- Introduction

- Health and Medical Standards

- Trends in the Vietnamese Pharmaceutical Market

- Characteristics of Vietnamese Consumers

- Laws and Regulations Concerning Pharmaceuticals

- Trends in Anticancer Drugs

- Foreign Entry Procedure

- Major Pharmaceutical Manufacturers

- Popular Drugs in Vietnam

- Future Pharmaceutical Market Outlook

- Conclusion

- ベトナム市場の情報収集を支援します

Introduction

Vietnam is no longer a manufacturing base with low labor costs, but an expanding consumer market.

When people hear about Vietnam and pharmaceuticals, the topic has often been the manufacturing industry. With the transfer of manufacturing facilities from China, the “world’s factory,” Vietnam became lined with manufacturing facilities of foreign-owned companies. This trend is known as “China plus one,” and it has been observed not only in pharmaceutical manufacturing, but also in the manufacturing industry as a whole.

However, these days Vietnam is highly regarded for its potential as a consumer market rather than a manufacturing base. The reasons fall into two main categories.

The first is that Vietnam’s population is growing steadily. Vietnam’s population will reach approximately 97 million in 2020. It is expected to continue to grow, and it is estimated that it will overtake Japan’s population in the 2040s.

Second, national income is increasing due to economic development. The wealthy and middle classes are expanding, and more and more Vietnamese are buying luxury goods and high-quality, high-priced products.

In addition, there is a growing health consciousness in Vietnam today. Demand for pharmaceuticals, health foods, and organic products is increasing, and many foreign companies are entering the market. Vietnam is a particularly promising market for Japanese pharmaceutical companies, as the “Japanese brand” is well established in Vietnam.

This report provides a comprehensive discussion and introduction to the pharmaceutical consumption market in Vietnam. First, the health and medical standards and disease structure of Vietnam are introduced, followed by market trends, trends, and players.

Health and Medical Standards

Let us begin with the level of health and medical care in Vietnam. According to the World Health Organization (WHO), Vietnam’s average life expectancy is 76 years and healthy life expectancy is 66.6 years, which is below the level of developed countries. Japan’s healthy life expectancy is between 72 and 74 years, a large gap with Japan. The “Population Strategy to 2030” announced by the Vietnamese government targets a total population of approximately 104 million, an average life expectancy of 75 years, and a healthy life expectancy of 68 years.

Although the image of Vietnam is often associated with a low obesity rate, the increasing obesity rate has become a social problem in Vietnam in recent years, and according to the WHO, the obesity rate for Vietnamese males is 16%, more than three times the 2005 rate, and the obesity rate for females is 24%, higher than that of males. The obesity rate for women was also higher than that of men at 24%.

Furthermore, the childhood obesity rate in major cities such as Ho Chi Minh City has reached about 40%, almost a tenfold increase over the past decade.

This is due to changes in dietary habits (e.g., widespread use of fast food, high beer consumption, etc.) and lack of exercise (e.g., lifestyle centered on bike transportation, lack of school grounds, etc.), which have led to an increase in the obesity rate. According to キリンホールディングスの調査「世界主要国のビール消費量」(2020年), Vietnam is the ninth largest beer consumer in the world and the top beer consumer in Southeast Asia.

Disease Structure and Mortality Factors

Next, we look at the disease structure and mortality factors in Vietnam: as of 1990, the proportion of infectious diseases was as high as 26%, but by 2017, the proportion of deaths due to infectious diseases had dropped to 10.5%. Meanwhile, the proportion of non-communicable diseases increased from 62.3% in 1990 to 79% in 2017, approaching the disease structure of developed countries, where the proportion of non-communicable diseases is large.

Looking at the causes of death among Vietnamese as of 2017, cerebrovascular disease (18.4%), ischemic heart disease (10.7%), tracheal, bronchial and lung cancer (5.86%), diabetes (3.8%) and chronic kidney disease (2.8%) were the top five diseases, with a large share of cardiovascular disease being a The top five diseases are diabetes (3.8%), diabetes mellitus (3.8%), and chronic kidney disease (2.8%).

Studies have shown that approximately 200,000 people in Vietnam die each year from cardiovascular disease, and that the hypertension rate among adults aged 18-65 is as high as 25%.

From 1990 to 2017, the proportion of “infectious diseases” such as “diarrhea, lower respiratory, and other infectious diseases” has decreased, while “non-communicable diseases” such as “cardiovascular diseases,” “neoplasms,” and “diabetes, genitourinary, hematologic, and endocrine diseases” have increased.

Lifestyle Changes

In Vietnam, the rate of lifestyle-related diseases such as diabetes is increasing due to lifestyle changes, which has become a social problem. Adults’ lack of physical activity, such as commuting by motorcycle and working at a desk, is becoming a serious problem not only in Japan but also in Vietnam.

While there are currently approximately 3.53 million diabetics in Vietnam, nearly 70% of patients are undiagnosed, and it is estimated that only 29% of those who have developed diabetes have received treatment at a medical institution.

The number of diabetics in Vietnam is expected to increase in the future, and it is predicted that the number of diabetics will grow to 6.3 million by 2045, an increase of 78.5% from the current level. The structure of disease is also changing, with the increase in national income accompanying economic development and changes in lifestyles related to diet and exercise, as well as the increase in lifestyle-related diseases.

On the other hand, Vietnam has also seen an increase in health awareness. Vietnam’s per capita spending on health care increased from about US$18 per year in 2000 to US$117 in 2015. This per capita healthcare expenditure is a combination of government and non-government spending, but the rate of increase is higher for non-government spending.

Trends in the Vietnamese Pharmaceutical Market

This chapter presents trends in the pharmaceutical consumption market in Vietnam.

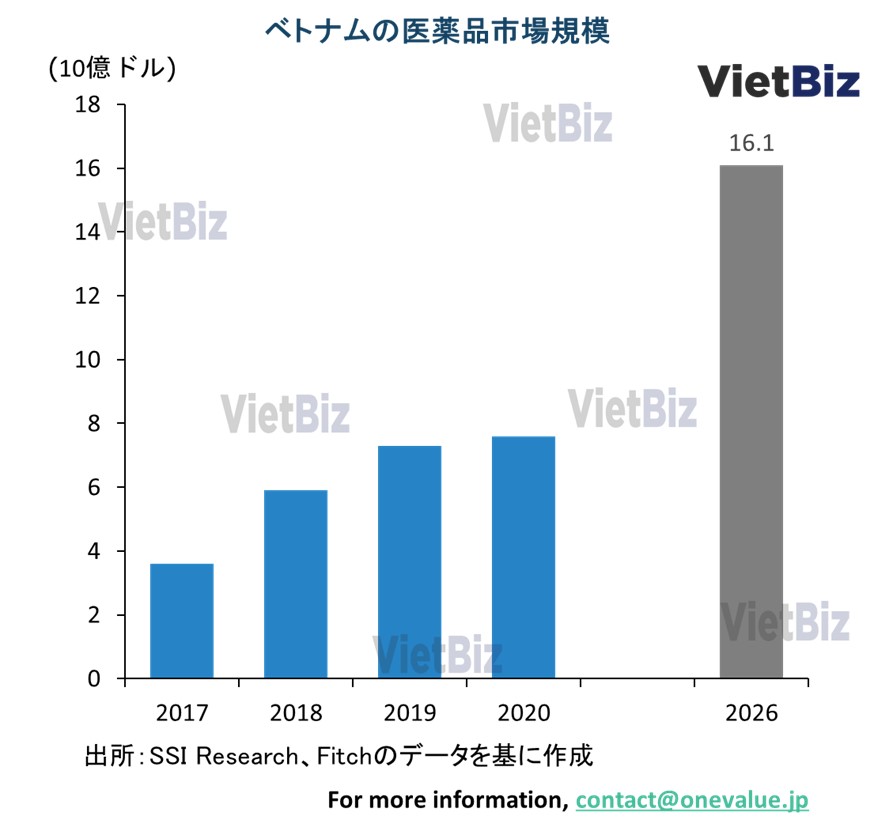

Vietnam Pharmaceutical Market Size

According to the British research firm Business Monitor International (“BMI”), the Vietnamese pharmaceutical market is expected to grow from US$7.7 billion (about ¥801.3 billion) in 2021 to US$16.1 billion (about ¥1,675.4 billion) by 2026.

In addition, the Vietnamese pharmaceutical market is expected to grow at a CAGR of +11.05% from 2016 to 2023, with ethical drugs expected to drive the market. As for over-the-counter (OTC) drugs, the market was worth about US$1.5 billion in 2018 and is projected to continue growing to US$2.3 billion by 2023.

In addition, Vietnam’s per capita expenditure on pharmaceuticals is expected to reach US$50 in 2020. The largest shares of pharmaceuticals by purpose are in the cardiac (14.7%), antibiotics (23.1%), oncology (12.9%), minerals/vitamins/immunology (9.5%), and digestive system (7.5%).

By disease, the demand for drugs related to cardiovascular diseases, liver cancer, and diabetes is expected to increase in the future. In addition, the generics market is large, with the market for generics amounting to US$32 billion in 2018, while the market for patented drugs was US$12 billion.

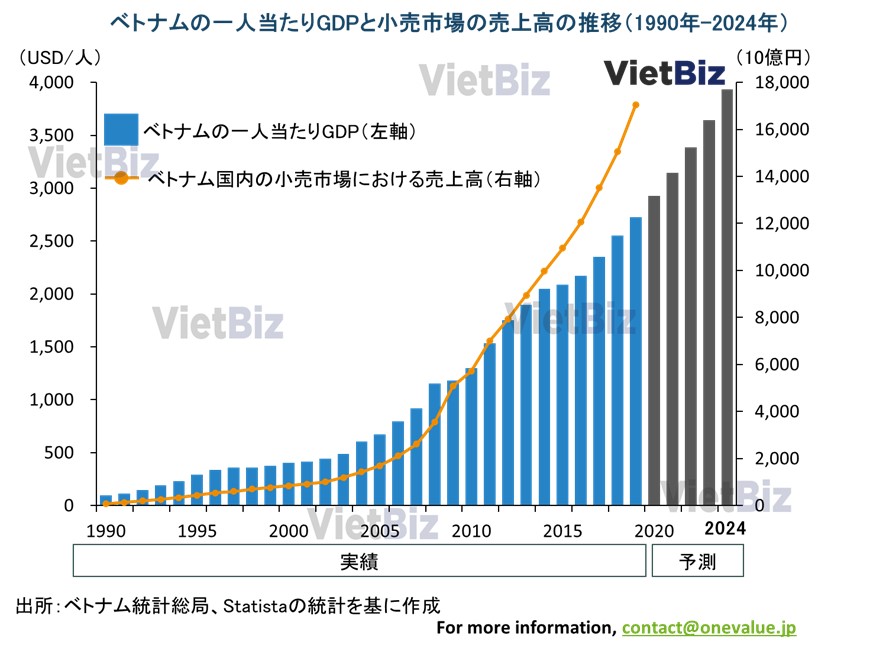

Income Level of Vietnamese Consumers

With economic development, the GDP per capita of the Vietnamese people has also increased rapidly over the past decade. According to data from the General Statistics Office of Vietnam (Ministry of Investment and Planning), the GDP per capita of Vietnamese people has more than doubled from US$1,297 in 2010 to US$2,725 in the period through 2020.

It is also projected to reach US$3,931 by 2024. As per capita GDP increases, retail sales and consumption in Vietnam are also expected to grow rapidly, making it a promising consumer market. It is more promising for foreign firms, especially Japanese firms with manufacturing strengths.

Consumption of pharmaceuticals and health foods is also expected to increase as Vietnamese people become more health conscious.

Current State of the Pharmaceutical Industry in Japan

It was announced that in 2016, domestically produced products had a market share of only 48% of all pharmaceutical products distributed in Vietnam. In addition, the three largest wholesalers of pharmaceuticals in Vietnam are all foreign-owned: Zuellig Pharma (Swiss-owned), Diethelm Vietnam (Singapore-owned), and Mega Products (Thai-owned), which account for about 40% of Vietnam’s pharmaceutical wholesaling and distribution market share.

In other words, it is no exaggeration to say that the majority of the pharmaceutical market in Vietnam is dominated by foreign products (mainly from France, India, South Korea, Germany, Switzerland, etc.) and the country is dependent on foreign pharmaceutical companies.

About 80% of the raw materials used for pharmaceuticals in Vietnam are imported from abroad. Among them, China and India are the major importers. This makes the Vietnamese pharmaceutical industry susceptible to external factors.

For example, the export restrictions on 26 pharmaceutical ingredients and raw materials, including paracetamol, issued by the Indian government in 2020, resulted in a significant increase in the cost of producing domestically produced pharmaceuticals in Vietnam in 2020.

Unlike in Japan, the OTC (over-the-counter) sales channel is the main channel for pharmaceutical consumption in Vietnam; according to statistics from the Vietnamese Ministry of Health in 2019, OTC accounted for about 80% of the value of pharmaceutical production, with ETC (ethical drugs) accounting for only about 20%.

This is in direct contrast to the Japanese pharmaceutical market, where OTC drugs account for only about 10% of sales. The current situation in Vietnam is that prescription drugs (drugs designated as prescription drugs in many developed countries) can be purchased without a prescription, and this is the reason for the high percentage of OTC drugs in the Vietnamese pharmaceutical market. This is something that Japanese companies need to be aware of when entering the Vietnamese pharmaceutical market.

Vietnam Pharmaceutical Market Trends

This paragraph introduces three trends in the Vietnamese pharmaceutical market.

Sale of Government-controlled Companies

Most of Vietnam’s major pharmaceutical companies were formerly state-owned enterprises, and many are still owned and controlled by local administrative agencies and the Vietnamese Ministry of Health.

In recent years, the Vietnamese government has been considering divesting itself of pharmaceutical companies in which it has substantial control and in which it holds a large share of stock. In particular, the government set a target to divest major companies such as Binh Dinh Pharmaceuticals, Coulomb Pharmaceuticals, Trafaco, Duoc Khoa Pharmaceuticals, Ge An Pharmaceuticals, and the Vietnam Pharmaceutical Corporation by the end of 2021, but due to factors such as rising stock prices and the Corona disaster in 2021, this could not be implemented as planned.

In addition, the government is basically selling off pharmaceutical companies to large foreign pharmaceutical companies. The government has a certain market share, and has abundant resources such as production plants, technology, and land, making it very difficult for major Vietnamese companies to acquire these companies.

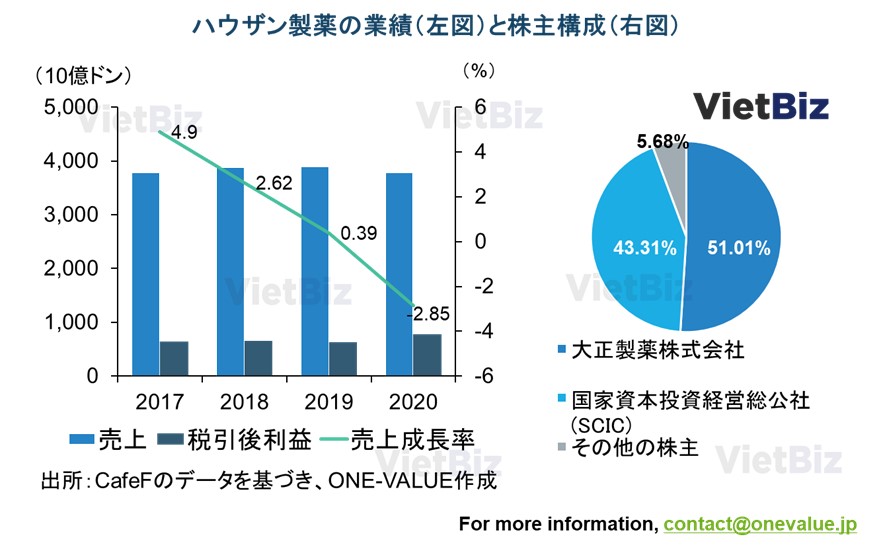

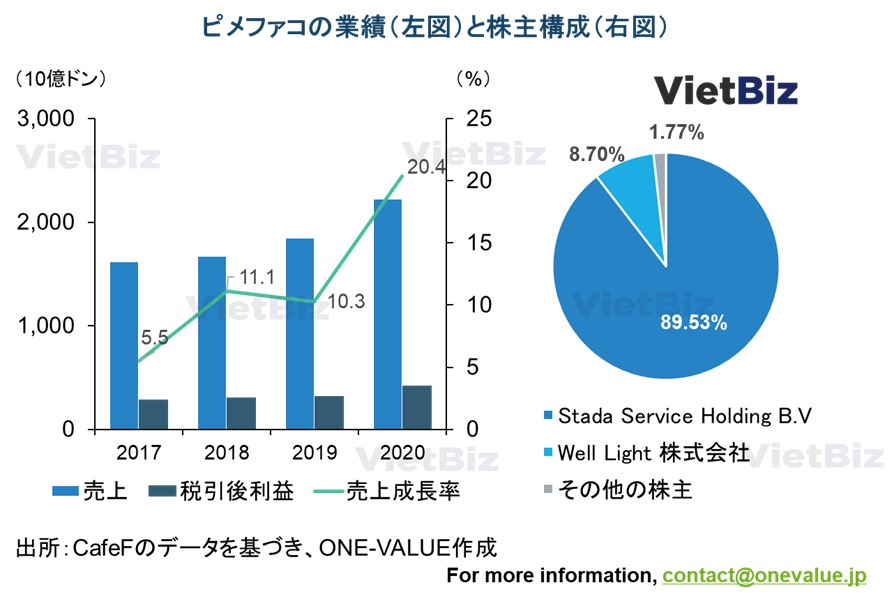

Examples of foreign companies that have acquired Vietnamese pharmaceutical companies include Japan’s Taisho Pharmaceutical’s acquisition of Hausan Pharmaceutical, the largest Vietnamese pharmaceutical company; the U.S. company Abt’s acquisition of Domesco; Japan’s Asuka Pharmaceutical’s acquisition of Ha Tay Pharmaceutical; and Germany’s Stada’s acquisition of 99% of Pimefalco’s shares.

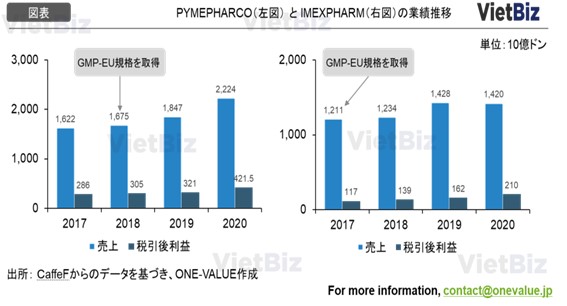

After being acquired, Vietnamese pharmaceutical companies tend to show positive changes in performance and technology transfer. In particular, with Stada’s support, Pimefalco became the first Vietnamese company to obtain GMP-EU status.

M&A transactions in the pharmaceutical industry are one of the powerful drivers of structural change in the industry and a major factor in the development of Vietnam’s pharmaceutical industry.

Intense Competition from EVFTA

The Free Trade Agreement and Investment Protection Agreement (EVFTA Agreement and EVIPA Agreement) between Vietnam and the European Union (EU) was approved by the Vietnamese National Assembly on May 28, 2020. From now on, Vietnamese pharmaceutical companies must compete fairly with EU companies in the Vietnamese market.

Under the EVFTA agreement, Vietnam will eliminate tariffs on pharmaceutical products produced in the EU. Specifically, tariffs on approximately 71% of pharmaceutical products produced by the EU will be eliminated immediately after the EVFTA is approved (May 28, 2020). For the remaining 29% of the pharmaceuticals specified in the agreement, tariffs will be gradually eliminated within five to seven years from the date of entry into force of the EVFTA.

This creates a major advantage for EU pharmaceutical companies, who can enter Vietnam at a lower price than before, while the quality of drugs from the EU is basically better than those produced domestically in Vietnam. In the next 5-10 years, competition in the Vietnamese pharmaceutical industry is expected to intensify, and domestic companies that cannot improve the quality of their products will be eliminated.

Improving the Quality of Vietnamese Products

Improving product quality is the only way for Vietnamese pharmaceutical companies to compete with strong foreign competitors. Currently, most Vietnamese pharmaceutical manufacturing companies have factories or production lines that meet GMP-WHO qualification, one of the minimum standards for the production of pharmaceutical products in Vietnam.

Upgrading a plant from its GMP-WHO status to the more advanced “GMP-EU” standard is a necessary step to improve the quality of pharmaceutical products.

However, the major domestic Vietnamese companies leading this trend of upgrading production plants are relatively young pharmaceutical companies with a lot of momentum, such as Imexpharm and Pymerpharco, rather than the big pharmaceutical companies that all Vietnamese know, such as Hausan Pharmaceuticals, Trafaco, and Domesco.

Imexfarm upgraded its plant to GMP-EU standards at the end of 2016 and increased sales by 35% in 2020. Pimefaco upgraded its plant to GMP-EU standards in 2018 and increased sales by 20% in 2020.

Since the average growth rate of the pharmaceutical industry in Vietnam is 8%/year, both companies have experienced very significant growth.

Characteristics of Vietnamese Consumers

This chapter introduces the characteristics of Vietnamese consumers.

Self-medication Is Mainstream

Vietnamese purchase non-prescription medications at drugstores for minor conditions. For many Vietnamese, especially those living outside of large cities, “going to the hospital” is associated with a serious illness or very serious condition. Consumers often choose to self-medicate, purchasing non-prescription drugs whenever possible and recuperating at home. They go to the hospital only if they do not feel the medication is effective and their condition worsens.

For example, in the case of general health problems such as fever, cough, and diarrhea, Vietnamese often go to a local drugstore, inform the pharmacist of their condition, and then purchase the drugs selected by the pharmacist.

This channel, the non-prescription retail channel (OTC), is the primary channel through which Vietnamese consume pharmaceuticals.

Converted from a Mom-and-pop Drugstore to A Major Drugstore Chain

Drugstores in the OTC channel, which account for 80% of pharmaceutical sales in Vietnam, play an important role in supplying medicines to the Vietnamese population.

Drugstores in Vietnam have been mostly privately owned stores whose owners are pharmacists. In Vietnam, there are many privately owned stores and mom-and-pop stores that sell snacks and daily necessities, and privately owned drugstores are one type of such store.

Papa’s Drug Stores are characterized by convenient traffic, often along roads, and close to homes and workplaces. In addition, the most popular stores are those where the pharmacists have excellent drug combinations and have the support of many people in the neighborhood.

Taking advantage of this feature, major Vietnamese retailers such as The Gioi Di Dong and FPT Retail have used their own financial resources to enter OTC drug retailing by opening modern drugstores in highly accessible locations with large numbers of residents.

These large companies also operate drugstores while leveraging their years of experience in the retail industry, including branding and customer service methods. These modern drugstores are generally performing well, with drugstore chains such as Pharmacity, An Khang (part of The Gioi Di Dong), and Long Chau (part of FPT Retail) currently expanding their store count rapidly. They are considered to have a significant advantage over traditional privately owned drugstores.

Laws and Regulations Concerning Pharmaceuticals

In order to produce and sell pharmaceutical products in Vietnam, pharmaceutical companies must implement the “Registration of Pharmaceutical Products” according to Decision 1203 / BYT / QD issued the Vietnamese Ministry of Health. The Ministry of Health classifies pharmaceutical products distributed in the Vietnamese market into three categories. The Ministry of Health classifies medicines distributed in the Vietnamese market into three categories: domestically produced medicines, foreign produced medicines, and medicines produced by domestic manufacturers for foreign brands (so-called OEM).

In the case of registration of drugs manufactured abroad, there are eight required documents.

- Good Manufacturing Practice (GMP) certificate from the manufacturing facility in the country of origin

- Marketing authorization certificate in the country of origin

- Product information (drug-drug interactions, dosage and administration, overdose precautions, storage conditions, shelf life, etc.)

- Detailed description of manufacturing and quality control processes

- Up-to-date stability data from three appropriate quantitative biological tests

- Identification of quality (including analytical methods for final product, raw materials, additives, etc.)

- 3 Product samples including certificate of analysis, active ingredients and additives

- Packaging including Vietnamese

Regarding the registration of pharmaceutical products, it takes approximately 6 months to obtain a sales license.

Trends in Anticancer Drugs

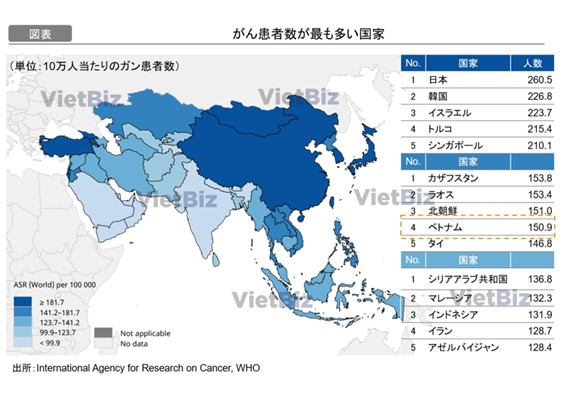

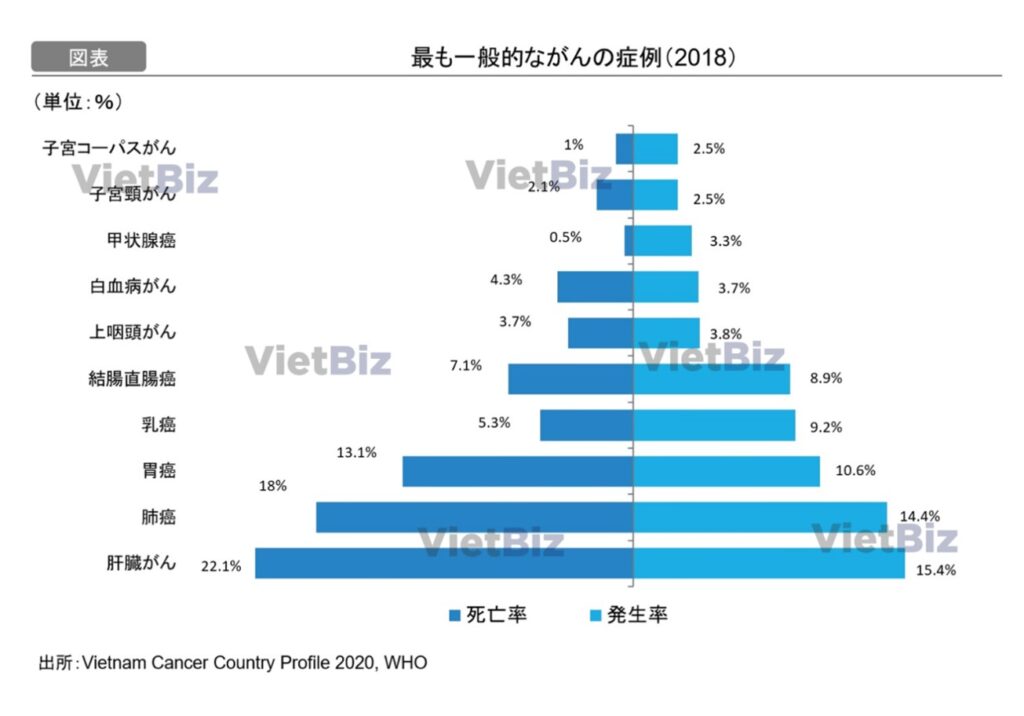

According to data from the World Health Organization WHO, Vietnam has one of the highest rates of cancer patients in the world. There are approximately 151 cancer cases per 100,000 Vietnamese, a figure higher than in neighboring countries such as Thailand (approximately 147/100,000), Indonesia (approximately 133/100,000), and Malaysia (approximately 132/100,000).

There are numerous causes for the recent surge in the percentage of cancer patients in Vietnam. First, alcohol consumption rates are much higher than in neighboring countries. In addition, the high smoking rate, increased carbohydrate consumption, lack of daily physical activity, and few regular health checkups have contributed to a lifestyle that can be described as unhealthy.

Although the Vietnamese government has developed a number of policies aimed at raising health awareness among individual citizens, many of these policies have failed to produce results, and the number of cancer cases continues to increase as a percentage of the population.

At the same time, the need remains unmet due to the country’s strained health care system and shortage of cancer drugs. Therefore, the demand for anticancer drugs will remain high for years to come, as will the demand for improvements in Vietnam’s health care system.

Foreign Entry Procedure

In order for foreign-invested companies to conduct pharmaceutical manufacturing, import/export, testing, and sales business in Vietnam, they must meet the same legal requirements as domestic companies and obtain a “Pharmaceutical Affairs License”.

Capital and Raw Materials

In accordance with the Law on Investment, 100% foreign investment is allowed in the manufacture of pharmaceuticals, and foreign companies, including Japanese companies, have invested in the country to date. In terms of raw material procurement, raw materials used for production at the company’s own factory can be imported, but a separate import license must be obtained for raw materials not yet registered in Vietnam. In fact, most of the raw materials in Vietnam cannot be procured locally and are dependent on imports.

Circulation Rights

In Vietnam, foreign-invested enterprises have been allowed to import products since 2009, but distribution is still not allowed. Therefore, only manufacturing companies can be established with 100% foreign capital, and by law, manufactured goods must be sold to Vietnamese companies with distribution functions, such as wholesale companies.

In reality, however, there are ambiguities in the operation of the legal provisions, and it is virtually possible for foreign companies to invest in local companies engaged in everything from manufacturing to sales operations. In fact, some foreign companies have already substantially entered the distribution business in various forms, and are expanding their business alliances and investments with local companies.

Cooperation with Local Companies

In general, foreign-invested companies, while possessing financial and technological capabilities, lack an understanding of the Vietnamese market and a competitive edge in distribution, and they wish to accelerate collaboration with local companies to cover these needs. Since the current legal regulations do not allow foreign-invested companies to distribute pharmaceuticals, collaboration with local companies is very important when targeting domestic demand, and share acquisition is an effective option.

For this reason, it is conceivable that foreign firms may participate in capital participation. However, there are cases where direct capital participation is difficult, and it is recommended that consultants and others familiar with the Vietnamese market be consulted on this point.

Major Pharmaceutical Manufacturers

DHG Pharmaceutical Joint Stock Company(DHG)

- Company name:DHG PHARMACEUTICAL JOINT – STOCK COMPANY

- Year of establishment:1974

- Location:Can Tho

- HP:www.dhgpharma.com.vn

Hau Giang Pharmaceutical is one of the largest pharmaceutical companies in Vietnam in terms of sales. Founded in 1974 as a state-owned company under the name 2/9 Pharmaceuticals, Hau Giang was officially issued shares in 2004, and as of 2021, Taisho Pharmaceutical of Japan is the major shareholder of Hau Giang. The State Capital Investment and Management Corporation (SCIC) of the Vietnamese government owns 43.3% of outstanding shares.

Hau Giang’s main products include antibacterial drugs, analgesics, diabetes medicines, and health foods; well-known brands well-known among Vietnamese, such as Haginat (an antibacterial drug), Klamentin (an antibacterial drug), and Hapacol (a fever reducer), account for over 70% of Hau Giang’s revenue.

Regarding Hausan Pharmaceutical’s performance, recent sales have remained mostly flat. However, profit margins for its main product lines remain favorable, and profits are expected to increase in the future with the support of the Taisho Pharmaceutical Group.

Pymepharco (PME)

- Company name:PYMEPHARCO

- Year of establishment:1989

- Location:Phu Yen

- HP:https://www.pymepharco.com/

Pymephaco Pharmaceutical (formerly Phu Yen Pharmaceutical and Medical Supplies State Company) was established in July 1989. In 2006, the government sold its shares in Pymephaco Pharmaceutical and privatized the company, changing its name to Pymepharco Joint Stock Company. Currently, the Dutch pharmaceutical company Stada Service Holding B.V. is the major shareholder, holding 89.53% of Pymephaco Pharmaceutical’s outstanding shares.

Pimefaco Pharmaceuticals’ main business is the manufacture of pharmaceutical products, primarily antimicrobials and antipyretics. Pimefaco Pharmaceuticals also operates an OEM production business for hair growth products and antibacterial drugs for its parent company, Stada Service Holding B.V.

As for Pimefaco Pharmaceuticals’ business situation, in 2019 and 2020 the company invested in the construction of the Hoang Van Thu plant, which specializes in the production of antimicrobials, thus increasing the company’s profits by only about 3% per year. This plant began production at the end of 2020, which is expected to improve Pimefaco Pharma’s antimicrobial sales and the company’s overall performance in the future.

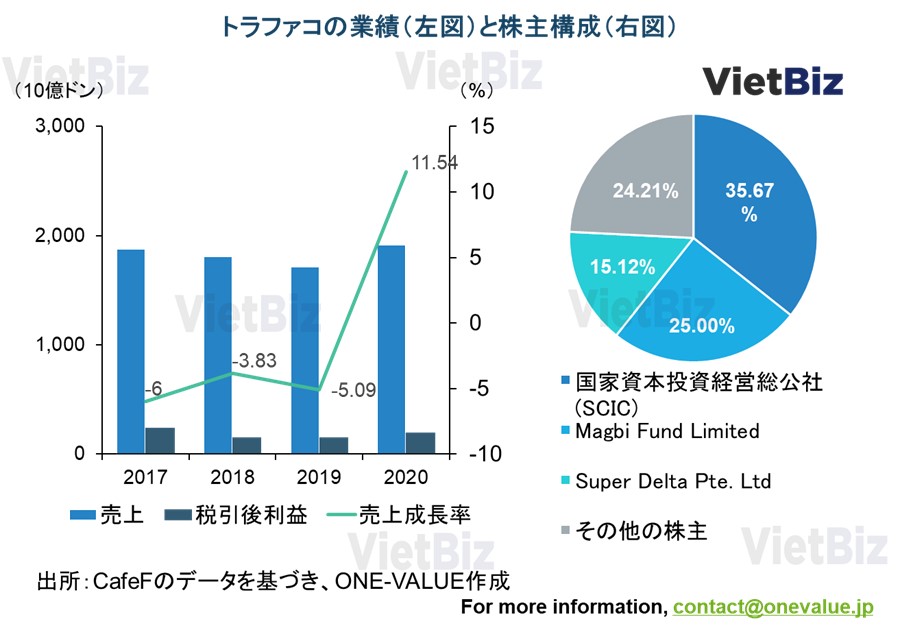

Traphaco JSC (TRA)

- company name:Traphaco JSC

- Year of establishment:1972

- Location:Ha Noi

- HP:https://traphaco.com.vn/

Trafaco Pharmaceuticals was founded in November 1972 as a pharmaceutical manufacturing team affiliated with a railroad medical company. The team focused on manufacturing serum, infusions, and distilled water to provide medical services to the country’s railroad hospitals during the Vietnam War.

Traphaco Pharmaceuticals’ main business areas include the purchase and cultivation of medicinal herbs or the production and processing of pharmaceutical products. Traphaco Pharmaceuticals’ main products are “Boganic” liver tonic and “Hoat Huyet Duong Nao” tonic.

Market research firm ACNielsen rated Trafaco Pharmaceuticals as having the best brand health in the Vietnamese pharmaceutical industry, with Trafaco’s Boganic and Hoat Huyet Duong Nao being the most well-known brands to the Vietnamese among drugs studied at the same grade.

A large portion of Trafaco Pharmaceutical’s financial results in recent years have been due to the cost of establishing new distribution systems. The opening of eight new distribution centers over the past two years has increased labor and SG&A expenses, but has yet to generate effective revenues. The cost of maintaining these distribution centers resulted in a nearly 20% decrease in after-tax profits for Trafaco Pharmaceuticals 2020 compared to 2017.

In addition, Traphaco Pharmaceutical has the highest profit margin in the pharmaceutical industry (over 40%) because it is able to procure most of its raw materials domestically.

Popular Drugs in Vietnam

Salonpas(Hisamitsu Pharmaceutical Co., INC.)

Salonpas has been sold in the Vietnamese market since 1994. Today, Salonpas is the most popular poultice in Vietnam and has permeated the lives of Vietnamese people. Furthermore, for Vietnamese consumers, Salonpas has become not just a brand but a synonym for the poultice itself. Many Vietnamese people recognize that they have used Salonpas even if they use a poultice other than Salonpas.

V Rohto(Rohto Pharmaceutical Co., Ltd.)

Rohto’s V-Rohto eye drops have been on the Vietnamese market since 2001; V-Rohto works to relieve eye tension, conjunctival congestion, and eye irritation caused by ultraviolet light and other rays.

Rohto was one of the first Japanese pharmaceutical companies to actively broadcast TV commercials after entering the Vietnamese market. Today, it is said that “Rohto” is the first name most Vietnamese associate with eye drops.

NAZAL SPRAY(Sato Pharmaceutical Co., Ltd)

Nazar nasal spray, manufactured by Sato Pharmaceutical, is used by many people in Vietnam who suffer from sinusitis and chronic rhinitis. Nazar spray products provide quick relief from runny nose, nasal congestion, and nasal allergies caused by sinusitis and influenza.

In fact, Sato Seiyaku hardly advertises this product in the Vietnamese market and does not officially market it widely. However, the brand has been formed by word of mouth from consumers who have used the product. Therefore, Nazar Spray is often sold through a route where the product is purchased in Japan and brought to Vietnam.

Seirogan(Taiko Pharmaceutical Co., Ltd.)

Seirogan is a drug used to treat digestive disorders, diarrhea, and abdominal pain. This product is widely known by word of mouth, but its main sales channel is informally brought in from Japan, and its selling price is very high. Therefore, this product is used primarily by the wealthy and those with long-term gastrointestinal problems.

PABRON GOLD A(Taisho Pharmaceutical Holding Co., Ltd)

Pabron Gold A is used to treat common cold symptoms such as cough, phlegm, sore throat, sneezing, runny nose, congestion, chills, fever, headache, joint pain, and generalized muscle pain.

Currently, this product is sold in Vietnam primarily through unofficial importation from Japan, and Taisho has not yet officially marketed it in Vietnam.

Future Pharmaceutical Market Outlook

The pharmaceutical industry is rated as one of the fastest growing industries in Vietnam over the next 5-10 years. It has social factors tied to its development, such as an aging population, increasing spending on pharmaceuticals and per capita income, and the growing health consciousness of the Vietnamese people. Furthermore, the divestiture of state-controlled pharmaceutical companies and some relaxation of foreign investor takeover defenses in the pharmaceutical industry would be policies that would facilitate changes in the internal structure of Vietnam’s pharmaceutical industry.

The Vietnamese government is positive toward foreign pharmaceutical companies that want to acquire domestic pharmaceutical companies or sell and manufacture in Vietnam.

Conclusion

This report provides a comprehensive discussion and introduction to the pharmaceutical consumption market in Vietnam.

First, regarding the level of health in Vietnam, the average healthy life expectancy is one year shorter than in Japan. The healthy life expectancy in Vietnam is 66 years, while in Japan it is 74 years.

Vietnam has an image of having a thin population, but in recent years, the increasing obesity rate has become a social issue. In particular, the obesity rate among children has reached 40% in urban areas, a ten-fold increase in ten years.

In terms of disease structure, the number of deaths from infectious diseases used to be relatively high, but in recent years the proportion of deaths from non-communicable diseases has been expanding, and the disease structure is approaching that of developed countries.

The pharmaceutical consumption market in Vietnam was worth US$7.7 billion in 2021, and is expected to grow to US$16.1 billion by 2026. In addition, the average annual growth rate is expected to be 11.05% between 2016 and 2023.

In addition, OTC accounts for 80% of Vietnam’s garment production value. Three trends in the market were identified: the sale of large pharmaceutical companies controlled by the Vietnamese government, increased competition due to the EVFTA, and improved quality of Vietnamese products.

Two characteristics of consumers were noted: a high level of self-medication and an increasing preference for modern drugstores.

Foreign pharmaceutical companies are allowed to manufacture pharmaceuticals with 100% foreign capital, but are not allowed to distribute them. However, there are several foreign companies that have effectively entered the pharmaceutical distribution market by exploiting the ambiguity of the law and regulations, including the possibility of investing in pharmaceutical companies that have distribution functions.

In general, the Vietnamese pharmaceutical industry is regarded as one of the fastest growing industries in Vietnam in the next 5-10 years. The Vietnamese government has also expressed its willingness to welcome the entry of foreign pharmaceutical companies. Vietnam is a particularly promising market for Japanese pharmaceutical companies, as the Japanese brand is well established in the country.

【関連記事】VietBizではベトナムの医薬品市場に関するレポートを他にも取り揃えています。本記事と併せてぜひご覧ください

ベトナム市場調査レポート一覧はこちらからもご覧頂けます。

ベトナム市場の情報収集を支援します

ベトナム市場での情報収集にお困りの方は多くいらっしゃるのではないでしょうか。

VietBizは日本企業の海外事業・ベトナム事業担当者向けに市場調査、現地パートナー探索、ビジネスマッチング、販路開拓、M&A・合弁支援サービスを提供しています。

ベトナム特化の経営コンサルティング会社、ONE-VALUE株式会社はベトナム事業に関するご相談を随時無料でこちらから受け付けております。