- Introduction

- Overview of the animal feed market in Vietnam

- Status of Animal Feed Producers in Vietnam

- Trends in Animal Feed Production in Vietnam

- Vietnamese Government Policy

- Challenges for Vietnam’s Animal Feed Industry

- Solutions to Challenges in Vietnam’s Animal Feed Industry

- Summary

Introduction

Feed production is thriving in Vietnam. Vietnam is a major producer of animal feed in Southeast Asia, and the free trade agreement offers great opportunities for market expansion; by 2020, Vietnam will be the 10th largest producer of population feed in the world and the 1st largest producer of animal feed in Southeast Asia.

This page will provide a comprehensive introduction and explanation of animal feed in Vietnam. First, we would like to confirm the definitions of the terms used in this report. The term “animal feed” used in this report refers to feed for livestock and poultry farming, such as cattle, pigs, and chickens, and does not include aquafeed used in aquaculture.

Overview of the animal feed market in Vietnam

The production of animal feed for the population of Vietnam is on the rise: the production of animal feed for the population in 2019 was 18.9 million tons, increasing to 20.5 million tons in 2020 and further to 21.9 million tons in 2021.

The average growth rate of output is about 7-8%/year. Foreign (FDI) enterprises account for about 60% of the output, while Vietnamese enterprises account for about 40%. The breakdown of animal feed types is 55.8% for swine, 40.4% for poultry, and 3.8% for other animals.

Vietnam is currently the top producer of animal feed for its population in Southeast Asia and the 10th largest in the world. On the other hand, Vietnam still imports about 70-85% of its animal feed raw materials.

Characteristics of the animal feed market in Vietnam

This section will describe the characteristics of Vietnam’s animal feed market.

Most Raw Materials Are Imported.

According to the Vietnam Animal Industry Department (MARD), Vietnam’s annual demand for raw materials used in animal feed production is 33 million tons, but domestic procurement can only supply about 13 million tons (about 40% of the total), with the remaining 22.3 million tons imported from China, India, Europe and the U.S. 2021, Vietnam imported 700,000 tons of feed additives and supplements worth US$1 billion.

Dependence on foreign raw materials is a serious risk that can lead to price and quality instability. It also increases production costs and can lead to loss of initiative in production.

Vietnam is a major agricultural country, and many of its agricultural products, specifically rice, coffee, rubber, cashew nuts, and fruits, are among the world’s top producers and exporters. However, they have not led to much use as raw materials for animal feed.

Foreign Companies Do Not Invest in Areas Where Raw Materials Are Produced

Because the harvesting and preservation processes of many Vietnamese farmers are not well developed, the quality of the feed as a raw material is not up to standards, and foreign firms tend not to invest much in developing raw material production areas. Foreign-invested enterprises do not use Vietnamese raw materials and mainly produce animal feed with imported raw materials.

Intense Competition and M&A Trends

The new corona pandemic in Vietnam around 2020 and 2021 made it difficult for many feed manufacturing companies to procure raw materials. On the other hand, there were many mergers and acquisitions by foreign companies in the animal feed sector in Vietnam after the Corona disaster.

De Heus Group (Netherlands) acquired 14 feed mills from Masan Group (Vietnam), becoming the largest animal feed producer in Vietnam with 22 mills. There are many other foreign companies that have entered the market and competition is fierce.

Animal Feed Prices Fluctuate with World Prices

Since October 2020, the price of animal feed has continuously increased due to the impact of the new corona epidemic, with an average increase of about 35%. One of the reasons for this increase is that climate change has caused China to increase its collection of domestically produced grain. On top of this, the paralysis of global supply chains has caused transportation costs to skyrocket, driving up animal feed prices in countries like Vietnam, which imports many of its animal feed ingredients.

Processing Technology Is Advancing Day by Day

Most of the newly invested animal feed production lines in Vietnam are new, and many of them are from developed countries such as Europe and the United States. About 80% of production facilities producing animal feed have automatic or semi-automatic production lines and apply at least one ISO, HACCP, GMP or equivalent quality management system.

Uneven Distribution of Feed Mills

Most feed mills and facilities are concentrated in delta regions such as the Red River Delta, Southeast, and Mekong River Delta. In regions where it is geographically difficult to locate manufacturing bases, such as the northwestern and north-central regions, there are fewer feed mills, resulting in higher transportation costs for raw materials and lower volumes supplied to the market. On the other hand, sales prices of livestock products (pork, beef, eggs, etc.) are lower in these regions. Companies in these regions are mainly small-scale enterprises and outsource to larger companies.

Status of Animal Feed Producers in Vietnam

According to the Vietnamese Ministry of Agriculture and Rural Development, as of May 2022, Vietnam has 269 artificial feed production plants with a design capacity of over 41 million tons. Of these, 90 factories belonging to foreign firms account for 33.4% of the total, but 65% of the market share. On the other hand, there are 179 factories belonging to domestic enterprises (66.5%), accounting for only 35% of the market share.

60% of animal feed mills in Vietnam have invested in technology, including the introduction of automatic production lines; 20% of the mills have reached the semi-automatic level, while the remaining 20% are in manual production with a production capacity of less than 30,000 tons/year.

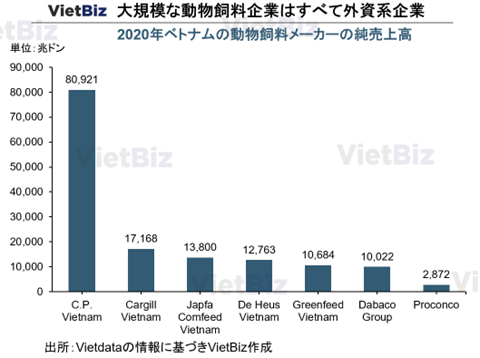

The large animal feed manufacturing companies are all foreign-funded, including C.P., Cargill, and Japfa, all of which have well-established management strategies and significant financial resources. A few Vietnamese-capitalized companies have performed well, but overall the performance of Vietnamese-capitalized companies is not very good.

Major Foreign Animal Feed Manufacturing Companies in Vietnam

This section introduces the major animal feed manufacturing companies operating in Vietnam mentioned above. All three companies listed below have excellent performance, indicating that the animal feed market in Vietnam is a large market.

C.P Vietnam (Thailand)

In 1993, C.P Group established the first animal feed manufacturing plant in Vietnam. By now, C.P Vietnam has the largest share of the animal feed market in Vietnam. In 2020, its sales reached VND80.091 trillion, up 25.1% from the previous year, and its after-tax profit reached VND18.896 billion, almost three times higher than the previous year.

Cargill Vietnam(U.S.)

Cargill is an American agricultural company that entered the Vietnamese market in 1995, and as of 2021, Cargill Vietnam owns 11 feed mills. billion dong, up 46.0% from the previous year.

Japfa Comfeed Vietnam (Indonesia)

Japfa invested in Vietnam in the form of a joint venture with Vietnam Livestock Corporation, and in 1999 Japfa changed its name to Japfa Comfeed Vietnam with 100% foreign capital. s sales reached VND13.8 trillion, up 33.2% from the previous year. After-tax profit increased 3.4 times over the previous year, reaching VND1.964 trillion.

Trends in Animal Feed Production in Vietnam

This chapter describes the trends and tendencies of feeds produced in Vietnam.

Trends in Feedstuffs Produced

Regarding the production of animal feed in Vietnam, population feed is mainly refined feed produced for raising pigs and chickens, while natural feed includes straw, grass, and agricultural by-products used for raising grazing livestock (swine, cattle, goats, sheep, and rabbits).

Worldwide, poultry feed is the most consumed feed as more consumers prefer chicken, eggs, etc. To some extent, the Vietnamese share a similar trend, with pork and poultry being more popular than beef and dairy products, resulting in greater demand for pig and poultry feed than for other types of feed. The percentage of pig and poultry feed produced in Vietnam is higher than the world average as of 2019.

ベトナムではブタ用飼料に次いで第2位である

出所:現地メディア Toplist

The Vietnam Poultry and Livestock Association forecasts that Vietnam’s demand for raw materials for animal feed will reach approximately 28-30 million tons/year over the next five years, with an average growth rate of 11-12%/year. Of this amount, about 15 million tons will be raw materials for poultry feed.

Trends in Raw Materials Procurement

The cost of raw materials accounts for about 60-70% of the product cost of animal feed. Population feed accounts for about 70% of the demand for animal feed, and the remaining 30% is either natural feed available to farmers or a mixture containing that natural feed.

Carbohydrate-Rich Raw Material Groups

Grains such as corn, wheat, bran, crushed rice, etc., and cassava account for about 21 million tons (more than 65% of the total) consumed. Among these, corn is the main raw material used in the production of animal feed. Vietnam’s current domestic production only meets about one-third of its corn demand. Therefore, Vietnam must import large quantities of corn each year.

Protein-Rich Raw Material Groups

Vegetable protein-containing raw materials include oil meal and corn residue, while animal protein-containing raw materials include meat and bone meal, poultry meal, shell meal, blood meal, fish meal, and fish oil, which account for 8.5 million tons (about 30% of total consumption). The production of these by-products is mainly done with relatively simple techniques such as drying and grinding.

Vietnam also has a variety of other feed and feed ingredients.

Vietnamese Government Policy

The Vietnamese government has announced the “Project on the Development of Animal Feed Processing Industry in the Period 2021-2030” in order to solve the problem of animal feed in different regions. Accordingly, the specific goal is for Vietnam to be self-sufficient in domestic production of about 40% of raw materials by 2030, of which the supplement group will be self-sufficient in about 50%.

Production Chain Development

The project to build animal feed manufacturing plants will consider the location and synergies with each rearing area, food processing area, etc. to reduce pressure on logistics. The Vietnamese government has the intention to restructure the entire supply chain of livestock production on the premise that the number of animal feed manufacturing plants will increase.

出所:現地メディア ASIA MEDIA VIETNAM

Expanding The Search for New Feed Ingredients

The Vietnamese government is promoting research and development for the utilization of new raw materials for animal feed. For example, since pigs are omnivorous animals and highly adaptable, a variety of foods for pigs can be used.

- Expand the use of new raw materials such as rice bran and cassava to replace the traditional raw materials of animal feed production in Asia, such as corn and soybeans.

- Strengthen partnerships between feed manufacturers and rice farmers to expand the use of broken bran and crushed rice bran. Also, develop utilization of insect feed to replace some of the protein-rich raw materials currently imported.

Expand Use of Agricultural by-Products as Animal Feed

The projected production capacity of animal feed mills by 2030 is approximately 40-45 million tons, but actual raw material production is only 30-32 million tons, or about 70% of production capacity.

Therefore, Vietnam needs to redevelop its raw material production areas and convert low-productivity arable land into high-productivity cultivation areas for corn, cassava, and other crops.

In addition, agricultural and processing by-products need to be fully utilized and turned into animal feed in rural areas of Vietnam. For example, a project of the Vietnam National Agricultural Extension Center will prioritize budgetary resources to support and replicate a model for growing corn and producing animal feed from agricultural waste and by-products.

Biotechnology Applications

The Vietnamese government strongly encourages the development of biotechnology. The application of technology can improve the nutritional value of by-products from yeast, pineapple residue, cassava residue, shrimp head shells, bone heads, pangasius fat, etc.

Challenges for Vietnam’s Animal Feed Industry

This chapter will examine the challenges facing Vietnam’s animal feed industry.

Low Quality of Artificial Feed

The quality of animal feed in Vietnam is inconsistent and unsafe, especially when mixed by manufacturers. This can affect the productivity, quality, and food safety of livestock products as well as cause environmental pollution.

Small Area Under Cultivation and Cultivation of Feed by-Products

The area under cultivation of grains, the main food source for pigs and chickens, is small and unproductive. In addition, the livestock and poultry slaughtering system in Vietnam is small in scale, and by-products cannot be processed into feed.

Solutions to Challenges in Vietnam’s Animal Feed Industry

This chapter examines solutions to the challenges of Vietnam’s animal feed industry.

Supply Chain Coordination

Adjust the network of animal feed production plants according to the needs of the domestic consumption market and export capacity. Relevant laws and regulations should also be developed, such as restricting the opening or expansion of new industrial feed mills in areas where there are already many feed mills.

Investments in Infrastructure System Improvements

Encourage investment in seaport infrastructure for import/export of raw materials and feedstuffs, system improvements in specialized warehouses, and systems for quality and other inspections.

出所:ベトナム現地メディア VnExpress

Development of Organic Feed

Vietnam needs to encourage the development of organic animal feed processing models and production technologies suitable for small livestock farmers and intensive farming models such as grass, corn, and rice, combined with mixed feed (TMR) processing technologies.

For example, there are already establishments in Vietnam that raise insects from livestock manure and agricultural by-products (blowflies and earthworms) and produce insect meals as a protein source for livestock in small enterprises.

Summary

Vietnam’s animal feed industry is projected to continue to grow. The animal feed market will be further developed through two strategies: the expansion of operations by large corporations and the shift from small-scale to large-scale intensive farming, while applying more sophisticated production models and technologies. The expansion of new sources of raw material supply and the use of agricultural waste are important factors for Vietnam’s animal feed industry to become less import-dependent and more self-reliant.

For Japanese firms, there is significant room for entry, especially in areas conducive to the sale of new high-quality feedstuffs and the procurement of raw materials.

【関連記事】ベトナムの他の産業については、こちらの記事も合わせてご覧ください。

ベトナム市場調査レポート一覧はこちらからもご覧頂けます。