Introduction: Packaging Container Market in Vietnam

This report describes and discusses the packaging container market in Vietnam.

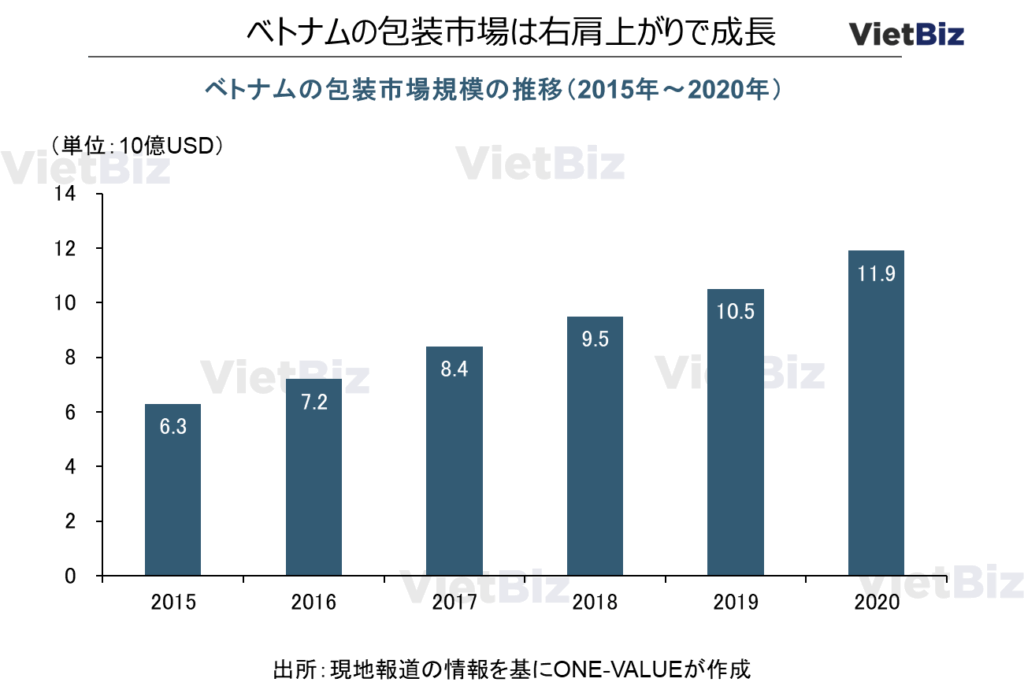

In general, as a country’s economy develops, the amount of packaging containers consumed tends to increase. This can be attributed to the following factors: population increases with economic development, the transition from traditional trade (traditional markets) to modern trade (modern markets such as supermarkets and convenience stores), and per capita consumption increases with income growth. In Vietnam, the market size of the packaging container market is also expanding against the backdrop of these factors. In this issue, we will discuss market trends and future prospects for packaging containers in Vietnam.

Three reasons why Vietnam’s packaging container market is promising

This chapter examines three reasons why Vietnam’s packaging container market is promising.

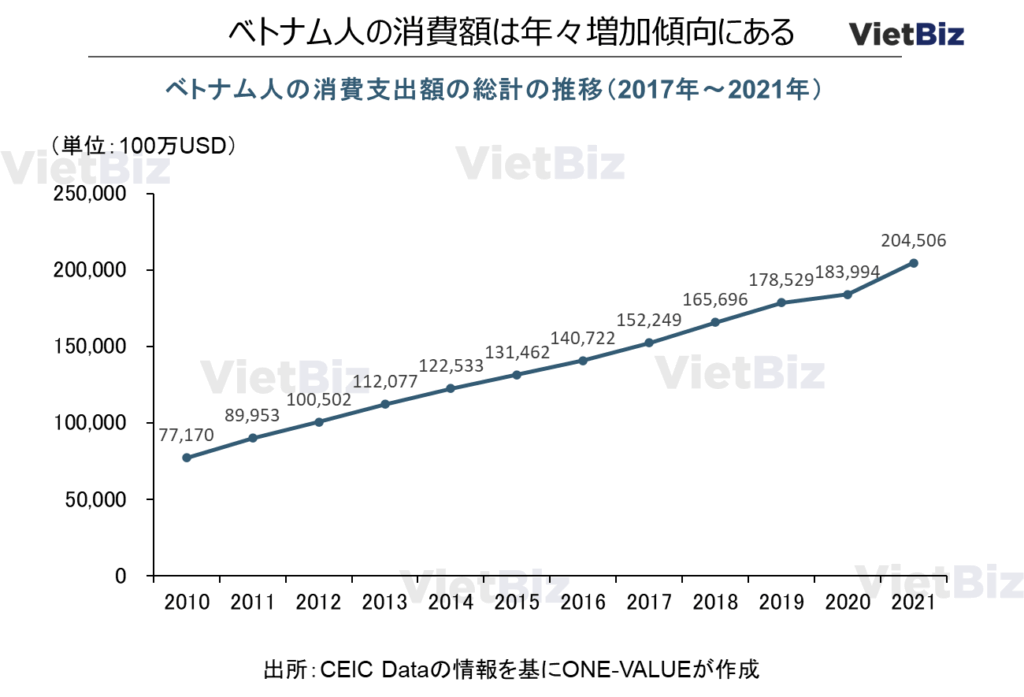

Vietnamese consumer spending up

The amount of money Vietnamese spend on consumption has been increasing year by year. This is due to (1) population growth and (2) rising per capita income. The population is expected to exceed 100 million by the end of 2023, and the income of the middle class (with a daily disposable income of 1,250 yen or more) is growing remarkably, especially due to the development of high value-added industries.

Traditional to Modern Trading

The modernization of retail formats has also had a significant impact on the packaging container market. In the past, food and other products were generally sold in traditional markets in Vietnam, called traditional trade, as shown in the figure on the left. At such markets, perishable foods such as meat are sold in open fields, and consumers are asked to weigh and sell the amount they want on the spot and take it home in plastic bags.

On the other hand, what has been rapidly expanding in recent years is the sale of meat in modern supermarkets and convenience stores, known as modern trade, as shown in the figure on the right. Here, meat is already cut into pieces and packaged in packs. The spread of this modern trade has been a major factor in increasing the consumption of packaging containers, especially in the food sector.

Expanding EC market

The last important growth factor is the expansion of the e-commerce market. Food delivery services such as Grab are now more commonly used than in Japan, and the sale of daily necessities is also becoming more common with the sale of daily necessities through Tiki, Shoppee, and other services. According to the Vietnamese Ministry of Industry and Trade, the growth rate of the Vietnamese EC market is 30% per year, and the EC market size is expected to reach USD 5 billion by 2025. This growth of the EC market has created a demand for large packaging containers to pack goods.

Points of Interest in the Development of Vietnam’s Packaging Container Market

We have reviewed the key growth factors that will drive the growth of Vietnam’s packaging container market. In the following section, we will discuss the direction in which the market will grow in the future.

Point 1: Improvement of technical capabilities in packaging container manufacturing

Among packaging materials, plastic packages made from a single layer of film and simple corrugated containers do not require high technical skills and are widely manufactured in Vietnam. On the other hand, the manufacture of vacuum packs and containers used to package pharmaceuticals and chemicals requires high technological capabilities, such as the use of multi-layered film to prevent leakage of liquids and gases, and very few companies in Vietnam are capable of manufacturing these products. Therefore, companies from South Korea, Europe, the United States, and other countries hold the Vietnamese market for these high-level packaging materials.

Under these circumstances, Vietnamese companies are also taking measures such as cooperating with foreign companies to develop products and building strong cooperative relationships with foreign companies with high technological capabilities through M&A. It remains to be seen to what extent packaging material manufacturing technology in Vietnam will develop in the future.

Point 2: Domestic procurement of raw materials

Because forestry is one of the major industries in Vietnam, paper raw materials for corrugated board and paper packaging can be easily procured domestically. On the other hand, the petrochemical and metal refining industries are not well developed in Vietnam, so the raw materials for plastics and other resins and aluminum are mainly imported from overseas.

In recent years, however, there have been moves in these areas, such as cooperation between foreign and Vietnamese companies to set up new manufacturing facilities. In the future, the procurement of raw materials will be key to improving the competitiveness of Vietnam’s packaging and container market in the global economy.

Summary

In the first half of this article, we have reviewed the Vietnamese packaging container market in terms of demand. We have identified three factors driving market growth: increased consumer spending, growing modern trade, and expanding e-commerce markets.

In the latter half of the presentation, he explained two key points for the future growth of Vietnam’s packaging container market, mainly from a manufacturing perspective: manufacturing technology and raw material procurement.

In particular, in terms of manufacturing technology, Japanese companies have high technological capabilities and are competitive enough in the Vietnamese market. In many cases, especially for high-quality packaging used for pharmaceutical products, products made in Japan are imported. The Vietnamese market for packaging containers could be considered a promising market for Japanese companies in the future.

【関連記事】ベトナム市場については、こちらの記事も合わせてご覧ください。

ベトナム市場調査レポート一覧はこちらからもご覧頂けます。

ベトナム市場の情報収集を支援します

ベトナム市場での情報収集にお困りの方は多くいらっしゃるのではないでしょうか。

VietBizは日本企業の海外事業・ベトナム事業担当者向けに市場調査、現地パートナー探索、ビジネスマッチング、販路開拓、M&A・合弁支援サービスを提供しています。

ベトナム特化の経営コンサルティング会社、ONE-VALUE株式会社はベトナム事業に関するご相談を随時無料でこちらから受け付けております。