Introduction:Overview of Big Data Utilization in Vietnam

In Vietnam, an increasing number of companies are promoting the use of big data, particularly in the retail and financial industries. Although one may have the impression that data utilization does not seem to be advanced in Vietnam, significant changes are actually beginning to take place, and the way big data is perceived is not much different from that of Japan.

For example, in Vietnam, electronic payment is becoming available not only at convenience stores and supermarkets but also at traditional markets. This is because in the past, market sellers have conducted business by handing over cash for the purpose of tax evasion, etc., but in some areas, customers are being turned away due to the unavailability of electronic payment.

Thus, Vietnamese retailers are focusing on promoting the use of data, as it is expected to enable them to collect information in traditional markets, which was not possible before.

This report will provide a comprehensive introduction and explanation of Vietnam’s big data and data utilization business, including an overview, government policies, case studies by industry, and company movements.

Vietnamese Government Policy

This chapter provides a timeline of the Vietnamese government’s views and policies on big data.

Resolution 124/NQ-CP: (Resolution of the responsible ministries on industrial development up to the years 2030 and 2045)

In September 2020, the Vietnamese government issued Government Resolution No. 124/NQ-CP on “Decision of the Responsible Ministries on Industrial Development Policies to 2030 and 2045”.

This resolution determines the ministries that will be in charge of actions essential for industrial development until 2030 and 2045. In this resolution, as it relates to big data projects, the Ministry of Commerce and Industry will be in charge of “the establishment of large industrial data centers at a level capable of performing database construction, analysis, and evaluation of companies and industrial products and able to withstand the load of efficient access by companies as needed,” and the Ministry of Information and Communication The Ministry of Information and Communication is to be in charge of the development of the “National DX Strategy” system by 2025, followed by the development of a large-scale data center by 2030.

Prime Minister’s Decision No. 749/QD-TTg:.

In Decision 749/QD-TTg, the Prime Minister specifically sets out the challenges and solutions regarding the national DX program as follows (Excerpts and translations of only the parts related to Big Data)

Develop digital government: apply the latest technology of social media to provide information and administrative services in a highly convenient manner. Promote big data analysis, artificial intelligence, VR, and AR to implement comprehensive DX in all aspects of the direction and management of state institutions and provide a superlative user-friendly system.

Development of the digital society: coordinate and expand training programs at graduate, university, and professional schools related to digital technologies such as artificial intelligence (AI), data science, big data, cloud computing, IoT, VR, AR, blockchain, and 3D printing.

In addition to these, the Vietnamese government has decided to replace paper ID cards with cards with IC chips, and has distributed these cards to about 50 million people, more than half the population, in just six months. The Vietnamese government expects to collect information from these cards and use it to manage the lives, health, and medical care of its citizens.

Thus, in Vietnam, the government is also actively promoting DX, including the collection and utilization of big data.

Big Data Application Trends in Vietnam

The use of big data in Vietnam generally began to spread around 2015. While the history is short, Vietnam has already seen examples of big data utilization in a wide range of fields.

This chapter will introduce examples of big data applications in Vietnam by sector.

Retail

Although not limited to Vietnam, big data is often used for inventory management in the retail industry. By using big data to predict what products will sell well, the aim is to improve the accuracy of product inventory adjustments and ensure efficient supply without excesses or shortages. It is now possible to accurately synchronize and list information at each stage of the supply chain, including production, distribution, and sales.

Big data can contribute not only to inventory management, but also to the formation of flexible customer service and promote an improved customer experience. For example, chatbot systems in e-commerce, etc. can collect and analyze customer data from conversations to accurately capture consumer needs.

In Vietnam, we can see companies that have already established such a system.

Insurance and Social Security

The Vietnam Social Security Administration (VSS), which administers social and health insurance, is building an “Ecosystem 4.0” to provide more advanced services to its policyholders. This ecosystem includes a centralized and localized information technology system, multi-platform software applications, etc. Based on a database, the VSS comprehensively manages policyholders, the insurance enrollment process, and insurance policies.

In 2021, the entire insurance industry in Vietnam will have about 30 application systems, a database of about 98 million people (equivalent to about 28 million households nationwide), more than 12,000 medical testing and treatment facilities, and more than 500,000 organizations, companies and ministries nationwide using public services.VSS, constantly improving its technological infrastructure, the national insurance database, basic services (identification, dialogue, customer care, risk management, and security), and the software that serves participants. In particular, it is using a new approach, data mining, to improve the social security system.

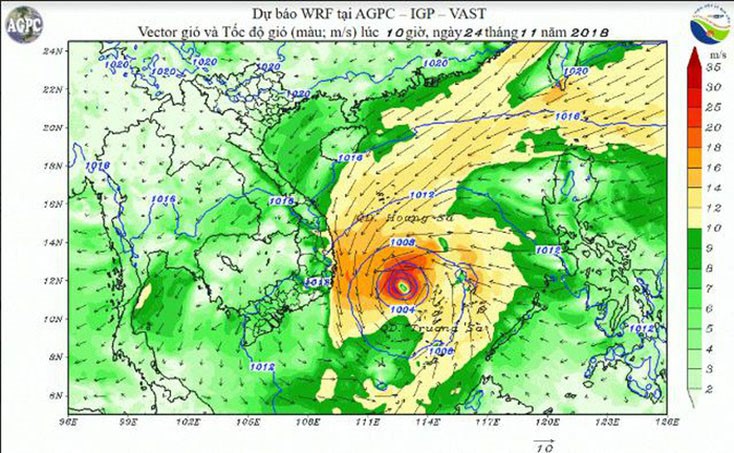

Disaster and Climate

Every year in Vietnam, natural disasters affect an average of more than 400 human lives and cause material losses of about 0.5% of GDP, affecting not only the environment and living conditions, but also the economy and society, and significantly impacting the country’s sustainable development . In the coming years, Vietnam is at high risk of encountering natural disasters, with losses accounting for 2.7% of GDP and an estimated 39 million Vietnamese people being affected.

Advanced technologies are beginning to be applied to predict and warn of various types of natural disasters, including numerical models to predict floods, droughts, salt damage, storms, landslides, and flash flood warnings; satellite-based disaster warning monitoring systems; disaster monitoring systems with on-site meters connected by IoT systems; and big data.

In Vietnam, about 80% of casualties and missing persons due to disasters are caused by floods and wind storms. In response to this, further utilization of rainfall data from the TRMM/GP satellite system is expected. It will be possible to observe damaging storms in Vietnam from the sea in three dimensions and to accurately determine the horizontal and vertical distribution structure of rainfall areas and changes in the developing and moving fields.

Traffic

The Vietnam Road Department (DRVN) is collecting big data and deploying and building the following database systems. Route monitoring system, vehicle load control system, driver license system, road asset management system (VRAMP, LRAMP), pavement management system (PMS), bridge management system (VBMS, LBMS), and toll monitoring system.

In the field of road traffic management, the “Digital Map Based Current Monitoring and Speed Control” system is an efficient traffic management, data mining and control system that includes receiving, monitoring, recording and analyzing data and generating reports according to DRVN and local management requirements. To date, the system has integrated data from more than 650,000 vehicle trips nationwide. Traffic congestion in urban areas of Vietnam is already a pressing issue, and the system is expected to improve the lifestyle of the Vietnamese people.

For vehicle management, a driver license management database system has been established to manage learners from registration to license issuance. Currently, driver license data, including approximately 6 million motor vehicle driver licenses and more than 15 million motorcycle driver licenses, has been consolidated in the DRVN, and an electronic driver license management website has been established to assist in the collation and retrieval of information on driver licenses and driving violations. The Ministry of Transportation and 63 provinces and cities have implemented Level 3 public services for driver license changes, with more than 48,000 driver license changes made to date. Level 4 public service on issuing international driver’s licenses has been implemented, with more than 6,500 international driver’s licenses issued so far. In Vietnam, online public services are classified as Level 1~4, with 4 being the highest and 1 being the lowest.

The vehicle load management system has been built and operated by DRVN since 2013. To date, the centralized vehicle load data monitoring and management software system is connected to 67 vehicle load control stations. The 45 vehicle load control stations, both mobile and fixed, process an average of more than 60,000 vehicle load control polls daily and serve as a data source for statistics and reporting on the status of vehicle load control for state management agencies.

In road management and maintenance, DRVN implemented the Vietnam Road Asset Management Project (VRAMP) with ODA from the World Bank. In particular, the road surface survey system (PMS) collects data on more than 22,000 km of national roads managed by road management departments and local authorities. For the Vietnam Bridge Management System (VBMS), the bridge management database includes aggregate data for over 6,000 bridges on the national road network and real-time information for 3,900 bridges in some management areas. A similar system is implemented for local road bridges (LBMS).

DRVN will deploy many other systems. An example is a cable-stay bridge monitoring system at four major bridges in Bai Chay, My Thuan, Rach Mieu, and Can Tho. The system provides indicators of factors affecting bridge structure, such as wind, rain, humidity, fog, earthquake, temperature, expansion, vehicle loads, and cable tension. Experts analyze and proactively plan timely maintenance work based on data collected by the report extraction software.

Smart Agriculture

Nguyen Thi Thu Thuy of the Department of Science, Technology, and Environment of Vietnam’s Ministry of Agriculture and Rural Development said that the agricultural industry is beginning to focus on DX solutions and application development in most sectors.

In agriculture, IoT and big data technologies are beginning to be applied through digital technology products such as software that can analyze data about the environment, plant types, and growth stages.

In large-scale livestock production, technologies such as IoT, blockchain, and biotechnology are widely applied. In dairy farming, the large companies TH True Milk and Vinamilk are the most active users of digital technologies.

In forestry, barcode DNA technology in the management of forest varieties and forest products, GIS technology for early detection and warning of forest fires, and monitoring software for deforestation and forest degradation are widely used.

Fisheries are also becoming increasingly digitalized with the use of ultrasonic fish finders, flow meters, satellite phones, seine receivers, net retrieval and release systems, GIS technology, and global positioning systems (GPS) to manage offshore fishing fleets. In addition, selective biotechnology, breeding of high-yield and high-quality varieties, recirculating aquaculture systems (RAS), biofloc technology (BT), nanotechnology, cage culture technology, and cold-water fish farming technology are also being applied.

Artificial intelligence technology is used in shrimp farming to analyze data on water quality, feed management, and shrimp health. Automation technology is widely applied in seafood processing, helping to reduce production costs and ensure the quality of marine products.

On the other hand, there are also scattered issues such as securing smart agriculture human resources, diffusion of technology to small and medium-sized enterprises, and lack of infrastructure, and foreign companies are expected to enter the market.

EC

In Vietnam, the economic value created by the application of digital technology to commerce reached VND81 trillion in 2017, with the prospect of reaching VND953 trillion by 2030. According to the draft National Data Strategy, which outlines Vietnam’s vision to 2030, the Vietnamese government aims for the digital economy to contribute 5% of GDP.

Vietnamese companies are concerned with how to obtain the reliable data they need to plan and execute their business development. While the investment potential is undisputed for large companies, the challenges of collecting and utilizing data are more complex when doing business with SMEs.

SMEs can ascertain customer satisfaction with their current services by simply paying attention to simple metrics such as orders, return rates, average length of purchase, and purchase amounts.

In addition, with the proliferation and “openness” of POS systems and EC platforms, the cost of maintaining data collection and analysis systems is much lower than in the past. The use of data in advertising is also expected to become more sophisticated, and marketing in Vietnam is expected to become more complex in the future.

Medical Care

Vietnam is said to have all the potential factors for the development of a digital health technology market. This is because Vietnam’s population has the right demographic characteristics for digital transformation in the healthcare sector. Vietnam is one of the countries in Asia with a relatively aging population. According to statistics from the Ministry of Health, there were approximately 57 million consultations and treatments of the elderly in 2018, accounting for 34% of all consultations and treatments nationwide.

The use of big data is widespread in Vietnam’s healthcare industry. Software such as electronic medical records (EMR), clinical decision support (CDS), diagnostic imaging (medical imaging), and genetic data (genomics) have enabled doctors to quickly assess each patient’s health status and provide timely treatment.

Furthermore, the use of big data in the healthcare industry will make it easier than ever to monitor health conditions at home. Analyzers that detect health conditions in real time will make it possible to provide prescriptions that are better suited to each individual patient.

Banking & Finance

Vietnam’s banking and finance industry has new development opportunities through the use of big data. Machine learning combined with big data is constantly providing guides on spending, saving, and investing, allowing for accurate personalization.

Viettinbank, for example, is integrating and building its data infrastructure through data warehousing, Business Intelligence (BI), and Master Data Management (MDM). This proves that the banking industry is on the right track in appreciating the potential of big data and growing stronger than ever. With risk modeling, fraud detection, and customer segmentation, banks can also detect credit risk and screen customers.

By understanding their customers through data analysis, banks can offer new services. There are examples of personalizing products for each customer, screening credit cards, and offering loans to specific customers in a timely manner.

For example, VIB (Vietnam International Commercial Joint-Stock Bank) applies AI and Big Data, as well as the latest technologies such as e-KYC (Electronic Know Your Customer) and e-Signature at a high level in the credit card issuance and approval process. VIB has reduced the processing and approval time for the e-card version to only 15 to 30 minutes (1/500th of the market average).

Furthermore, by using data to analyze customer behavior, product proposals can be made based on financial information and consumer behavior to create more optimal product solutions for both the customer and the bank.

For example, TPBank saw an 87% year-on-year increase in the number of customers registered to use its online banking services during the period January~May 2022. In particular, thanks to the introduction of the comprehensive e-KYC method in the TPBank application, the number of customers who opened accounts through e-KYC increased by 790% during the same period. The number of online transactions at TPBank also increased significantly. Currently, the number of online transactions accounts for 92% of the bank’s total number of transactions.

Movement of Vietnamese Companies

Three large companies that are particularly strong proponents of big data and data utilization in Vietnam are Vingroup, FPT Software, and Viettel.

Vingroup

Founded in 1993, Vingroup is the largest conglomerate in Vietnam and is currently expanding its business into real estate development, electric vehicle production, healthcare, and education, while promoting the consolidation and reorganization of its businesses.

In September 2021, Vingroup Corporation (VIC) established VinBigData, with a charter capital of approximately VND471 billion, 99% of which was contributed by Vin Group. VinBigData has registered 25 business areas, of which scientific research and technology development are the two main areas.

Bin Big Data will operate on a laboratory-company model, focusing on three core areas: basic research, applied product development, and science and technology funding and training. Major research themes include computational biomedicine, speech and language processing, computer vision, and medical image processing.

The VinBig Data ecosystem includes VinGen, a genomic data analysis platform that supports precision medicine; VinBase Language, a suite of products developed from natural language processing technology; VinBase Vision, a platform that supports information identification, analysis, and extraction; and VinDr, an integrated artificial intelligence platform on medical image collection and transmission systems.

Binh Big Data has a team of more than 200 engineers and scientists with a long-term vision to contribute to the lives of Vietnamese people by mastering core technologies and developing Vietnam’s leading technological products from international research projects.

In December 2021, Bin Group introduced ViVi, a virtual assistant researched and developed by Bin Big Data, which will be installed in the smart EVs of VinFast, a car manufacturer operated by Bin Group, and will play the same role as Siri, Alexa, and Google Assistant It has the same role as Siri, Alexa, and Google Assistant.

FPT Software

FPT Software (a group company of FPT Corporation) is a leading DX-driven Southeast Asian technology company with 57 offices in 26 countries.

In June 2020, FPT Software established Trandata, a group company specializing in data application research and providing data platforms for the Vietnamese market. Through the application of big data, artificial intelligence, and blockchain technology, Trandata aims to apply data in various sectors such as banking and finance, e-commerce, education, health, and many other industries.

On January 19, 2022, Trandata signed a strategic business cooperation agreement with True Data Corporation, which owns a big data platform that handles consumer purchasing data for 60 million consumers, one of the largest in Japan.

Through this partnership, the two companies will conduct research on Vietnamese consumers’ consumption behavior toward Japanese products and forecast the Vietnamese retail market, and jointly promote business expansion and the development of technological solutions. Specifically, True Data will make a large investment in Trandata to expand its data business in the Vietnamese market, focusing on big data technology.

Viettel

Viettel, established on June 1, 1989, is a state-owned company owned by the Vietnamese Ministry of National Defense and is the largest mobile telecommunications operator in Vietnam. Currently, Viettel has investments and operations in 13 countries in Asia, the Americas, and Africa, and its business target is 270 million people, or about three times the population of Vietnam.

On December 18, the Vietnamese Ministry of Information and Communications launched the Viettel Data Mining Platform (Viettel Data Mining Platform).

Viettel Data Mining Platform applies the world’s most advanced technologies, for example Big data processing technology, continuous data (big data, streaming data), social network data aggregation (crawler) technology, Vietnamese natural language processing technology (NLP), optical character recognition (OCR), data mining technology for data analysis, statistical algorithms, machine learning, etc. In.

Viettel Data Mining Platform can specifically perform forecasting, risk analysis, and anomaly detection in business management. For example, detecting financial fraud, preventing industrial accidents, avoiding property loss, and minimizing inventory.

The Viettel Data Mining Platform is currently deployed in organizations such as the Bureau of Statistics, 14 provincial and municipal offices, Viettel Construction, and PC1 Group.

Market Scale of Data Centers in Vietnam

A data center is a facility dedicated to the installation and operation of servers and other types of computers and communications equipment, and is considered one of the most important IT infrastructures.

In Vietnam, the development of big data is inextricably linked to the development of data centers, as the country has a law that allows data collected domestically to be stored domestically.

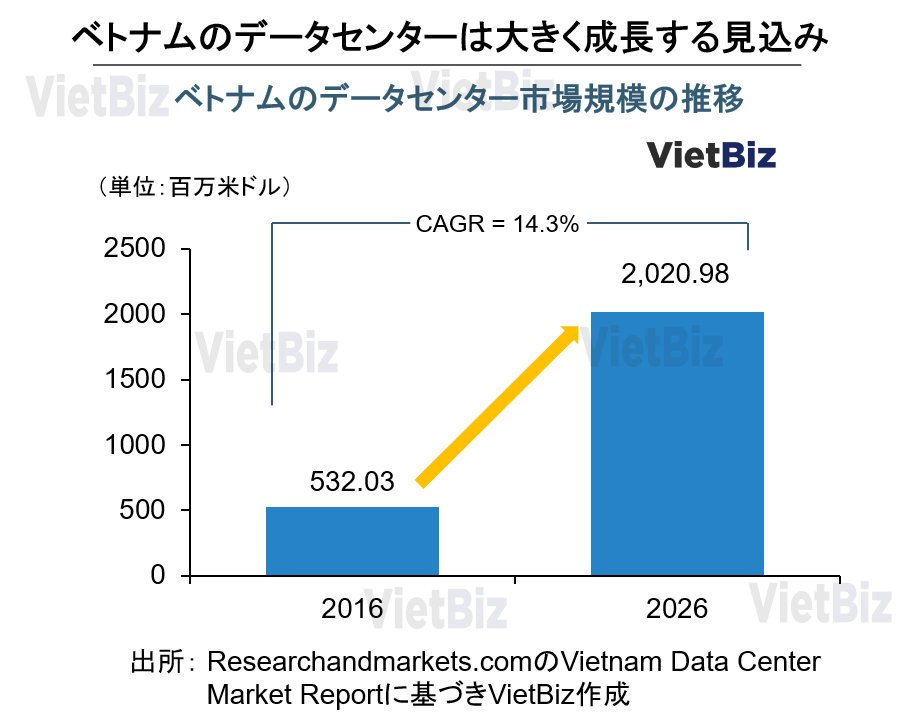

Vietnam’s data center market size was USD 856 million as of 2020; it was USD 532.23 million in 2016, so it has grown by about 60% in four years.

The future data center market in Vietnam is expected to grow at an average annual rate of over 14.64% until 2026, when it is projected to reach approximately USD 2 billion.

According to ResearchAndMarkets, Vietnam is rated as one of the top 10 emerging markets in the global data center industry, with impressive growth and the ability to provide services at international standards.

Thus, as Vietnam’s data centers are growing rapidly, the use of big data is expected to grow rapidly at the same time.

Vietnam’s data centers by solution are classified into IT infrastructure, general infrastructure, electrical infrastructure, mechanical infrastructure, and other infrastructure, with IT infrastructure accounting for 65.62% of the total due to increased demand. By type, the data centers are categorized into enterprise and web hosting. Enterprises accounted for 64.56% of the total and is expected to continue to grow due to the increasing demand for data storage solutions among enterprises. By end-user industry, this segment includes IT and telecommunications, government, BFSI, healthcare, and others.

Summary and Future Outlook

In Vietnam, the use of big data is being promoted in many industries, including retail. In addition to business aspects, there are many government-led examples of big data utilization in highly public areas such as healthcare, social security, and other public administration.

Big data utilization in Vietnam is being led primarily by large, industry-leading companies, and is not yet common among small and medium-sized enterprises. However, as the size of the data center market indicates, the use of big data in Vietnam as a whole is expected to continue to grow.

【関連記事】ベトナムのIT分野については、こちらの記事も合わせてご覧ください。

ベトナム市場調査レポート一覧はこちらからもご覧頂けます。

ベトナム市場の情報収集を支援します

ベトナム市場での情報収集にお困りの方は多くいらっしゃるのではないでしょうか。

VietBizは日本企業の海外事業・ベトナム事業担当者向けに市場調査、現地パートナー探索、ビジネスマッチング、販路開拓、M&A・合弁支援サービスを提供しています。

ベトナム特化の経営コンサルティング会社、ONE-VALUE株式会社はベトナム事業に関するご相談を随時無料でこちらから受け付けております。