- Introduction

- Types of Company Forms in Vietnam

- Comparison of each company form

- Conclusion: Selecting the right corporate form the right situation and purpose

- ベトナム市場の情報収集を支援します

Introduction

There are various ways to expand into Vietnam, such as selling products, investing in a local company, or setting up a representative office. One of the ways for Japanese companies to expand into Vietnam is to establish a company locally. In this article, we will focus on the establishment of a company in Vietnam, and explain the types of companies that are allowed to be established in Vietnam. The types and regulations for establishing a company in Vietnam are stipulated in the Law on Enterprises of 2020 (59/2020/QH14), and this explanation will be based on the provisions stipulated in the Law.

Types of Company Forms in Vietnam

The following five corporate forms are recognized in Vietnam

- One member limited liability company

- Two or more member limited liability company

- Joint Stock Company

- unlimited partnership

- Private company

Below, we will add a detailed description of each company form.

one-person limited liability company

A one-person limited liability company (Vietnamese: CÔNG TY TRÁCH NHIỆM HỮU HẠN MỘT THÀNH VIÊN) is a form of company formation where the investor is one individual or one organization.

When a Japanese company or a Japanese person establishes a company with sole investment, it is a one-person limited liability company. The investors are liable for the company’s debts to the extent of the amount of capital they have invested. A limited liability company cannot issue shares.

Limited liability company with two or more members

A two or more member limited liability company (Vietnamese: CÔNG TY TRÁCH NHIỆM HỮU HẠN HAI THÀNH VIÊN TRỞ LÊN) is a form of company formation where the investors are two or more individuals or two or more organizations (the maximum number of investors is 50 individuals or organizations).

The company becomes a limited liability company for its members. The investors are liable for the debts of the company to the extent of the amount of capital they have invested. A limited liability company cannot issue shares.

Incidentally, the system of classifying limited liability companies according to the number of members (number of investors) as “one person” and “two or more persons” is rare even from an international perspective, and can be said to be a unique feature of Vietnamese corporate law.

joint stock company

A joint stock company (Vietnamese: CÔNG TY CỔ PHẦN) is a form of company formation in which the investors are three or more individuals or three or more organizations. The articles of incorporation capital of the company is divided equally into units of “shares” and the shares are freely transferable. The shareholders are liable for the debts of the company to the extent of the amount of capital they have contributed (the par value of the shares they own).

unlimited partnership

A partnership (Vietnamese: CÔNG TY HỢP DANH) is established by two or more unlimited partners who invest and jointly own the company. The partners must be individuals, and no organization can be a partner. The company also allows investors who do not jointly own the company, but only make a capital contribution.

The unique feature of a limited partnership is that it differs from a limited liability company or a joint stock company in that it is liable for all obligations of the company with its own assets.

private company

A private company (Vietnamese: DOANH NGHIỆP TƯ NHÂN) is established by one individual who invests and owns the company. It differs from a one-person limited liability company in that the individual is responsible for all obligations of the company with his/her own assets. The concept of a private company is similar to that of a “sole proprietorship.

Comparison of each company form

In the following, we will compare each of the five corporate forms from eight different perspectives in order to better clarify the differences between them.

Company Ownership

An organization can only be the owner of a corporation in one- and two-person limited liability companies and joint stock companies; in a partnership or private company, an organization cannot be the owner of a corporation.

Number of employees and investors

In the case of a one-person limited liability company, the number of investors is limited to one person and one organization. If there are two or more investors, the company becomes a two or more member limited liability company. The maximum number of investors in a two-person limited liability company is 50. A joint stock company must have three or more investors, and there is no upper limit to the number of investors. A general partnership company requires two or more partners, and if it has only one partner, it becomes a private company.

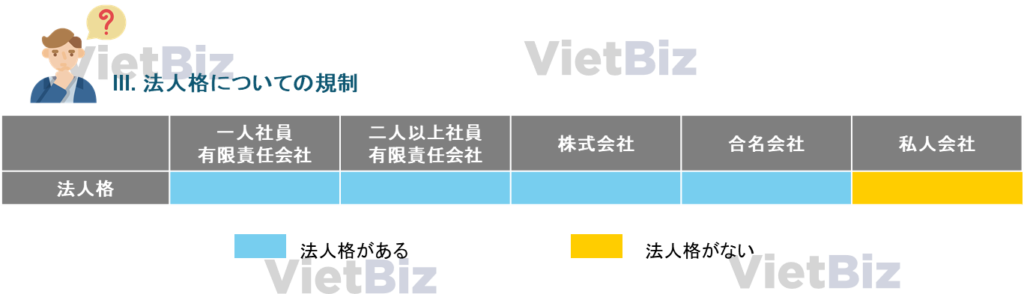

legal personality

A private company cannot have a legal personality, while all other forms of companies have legal personality. In this sense, as mentioned above, a private company can be viewed as a sole proprietorship.

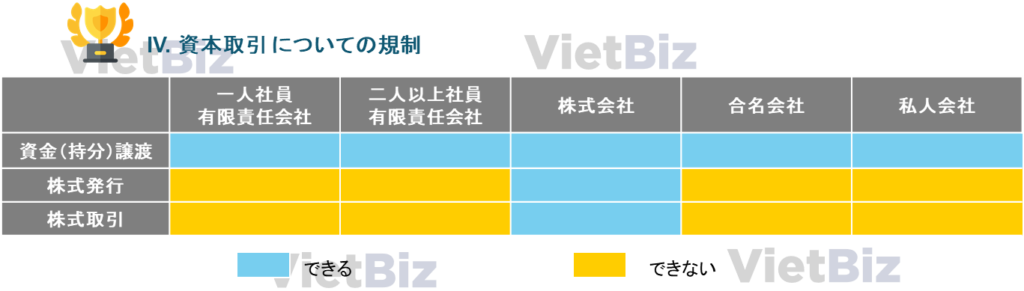

capital transaction

Limited liability companies, general partnership companies, and private companies cannot issue shares, and therefore cannot freely issue shares or conduct transactions to transfer shares to others. If an investor in such a company wishes to transfer his/her equity interest to another party, he/she must transfer his/her equity interest, which is regulated as follows depending on the type of company.

Transfer of equity interest in a limited liability company

If a member of a limited liability company wishes to transfer part or all of his/her interest, the following process should be followed.

- Offers to sell his/her interest to any employee other than himself/herself, offering the same terms and conditions for the sale of his/her interest to any employee other than himself/herself.

- If no employee purchases his/her interest within 30 days from the date of the offer to sell, he/she may transfer his/her interest to a person other than himself/herself, offering the same terms and conditions as those offered to the employee.

Transfer of interest in a limited partnership

If a limited partnership member wishes to transfer part or all of his/her interest, he/she must obtain the approval of all other limited partnership members.

Transfer of interests in a private company

Selling an interest in a private company with one owner is the same as selling the private company itself. The private company owner is free to sell or transfer the company.

Articles of Incorporation Capital

In the case of a limited liability company or a joint stock company, the investors are liable for the company’s claims, liabilities, obligations, etc. to the extent of the paid-in capital. On the other hand, in the case of a limited liability company, the partners of the limited liability company are liable for the obligations of the company to the extent of all of their own assets (in the case of the investors, to the extent of the paid-in capital). Similarly, a private company is liable to the extent of all its assets.

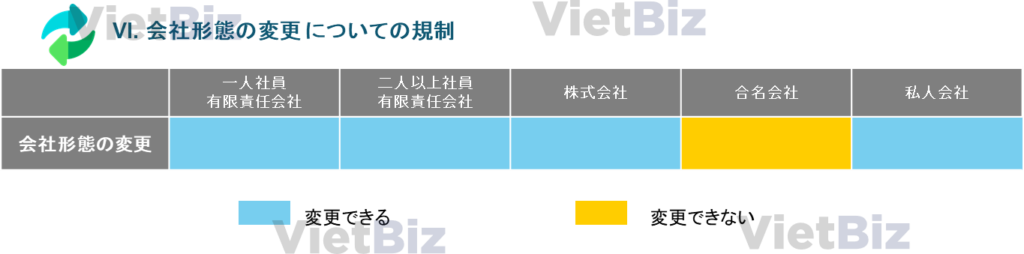

Change of corporate form

A change of corporate form is permitted in the following cases

- Conversion from a Limited Liability Company to a Stock Company

- Conversion from a Stock Company to a Limited Liability Company

- Conversion from a Private Company to a Limited Liability Company, Joint Stock Company or Partnership Company

- Conversion from a one member limited liability company to a two or more member limited liability company

Possible reasons for converting the corporate form include the conversion of a company initially established as a limited liability company to a joint stock company, which can issue shares for the purpose of going public. On the other hand, it should be noted that the conversion of a Gomei Kaisha to another form is not permitted.

Company decision-making bodies

It is the decision maker. In the case of a two or more member limited liability company, the general meeting of members who invest in the company is the highest decision-making body. In the case of a joint stock company, the general meeting of shareholders of those holding shares is the decision-making body. In the case of a limited liability company, the highest decision-making body is also the general meeting of members attended by all partners of the limited liability company.

Conclusion: Selecting the right corporate form the right situation and purpose

In this report, we have explained the forms of company incorporation under the Vietnamese Enterprise Law. The information explained in this report is important not only for Japanese companies establishing a company in Vietnam, but also for those searching for partners, mergers and acquisitions, and doing business with Vietnamese companies.

Particular points that Japanese companies should pay attention to are the “transfer of capital (equity)” and “the extent of the investor’s liability to the company. For example, a limited liability company has a distinctive provision that allows the transfer of equity interests to be offered for sale first to the employees, and then, if there are still no takers, to be offered for sale outside the company on the same terms and conditions.

In terms of the extent of liability for the company, it is important to keep in mind that limited liability companies and joint-stock companies have literally limited liability “to the extent of their investment,” whereas general partnerships and private companies have unlimited liability “to the extent of their own assets.

As economic exchange between Vietnam and Japan becomes closer and closer, a proper understanding of Vietnam’s corporate law will be required. In addition, since corporate law is often revised in response to the economic situation at any given time, VietBiz will continue to provide commentary on the latest systems as they become available.

【関連記事】ベトナムビジネスの最新動向については、以下の記事もご覧ください。

ベトナム市場調査レポート一覧はこちらからもご覧頂けます。

ベトナム市場の情報収集を支援します

ベトナム市場での情報収集にお困りの方は多くいらっしゃるのではないでしょうか。

VietBizは日本企業の海外事業・ベトナム事業担当者向けに市場調査、現地パートナー探索、ビジネスマッチング、販路開拓、M&A・合弁支援サービスを提供しています。

ベトナム特化の経営コンサルティング会社、ONE-VALUE株式会社はベトナム事業に関するご相談を随時無料でこちらから受け付けております。