidentally, the chairman of Pacific Holdings has close ties to ECOPARK, a major real estate company.

Unlike other companies under the umbrella of the Vietnamese Ministry of Construction, VCG was founded from the beginning as a multi-industry company. Today, VCG is not only a general contractor for various private and public projects, a construction company involved in water supply and drainage systems and environmental facilities, but also an importer and exporter of construction machinery, equipment, and materials.

Currently, the construction of the Long Thanh International Airport, in which the Vietnamese government is particularly investing, is being carried out by VCG, which is the prime contractor for the project because of its superior technology and execution capabilities.

representative company:DEO CA GROUP

| company name | DEO CA GROUP |

| year of establishment | 1985 |

| head office | Ho Chi Minh |

| HP | https://deoca.vn/ |

Deo Ca Group (HHV) is known as the “King of Tunnels” in Vietnam.

HHV was established in 1985 and was one of the first private companies in the construction industry in Vietnam. Currently, HHV is constructing the aforementioned North-South Expressway project, National Highways 4 and 5 in Hanoi, and National Highways 3 and 4 in Ho Chi Minh City. In addition, within 2022, HHV plans to complete the previously awarded Cam Lam – Vinh Hao Expressway, Trung Luong – My Thuan Expressway, Dong Dang – Tra Linh Expressway, etc. The company announced that it plans to complete the Cam Lam – Vinh Hao Expressway, the Trung Luong – My Thuan Expressway, and the Dong Dang – Tra Linh Expressway. All of these highways are important for improving regional connectivity, and the Vietnamese government and local people are particularly excited about these projects.

The Trung Luong – My Thuan Expressway (Southern Vietnam), a “Project of National Importance” in 2021.

出所:odbaoline.com

Harbors

The Vietnamese government intends to promote trade as one of the core areas in the country’s future medium- and long-term development strategy. Therefore, the development of international ports capable of handling exports has become very important.

Currently, Vietnam has two international ports, the Cat Lai International Port in Ho Chi Minh City and the Hai Phong International Port Complex in Hai Phong City, which mainly serve the needs of imports and exports, but most of these international ports are over capacity, and it is believed that there is a shortage of international ports. The Vietnamese government has announced a policy to construct new international ports in the future.

However, there are no domestic companies in Vietnam that have sufficient financial resources and construction technology to build international ports. The “Cai Mep – Thi Vai Port Complex” (Ba Ria Vung Tau Province), the largest international port complex currently under development in Vietnam, is being developed by a French company in cooperation with Gemadept, a company affiliated with the Vietnamese Ministry of National Defense.

It is believed that Vietnam still needs to cooperate with foreign companies to build an international port.

representative company:Gemadept

| company name | Gemadept |

| year of establishment | 1990 |

| head office | Ho Chi Minh |

| HP | https://www.gemadept.com.vn/vi/ |

Gemadept, a state-owned company established in 1990 under the umbrella of the Vietnamese Ministry of Defense, has been in operation for more than 30 years and is a leading port and logistics company that connects Vietnam to the international community.

Currently, Gemadept operates eight ports in Vietnam with a total capacity of 5 million TEUs. The reason why we want to introduce Gemadept as a leading port development company is that Gemadept, in cooperation with French logistics giant CMA Terminals, is constructing and operating the Cai Mep – Thi Vai deep sea port complex in Ba Ria Vung Tau province. This is because the company is constructing and operating the Cai Mep – Thi Vai deep sea port complex in Ba Ria Vung Tau Province. This deepwater port complex is a project that will play a very important role in the future economic development of southern Vietnam.

The Cai Mep – Thi Vai port complex can accommodate vessels of up to 200,000 DWT, making it the largest deepwater international port in Vietnam and one of the ten largest ports in the world. Currently, the Cai Mep – Thi Vai port complex is operating in Phase 1, and Phase 2 of the port is under construction and is expected to be operational in 2024.

Previously, international cargo ships transporting goods to southern Vietnam and Ho Chi Minh City used Cat Lai port (in Ho Chi Minh City), but because Cat Lai port is located deep inland, the parent vessel has no access to Cat Lai port. Therefore, international cargo vessels with goods bound for southern Vietnam always transshipped the goods to smaller cargo vessels at the Port of Singapore and transported them to Cat Lai Port. As a result, the cost of sea transportation to southern Vietnam and Ho Chi Minh City is very high. To solve this problem, the Vietnamese government is planning to move international shipping routes to southern Vietnam to the Cai Mep-Thi Bai port complex instead of Cat Lai port.

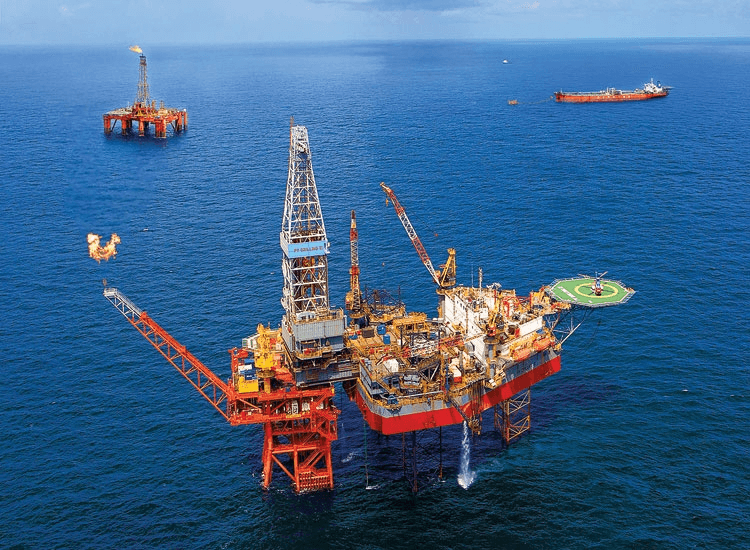

Petroleum

In Vietnam, all oil development projects are invested and implemented by Petrovietnam, a state-owned enterprise. In this context, most of the actual construction work for projects invested or co-financed by Petrovietnam is carried out by Petrovietnam Construction, a subsidiary of Petrovietnam.

representative company:Petro Vietnam Construction

| company name | Petro Vietnam Construction |

| year of establishment | 1990 |

| head office | Hanoi |

| HP | www.pvc.vn |

PetroVietnam Construction (hereinafter: PVC) is a subsidiary of the Vietnam National Oil and Gas Group (PetroVietnam, Petro Vietnam). Most of the projects related to energy, oil, and gas that PVC implements are major national projects and have special significance for Vietnam’s economic development.

Typical projects undertaken by PVC:

- Petroleum: Phu Myertilizer plant, Ca Mau fertilizer plant, Dung Quat oil refinery.

- Oil-fired power generation: Thai Binh II oil power plant, Nhon Trach II thermal power plant, Phu Tho Ethanol Biofuel plant, Dinh Vu polyester synthetic fiber plant, Vung Ang thermal power plant.

- Oil and gas drilling operations: Dai Hung drilling rig, Moc Tinh 1 rig foundation and BienDong project superstructure.

- Oil logistics: Cu Lao Tao oil warehouse, LP gas storage, oil tanks in Dung Quat industrial park, gas pipeline to industrial parks offshore Ba Ria Vung Tau province and Dong Nai.

出所:pvep.com.vn

Japanese Construction Companies Operating in Vietnam

There are many Japanese construction companies operating in Vietnam.

Obayashi Corporation

Obayashi Corporation entered the Vietnamese construction market in 1992 with the establishment of representative offices in Ho Chi Minh City and Hanoi.

In Vietnam, Obayashi Corporation was the general contractor for many huge projects, including the Japanese Consulate in Vietnam (Ho Chi Minh City), Tan Tri Bridge (Hanoi), Tan Son Nhat International Airport Passenger Terminal (Ho Chi Minh City), Saigon River Tunnel Road (Thu Thiem Tunnel, Ho Chi Minh City), and Ho Chi Minh East-West Expressway (Ho Chi Minh City).

The Saigon River Tunnel Road connecting Districts 1 and 2 in Ho Chi Minh City is particularly famous as an ODA project by Japan. It is also famous for being the first tunnel through a river bed in Vietnam.

Shimizu Corporation

Shimizu Corporation entered the Vietnamese market in 1992. Shimizu Corporation has executed many large-scale projects in Vietnam, among which the Bai Chay Bridge (Halong City, Quang Ninh Province) is considered to be a representative project. In addition, Shimizu Corporation was one of the contractors for the construction of Ho Chi Minh City’s first subway (metro).

出所:クアンニン省新聞

Kajima Construction

Kajima Corporation has entered the real estate and construction industry in Vietnam by establishing the Indochina Kajima Development joint venture in cooperation with Indochina Capital, a local Vietnamese company.

At present, most of Kajima Corporation’s projects in Vietnam are funded by joint ventures. Among them, “Wink Hotels” and “Bai Nom Luxury Resort” in Phu Yen Province were constructed by Kajima Corporation.

Challenges Facing the Vietnamese Construction Industry

This chapter examines the challenges facing Vietnam’s construction industry.

Soaring Raw Material Prices

The recent surge in raw material prices has been a major problem for the Vietnamese construction industry. The easing of monetary policies around the world and the problems in Russia and Ukraine have caused fuel and construction material prices to continue to rise, making it difficult for construction companies to procure iron, steel, stone, and other construction materials for use in construction. In addition, the soaring prices of construction materials may reduce construction companies’ profit margins.

Against a background of rapidly increasing raw material prices, the Vietnamese government has decided to suspend the construction of several infrastructure projects with public investment in 2022.

出所:ベトナム政府新聞

Vietnam’s Rainy Season

Construction work in Vietnam becomes more difficult to implement during the rainy season. Vietnam has a tropical climate with high annual rainfall and frequent guerrilla downpours.

The rainy season in Vietnam is from May to October each year. During the rainy season, it can rain for several days in a row, making it very difficult for construction companies to carry out work during the rainy season.

Summary

Vietnam’s construction industry still has significant room for growth due to the country’s nationwide urbanization. The market size of private construction work in Vietnam has nearly doubled between 2015 and 2021.

In addition, infrastructure development is projected to grow faster than private construction work in the coming years. To support the economic recovery, the Vietnamese government has indicated that it will focus on the international deepwater port, Long Thanh International Airport, and the North-South Expressway.

Therefore, there is still room for Japanese companies to enter the Vietnamese construction industry, especially in the infrastructure sector.

There are only two super general contractors in Vietnam, and foreign construction companies, including Japanese firms, have been making inroads into the country so far.

On the other hand, the Vietnamese construction industry is also facing challenges such as the rising cost of construction materials and Vietnam’s rainy season.

▼ベトナム建設市場の市場調査、M&A、ビジネスマッチングの支援をご要望の方は以下からご連絡ください。

【関連記事】ベトナムの建設市場・不動産ついては、こちらの記事も合わせてご覧ください。

ベトナム市場調査レポート一覧はこちらからもご覧頂けます。

ベトナム市場の情報収集を支援します

ベトナム市場での情報収集にお困りの方は多くいらっしゃるのではないでしょうか。

VietBizは日本企業の海外事業・ベトナム事業担当者向けに市場調査、現地パートナー探索、ビジネスマッチング、販路開拓、M&A・合弁支援サービスを提供しています。

ベトナム特化の経営コンサルティング会社、ONE-VALUE株式会社はベトナム事業に関するご相談を随時無料でこちらから受け付けております。