- Introduction

- Laws Constituting the Vietnamese Accounting System

- Differences between Vietnamese and Japanese Accounting Systems

- Conclusion

- ベトナム市場の情報収集を支援します

Introduction

Accounting systems differ from country to country, and in the case of Vietnam, the Vietnam Accounting Standard (VAS) is used.

As of 2022, all enterprises established in Vietnam will be required to record their financial transactions in accordance with the Vietnamese Accounting Standards (VAS), and all financial information, including the Annual Report, to be disclosed by the enterprise will also have to be prepared in accordance with the VAS.

Therefore, understanding Vietnamese accounting standards is essential knowledge, especially when doing business in Vietnam. In this article, we would like to explain the differences between Vietnamese accounting standards and Japanese accounting standards, as well as points that Japanese businessmen should keep in mind.

【関連記事】ベトナムの会計基準を基に、VietBizではベトナムの代表的な企業の財務分析を行っています。本記事と併せてぜひご覧ください

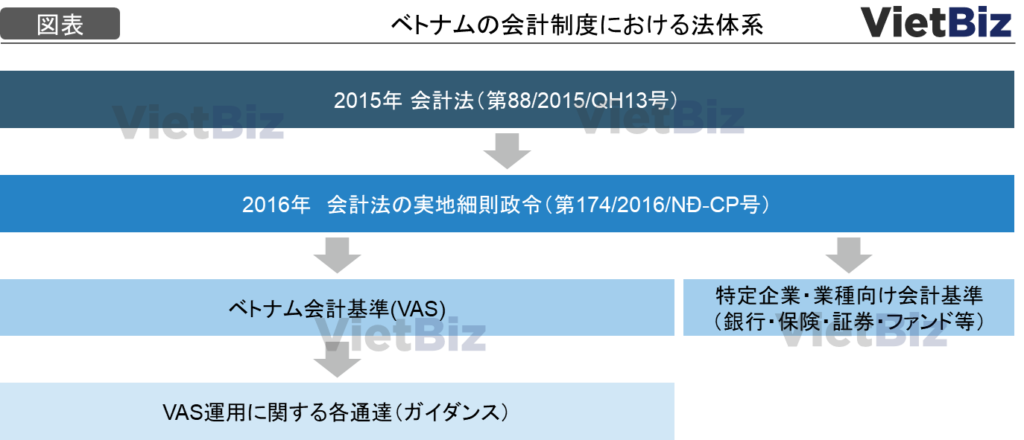

Laws Constituting the Vietnamese Accounting System

Before describing the details of the accounting system, an overview of the laws that form the system will be provided. Vietnam’s accounting system is considered to be based on International Financial Reporting Standards (IFRS), and plans are underway under the Ministry of Finance to require listed companies and large enterprises to adopt IFRS by 2025.

Accounting Law (No. 88/2015/QH13)

The most senior law that sets the framework for Vietnam’s accounting system is the Law on Accounting (No. 03/2003/QH11), which was enacted in 2003. This Accounting Law was revised in 2015 and is now known as the Accounting Law (No. 88/2015/QH13).

The 2015 Law revised the 2003 Accounting Law, which previously stated that all assets should be recorded at cost, so that financial instruments, monetary assets denominated in foreign currencies, and assets and liabilities with significant price fluctuations as determined by the Ministry of Finance, can be revalued at fair value at the end of the period.

Practical Detailed Regulations Decree of the Accounting Act(No. 174/2016/NĐ-CP)

In addition, the detailed regulations that explain the Accounting Law in more detail, such as the method of keeping accounting documents, accountants, chief accountants, etc., are stipulated in Decree No. 174/2016/NĐ-CP on the Detailed Regulations for the Implementation of the Accounting Law.

Vietnamese Accounting Standards (VAS)

A total of 26 accounting standards were issued between 2001 and 2005. These VASs are the Japanese equivalent of “Accounting Standards” and the European equivalent of “IFRS,” and are the totality of accounting standards.

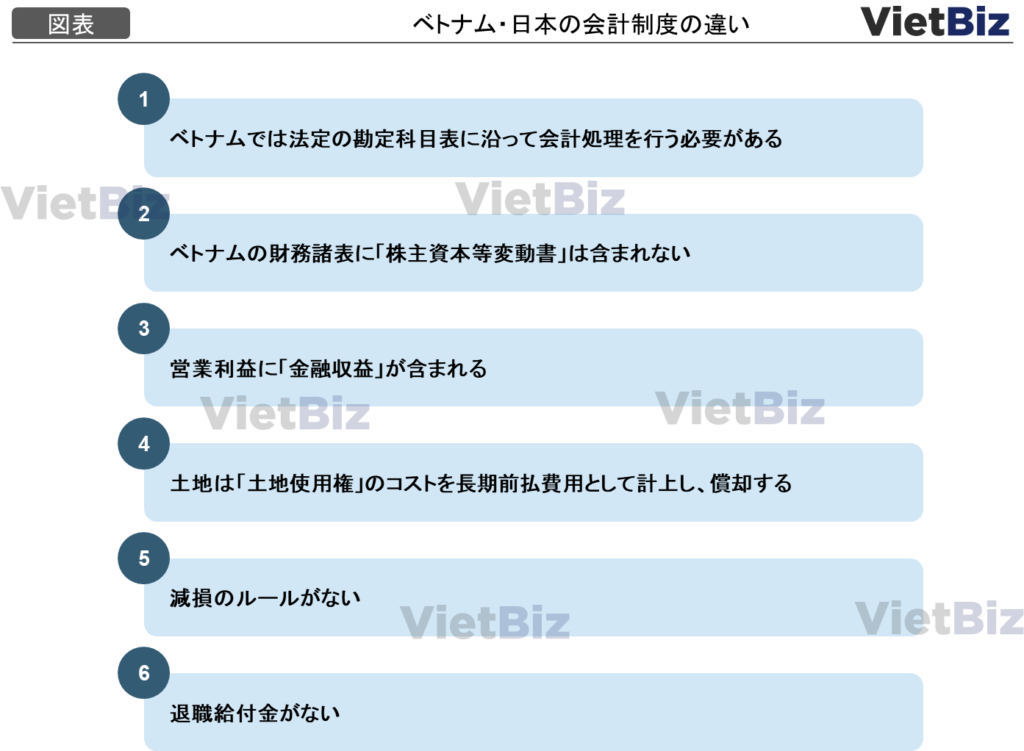

Differences between Vietnamese and Japanese Accounting Systems

In the following, we would like to explain what differences exist between the Vietnamese and Japanese accounting systems. In this article, we will explain six differences and points to note that are particularly important in practice.

There Is A Statutory Chart of Accounts in Vietnam.

In Vietnam, there is a statutory chart of accounts established by the government, with a specific account code for each account. All enterprises in Vietnam are required to record according to this chart of accounts and account codes.

Even in Japan, there are account codes determined by the Japanese Industrial Standards (JIS) and each accounting software, but the application of these codes is solely at the discretion of the company. The fact that the chart of accounts is set by the government is a major feature of Vietnamese accounting standards.

We hope you will find the list of account codes for Vietnam downloadable below.

Advantages of A Defined Chart of Accounts

A unified chart of accounts has the advantage of making it easier to compare financial information among companies. In Japan, financial statement items may differ slightly from company to company. In Vietnam, however, all accounts are standardized, so there are no differences among companies.

No Statement of Changes in Stockholders’ Equity

In Japan, financial statements consist of four major components: (1) Balance Sheet (BS), (2) Profit and Loss Statement (PL), (3) Cash Flow Statement (CF), and (4) Statement of Changes in Net Assets.

Therefore, in order to see the movement of shareholders’ equity, it is necessary to extract information from other financial statements and perform calculations separately. This is a major disadvantage in reading financial information.

Operating Income Includes “Financial Income”.

In the Japanese income statement, “operating income” is derived by subtracting general and administrative expenses from “gross profit,” which is sales minus cost of sales, while in the Vietnamese income statement, “financial income” and “financial expenses” are added to operating income.

Financial income and expenses are mainly income and expenses from financing activities carried out by the entity and include gains (losses) from stock transfers, interest income from loans receivable, and foreign exchange gains (losses).

Operating profit can be described as “the profit earned by a company from its core business,” but it is clear that in Vietnam, financial activities are also considered part of a company’s core business.

Land Is A Right of Use, So It Is Recorded as A Long-term Prepaid Expense and Amortized

The basic premise is that land ownership by private individuals, whether foreign or domestic, is not allowed in Vietnam. Article 53 of Vietnam’s Constitution (2013) also stipulates that “land is public property belonging to the ownership of all the people, and the State shall represent the owners and manage it in a unified manner.

Therefore, when a company uses land in Vietnam, it purchases “land use rights” with a fixed term. The purchased “land use right” is capitalized as a long-term prepaid cost and amortized every fiscal year.

On the other hand, in Japan, “land” is recorded at its acquisition price and is not depreciated, so it is important to note that accounting methods in Japan and Vietnam are fundamentally different.

Points to Keep in Mind When Accounting for Land Use Rights

The accounting treatment of land use rights, which is unique to Vietnam, can have a significant impact on financial statements. For example, consider an example of purchasing a 50-year land-use right for 100 million yen and selling it for 100 million yen in the 25th year. Since the land-use right is depreciated, the value of the land-use right is half of its original value of ¥50 million at the 25th year. Since the land-use right is sold for 100 million yen, a profit of 50 million yen is recorded (this is often the case in Vietnam, as land values increase every year).

On the other hand, in Japan, land is recorded at its acquisition price all the time, so selling a 100 million yen piece of land for 100 million yen would result in zero profit.

Therefore, when analyzing Vietnam’s financial statements, it is necessary to closely examine what profits are included in a company’s “profits.

No Idea of Impairment

In Vietnam, no impairment accounting rules have been issued and, in fact, Vietnamese companies do not recognize impairment losses. While in Japan, impairment tests for real estate, equipment, and entire businesses are regularly performed and the fair value (true value) of assets and businesses is reflected in the financial statements, in Vietnam, even if a business is in shambles, no impairment is performed.

Points to Note Regarding the Absence of Impairment Accounting

Since there is no impairment accounting, when conducting financial due diligence in M&A, it is especially necessary to carefully check “whether the business/business is really generating cash. When calculating corporate value, it is necessary to carefully evaluate the business not only financially, but also by keeping the above points in mind.

In addition, the equipment owned by a company should be checked not only on the documents but also on site to confirm that it is really an asset.

No Retirement Benefits

In Vietnam, an unemployment insurance system was introduced in 2009, and retirement benefits are also paid from unemployment insurance. Therefore, companies pay regular unemployment insurance premiums for their employees, but are not required to record a provision for retirement benefits. Some companies also have their own retirement benefit plans, but they are not allowed to include the provision for such plans in their deductible expenses.

Conclusion

This article has described the major differences between the Vietnamese and Japanese accounting systems and standards. While there are some major differences as seen above, there are no differences that would have a significant impact on financial information, and there is no need to be overly nervous.

The major points of difference mentioned in this article are the depreciation of land use rights and the absence of impairment accounting. These points need to be carefully scrutinized in actual due diligence with the understanding that there are differences.

As mentioned in the first half of this report, Vietnam is currently in the process of introducing IFRS to its own country, and these differences are expected to converge in stages.

ベトナム市場調査レポート一覧はこちらからもご覧頂けます。

ベトナム市場の情報収集を支援します

ベトナム市場での情報収集にお困りの方は多くいらっしゃるのではないでしょうか。

VietBizは日本企業の海外事業・ベトナム事業担当者向けに市場調査、現地パートナー探索、ビジネスマッチング、販路開拓、M&A・合弁支援サービスを提供しています。

ベトナム特化の経営コンサルティング会社、ONE-VALUE株式会社はベトナム事業に関するご相談を随時無料でこちらから受け付けております。