Introduction.

Vietnam has a thriving seafood industry. In addition to the domestic market, Vietnamese seafood products are exported to many countries around the world, including the most demanding countries such as Japan, the United States, Korea, and Europe. In particular, the export value of many fishery products, such as pangasius (white fish) and shrimp, has ranked among the highest in the world for several consecutive years.

Feed is one of the most important elements in the cost structure of aquaculture, with costs typically accounting for about 70% of the total.

The demand for seafood feed in Vietnam is increasing both in quantity and quality as the potential for exporting to markets in developed countries with high quality standards increases, and the seafood feed industry in Vietnam is considered one of the industries expected to develop in the future.

This report provides a comprehensive overview of key information on Vietnam’s seafood and feed industry, such as market size, industry characteristics, difficulties faced, and government policies to promote development.

Overview of the seafood and feed industry in Vietnam

This chapter introduces and explains basic information about the seafood feed industry in Vietnam.

Size of industry

In terms of Vietnam’s overall feed industry (including livestock, poultry, and fishery feed), feed production continues to increase year after year due to Vietnam’s overall increase in consumption demand. Vietnam’s feed production in 2020 reached 23,673.4 thousand tons. Vietnam leads Southeast Asia in feed production and is among the top 10 countries in the world.

As for fishery feed, Vietnam’s fishery feed production in 2020 will reach 5628.4 thousand tons, almost double the production in 2015, accounting for 24% of total feed production.

In general, Vietnam’s domestic supply of aquafeed meets about 85% of domestic demand, some of which is exported to Asian countries; in 2021, the export value of aquafeed (including fishmeal) reached US$685.2 million.

Industrial Features

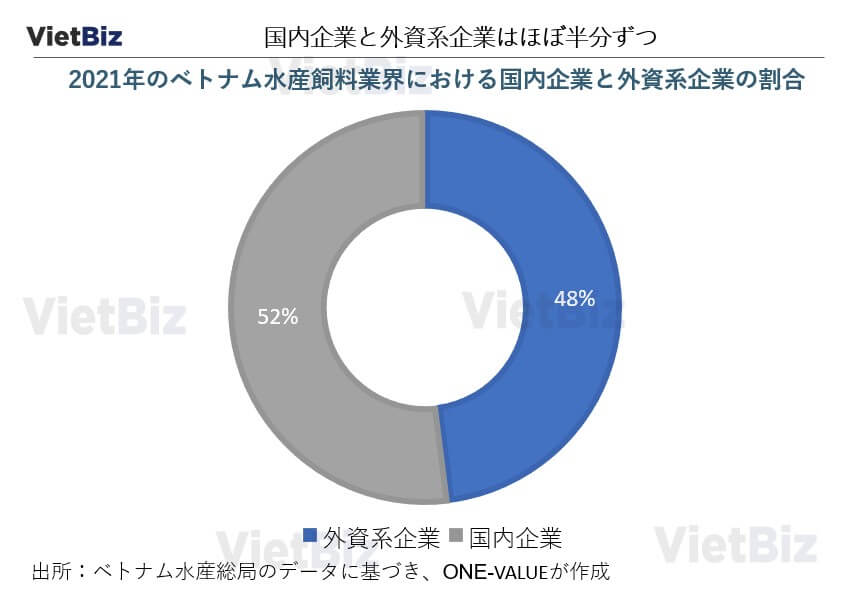

According to a report by the General Department of Fisheries of Vietnam, there are currently a total of 121 enterprises producing fish feed throughout the country. Of these, 58 are foreign-invested enterprises (FDI enterprises), accounting for 48% of the total. The production capacity of foreign-invested enterprises has reached 5.2 million tons/year, exceeding that of domestic enterprises (4.7 million tons/year). In addition to feed production enterprises, there are 63 enterprises (20 foreign-invested enterprises and 43 domestic enterprises) nationwide that produce all types of raw materials for marine feed production, including fish meal, rice bran, crackers, rice oil, wheat flour, mineral mixes, vitamins, and feed additives.

In the Vietnamese seafood feed market, foreign-owned firms account for the majority of the market share, although they are fewer than Vietnamese firms. Specifically, foreign-invested firms account for about 80% of the seafood feed market. As far as shrimp and pangasius feed, Vietnam’s major export commodities, are concerned, the share of foreign-invested firms is 90-95% and 65-70%, respectively. Foreign-invested enterprises with larger parent company capital often have competitive advantages such as factories, modern machinery, production technology, and high-quality products and services, and are more popular with consumers.

Currently, Vietnamese aquafeed enterprises are mainly concentrated in the Mekong Delta region. This is because the Mekong Delta region is one of the leading aquaculture regions in Vietnam.

Provinces with high concentrations of fish feed companies include Vinh Long, Bac Lieu, Can Tho City, and Dong Nai Province. The companies sell through two channels: direct sales and indirect sales through wholesale and retail distributors in the provinces.

In addition to seafood feed companies, recently more and more large seafood companies involved in aquaculture, processing, and exporting, such as Minh Phu, Hung Vuong, and Viet Uc, have been producing their own feed.

Major key players

This section will introduce the main players in the Vietnamese seafood feed market.

Uni-President Vietnam

| 設立 | 1999 |

| 資本 | 外資系(完全子会社) |

| 本社 | 台湾 |

| 主要製品 | 水産飼料(エビ、魚、カエル)、家畜・家禽飼料(豚、牛、鴨、鶏、うずら)、小麦粉、即席めん |

| 規模 | 4か所の水産飼料工場(Binh Duong省、 Tien Giang省、 Quang Nam省、 Ninh Thuan省) |

| 主な販売先 | ベトナム国内、アジア諸国 |

Uni-President is a leading company in the production of seafood feed, especially shrimp feed, in Vietnam. Uni-President accounts for about 30-35% of the shrimp feed market share in Vietnam. It has four factories in major aquaculture areas in the south and supplies about 400,000 tons of feed to the market annually.

CP Vietnam

| 設立 | 1998 |

| 資本 | 外資系(完全子会社) |

| 本社 | タイ |

| 主要製品 | 水生飼料(エビ、魚)、 家畜・家禽飼料 (豚、鶏) |

| 規模 | 3か所の水産飼料工場 |

| 主な販売先 | ベトナム国内 |

C.P. Group (Charoen Pokphand) is one of the largest companies in Thailand in the field of industry and agriculture.C.P. Vietnam was established in 1988 and is oriented to operate in the 3F (Feed – Farm – Food) from farm to final consumer. In the field of aquatic feed production, C.P. Vietnam’s factories apply many international management standards such as high quality, traceability, ISO, HACCP, GMP, Global GAP, and BAP, and each factory has a maximum production capacity of 249,600 tons/year.

De Heus Vietnam

| 設立 | 2008 |

| 資本 | 外資系(完全子会社) |

| 本社 | オランダ |

| 主要製品 | 水産飼料(エビ、魚)、家畜・家禽飼料(豚、牛、山羊、鴨、鶏、うずら) |

| 規模 | 3か所の水産飼料工場(Vinh Long省、Bac Lieu省)、1つの水産養殖研究開発センター |

| 主な販売先一覧 | ベトナム国内、カンボジア、インド、ミャンマー、フィリピン、バングラデシュ、インドネシア |

De Heus Vietnam is part of the De Heus Group, a global player in the field of feed production. 2011 saw the company’s decision to enter the seafood feed sector with the acquisition of the Vinh Long seafood plant. After a short period of upgrading and expansion, the plant was equipped with a modern Dutch production line with a capacity of up to 100,000 tons/year. The company has also invested in a seafood R&D center, considered the most modern in Vietnam, and has shown constant efforts in product development and improvement.

Cargill Vietnam

| 設立 | 1995 |

| 資本 | 外資系(完全子会社) |

| 本社 | アメリカ |

| 主要製品 | 水産飼料(エビ、魚)、 家畜・家禽飼料 (豚、鶏) |

| 規模 | 3か所の水産飼料工場(Dong Thap省、Tien Giang省、Hung Yen省) |

| 主な販売先 | ベトナム国内、アジア諸国、環太平洋地域の国々 |

Cargill entered the Vietnamese market in 1995 and is primarily engaged in the production of livestock and poultry feed and aquatic feed. In the field of aquafeed, Cargill produces shrimp and fish feed, which is mainly deployed in the Vietnamese market and other countries in the Asia-Pacific region.

Proconco

| 設立 | 2007 |

| 資本 | 外資系(ジョイントベンチャー) |

| 本社 | ベトナム、フランス |

| 主要製品 | 水産飼料(魚) |

| 規模 | 1か所の水産飼料工場 (Hung Yen省) |

| 主な販売先 | ベトナム国内 |

Proconco is a very familiar feed brand with a long history for Vietnamese farmers: in 1991, a Vietnamese-French joint venture, Proconco, was established, the first joint venture in the field of feed production in Vietnam.

In 1997, Proconco continued its expansion into the seafood feed sector by building a factory in Can Tho province, which was also the first seafood feed factory in Vietnam In 2014, Proconco was ranked among the Top 100 animal feed producers in the world.

Challenges for Vietnam’s seafood and feed industry

This chapter examines the challenges in Vietnam’s seafood feed industry.察していく。

Dependence on imports for raw materials

Despite being one of the world’s leading agricultural producers and exporters, Vietnam imports large quantities of raw materials for livestock, poultry, and fishery feed from abroad. As a result, 60-80% of the feed used annually in the fisheries industry is imported.

Vietnam typically imports raw materials such as corn, soybeans, fishmeal and animal fat, mainly from the US, Australia, Argentina, Brazil, India and the EU.

For some imported raw materials, such as fishmeal, Vietnam can still produce and sell them at the same price as imports. However, large fish feed companies prefer imported raw materials because of their international standard certificates and traceability.

Over-reliance on imported feed ingredients has the major disadvantage of making it difficult for Vietnam to control fluctuating food prices. On top of that, the import process has to go through many intermediaries, which makes the selling price very high when it reaches the end-user.

Foreign companies dominate the market and domestic companies are not competitive

Although there are many domestic firms in Vietnam, many are small and medium-sized enterprises (SMEs), and their competitiveness is much weaker than that of foreign-invested firms. As a result, the market share in the industry is also dominated by foreign-invested firms. Reasons for this include the fact that domestic firms do not have abundant capital like foreign-invested firms, older machinery and production technology, and lower labor productivity. Foreign firms have better control over market prices.

National policy for the industry

Currently, policies on the fisheries feed industry are summarized in the Feed Industry. According to the Ministry of Agriculture and Rural Development’s project for the development of the feed processing industry in 2021-2030, specific goals include the following.

- Feed production target is about 30-32 million tons/year

- All feed manufacturing enterprises apply quality management system ISO, HACCP, GMP or equivalent

- Vietnam’s technical standard for feed production, management and quality to be the most advanced standard in ASEAN region

- About 40% of total raw materials are self-sufficient in domestic production

To achieve the above goals, the following specific solutions are presented.

Promoting mechanization and high-tech in production and management

The Vietnamese government encourages enterprises to invest in mechanization of operations, research and transfer in nutrition and production of fishery feed. In particular, small and medium enterprises in Vietnam are encouraged to use digital technology to reduce the cost of seafood feed production.

Actively procure raw materials for production

To reduce dependence on imported raw materials, the first solution is to utilize agricultural by-products. Currently, Vietnam’s production of agricultural by-products (including cultivation, livestock, forestry, and fishing) is about 156.8 million tons. Some of these by-products have potential utilization potential, such as dried fish residues, dried shrimp, banana stalks, corn residues, corn cobs, and rice straw. However, advanced technology and new facilities are needed to effectively utilize these by-products.

The government also encourages ministries and companies to invest in research and development in the area of raw materials, such as corn and soybeans, as well as by-products.

Incentives for Investment Companies

The production of fishery feed is one of the sectors that will receive preferential treatment from the Vietnamese government, with particular attention given to projects to develop raw material production areas and investment projects in machinery and production technology. Specifically, according to Decree No. 61/2010/ND-CP on Policies to Encourage Enterprises to Invest in Agriculture and Rural Areas, investment projects in the fishery and feed industry are entitled to the following preferential treatment.

- Land Use Fee Exemption/Remission

- State Land and Water Rental Fee Exemption/Remission

- Assistance for Household and Individual Land or Water Rental

- Other Preferential Assistance: Human Resources Development Assistance, Market Development Assistance, Consulting Services, Science and Technology Application Assistance Support for freight charges

Summary

Foreign firms currently hold a large share of Vietnam’s seafood and feed industry. It is expected that foreign firms will continue to increase their participation in the industry in the future as domestic demand in Vietnam grows. On the other hand, Vietnam’s fishery feed industry faces a number of problems, such as its reliance on imports for raw materials and the low production capacity of domestic companies. In response to these problems, the Vietnamese government has introduced a number of policies to encourage enterprises to invest in the development of raw material production areas, make effective use of domestic raw materials, and utilize mechanization and technology in production and management. Thus, although foreign firms already have a large presence in the Vietnamese fish feed market, there are still many issues to be addressed, and we believe that there is ample room for Japanese firms to enter the market in the future.

【関連記事】ベトナムのその他の分野については、こちらの記事も合わせてご覧ください。

ベトナム市場調査レポート一覧はこちらからもご覧頂けます。

ベトナム市場の情報収集を支援します

ベトナム市場での情報収集にお困りの方は多くいらっしゃるのではないでしょうか。

VietBizは日本企業の海外事業・ベトナム事業担当者向けに市場調査、現地パートナー探索、ビジネスマッチング、販路開拓、M&A・合弁支援サービスを提供しています。

ベトナム特化の経営コンサルティング会社、ONE-VALUE株式会社はベトナム事業に関するご相談を随時無料でこちらから受け付けております。