Introduction:GDP in Vietnam

Vietnam is one of the fastest growing economies in Southeast Asia, with average incomes increasing and urbanization and industrialization progressing at a rapid pace in tandem with economic development. The people’s standard of living is improving year by year and the population is increasing, making Vietnam’s consumer market one of the most promising markets in the world.

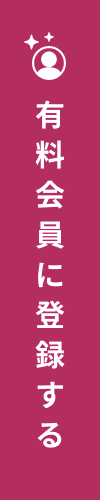

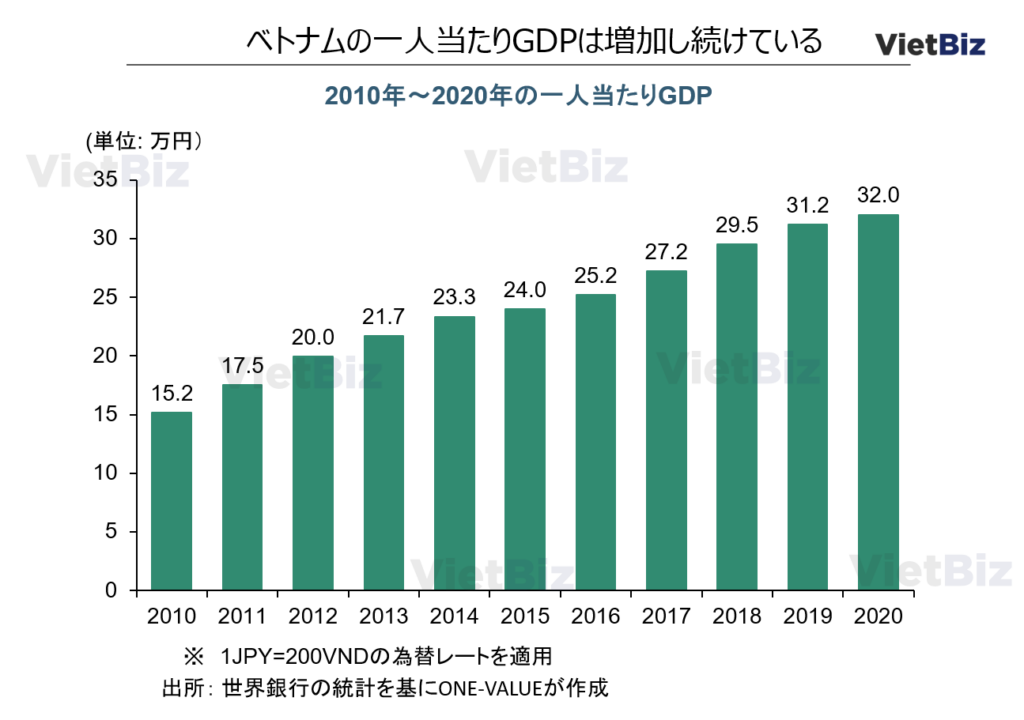

In 2020, Vietnam’s GDP per capita reached 320,000 yen and is projected to increase to 450,000 yen by 2024. Vietnam’s GDP per capita has nearly doubled in the 11 years between 2010 and 2020. (World Bank study) Vietnam has maintained positive GDP growth for the past 30 years. In recent years, the country has continued to maintain high growth rates of around 7%, and even in 2021, the year most affected by the Corona disaster, the country still experienced positive growth.

Against this backdrop, Vietnam is attracting increasing attention as a consumer market, and an increasing number of companies are considering expansion into the country. On the other hand, there are barriers to entry, such as the culture and business customs unique to Vietnam.

With this background in mind, this report will discuss and guide you on how to develop sales channels in Vietnam.

Retail Market in Vietnam

The Ministry of Industry and Trade announced that the size of Vietnam’s retail and service market in 2021 was VND4,789.5 trillion. This market size is approximately 2.5 times larger than in 2011. With the increase in national income, Vietnam’s retail market is growing every year. The size of the retail market is expected to continue to grow in line with the aforementioned GDP increase.

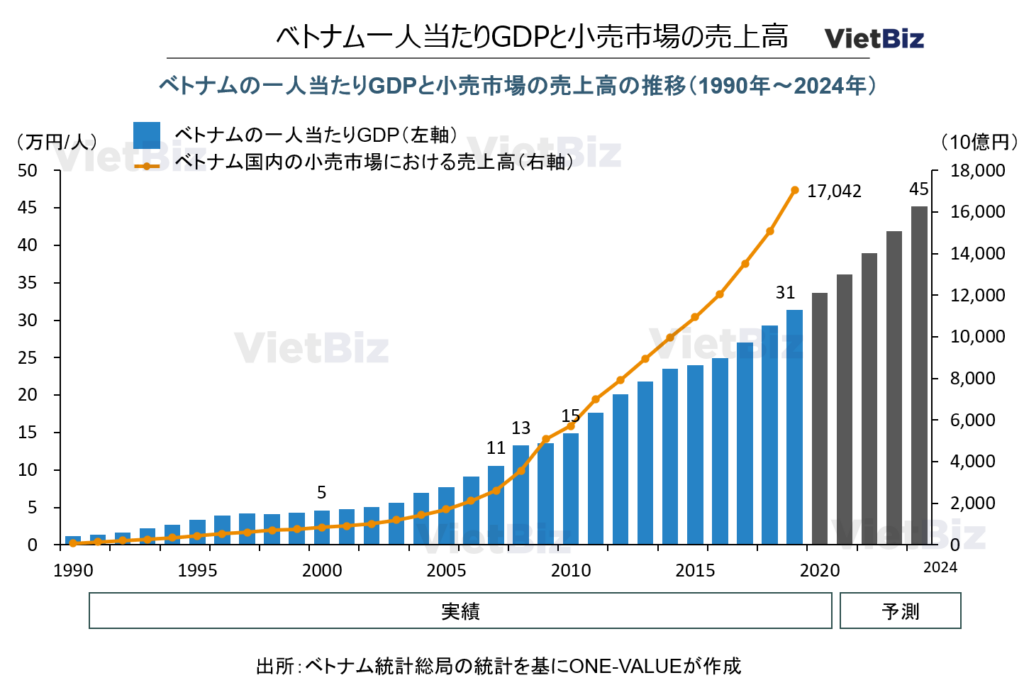

One factor that has led to the increase in the size of the retail market is the increase in the average income and disposable income of the Vietnamese people. According to the General Department of Statistics of Vietnam, the average monthly per capita income in 2020 increased threefold to 4.19Mil VND/month (2.095Mil/month) compared to 2010; the average monthly per capita income increased by about 8.2% from 2016 to 2020. The Five-Year Plan for Economic and Social Development in 2021-2025, published by the Vietnamese government, targets an annual GDP per capita of US$4,700-5,000 in 2025 (¥45,000-¥48,000/month).

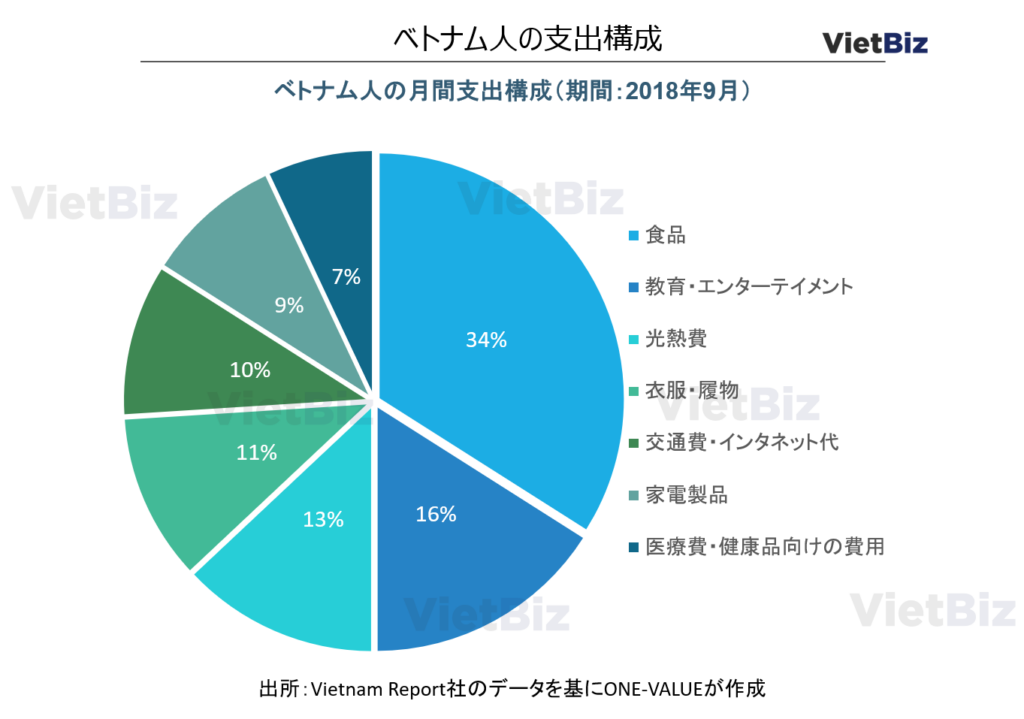

Expenditure Composition of Vietnamese

The Vietnamese spend the most on food, accounting for 34% of their monthly spending composition. Education and entertainment is next in spending, accounting for 16% of the total, followed by education and entertainment at 16%. Clothing and footwear comes in third at 13%. The lowest spending is on medical and health care. (Source: Vietnam Report)

Retail Channels in Vietnam

The Vietnamese retail market is structured with modern trade accounting for about 20% and traditional trade about 80%. In urban areas, modern trade, such as supermarkets and convenience stores, is becoming more prevalent. In addition, e-commerce delivery networks are also developing. On the other hand, traditional trade is still dominant in rural and regional areas.

出所:現地メディア Brands Vietnam

Traditional trade refers to the retail channel through small businesses called mom-and-pop stores, which are privately owned grocery and household goods stores, general merchandise stores, cell phone dealers, etc.

Modern Trade in Vietnam

In recent years, urbanization has accelerated and purchasing power has increased in Vietnam. Traditional trade will remain the mainstream for a while longer, but modern trade is attracting increasing attention.

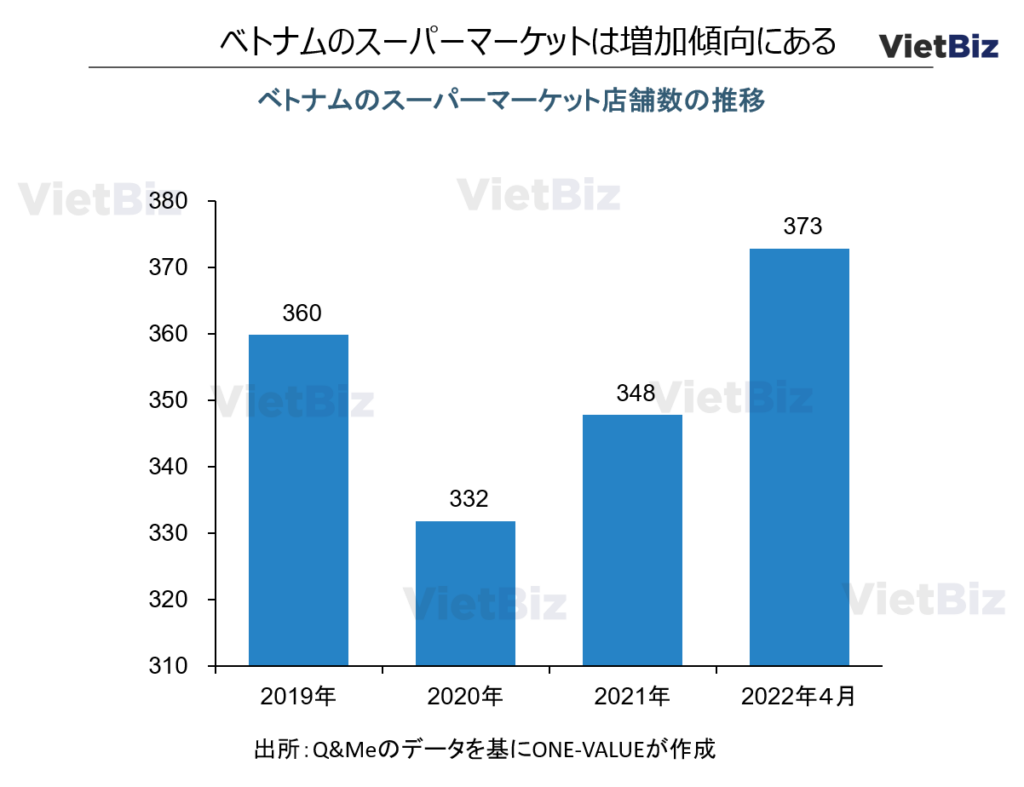

Supermarkets

The number of supermarket outlets is increasing in Vietnam. Although the entire retail sector was severely affected by the Corona disaster, the number of supermarket outlets increased by 7% as of April 2022 compared to 2021. Approximately 23.8% of supermarkets are located in Hanoi and 23.3% in Ho Chi Minh City, meaning that just under half of the country’s supermarkets are concentrated in these two major cities. as of April 2022, COOP MART is the largest supermarket in Vietnam with 128 stores nationwide. Winmart is next, with 123 stores.

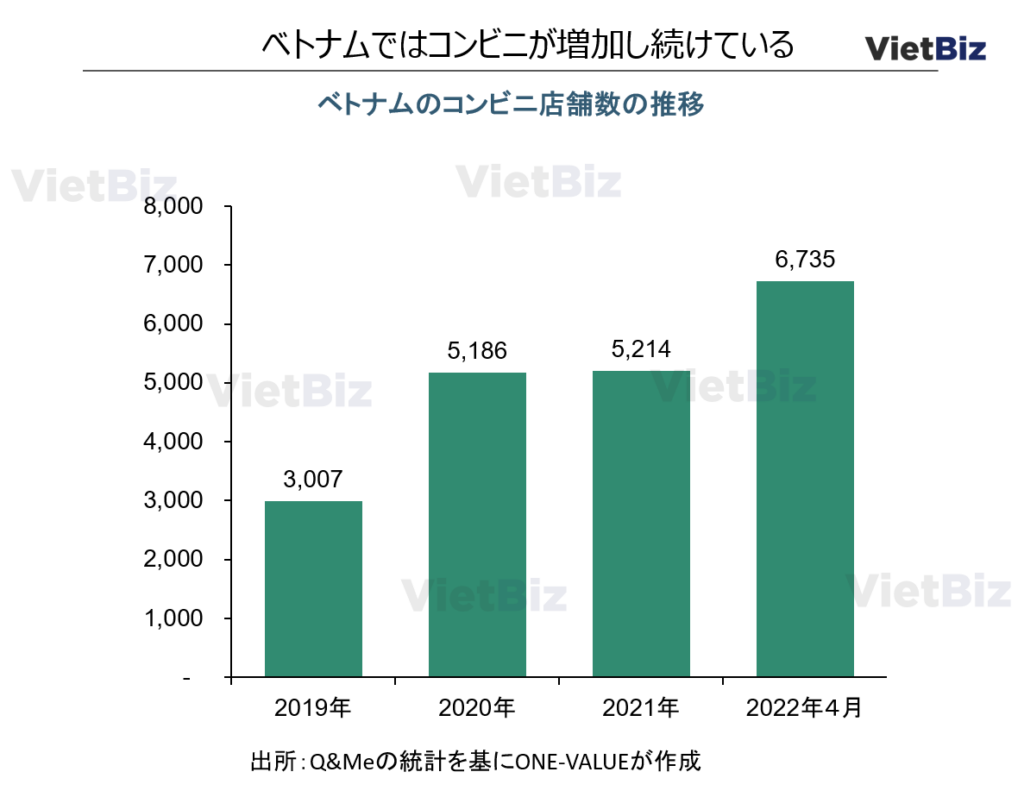

Convenience stores

The rapid growth of Winmart+ and Bach Hoa Xanh has transformed the modern trade in Vietnam: as of April 2022, there were 6,735 convenience stores nationwide in Vietnam, a 29% increase compared to 2021, double the number of stores from 2019.

Among convenience store chains, Winmart+ has the largest number with 2,601 stores. Next in line is Bach Hoa Xanh, with 2,147 stores; the two brands Winmart+ and Bach Hoa Xanh together account for 70% of all convenience stores in Vietnam.

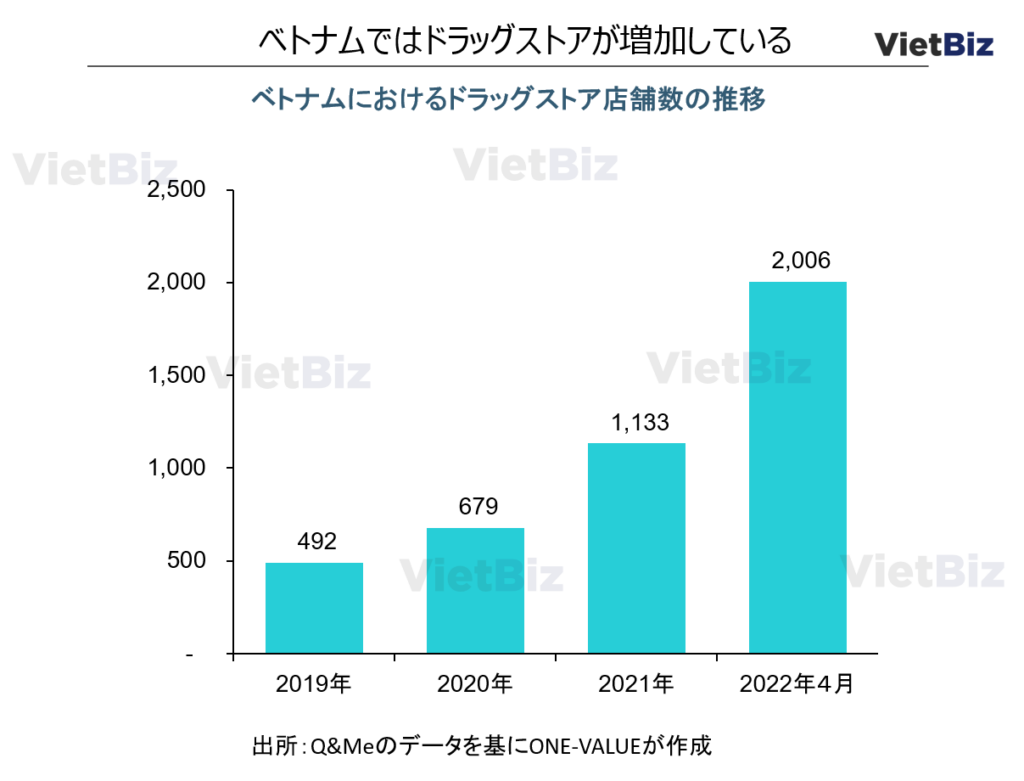

Pharmacies

Starting in 2019, the number of drugstores in Vietnam is growing rapidly: as of 2019, there were 492 drugstores across the country; by April 2022, this number will quadruple to 2,006. comparing the number of stores from 2021 to April 2022, there is a 77% increase, so especially It can be said that the number of drugstores is rapidly increasing after 2021.

The largest drugstore in Vietnam is Pharmacity, which operates 1,000 stores nationwide. The next largest drugstore is Long Chau under FPT, which operates 535 stores nationwide; the third largest is An Khang Pharmacy, with 210 stores. Matsumotokiyoshi is the only Japanese-affiliated drugstore with two stores in Ho Chi Minh City.

Traditional Trade in Vietnam

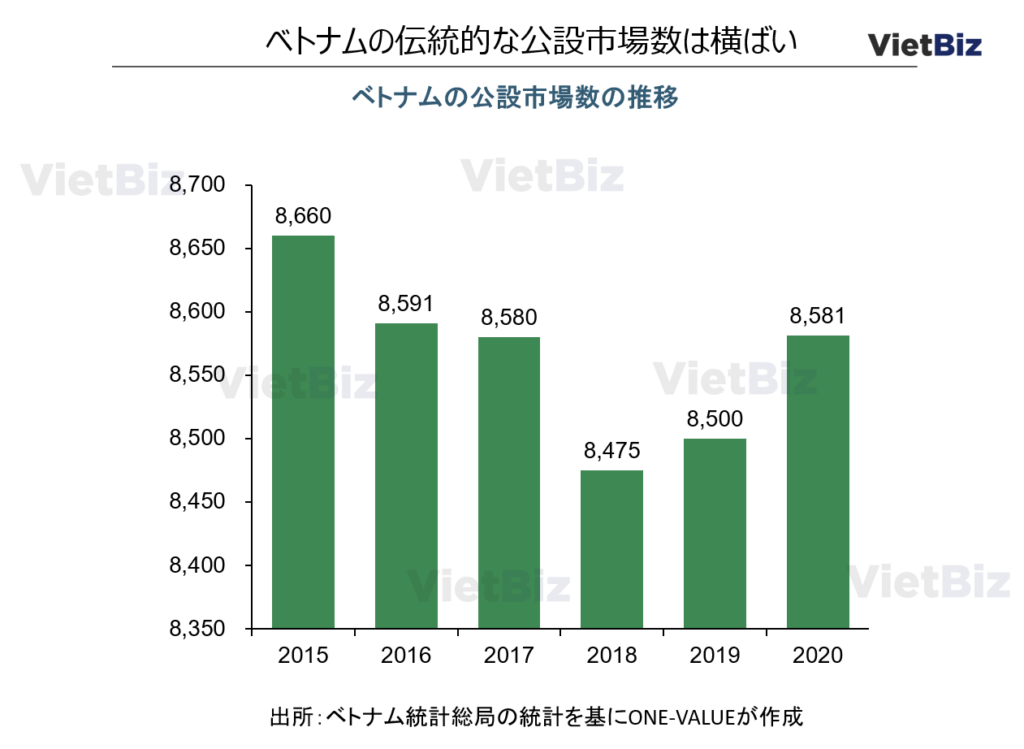

Traditional trade in Vietnam is the dominant sales channel, accounting for about 80% of the retail market; between 2015 and 2020, the number of public markets across Vietnam hovered around 8,600; it has increased in the three years since 2018, but not to the peak on the graph, 2015. In addition, since Vietnam was most affected by the Corona disaster in 2021 after this time, it is unlikely that the number of public markets will increase significantly in the future, and modern trade is still expected to continue in Vietnam in the future.

Traditional trade in Vietnam includes not only public markets, but also papermaker stores and other retailers. Outside of metropolitan areas, especially in rural areas, mom-and-pop stores are the most numerous sales channel.

According to Nielsen, there are 1.4 million mom-and-pop stores in Vietnam. The new coronavirus has severely affected the business activities of mom-and-pop stores and general stores across the country, but they are expected to recover well in the near future because they offer convenient and fast shopping within a short distance. On the other hand, some traditional mom-and-pop stores and general stores are now introducing technology and modernizing their operations.

Measures to Develop Sales Channels in Vietnam

In this chapter, we list two relatively inexpensive ways to enter the Vietnamese market.

Matching Events

There are many private companies that support business matching between Japan and Vietnam. On the other hand, the Japanese government also organizes exhibitions and business meetings, which are supported by JETRO (Japan External Trade Organization). Various types of events are planned and held to match Vietnamese companies with Japanese companies, such as seminars for cultural and technological exchanges, and introduction and matching of local specialties and products.

出所:ベトナム商工省EC・デジタル経済局

Collaboration with Buyers

At this stage, few Japanese companies have a deep understanding of the Vietnamese market and Vietnamese consumers. Therefore, it is very difficult for most Japanese companies to sell Japanese products in Vietnam on their own.

Therefore, cooperation with local Vietnamese companies is effective. In recent years, OEM manufacturing, for example, has been attracting attention.

On the other hand, now that EC is growing rapidly in Vietnam, collaboration with individual buyers in Vietnam is considered one of the most promising methods. Influential individual buyers on the Internet promote their products on Facebook, TikTok, YouTube, etc., and sell them through cross-border EC. By collaborating with individual buyers with high transmission ability, new sales channels in the Vietnamese market can be developed.

Developing Sales Channels for Japanese Products in Vietnam

This chapter examines the current status of Japanese products in the Vietnamese market, issues to be addressed, and key points for developing sales channels.

Promotion of Japanese products

Japanese products have long been very popular in Vietnam. However, there are some Japanese products that, although good, are not well known by the Vietnamese people because of marketing stumbles and lack of brand recognition. Therefore, it is very important to get people to fully understand the value of a product before selling it in Vietnam. In such branding and sales channel development, there are, for example, the following ideas.

Use of KOL Marketing

It is a fact that word of mouth has a significant influence on Vietnamese people’s decision to purchase products; according to a Nielsen survey, 90% of Vietnamese people trust word of mouth from relatives, friends, and acquaintances more than advertisements. Therefore, it is more effective to advertise products through KOLs (Key Opinion Leaders), who have a small group of fans, as well as through mass advertising, to reach consumers more effectively.

In-store Tasting

This is a form of promotion frequently used by supermarkets. It allows the company to collect information directly from consumers at the point of sale, such as taste preferences, desires for new products, etc. Based on this information, manufacturers can develop more precise sales strategies.

Cultural Exchange Events

Hold events like the so-called “Japan Fair” to advertise products while promoting cultural exchange between Japan and Vietnam. This can improve the customer experience while providing product information to those attending the event.

出所:現地メディア Nguoidothi.net

In developing sales channels for Japanese products in Vietnam, consideration should first be given to developing them through modern trade sales channels, with flexible promotion. However, in the long term, products should be designed and supplied on the premise of local production or product prices that meet local needs. The ideal sales channel development is to start development in the modern trade and then to be handled in the traditional trade as well.

Many of these factors are common not only to Vietnam, but also to overseas business in general.

Why Are Japanese Products So Popular?

For a long time, Vietnamese consumers have had a strong affinity for Japanese-made products such as automobiles, motorcycles, televisions, refrigerators, and washing machines. Although not many Japanese-made daily consumer goods (FMCG) are purchased compared to those made in Thailand, China, etc., in recent years, more attention has been paid to Japanese-made daily consumer goods. There are three reasons why Japanese-made products are preferred in Vietnam, for example

High Quality

Even in Vietnam, Japanese products are recognized as being of high quality. Many Vietnamese associate Japanese-made products with high technology and high durability. Vietnamese consumers have a high level of confidence in Japanese products, especially in the aforementioned home appliances and automobiles.

Luxury Image

In Vietnam, products imported from Japan are generally more expensive than those produced domestically or imported from China. Because of their high quality and high prices, many Vietnamese perceive Japanese products as luxury goods. For this reason, Japanese products are often given as souvenirs and gifts in Vietnam. Currently, as the standard of living in Vietnam improves, there is also a tendency to treat oneself to Japanese products. The beautiful packaging has also influenced the formation of a luxurious image of Japanese products. Several stores and e-commerce sites specializing in Japanese products can also be found.

High Level of Health and Safety

Vietnamese awareness of safety and hygiene has increased in the wake of the Corona disaster. In particular, products with high safety and hygiene standards are gaining in popularity, especially for food, health care, beauty, and baby care products. For example, many products made in Vietnam are unclear about the ingredients and pesticides contained in the products. Since high safety and hygiene standards and traceability are the strengths of Japanese products, Japanese-made food, health care, beauty, and baby care products are highly favored in Vietnam.

出所:現地メディア sipromi.com

Localization for Vietnamese

Although Japanese products have many strengths, the tastes of Japanese and Vietnamese consumers are still different, and the deciding factors for purchase are also different. Therefore, before entering the Vietnamese market, you should understand the characteristics of the Vietnamese market and Vietnamese consumers in advance. It is very important to have a deep understanding of the target market and consumers, and then customize your products for the Vietnamese. The characteristics of Vietnamese consumers include, for example

Eating Habits

Vietnam is a long country stretching from north to south, and the seasoning of dishes differs somewhat from region to region. People in the northern part of the country use light flavors with less sweetness and saltiness. The dishes in the central region are the spiciest. Southern dishes are sweetly seasoned. Japanese food is often perceived as a bit salty by the Vietnamese. When Japanese companies enter the Vietnamese market, they should adjust their products to meet Vietnamese tastes according to these differences.

Putting Children First

Vietnamese parents generally provide the best for their children as much as possible. This is of course true in Japan as well, but in Vietnam the trend is even stronger, and the cost of children’s education and other expenses are increasing every year. When purchasing food, clothing, toys, baby care products, etc., product quality and safety are more important factors than price. Therefore, made-in-Japan products are the choice of many Vietnamese mothers.

Increased Interest in Beauty

In Vietnam, women as well as men are increasingly interested in beauty. Spending on beauty is also increasing, and demand for higher quality beauty products is high. Korean companies hold a high share of the beauty market. Japanese beauty products are also diverse, but it is believed that there are still few products that match the tastes of Vietnamese consumers.

Summary

As a prerequisite for developing sales channels in Vietnam, it is important to understand the country and the Vietnamese people.

This report provides an overview of sales channel development in Vietnam, an environment that is different from that of Japan. There are many factors to consider, such as the penetration of modern trade and increased awareness of health issues. Careful market research and collaboration with local firms are essential to achieve good results.

【関連記事】ベトナムでの販路開拓に関連する分野ついては、こちらの記事も合わせてご覧ください。

ベトナム市場調査レポート一覧はこちらからもご覧頂けます。

ベトナム市場の情報収集を支援します

ベトナム市場での情報収集にお困りの方は多くいらっしゃるのではないでしょうか。

VietBizは日本企業の海外事業・ベトナム事業担当者向けに市場調査、現地パートナー探索、ビジネスマッチング、販路開拓、M&A・合弁支援サービスを提供しています。

ベトナム特化の経営コンサルティング会社、ONE-VALUE株式会社はベトナム事業に関するご相談を随時無料でこちらから受け付けております。