- Introduction

- Definition of Fisheries in Vietnam

- Market Size of the Fisheries Industry in Vietnam

- Trends in Marine Products Exports to Vietnam

- Supply Chain in Vietnam’s Fisheries Industry

- Vietnamese Government Policy

- Competitiveness to Export to the World

- Future Prospects for the Vietnamese Seafood Industry

- Company Profile

- Summary

Introduction

Vietnam is a fisheries powerhouse with a long coastline of over 3,000 km from north to south and a vast exclusive economic zone (EEZ). The fisheries industry is an important industry for economic development and is flourishing in many countries around the world. The fisheries industry also plays an important role as part of local specialties and traditional food culture. In many countries, fisheries products are an important source of food, supporting the foundation of the local economy.

Vietnam’s exports, especially of cultured shrimp pangasius, have continued to expand in recent years, with the main export destinations being the United States, Japan, and China. Vietnam is growing as a global fisheries powerhouse and continues to attract attention as a promising market. This report will discuss the export of marine products and fish processing in the Vietnamese fisheries industry.

Definition of Fisheries in Vietnam

In general, the fisheries industry refers to industries involved in the aquaculture, fishing, processing, and distribution of fish and other aquatic organisms, primarily in marine and inland waters.

In Vietnam, the sectors are generally divided into the following five categories

Market Size of the Fisheries Industry in Vietnam

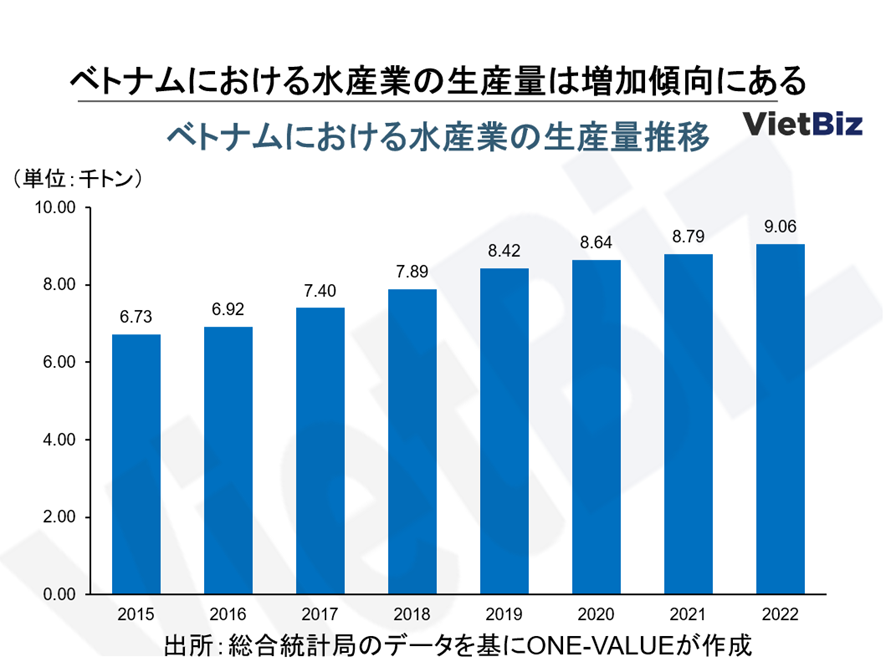

With regard to production in Vietnam’s fisheries industry, from 2015 to 2022, the production continues to increase from about 6.73 million tons to 9.06 million tons at a compound annual growth rate (CAGR) of 4.34%.

Vietnam’s fisheries industry is mainly concentrated in Vietnam’s large economic zones, including the Mekong Delta (27.82%), North Central and Central Coast (11.1%), and Red River Delta (6.84%). The Mekong Delta and Red River Delta specialize in aquaculture, and the production of marine products in the Mekong Delta and Red River Delta accounts for about 70% of Vietnam’s total production. The North Central and Central Coast specialize in fishing, accounting for more than 85% of the region’s total seafood production.

The Vietnamese government intends to increase the share of aquaculture in the fisheries industry and increase catches outside the coast. In recent years, the Vietnamese fisheries industry has focused on exporting high value-added products and aims to develop as a commodity producer with advanced technology in a sustainable manner in all environments: freshwater, brackish water, and saltwater.

Trends in Marine Products Exports to Vietnam

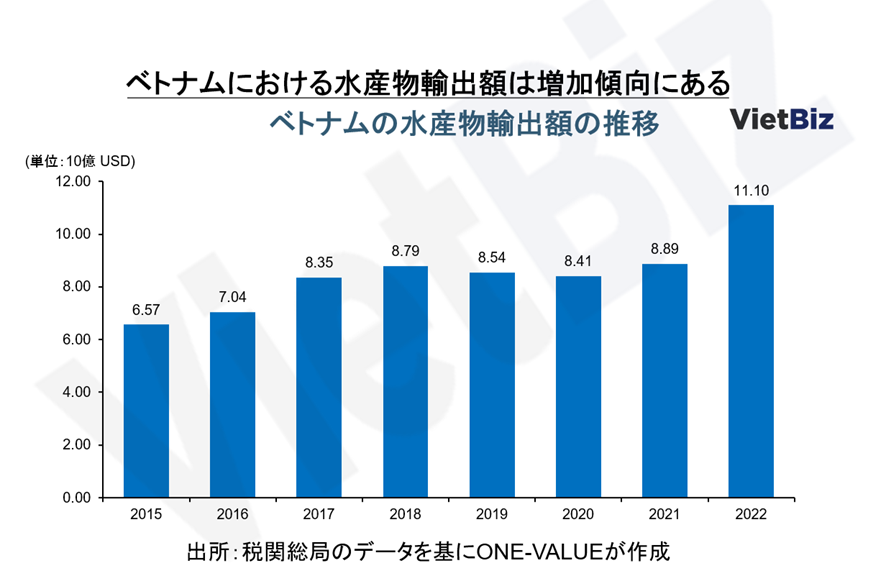

Vietnam exports marine products to more than 160 countries around the world and will be the third largest fishery power in the world in 2022.

Fisheries Products Exported

Vietnam’s seafood exports have increased from 1997 to the present, with an average annual growth rate of more than 9%. Vietnam’s marine products are exported to more than 160 countries around the world.

In 2022, the value of seafood exports reached a record high of approximately US$11 billion, up 23.8% from the previous year (US$8.89 billion). This makes Vietnam the world’s third largest fishery power after China and Norway.

Main Export Destinations

As of 2022, the United States is Vietnam’s largest export destination for marine products, with exports valued at US$2.1 billion. China and Hong Kong are at US$1.8 billion, Japan at US$1.7 billion, and ASEAN countries at US$790 million.

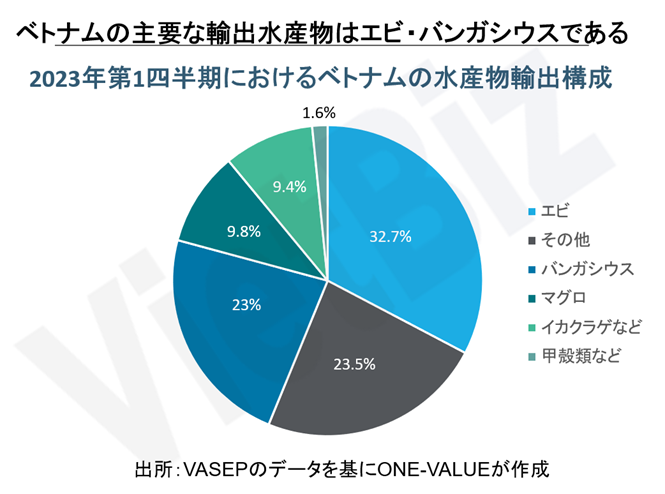

Main Products

Vietnam’s main exports are shrimp and pangasius. In 2022, export sales of brackish water shrimp reached about US$4.2 billion (up 13% from 2021) and pangasius reached US$2.35 billion (up 70% from 2021). Other leading exports include tuna, squid, octopus, and

Supply Chain in Vietnam’s Fisheries Industry

The supply chain in Vietnam’s fisheries industry can be divided into four main stages.

Fisheries and Aquaculture

Regarding aquaculture of marine products, Vietnam does not have many large-scale aquaculture farms. Small-scale aquaculture farms may lack knowledge of aquaculture techniques and products.

Regarding the fishing of marine products, most fishing vessels are operated on an individual or family scale, are small in size, and the majority have wooden rigging. On-board facilities are mostly inadequate. In addition, banks and cooperatives provide funding and assistance to aquaculturists and fishermen.

Wholesale of Marine Products

Most companies in the Vietnamese seafood processing industry have not established a system to purchase seafood products directly from fishermen or aquaculturists, and mainly intermediaries (brokers, small markets) purchase seafood products from fishermen or aquaculturists and distribute the products to seafood companies. The brokerage companies that purchase from them have insulated containers, scales, shelves, ice crushers, and other equipment, but they are not well-equipped and are not fully equipped.

Processing of Marine Products

Vietnam’s marine products are mainly limited to crude, initial processing, semi-finished products, or supply of raw materials for importers, and processing that brings high added value has not yet been undertaken. Vietnamese fishery products are processed and exported according to orders from abroad, and the value-added status is not high.

Sales, Trade and Export

Most of Vietnam’s marine products are produced and processed for export, and less than about 20% of total production is consumed for the domestic market. Vietnam’s domestic market demand is high and inadequately supplied. Vietnam’s processed seafood products, although exported in large volumes, may not meet the requirements of each import partner country’s market.

In some cases, Vietnamese fishery products are not labeled with detailed origin labels, and such products cannot be exported. In addition, most of the domestic market does not utilize origin labeling. Therefore, Vietnamese fishery products are not effectively utilizing what they produce.

Vietnamese Government Policy

The Vietnamese government has put forth various policies and directives to focus on the fisheries industry. Specifically, these include the enhancement of support measures related to the development of the fisheries industry, the application of technology, and preferential trade agreements.

Enhancement of Support Measures for the Development of the Fisheries Industry

The fisheries industry is considered one of the five priority marine economic sectors in Vietnam’s marine strategy. To promote the development of the fisheries industry, a number of fiscal, credit, and trade policies have been implemented to support the development of this sector. Specifically, these include tax, fee, and insurance incentives for fishing vessels and support for aquaculture facilities.

Use of Technology

The government directs the development of the fisheries industry in the direction of increasing productivity, reducing costs, and increasing the value of mining, aquaculture, and processing of marine products by enhancing the use of technology. Specifically, this includes encouraging investment in research and technology transfer for existing varieties, applying energy-saving technologies to production activities, and using technologies for recycling and reusing by-products.

Trade Agreement Preferences

The use of preferential measures in trade agreements is also being promoted to increase competitiveness. For example, the EU-Vietnam Free Trade Agreement (EVFTA) has eliminated tariffs on seafood exports from Vietnam to the EU (some items are being phased out). This is a major advantage that Vietnamese products have over competing countries such as India and Thailand.

Competitiveness to Export to the World

The following are some of the competitive advantages that Vietnamese fishery products have

Diverse Marine Products

Vietnam is a region with a wide variety of marine and freshwater life, which directly translates into the diversity of products exported.

Labor

Vietnam has a young and abundant labor force. It is possible to secure the necessary labor force to process and treat large quantities of marine products.

Government Supports

The Vietnamese government has put in place various measures to support the domestic fish processing industry. These include simplified financing, tax incentives, and technical assistance.

Export and Import

Vietnam imports and exports seafood products to and from many countries, and Vietnamese processed seafood products are advantageous for export because they meet the strict market standards of many developed countries.

Future Prospects for the Vietnamese Seafood Industry

This chapter describes the short-term and long-term prospects for the future of the Vietnamese fisheries industry.

Short-term Outlook

The Vietnam Association of Seafood Processors and Exporters (VASEP) analyzes that the main growth factor for Vietnam’s seafood industry is that more than 80% of its performance is derived from exports.

In the first quarter of 2023, the decrease in purchasing power in export destination markets has led to lower export prices for Vietnam’s seafood products, thus increasing the supply of seafood products for domestic consumption. This is expected to lead seafood companies to increase their processing volume for the domestic market and develop their logistics network, including domestic warehouses.

Long-term Outlook

The long-term prospects for Vietnam’s fisheries industry are discussed from two perspectives: the government’s development policy and the development policy of each region.

Development Policy of the Vietnamese Government

Community Development Policy

Company Profile

In this chapter, we introduce Hacaseafood as an example of a local Vietnamese seafood company. Since it is one player in Vietnam’s seafood industry that has been described so far in this report, we hope that it will help you understand the market better.

| company name | HA NOI – CAN THO SEAFOOD JSC(HACASEAFOOD) |

| slogan | “QUALITY SUSTAINABLY SOURCED SEAFOOD” |

| year of establishment | 2005 |

| head office | Con Tho city |

Hanoi – Can Tho Seafood Co. It is mainly engaged in water heritage processing and seafood exports, with a processing capacity of approximately 120 tons/day of seafood products, and has been providing fresh seafood products to both Vietnamese and foreign customers since its establishment in 2005. The supply chain is an integrated production system, from aquaculture and processing to the production of value-added seafood products such as breaded and marinated fish. hacaseafood owns three aquaculture farms on a 2-hectare site, where it also raises pangasius fingerlings and grows them to maturity.

Main Products

Here are some of Hacaseafood’s main products.

Perishable Foods

Processed Food

Hacaseafood offers a variety of processed products, including breaded and prepped products and other specialty products. The fish-based surimi products are carefully scaled, skinned, and boned before the product is produced. Value-added products are hand-trimmed, vacuum-packed, and bagged to ensure freshness. They are also ideal for deep frying, and are easy products that can be prepared either frozen or after thawing. The package includes cooking instructions.

Investment in Fisheries

Regarding opportunities to enter the Vietnamese seafood market, Vietnamese domestic companies have not yet been able to take full advantage of domestic demand, and there are many investment opportunities for Japanese companies with advanced processing technology. It would be possible for companies with processing technology to create higher value-added products by investing in Vietnamese domestic companies.

Vietnam does not have a cold chain, such as refrigerated warehouses and refrigerated transportation, which increases the cost of products and lowers their quality. There are also investment opportunities for logistics service companies, such as refrigerated transportation, refrigerated warehousing, and

Summary

This report describes Vietnam’s seafood industry, with a particular focus on seafood processing and exports. Vietnam is one of the world’s leading producers and exporters, mainly of shrimp and pangasius. In addition to this, Vietnam is a fisheries powerhouse with vast ocean areas and is blessed with abundant fishery resources.

On the other hand, there are significant challenges in the processing and distribution of marine products. With regard to the processing of marine products, Vietnam only performs minimal processing in accordance with the instructions of the developed countries to which it exports, and there are few high value-added products. In terms of distribution, Vietnam has not been able to ensure traceability, such as detailed origin labeling, and has not been able to make effective use of the amount of products it produces. In response to this situation, the Vietnamese government is enhancing measures and support to promote the development of the fisheries industry. It has already provided support for facilities, promoted research, and concluded trade agreements that are advantageous to Vietnam.

This report concludes with an actual Vietnamese local fishery company, Hacaseafood, which manufactures products with an integrated supply chain. The company is involved in a wide range of products, from aquaculture and basic processing to preparation and cooking.

【関連記事】ベトナムについては、こちらの記事も合わせてご覧ください。